[ad_1]

This week, whereas the Nasdaq and S&P 500 indexes are poised to shut practically degree, a couple of standout shares are set to conclude with spectacular beneficial properties.

So on this article, we are going to check out the highest 4 shares when it comes to efficiency this week and use InvestingPro to investigate their prospects going forward.

Diamondback Vitality and Uber are a few of the names we plan to debate on this evaluation.

In 2024, make investments like the massive funds from the consolation of your house with our AI-powered ProPicks inventory choice software. Study extra right here>>

Whereas main indexes just like the and have seen a comparatively stagnant efficiency this week, a number of particular person shares have bucked the pattern, reaching vital beneficial properties.

This text will analyze 4 notable performers:

Diamondback Vitality (NASDAQ:) +17.65%

Uber (NYSE:) +14.78%

Airbnb (NASDAQ:) +6.84%

Leonardo (OTC:) +8.93%

We’ll discover the current information and occasions that will have contributed to their success, in addition to delve into their monetary well being and potential dangers.

What Sparked a Rally in These Shares?

Diamondback Vitality not too long ago introduced a 7% improve in its base dividend to $3.60 per share per yr, beginning in This fall 2023.

Moreover, it entered a definitive merger settlement valued at round $26 billion with Endeavor Vitality Sources, anticipated to shut in This fall 2024.

Within the final session, Uber led the S&P 500 with a 14% improve, reaching new all-time highs, following a $7 billion share buyback plan announcement. Morgan Stanley, amongst others, raised the goal value to $90.

Airbnb reported constructive This fall 2023 , indicating sturdy total journey demand, with a modest improve in gross reserving worth (GBV) and income. The quarter noticed a powerful rise in EBITDA attributed to efficient expense administration.

Leonardo additionally exhibited robust efficiency, expressing confirmed curiosity in Iveco’s protection car unit.

Moreover, it signed an MoU with Saudi Arabia’s Ministry of Funding and the Basic Authority for Navy Trade to guage investments and collaborations within the aerospace and protection sector.

Is There Nonetheless Time to Be part of the Rally?

Let’s check out InvestingPro’s Truthful Values for every inventory, based mostly on a number of acknowledged monetary fashions tailor-made to the precise traits of the businesses to grasp the place they stand from a elementary perspective proper now:

1. Diamondback Vitality

For Diamondback Vitality, InvestingPro’s Truthful Worth, which summarizes 15 funding fashions, stands at $173.34, which is beneath the present inventory value.

Diamondback Truthful Worth

Supply: InvestingPro

With InvestingPro, you’ll be able to actively observe analysts’ forecast developments. Analysts specific bullish sentiment on the inventory, setting a goal value at $186.62, which considerably differs from Truthful Worth.

Regardless of the disparity between analysts and Truthful Worth concerning bullishness and goal value, the constructive facet lies in its low-risk profile. The inventory demonstrates glorious monetary well being, receiving a rating of 4 out of 5.

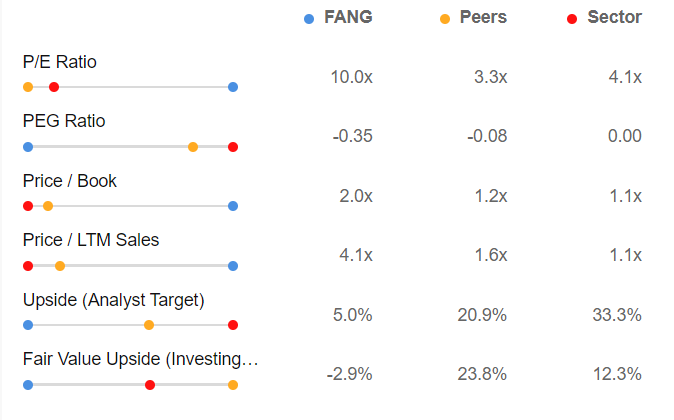

Analyzing the inventory within the context of the market and rivals, it’s presently deemed overvalued.

Supply: InvestingPro

Diamondback Vitality is now value 4.1x its income in comparison with the business’s 1.1x, and the Value/Earnings ratio at which the inventory is buying and selling is 10 occasions in opposition to an business common of 4 occasions, which once more stands to substantiate its present overvaluation.

2. Uber

For Uber, InvestingPro’s Truthful Worth, which summarizes 12 funding fashions, stands at $64.25, which is beneath the present value.

Uber Truthful Worth

Supply: InvestingPro

InvestingPro subscribers have been monitoring analysts’ forecasts, and they’re optimistic in regards to the inventory, setting a bullish goal at $83.64.

Regardless of the present disparity between analysts and Truthful Worth on the chance of an increase, there may be constructive information concerning the inventory’s low-risk profile, boasting a stable monetary well being rating of three out of 5.

