[ad_1]

I joined Sean Callebs on CGTN America this Black Friday to debate the state of the patron and Inventory Market transferring ahead. Discover out why I’m LONG Santa and SHORT the Grinch! Due to Sean and Kamelia Kilawan for having me on:

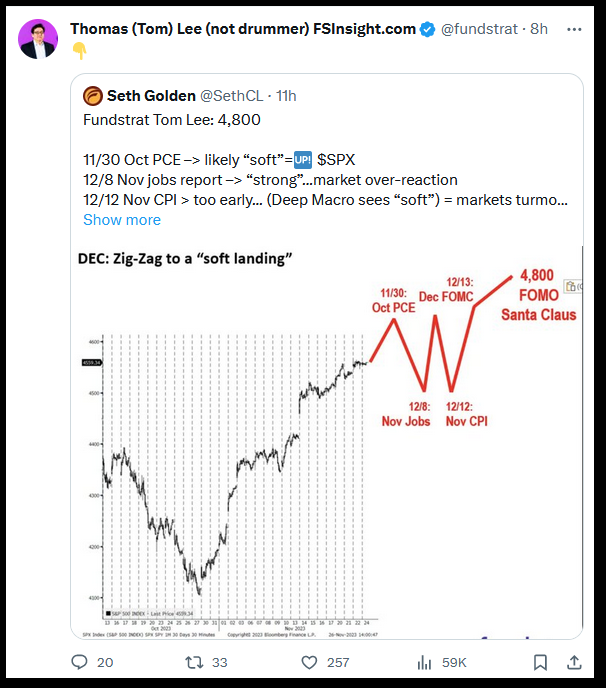

I have to make clear that with all the big good points in November and starting widespread exuberance, the historic knowledge helps some stage of weak spot in early December earlier than a ultimate year-end “Santa” rally. Listed below are two takes – one quantitative (knowledge since 1950)), one qualitative:

Dec:Zig-Zag to a

In the event you missed final week’s podcast|videocast with the Vacation, it’s possible you’ll wish to test it out right here. It was one of the vital essential of the 12 months:

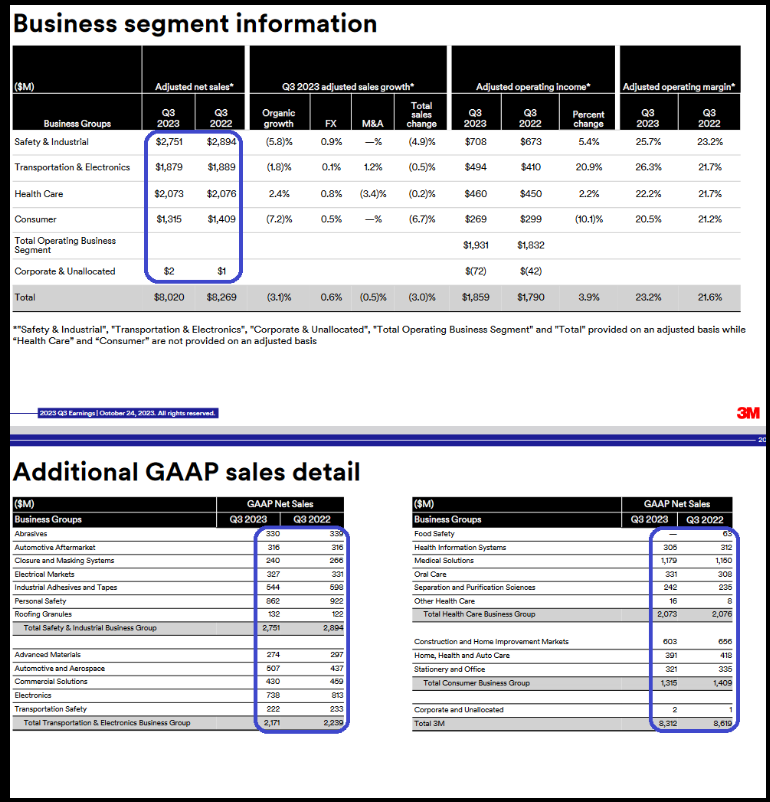

As we wind down an incredible earnings season, I’m attempting to spotlight the outcomes from 1-2 firms per week that we have now talked about on our weekly podcast|videocast(s). At present we’ll do a deep dive on MMM and CCI:

