[ad_1]

This week, Dow Jones is ready to submit small losses whereas the S&P 500 eyes modest beneficial properties and Nasdaq builds bullish momentum.

In the meantime, some shares which have carried out nicely over the previous week embrace names like Constellation Vitality Corp and Palo Alto Networks.

On this piece, we’ll delve deep into why the shares carried out nicely over the week and their prospects going ahead.

In 2024, make investments like the massive funds from the consolation of your own home with our AI-powered ProPicks inventory choice device. Be taught extra right here>>

This week, is on the right track to finish the week barely within the pink. In the meantime, the S&P 500 is poised to shut with modest beneficial properties because the appears to finish the week on a bullish observe.

The 5 shares which might be making a distinction for these indexes with stable beneficial properties are:

Constellation Vitality (NASDAQ:) +25.72%

Palo Alto Networks (NASDAQ:) +10.09%

Saipem SpA ADR (OTC:) +22.94%

What’s Driving the Positive factors for These Shares?

Constellation Vitality’s inventory skilled a surge because it disclosed substantial institutional possession inside the group, with an 84% stake. This possession is anticipated to play a pivotal position in shaping strategic choices shifting ahead.

Regardless of reporting fourth-quarter per share of -$0.11, which fell $1.91 beneath analysts’ estimates of $1.80, Constellation Vitality’s income for the quarter was $5.8 billion, falling in need of consensus estimates of $7.74 billion.

Palo Alto Networks inventory posted sturdy beneficial properties after revealing that Nancy Pelosi has made a major funding within the cybersecurity firm.

Pelosi’s funding contains holdings price between $500,000 and $1 million (Feb. 12) and one other set of name choices estimated to be valued between $100,000 and $250,000 (Feb. 21), as reported in a monetary disclosure type submitted to Congress.

Moreover, Saipem reported internet revenue of 179 million euros for the total 12 months 2023, marking its greatest consequence within the final 10 years. It is a outstanding turnaround from the corresponding interval in 2022 when the corporate reported a internet lack of 209 million euros.

On this piece, we’ll analyze every inventory utilizing InvestingPro’s Honest Worth. The Honest Worth is set for every inventory primarily based on numerous monetary fashions tailor-made to the shares’ particular metrics.

Constellation Vitality

InvestingPro’s Honest Worth, which summarizes 13 funding fashions, stands at $109.87, or -34.8% lower than the present value.

Honest Worth

Supply: InvestingPro

InvestingPro subscribers have been capable of observe the event of analysts’ forecasts surveyed, as for the goal value they’re bearish on the inventory, at $147.64.

Whereas analysts and Honest Worth are at present in settlement on the draw back prospects, excellent news comes from the low-risk profile. The corporate is in good monetary well being, with a rating of three out of 5.

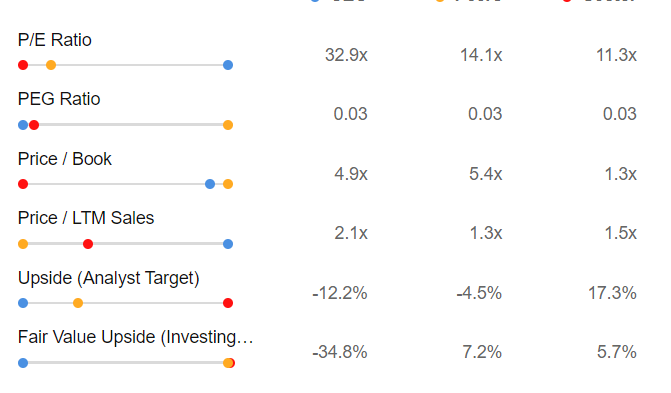

Delving deeper, we are able to see how the comparability with the market and opponents, sees the attainable draw back confirmed, the inventory at a doubtlessly overvalued valuation.

Supply: InvestingPro

Wanting on the best-known indicators, Constellation Vitality is now price greater than 2X its revenues in comparison with the business’s 1.5x, and the Worth/earnings ratio at which the inventory is buying and selling is 32.9X towards an business common of 11.3x, which stands to spotlight its excessive overvaluation.

Palo Alto Networks

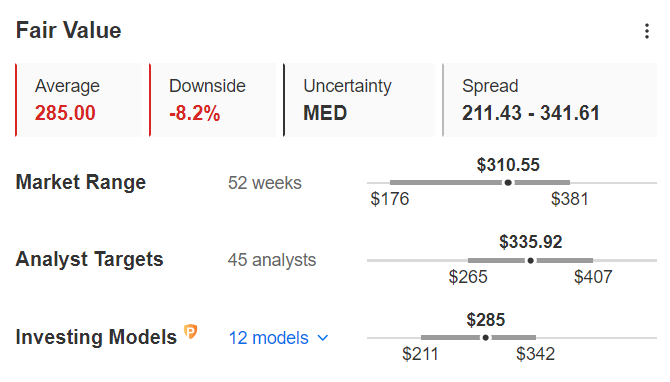

InvestingPro’s Honest Worth, which summarizes 12 funding fashions, stands at $285, or -8.2% from the present value.

