[ad_1]

ALEAIMAGE/E+ by way of Getty Photos

This text was coproduced with Leo Nelissen.

A couple of month in the past, Sports activities Illustrated revealed a chunk about one former Kentucky Wildcat dunking on one other.

One drawback with (the College of) Kentucky placing a ton of expertise within the NBA and G-League is that we regularly see some Kentucky-on-Kentucky crime relating to making nice performs.

This occurred within the G-League not too long ago as former Kentucky middle Oscar Tshiebwe dunked on former Wildcat ahead Jacob Toppin. Now, to be honest, Toppin made a enterprise determination to not soar with Tshiebwe, which was doubtless sensible. However all Kentucky followers know that Toppin can soar out of the fitness center, so maybe if he had jumped, the end result may have been completely different.

Faculty basketball followers will perceive all these references. However I will not bore everybody else with the main points. I solely convey the story up for 3 causes:

I’m a university basketball fan. Fanatic, even. It is formally March, which implies we’re counting down the times till March Insanity! I will be operating my conventional March Insanity matchups.

That is why I’ve “leaping out of the fitness center” on my thoughts.

The phrase is fairly self-explanatory, and you may see it utilized in different sports activities resembling volleyball. However general, it refers to basketball athletes who can take to the air when going for a slam dunk.

Not solely is that feat exceptionally spectacular to observe, it makes the act of scoring a complete lot simpler. We admire that type of functionality throughout.

The Air Up There

Who has the best vertical soar in NBA historical past?

International sports activities content material platform Sportskeeda answered that query this previous October, writing how:

“… if you do not have a operating leap over two ft (24 inches), you might be in all probability by no means going to be drafted [by the NBA] even when you’ve got each different facet of your sport sorted.”

And of those that are drafted, most do not make the historical past books, in contrast to:

Dee Brown and Harold Miner, identified for having 44-inch soar Shannon Brown along with his 44.5-inch soar Zion Williamson at 45 (Spartanburg Day College Alum) Zach LaVine, James White, and Anthony Webb at 46 Jason Richardson at 46.5 Darrell Griffith and Michael Jordan at 48.

Some statisticians additionally record Wilt Chamberlain on the gravity-defying peak. And it’s gravity-defying. Make no mistake of it.

That is 4 ft excessive!

With all due respect to the aforementioned Oscar Tshiebwe, even he is bought “simply” a 33-inch soar. His former teammate, Toppin, simply clears him at 45 inches – proper up there with many of the greats Sportskeeda listed…

However nonetheless three inches in need of the Jordan-esque document.

I feel that is all necessary to notice. We wish to acknowledge greatness the place we discover it in essentially the most life like sense doable. For example – once more, with all due respect to these concerned – the rationale why Michael Jordan is remembered a lot greater than Darrel Griffith is as a result of:

Jordan noticed 6 NBA championships; Griffith noticed none. Jordan performed 15 NBA seasons; Griffith performed 10. Jordan performed in 13 playoffs; Griffith performed in six. Jordan noticed 14 all-star video games; Griffith 0.

And the record goes on from there. So whereas we are able to and will keep in mind Griffith tying for first relating to leaping…

We also needs to acknowledge all the opposite stats as nicely.

Discovering the Biggest REITs Round

Once more, I convey this all up due to my actual property funding belief (REIT) model of March Insanity. Whereas the precise faculty basketball match it is patterned on would not start for a couple of extra weeks, I am raring to get began with the comparisons.

Which REITs will make my Candy 16 record?

I am already starting to place that bracket collectively in my thoughts.

I wish to give everybody a good suggestion of the sorts of firms that qualify for the competitors.

Right now, I am doing that by that includes three of the best REIT “leapers” which can be positive to be among the many finest 16 I can categorize. By this, I imply REITs which can be rising the quickest – with out being utterly insane.

Once more, we have to acknowledge all of the stats collectively to find out which firms are reaching greatness – moderately than simply trying nice at first look.