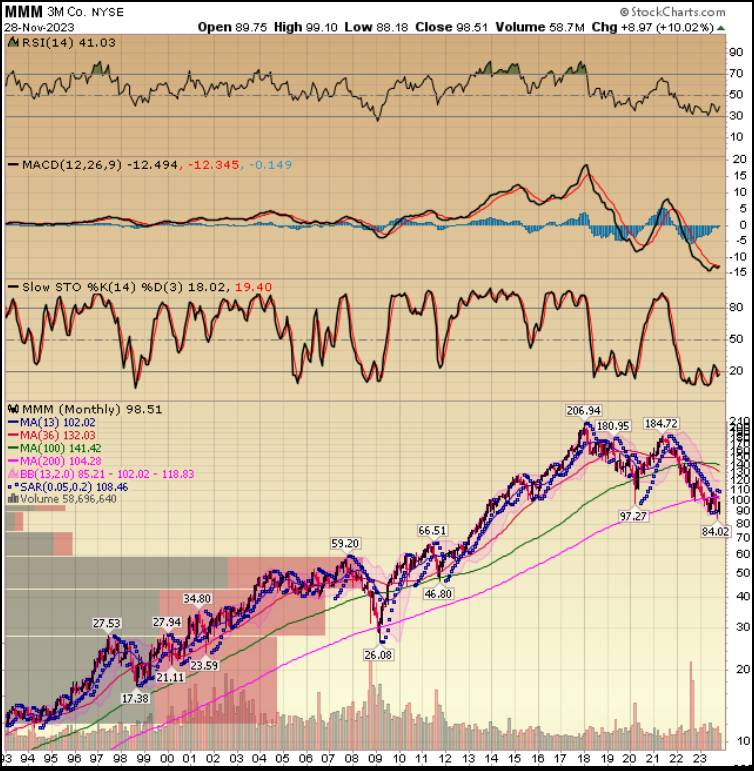

3M (NYSE:) Replace

Whereas 3M has began to point out early indicators of restoration from after we first began speaking about it on our weekly podcast|videocast(s), we imagine it’s simply getting began on a large multi-year restoration. Here’s a detailed replace from the latest earnings name, presentation and different developments:

CCI Replace

Billionaire Activist – Paul Singer’s Elliott Administration has begun a brand new Activist marketing campaign on Crown Fort (NYSE:). In case you have been a daily viewer of Charles Payne on Fox Enterprise, a shopper, or common listener of our podcast|videocast you’ll have seen the worth earlier than the marketing campaign began:

BABA Replace

The Chinese language are strengthening the (stable black line circled in inexperienced under) once more. It has begun to rise since Xi’s speech on the APEC assembly in San Francisco two weeks in the past. Within the face of robust stress with the US he claimed together with his phrases that China was able to be a “accomplice” and “good friend” to the US. He spoke of a peaceable coexistence, cooperation and “mutual respect.” He vowed to “by no means pursue hegemony or enlargement.” Phrases are one factor, however it was instantly adopted up with motion. See the inexperienced circle on the underside proper to know the transfer within the Yuan (straight up off of 15 12 months lows). A stronger Yuan makes China’s exports LESS aggressive. That is am olive department (doubtlessly in alternate for future tariff discount) – we’ll see.

Alibaba’s inventory value has outperformed during times of rising Yuan and collapsed during times of weakening Yuan. Will the ~$28.10B (final 4 quarters) of annual free money move technology (+27% YoY development final quarter alone) and Chinese language market cloud management begin to matter as soon as once more?

We’re going to search out out shortly.

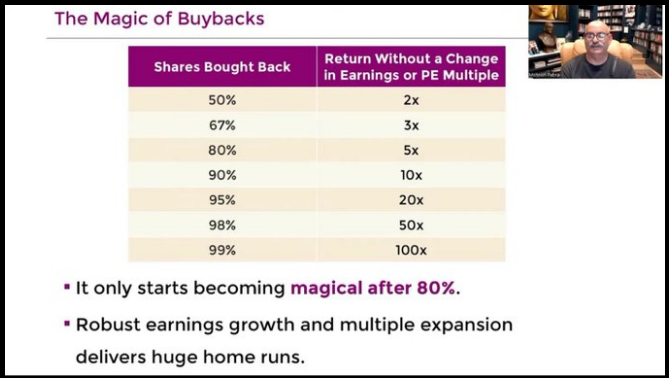

To place issues in perspective, if the alternate price had been to revert to 2017 ranges, that very same $28.10B of Free Money Movement turns into $33.12B with none enterprise enchancment. If we proceed to develop at 27% (which the final 4 quarters’ avg. development was increased), you’re at $42B of annualized free money move. Add the web money on the stability sheet you could possibly purchase in all the firm in ~3 years. What does that hypothetical appear like? Here’s a generic desk from Monish Pabrai:

All the perfect fundamentals on this planet received’t matter, till they do. We spent an hour on Alibaba’s fundamentals, developments and the longer term final week. As the remainder of the portfolio has appreciated, the share weight of Alibaba (NYSE:) has declined (regardless of no change in shares held). The place acceptable (and under our place measurement threshold), we added measurement (in some circumstances AGGRESSIVELY) previously couple of days with the intention to get Alibaba again as much as a significant weight within the portfolio.

