[ad_1]

Nikada

By Wenli Invoice Hao

Because the main dividend index supplier, S&P DJI is continually searching for new approaches and methodologies to deliver novel concepts to the market. Our just lately launched S&P 500® Excessive Dividend Development Index is a prime instance of this revolutionary pondering, because it incorporates a forward-looking evaluation into its methodology. This index tracks firms within the S&P 500 that haven’t solely supplied constant or rising dividends previously but additionally have the very best forecast dividend yield development. In doing so, constituents are chosen based mostly on what dividend they’re anticipated to pay as an alternative of being assessed solely on what they’ve paid previously.

On this weblog, we are going to current the index methodology, introduce the S&P World Dividend Forecasting Dataset and evaluation the index’s threat/efficiency profile.

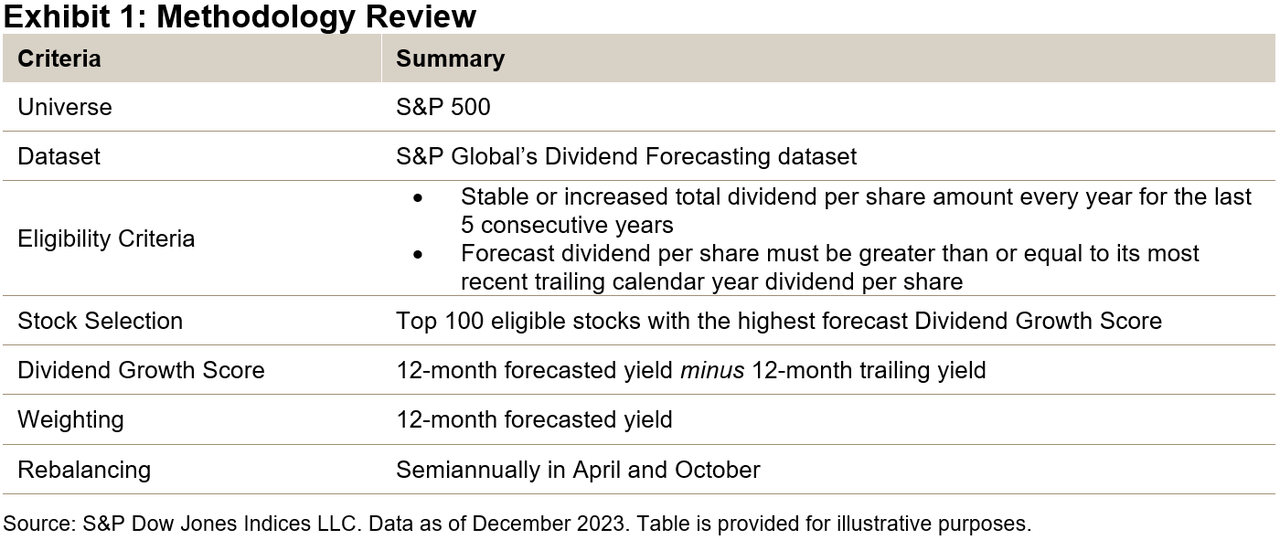

Methodology Overview

To be eligible for choice, constituents will need to have maintained or grown their historic dividends for five consecutive years and should even be projected to take action over the subsequent 12 months.

From this pool of eligible shares, the highest 100 constituents with the very best forecast dividend development scores are chosen. The rating is computed because the 12-month forecast yield minus the 12-month historic yield.

Lastly, the index constituents are weighted by forecast dividend yield with constraints positioned on particular person shares and GICS® sectors.1 To scale back turnover, the index makes use of a 20% buffer.