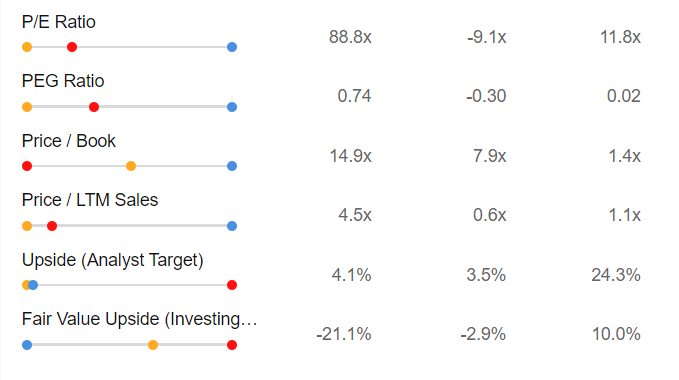

Upon nearer examination, when evaluating the inventory to the market and rivals, it seems to be doubtlessly overvalued.

Supply: InvestingPro

If we once more have a look at the best-known indicators, we are able to see that Uber is now value 4 and a half occasions its income in comparison with the business’s 1.1x, and the Value/Earnings ratio at which the inventory is buying and selling is 88.8X in opposition to an business common of 11.8x, which stands to spotlight its overvaluation.

3. Airbnb

For Airbnb, InvestingPro’s Truthful Worth, which summarizes 12 funding fashions, stands at $140.89, which can be beneath the present value.

ABNB Truthful Worth

Supply: InvestingPro

The inventory has a bearish goal value of $143.69, based on analysts.

Regardless of the consensus between analysts and Truthful Worth on the potential draw back, the inventory’s low-risk profile is a constructive facet, with a superb monetary well being score of 4 out of 5.

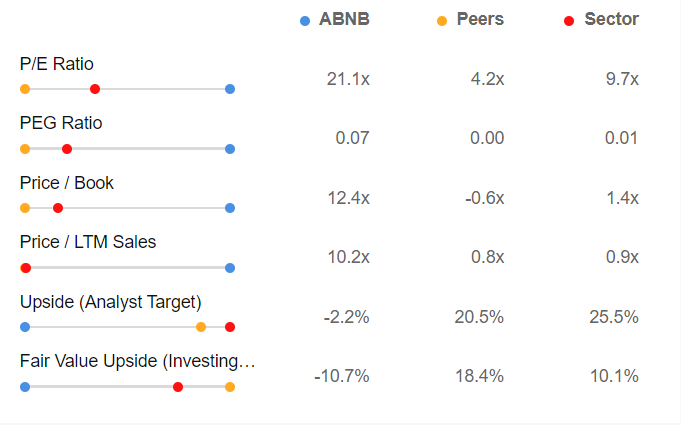

Upon evaluating the inventory with the market and rivals, it turns into evident that the inventory could also be doubtlessly overvalued.

Supply: InvestingPro

We will see that Airbnb is now value greater than 10 occasions its income in comparison with 0.9x within the business, and the Value/Earnings ratio at which the inventory is buying and selling is 21.1X in opposition to an business common of 9.7x, which stands to substantiate its overvaluation.

4. Leonardo

For Leonardo, InvestingPro’s Truthful Worth, which summarizes 15 funding fashions, stands at $9.68.

Leonardo Truthful Worth

Supply: InvestingPro

Whereas analysts and Truthful Worth presently align on the potential draw back, there may be encouraging information from the low-risk profile, boasting a sound monetary well being rating of three out of 5.

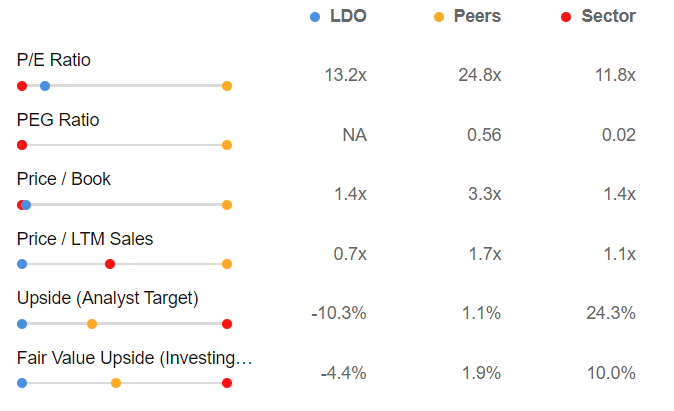

A better examination reveals that compared to the market and rivals, the inventory seems to hold a doubtlessly overvalued valuation.

Supply: InvestingPro

If we have a look at the best-known indicators, we are able to see that Leonardo is now value 0.7x its revenues in comparison with the business’s 1.1x, and the Value/Earnings ratio at which the inventory is buying and selling is 13.2X in opposition to an business common of 11.8x, which stands to spotlight its overvaluation.

Conclusion

In conclusion, though the shares exhibit a stable monetary state with well-defined strengths, traders stay assured within the continuation of the bullish pattern.

Nonetheless, downward forecasts loom given the substantial beneficial properties recorded over the previous yr: Leonardo at +77%, Diamondback Vitality at +32.5%, Uber at +134%, and Airbnb at +19.8%.

***

Take your investing recreation to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already effectively forward of the sport in relation to AI-powered investing, extensively utilizing, customizing, and creating it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own properties with our new flagship AI-powered stock-picking software: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% during the last decade, traders have the perfect collection of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe Right this moment!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or advice to speculate as such it’s not meant to incentivize the acquisition of property in any approach. I wish to remind you that any kind of asset, is evaluated from a number of factors of view and is extremely dangerous and subsequently, any funding resolution and the related threat stays with the investor.

[ad_2]

Source link