[ad_1]

Regardless of trade challenges, LVMH has constantly surpassed expectations, sustaining regular financial development by diversifying its portfolio.

With iconic manufacturers like Dior and Louis Vuitton below its umbrella, LVMH has navigated obstacles, together with a current choice to delist Tod’s, showcasing its strategic funding strategy.

Whereas current inventory efficiency reveals a slight decline, analysts stay optimistic, with a goal worth estimated at $943 per share, suggesting a possible uptrend for LVMH.

Make investments like the large funds for lower than $9 a month with our AI-powered ProPicks inventory choice software. Be taught extra right here>>

LVMH Moet Hennessy Louis Vuitton (OTC:) (EPA:) has navigated by way of a number of macroeconomic challenges of late. Elements reminiscent of escalating rates of interest, surplus stock accumulation, and apprehensions relating to a dip in Asian demand amidst the Chinese language disaster have posed notable obstacles.

Nonetheless, this French conglomerate, which owns prestigious manufacturers like Dior, Louis Vuitton, Fendi, Tiffany, Bulgari, Moët & Chandon, and Sephora, has constantly exceeded expectations, overcoming these challenges with nice success.

Consequently, it has sustained an unwavering development trajectory, marked by a gradual uptick in revenues during the last 4 years. The corporate has demonstrated unwavering dedication to growth by way of constant investments throughout numerous ventures.

A current strategic maneuver underscores this dedication, as evidenced by the choice to delist Tod’s from the Milan Inventory Alternate. This transfer underscores LVMH’s dedication to astute investments and reinforces its place as a savvy trade chief.

How Has LVMH Inventory Fared in Phrases of Returns?

LVMH has constantly exhibited strong efficiency throughout numerous timeframes. Over the previous decade, it has witnessed a exceptional surge, boasting a considerable improve of 601% on the .

Within the medium time period, its development trajectory stays spectacular, registering a stable 46% uptick during the last three years. Equally, within the quick time period, it has demonstrated resilience, accruing good points of 13% over the previous three months. Nonetheless, regardless of a better-than-expected efficiency within the fourth quarter of 2023, a discernible deceleration in growth is clear, primarily attributable to challenges inside the luxurious sector.

Moreover, LVMH instructions substantial worth on the European inventory market, boasting a market capitalization of $444.5 billion, securing the second place, trailing solely behind the pharmaceutical big Novo Nordisk (NYSE:NYSE:), which instructions a market capitalization of $575 billion.

The current marginal dip in LVMH’s inventory, down by 4% within the final month, raises queries relating to whether or not the luxurious model has already reached its pinnacle out there.

Truthful Worth and Goal Worth

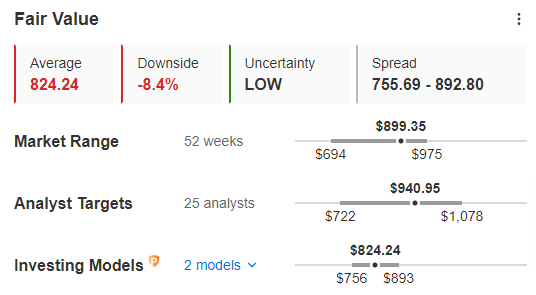

Upon using InvestingPro’s instruments to conduct a radical inventory evaluation, the Truthful Worth evaluation, which encapsulates 14 esteemed monetary fashions tailor-made to LVMH’s distinctive attributes, signifies that the inventory is at present buying and selling at a premium of 8.4% above its honest worth.

Supply: InvestingPro

InvestingPro’s common of 25 analyst rankings reveals a extra optimistic sentiment relating to the inventory’s potential. They anticipate a possible uptrend and challenge a goal worth of $940 per share, representing a roughly 12% improve over the present valuation.

Moreover, market specialists regard LVMH as a reliable funding alternative. As an illustration, RBC Capital lately reiterated a constructive Outperform score for the French conglomerate and established a goal worth of $980.

***

DON’T neglect to reap the benefits of the InvestingPro+ low cost on the annual plan (click on HERE), and you’ll find out which shares are undervalued and that are overvalued due to a collection of unique instruments:

ProPicks, inventory portfolios managed by synthetic intelligence and human experience

ProTips, simplified data and information

Truthful Worth and Monetary Well being, 2 indicators that present quick perception into the potential and danger of every inventory

Inventory screeners and

Historic Monetary Information on hundreds of shares, and lots of different providers!

That is not all, here is a reduction on the annual plan of InvestingPro! click on HERE

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, provide, recommendation, counsel or suggestion to take a position as such it isn’t supposed to incentivize the acquisition of property in any method. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and due to this fact, any funding choice and the related danger stays with the investor.

[ad_2]

Source link