Dividend Forecasting Knowledge

The Dividend Forecast Dataset is sourced from S&P World Market Intelligence, which is one other division inside S&P World. This workforce has greater than 40 professionals performing basic evaluation with the aim of delivering exact forecasts of the dimensions and timing of dividend funds. They serve over 150 prospects internationally, together with many of the top-tier world banks.2

Efficiency Evaluate

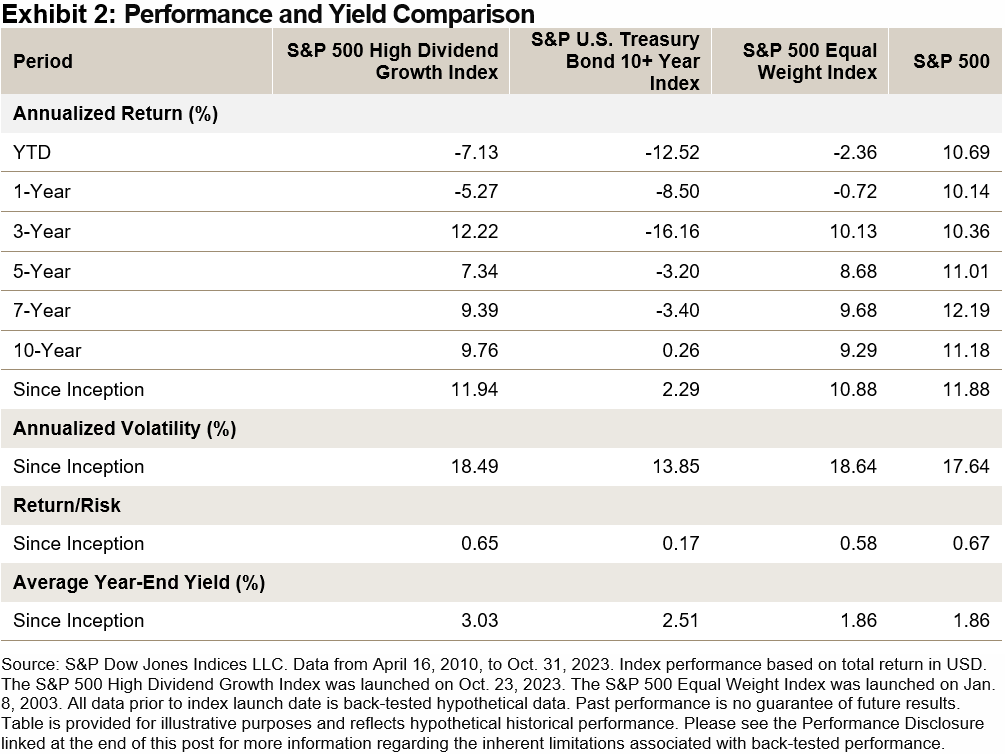

The efficiency statistics that observe are calculated beginning in 2010, when the info for the dividend forecasting dataset started. Therefore, the back-tested knowledge incorporates forecasts that had been saved as and once they had been made, with no look-ahead bias.

Whereas this era has been a robust efficiency interval for the S&P 500, the S&P 500 Excessive Dividend Development Index has greater than stored tempo. Since 2010, it has had an annualized return of 11.94% whereas delivering a considerably larger yield.

Draw back Safety and Upside Participation

The historic seize ratios versus the S&P 500 present that the S&P 500 Excessive Dividend Development Index has exhibited reasonably defensive traits (94.5% draw back seize). Furthermore, on common, the index has traditionally participated in 96% of the market return in up-market durations.3 That is larger than most dividend methods and is probably going a results of its comparatively decrease worth tilt and better development tilt.