Supply: InvestingPro

The analysts interviewed maintain a bullish view, setting a goal value at $335.92.

Regardless of differing opinions between analysts and Honest Worth concerning the probability of an increase, the optimistic facet lies within the low-risk profile.

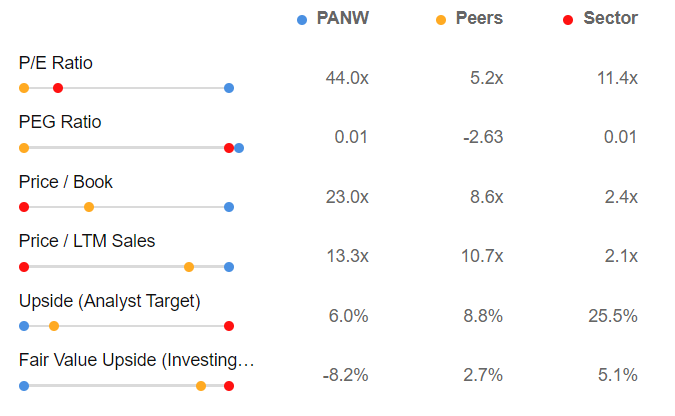

The inventory demonstrates wonderful monetary well being with a rating of 4 out of 5. Moreover, when evaluating the inventory with the market and opponents, additional affirmation means that the inventory could at present be overvalued.

Supply: InvestingPro

Palo Alto Networks is now price greater than 13 occasions its revenues in comparison with two occasions within the business, and the Worth/Earnings ratio at which the inventory is buying and selling is 44X towards an business common of 11.4x, which stands to substantiate its sturdy overvaluation.

Saipem

InvestingPro’s Honest Worth, summarizing 9 funding fashions, pegs Saipem’s worth at $0.34, reflecting a +16.6% improve in comparison with the current value.

Honest Worth

Supply: InvestingPro

Whereas analysts and Honest Worth align on the potential for an upward motion, much less reassuring is the danger profile, at present marked at a good degree of economic well being, with a rating of two out of 5.

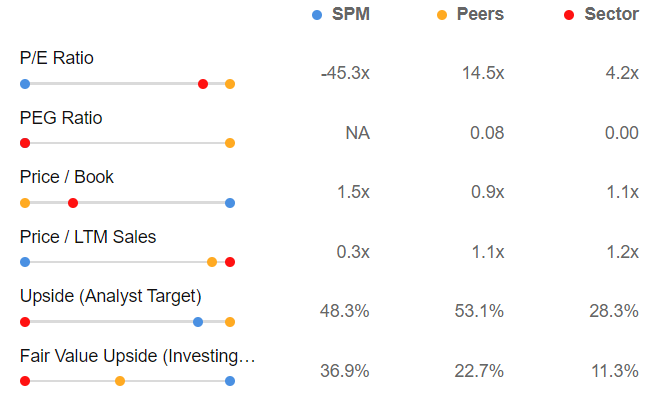

Additional evaluation reveals that when in comparison with the market and opponents, the inventory is positioned with a possible undervaluation.

Supply: InvestingPro

Inspecting the outstanding indicators, Saipem’s valuation is at present at 0.3x of its revenues, in stark distinction to the business’s 1.2x.

The Worth/Earnings ratio of the inventory stands at -45.3x, a major deviation from the business common of 4.2x, emphasizing its undervalued standing.

Conclusion

In conclusion, Constellation Vitality Corp and Palo Alto Networks showcase sturdy monetary well being with well-defined strengths. Nonetheless, the truthful worth signifies that each shares might see a draw back at present ranges.

The substantial beneficial properties registered over the previous 12 months, amounting to 121% for the previous and 64% for the latter, could immediate a reversal in the end.

As for Saipem, the inventory reveals a number of important strengths, together with a mean Honest Worth and optimistic forecasts mirrored in analysts’ goal costs.

Nonetheless, it falters within the monetary well being rating. Regardless of this, the inventory has delivered a optimistic efficiency of 9.62% within the final 12 months.

***

Take your investing sport to the subsequent degree in 2024 with ProPicks

Establishments and billionaire traders worldwide are already nicely forward of the sport relating to AI-powered investing, extensively utilizing, customizing, and growing it to bulk up their returns and decrease losses.

Now, InvestingPro customers can just do the identical from the consolation of their very own houses with our new flagship AI-powered stock-picking device: ProPicks.

With our six methods, together with the flagship “Tech Titans,” which outperformed the market by a lofty 1,183% over the past decade, traders have the most effective number of shares available in the market on the tip of their fingers each month.

Subscribe right here and by no means miss a bull market once more!

Subscribe As we speak!

Disclaimer: This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation, or suggestion to take a position as such it isn’t meant to incentivize the acquisition of property in any method. I want to remind you that any kind of asset, is evaluated from a number of factors of view and is very dangerous and due to this fact, any funding determination and the related danger stays with the investor.

[ad_2]

Source link