For any basketball followers on the market who’re fast to take offense, that is not a potshot in opposition to any of the celebrities I’ve named on this article. I am strictly speaking about firms now.

Firms that may develop their enterprise operations… develop their dividends… and develop their inventory costs: It is an awesome mixture – when dealt with in a sustainable vogue.

We’re not searching for REITs that may put a powerful and even excellent quarter in right here or there. They needn’t even apply to the Candy 16 “tryouts.”

I am searching for consistency and actual reward potential. Which is why I am liking the seems to be of the next three company landlords.

Switching again to basketball for a minute, I feel it is secure to say these REITs can soar proper out of the company fitness center.

Important Properties Realty Belief (EPRT) – 5% Yield, Undervalued, And Very Important!

Important Properties Realty Belief, on this article, known as Important Properties or EPRT, is an internally managed REIT that makes a speciality of buying and proudly owning single-tenant properties.

These properties are strategically leased to middle-market firms working in service-oriented or experience-based industries.

As its identify reveals, the corporate prefers firms in areas which can be important to our day by day lives.

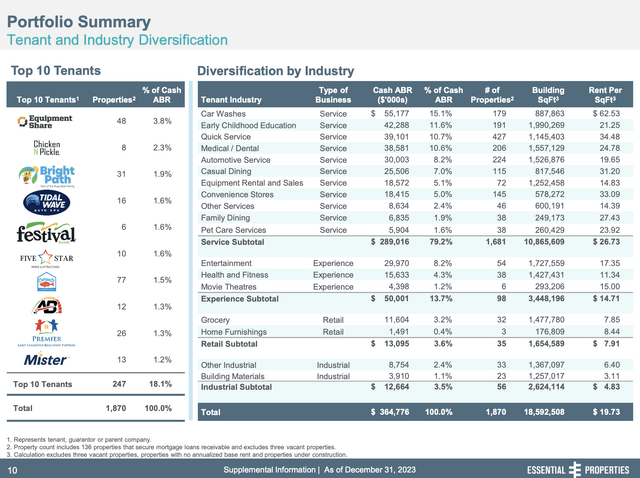

As we are able to see within the overview beneath, the corporate has a various portfolio protecting 16 industries, together with automotive companies, leisure, grocery, and healthcare, amongst others.

Whereas it is robust to make the case that automobile washes are important (if money is tight, I will not wash my automobile), the corporate’s technique protects it in opposition to headwinds like e-commerce disruptions that are likely to weigh on sure landlords in different areas.

Virtually the entire firm’s property are protected in opposition to disrupting traits.

On the finish of the fourth quarter of 2023, the corporate’s portfolio consisted of 1,873 properties leased to 374 tenants. Its high 10 tenants accounted for simply 18% of its annual base hire, which signifies that it’s not depending on a couple of giant tenants, decreasing dangers considerably.

EPRT IR

One other large professional of this enterprise is its give attention to long-term lease agreements, with a weighted common lease time period of 14 years. This will increase visibility and provides some security along with the truth that a number of its tenants function in important areas, as we already briefly mentioned.

With that in thoughts, even higher than shopping for security is the mix of development and security!

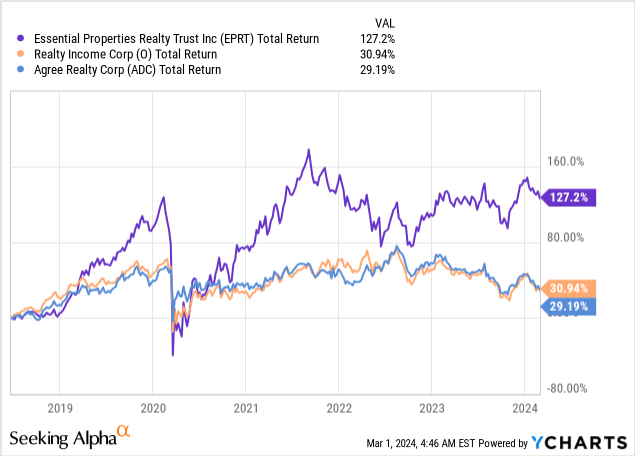

Since its IPO in 2018, EPRT has proven spectacular development, delivering a complete return of 127%, outperforming trade friends like Agree Realty (ADC) and Realty Revenue (O).