Historic Yield and Dividend Development Evaluation

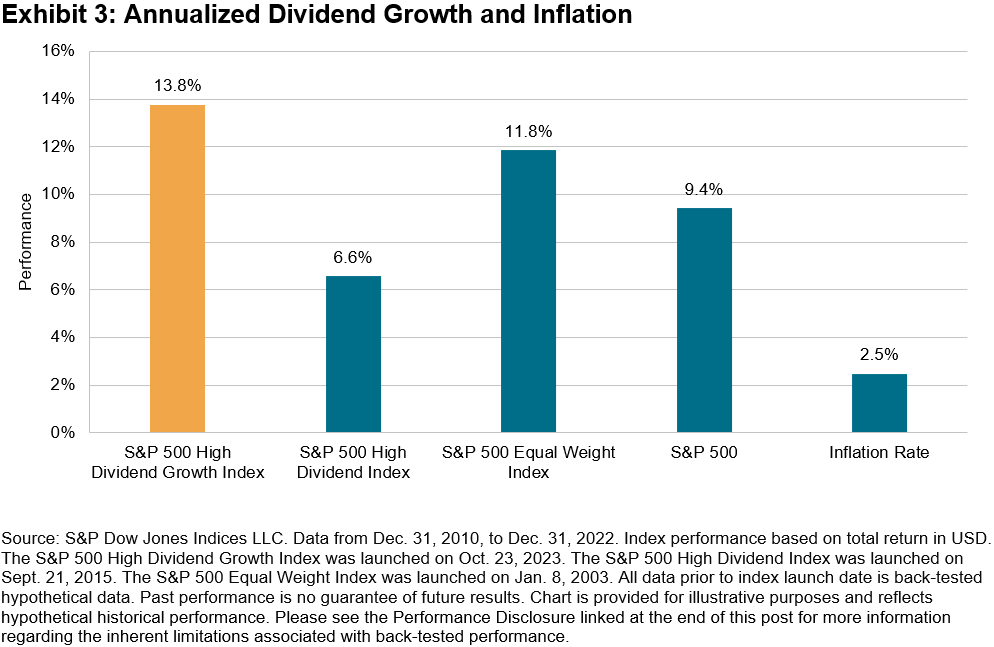

This revolutionary methodology affords a singular mix of dividend development and excessive yield. Since 2010, the index has had a median yield of over 3%, comfortably outperforming its benchmark and different methods inside the dividend development class.

Impressively, for a dividend technique providing a excessive yield, the index additionally has a excessive annualized dividend development price. From 2010 to 2022, the S&P 500 Excessive Dividend Development Index grew its dividend at an annual price of 13.8% (see Exhibit 3). This outpaces the long-term U.S. inflation price, even with the current spike in inflation over the previous couple of years.

Issue Publicity

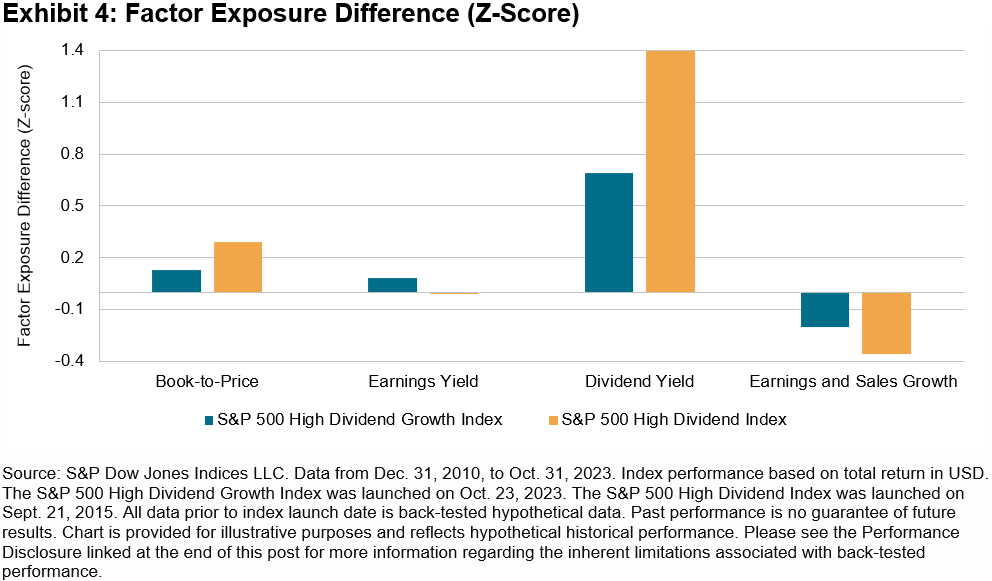

Exhibit 4 reveals the issue publicity distinction between the S&P 500 Excessive Dividend Development Index and S&P 500 Excessive Dividend Index when it comes to Axioma Danger Mannequin Issue Z-scores. The S&P 500 Excessive Dividend Development Index demonstrated much less worth tilt and had decrease dividend yield than the S&P 500 Excessive Dividend Index.