Will good issues occur earlier than the top of the 12 months for Alibaba? Who is aware of. There could also be some extra tax loss harvesting in early December (if there are any sellers left!). I’m completely content material to let the corporate financial institution money and purchase in shares all day lengthy whereas the remainder of the portfolio continues to understand.

In the future folks will get up to the truth that the share rely is down 50% and the inventory is up 4x. After they come to that realization, and are scrambling to chase the inventory, we’ll be completely happy to assist them out with all of the NEW and OLD inventory we personal. Till then, we’ll sit on our palms and wait. Why? As a result of there isn’t a higher different prime quality enterprise with comparable upside to duplicate a present ~21.8% Free Money Movement yield:

Market Cap: 190B + Debt: (1.12 + 14.18 + 7.5 = 22.9B) = 212.9B – Money & Equiv: 83.8 = $129.1B

/ Free Money Movement (6.198 + 5.391 + 4.698 + 11.818)= $28.1B FCF = 21.8% Free Money Movement Yield. Discover me a greater rising enterprise I can purchase with a 21.8% Free Money Movement yield – dedicated to restoring double digit ROIC – and I’ll hear. I’ve by no means seen a greater high quality enterprise (with extra upside optionality) – quickly accessible at such a low value – in my profession.

RIP Charlie…

Now onto the shorter time period view for the Normal Market:

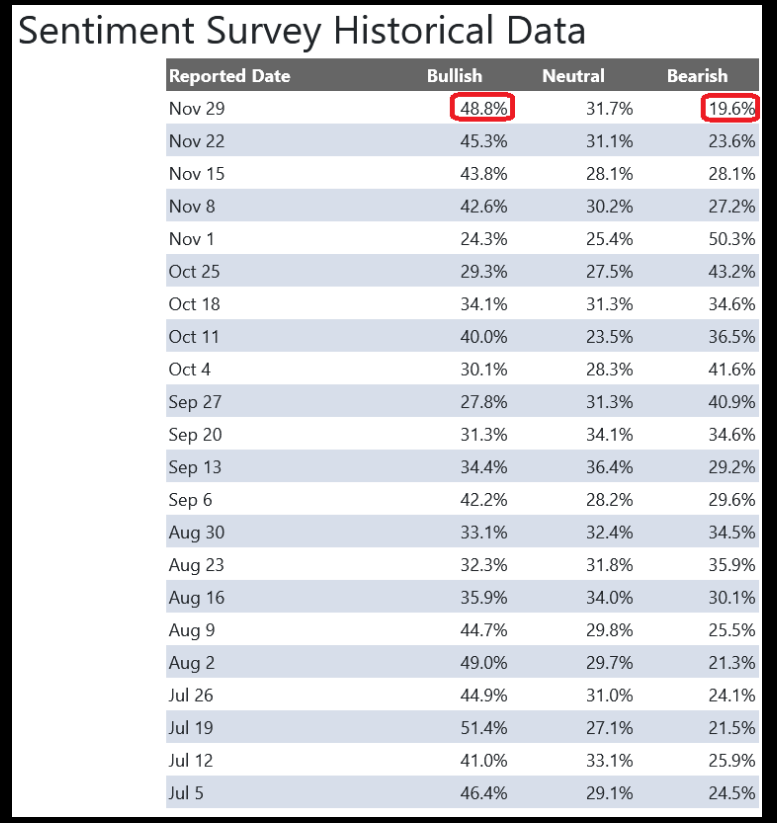

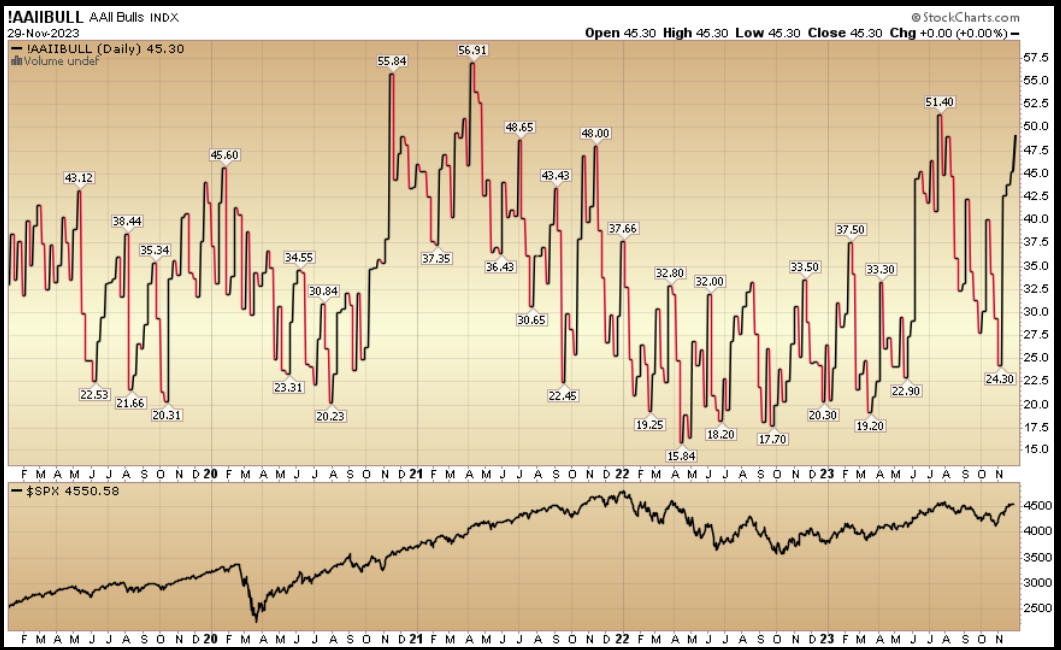

On this week’s AAII Sentiment Survey end result, Bullish % (Video Clarification) rose to 48.8% from 45.3% the earlier week. Bearish % dropped to 19.6% from 23.6%. Retail buyers have gotten giddy. This stage can keep elevated throughout main strikes (see under), however be open minded to a bit of give-back in markets (within the quick time period) to knock the knowledge out of their thoughts earlier than transferring increased.

The CNN “Concern and Greed” flat-lined from 64 final week to 64 this week. By this metric, buyers are a bit giddy, however not but euphoric. You’ll be able to find out how this indicator is calculated and the way it works right here: (Video Clarification)

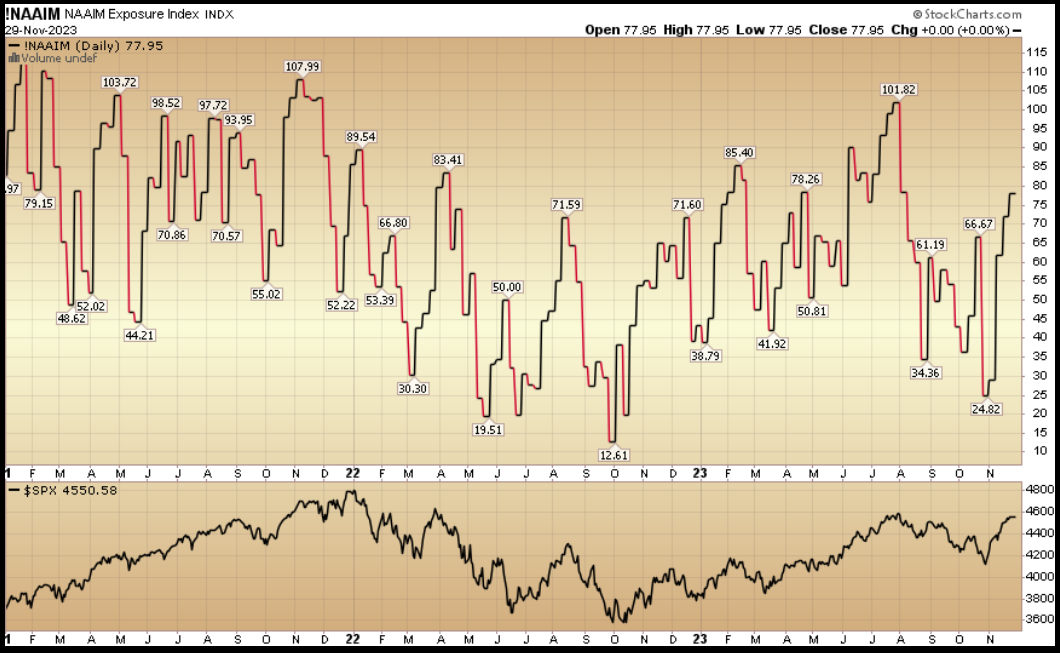

And at last, the NAAIM (Nationwide Affiliation of Energetic Funding Managers Index) (Video Clarification) moved as much as 77.95% this week from 61.75% fairness publicity two weeks in the past. The 12 months finish chase is ongoing:

This content material was initially printed on Hedgefundtips.com.

[ad_2]

Source link

Add comment