Looking for Alpha

(Looking for Alpha)

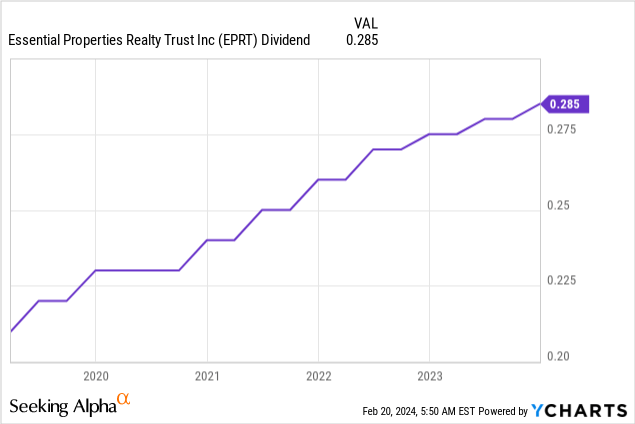

Moreover, the inventory comes with an honest yield. Paying $0.285 per share per quarter, it presently yields 4.8%, protected by a 66% payout ratio.

The corporate’s five-year dividend CAGR is 20.9%. It has hiked its dividend a number of instances per 12 months since its IPO, which exhibits a number of shareholder dedication.

Looking for Alpha

(Looking for Alpha)

The three-year dividend CAGR is 6.4%, which continues to be extraordinarily engaging for a inventory yielding 5%.

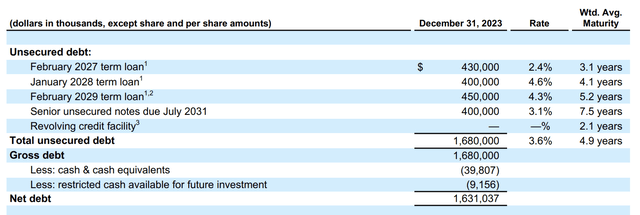

Furthermore, the corporate has a wholesome steadiness sheet with near $800 million in liquidity and an investment-grade credit standing of BBB-.

Even higher, in gentle of elevated rates of interest, the entire firm’s debt is unsecured and comes with a weighted common yield of three.6%, a quantity that comes near a few of the finest operators within the trade.

The weighted common maturity of its debt is 4.9 years, which buys the corporate a number of time on this unfavorable time.

EPRT

(Important Properties Realty Belief)

Wanting forward, EPRT stays optimistic about its development prospects, supported by sturdy operational efficiency and a promising funding pipeline.

Analysts undertaking constant development, with an anticipated AFFO (adjusted funds from operations) development fee of 5% in 2024, probably adopted by 7% development in 2025 and 6% development in 2026.

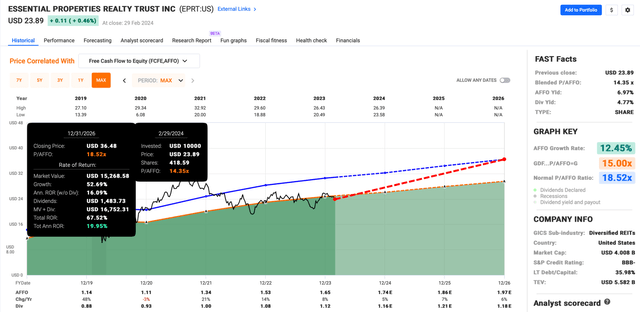

FAST Graphs

These numbers additionally translate to a good valuation. The corporate presently trades at a blended P/AFFO ratio of 14.4x, which is nicely beneath its normalized 18.5x a number of.

The mixture of its dividend, anticipated AFFO development, and normalized AFFO a number of ends in roughly 50% undervaluation.