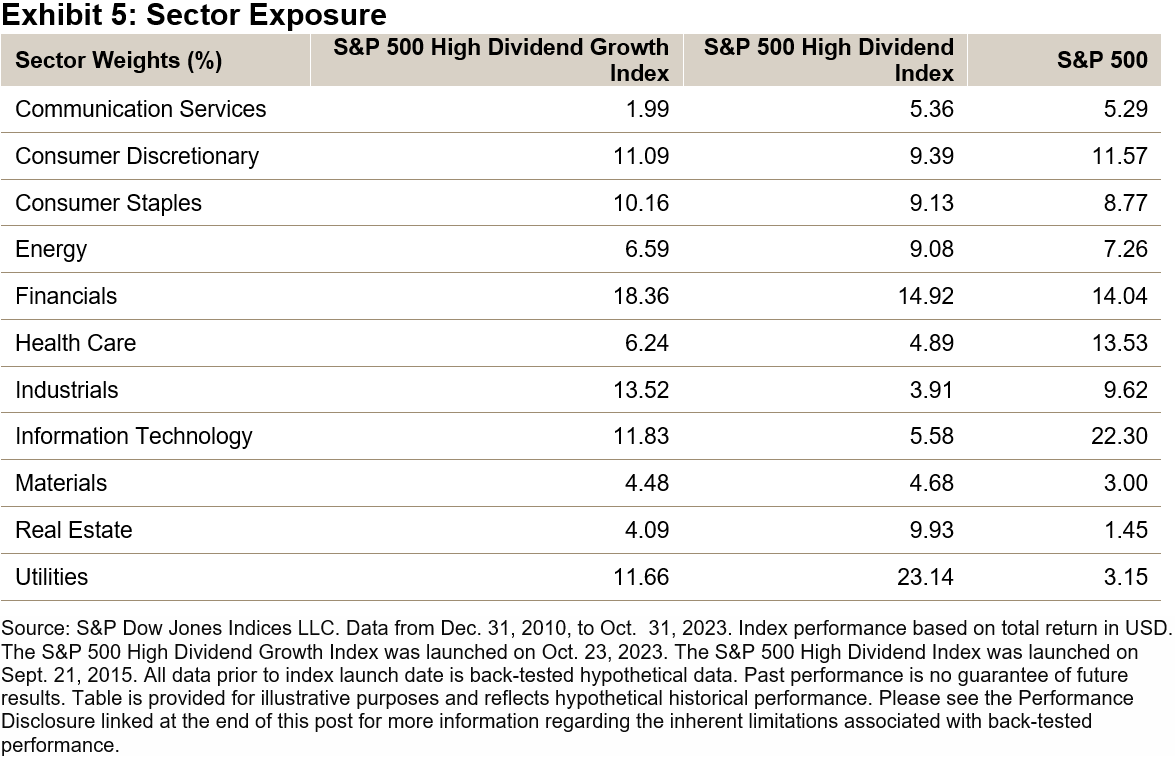

Sector Publicity

From a sector perspective, the S&P 500 Excessive Dividend Development Index had decrease sector weights in Utilities (-11.5%) and Actual Property (-5.8%), whereas having larger sector weights in Industrials (9.6%) and Info Expertise (6.3%) than the S&P 500 Excessive Dividend Index (see Exhibit 5).

In a market filled with passive dividend options, the S&P 500 Excessive Dividend Development Index stands out by using a forward-looking strategy whereas traditionally providing excessive dividend development and excessive yield. This index’s historic decrease worth tilt and better development tilt could assist to keep away from sacrificing potential upside when in search of excessive yield.

1 For additional details about the index design, please see the S&P 500 Excessive Dividend Development Index Methodology.

2 For extra data, please see this hyperlink.

3 The market is outlined because the month-to-month efficiency of S&P 500 benchmarks from April 16, 2010, to Oct. 31, 2023.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P World. All rights reserved. This materials is reproduced with the prior written consent of S&P DJI. For extra data on S&P DJI please go to www.spdji.com. For full phrases of use and disclosures please go to www.spdji.com/terms-of-use.

Authentic Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.

[ad_2]

Source link