Whereas it could take time till the market applies a better a number of to REITs in a high-rate setting, we’re coping with a powerful REIT able to persistently elevated AFFO development that trades at a beautiful valuation with a juicy yield.

In different phrases, a real March Insanity contender!

American Tower Company (AMT) – 3.4% Yield, Important, and Manner Too Low-cost

Identical to Important Properties, American Tower can be important – very important!

Along with its friends Crown Fortress (CCI) and SBA Communications (SBA), the corporate dominates the cell tower trade in the USA, proudly owning the infrastructure wanted to help telephony, 4G, and 5G on our telephones, tv, and a lot extra!

Nevertheless, in contrast to CCI, American Tower serves 25 nations, using roughly 6,000 folks to handle near 225 thousand communication property!

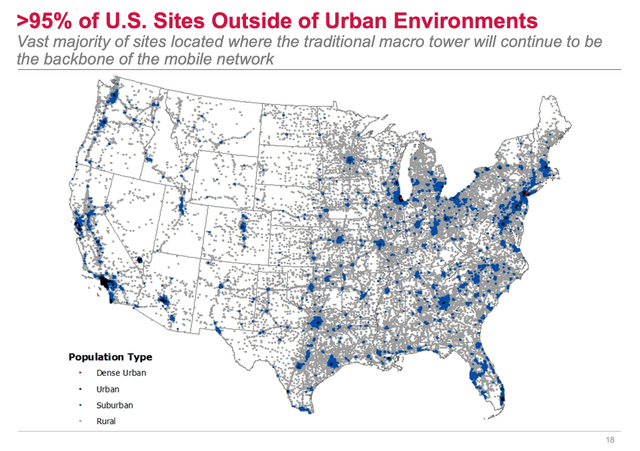

On high of that, the corporate has 28 information facilities and greater than 95% publicity to non-urban environments, which helps the necessity for macro towers because the “spine of the cell community.”

AMT IR

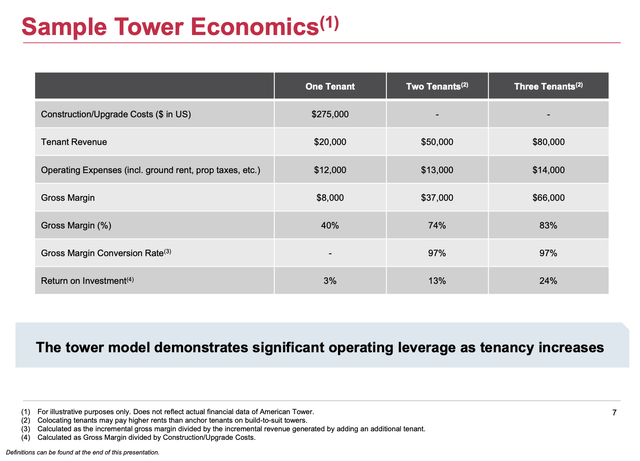

Moreover, the corporate, which has restricted churn and 2-4 annual inflation escalators, has a implausible enterprise mannequin the place it might probably simply leverage present property.

For instance, trying on the chart beneath, we see that the corporate can add new tenants to present towers with minimal extra prices.

AMT IR

To date, this enterprise mannequin continues to shine, boosted by secular demand development.

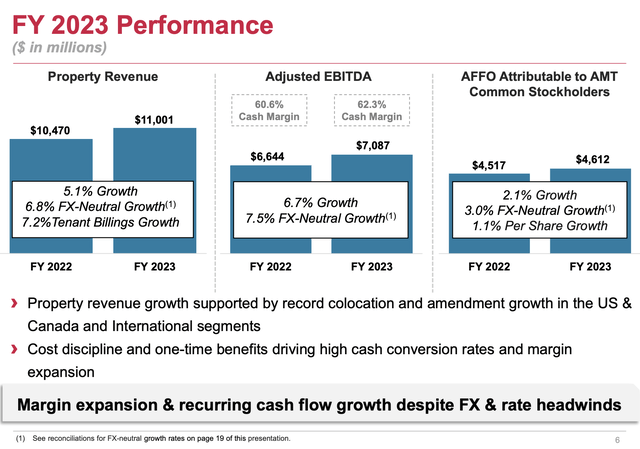

For instance, in 2023, American Tower achieved document outcomes.

Consolidated property income grew over 5%, reaching over $11.1 billion, with virtually 7% development on a currency-adjusted foundation.

Natural tenant billings development stood at 6.3%. This displays continued demand for the corporate’s numerous international asset portfolio.

AMT IR

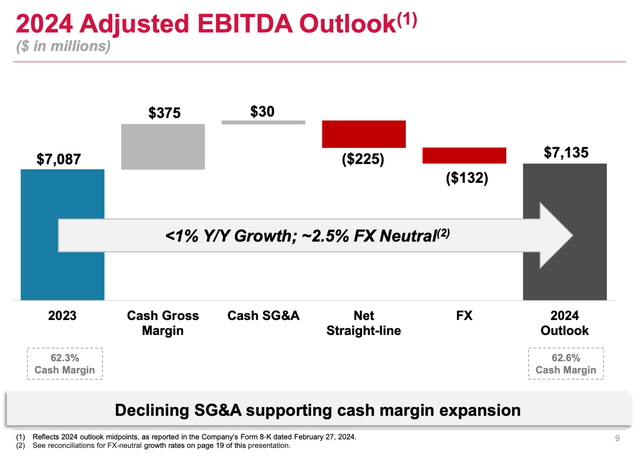

Furthermore, as we are able to see above, adjusted EBITDA elevated by roughly 7%, exceeding $7 billion, with cash-adjusted EBITDA margins bettering roughly 170 foundation factors to 62.3%.

What issues much more than sturdy 2023 outcomes is its outlook. This 12 months, the corporate expects to generate greater than $11.1 billion in property revenues. That is no less than 1% development. EBITDA development is predicted to be within the low-single-digit vary as nicely.

AMT IR

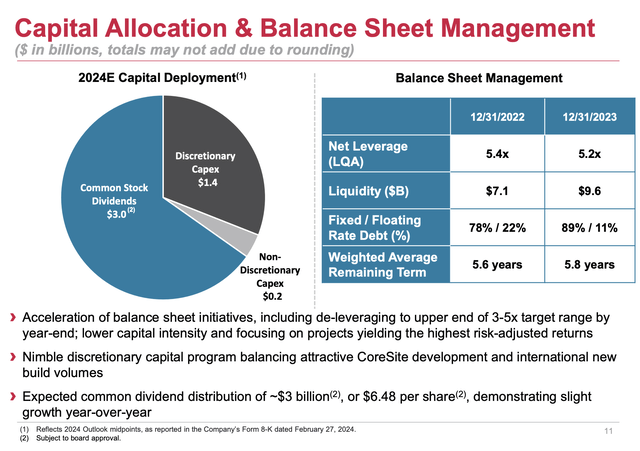

So as to keep elevated development, the corporate plans to speculate $1.6 billion. Roughly 90 cents of each greenback is predicted to be put into discretionary tasks, together with the event of present CoreSite information facilities.

The corporate additionally goals to cut back debt, concentrating on a decline in internet leverage to satisfy the higher finish of its 3x to 5x leverage goal by the top of this 12 months.

AMT IR

With regard to its dividend, the corporate will doubtless keep an annual dividend distribution of roughly $3 billion.

Dividend development is predicted to stay subdued to ensure that the corporate to give attention to development and steadiness sheet safety.

Over the previous 5 years, the dividend CAGR was a powerful 15.4%. Over the previous three years, that quantity was nonetheless 12.5%.

On December 14, it hiked its dividend by 4.9%.

At the moment, the corporate pays $1.70 per share per quarter. That is a yield of roughly 3.4%, protected by an more and more wholesome steadiness sheet with an investment-grade BBB- ranking and a 66% 2024E AFFO payout ratio.

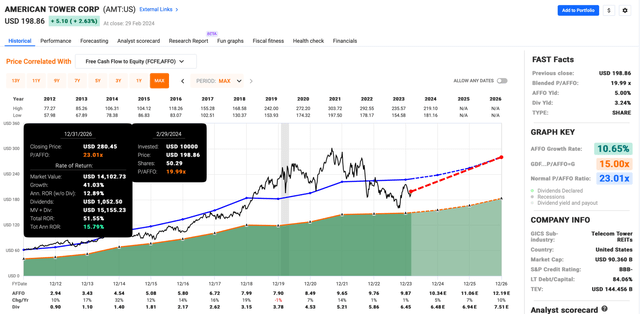

Whereas dividend development could come down a bit, there’s excellent news, as analysts anticipate the corporate to take care of constant earnings development.

This 12 months, AFFO development is predicted to be 5%, probably adopted by an acceleration to 7% and 10% in 2025 and 2026, respectively.

FAST Graphs

At the moment, AMT trades at a blended P/AFFO ratio of 20x, which is beneath its longer-term normalized ratio of 23x AFFO, suggesting 15% annual returns.

Nevertheless, as traditional, please keep in mind that these elevated returns doubtless require a constant decline in rates of interest and inflation.

Nonetheless, present costs supply alternatives for long-term traders searching for worth, development, and revenue.

Particularly in gentle of its dominant place in a necessary trade, I consider AMT is likely one of the finest contenders for March Insanity!

Identical to my subsequent choose.

Rexford Industrial Realty (REXR) – 3.3% Yield And The Potential Of Huge Upside

Rexford Industrial Realty is an organization I’ve mentioned in different articles current articles as nicely.

Nevertheless, it is too good to not be included on this article as nicely, as it could be one of many favorites in March Insanity.

In any case, it is a inventory that, ignoring always-ongoing enterprise and financial dangers, solely depends on getting a greater valuation to proceed its long-term uptrend.

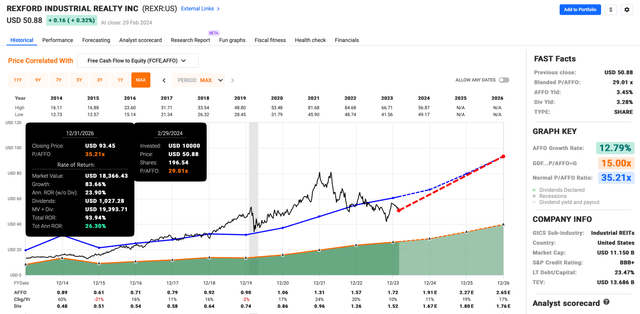

Utilizing the information within the chart beneath, REXR, which has returned greater than 15% per 12 months since its 2014 IPO, is predicted to take care of elevated AFFO development.

This 12 months, AFFO development is predicted to be 11%, probably adopted by an acceleration to 19% development in 2025 and 17% development in 2026.

FAST Graphs

Whereas the numbers above are clearly topic to many variables, they’re much like development charges seen in 2016-2018 and 2020-2023.

Therefore, I not solely like the corporate due to its constant development but in addition due to its valuation.

Purely technically talking, the inventory has an implied annual return of 26% by 2026 based mostly on a return to its normalized valuation a number of of 35.2x AFFO. It presently trades at 29x AFFO.

Even when this requires decrease charges, there is a juicy margin of security right here, backed by a implausible enterprise mannequin!

Rexford Industrial Realty is one in every of America’s largest industrial landlords, specializing in the most effective market within the nation: Southern California.

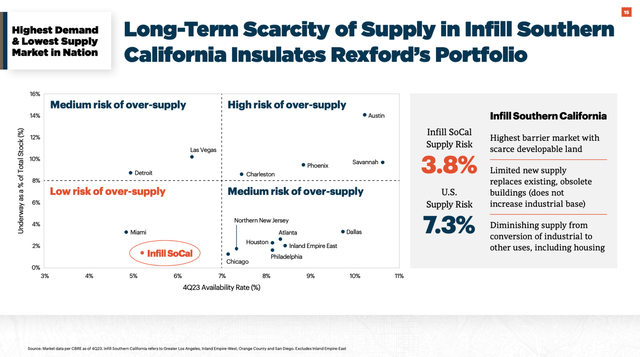

SoCal is a market that’s house to the largest shopper base within the nation, two big ports (LA and Lengthy Seashore), and important provide constraints supporting pricing.

Whereas markets like Austin are susceptible to new provide dangers, Southern California’s infill market advantages each from low provide dangers and subdued vacancies.

REXR IR

One more reason why I like REXR is its capability to develop internally with out being pressured into new acquisitions.

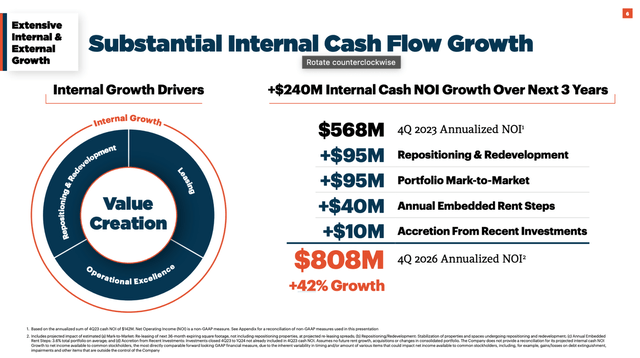

The corporate, which presently has greater than 670 buildings specializing in warehouses, manufacturing, and different companies, tasks a considerable 42% inside money NOI (internet working revenue) development streak over the subsequent three years.

REXR IR

This explains why analysts are so upbeat in regards to the firm’s future!

It additionally has a implausible steadiness sheet with a credit standing of BBB+, one step beneath the A spread.

REXR, which has $1.2 billion in liquidity, has a internet leverage of simply 3.6x EBITDA and no main debt maturities in 2024 and 2025.

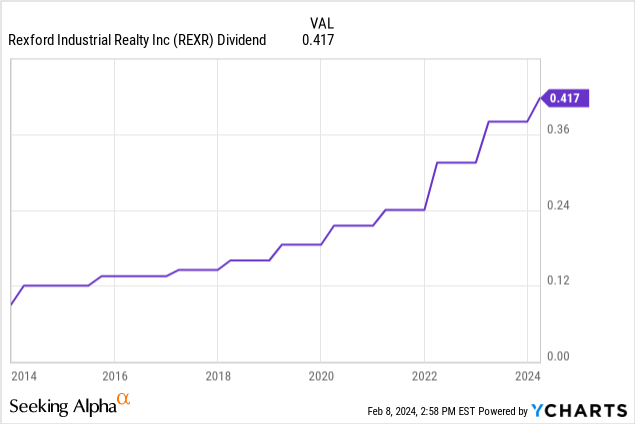

Furthermore, whereas its 3.2% dividend yield might not be very juicy, its dividend has not too long ago been hiked by 10%. Furthermore, if anticipated development charges supply any indication, dividend development is predicted to stay elevated.

Looking for Alpha

Consequently, REXR entered this month as a high contender for March Insanity, because it’s laborious to beat an organization with constant dividend development, subdued provide dangers, elevated inside development alternatives, a steadiness sheet supporting acquisitions in instances of elevated charges, and a beautiful valuation.

Takeaway

Get able to witness REITs leaping out of the company fitness center, identical to basketball stars making an attempt slam dunks.

Much like the spectacular feats on the courtroom, these REITs, Important Properties, American Tower, and Rexford Industrial, present outstanding development potential whereas staying grounded in stable fundamentals.

With a beautiful mixture of development, security, and engaging valuations, these REITs are primed to outperform, providing traders a successful mixture of revenue and development.

[ad_2]

Source link