[ad_1]

Financial Indicators & Central Banks:

Treasury yields are sinking as bonds await the FOMC’s outcomes. The market is recovering barely from this month’s selloff that has taken charges to the best ranges since late November.

Inventory markets traded blended in a single day, whereas Bonds have been in demand because the FOMC announcement comes into view.

German producer costs fell -4.1% y/y in February. PPI has bottomed out, however thus far remains to be firmly in adverse territory, largely due to a -10.1% y/y drop in power costs. Developments are backing the ECB’s evaluation that issues are transferring in the correct path. Companies value inflation although, which is extra pushed by wage progress than items costs, stays stubbornly excessive for now.

UK inflation continues to decelerate including assist to the bond market. The information confirms that inflation is transferring in the correct path, but in addition that it stays far too excessive, which can justify a dovish maintain from the BoE tomorrow.

FOMC Guidelines: The FOMC will concern its post-meeting assertion in the present day. Expectations are for no coverage change at this assembly, however verbiage might be intently monitored for hints concerning the speed path within the the rest of 2024. The SEP was final up to date in December, and is due for one more replace at this March assembly.

Market Traits:

A blended open on Wall Road with some weak spot on revenue taking after additional AI impressed beneficial properties. The Dow climbed 0.83%, with the S&P500 (US500) advancing 0.56%, whereas the NASDAQ (US100) was up 0.39%.

ASX paring a few of Tuesday’s beneficial properties, whereas China bourses nudged larger.

Nvidia (+1.07%) debuts next-generation Blackwell AI chip at GTC 2024.

Microsoft hires DeepMind founder to steer new AI shift.

Apple is in talks with Alphabet’s Google to doubtlessly incorporate Google’s “Gemini” generative AI engine into its iPhones.

Monetary Markets Efficiency:

The USDIndex discovered a bid too after the BoJ’s dovish hike. It examined 104.06 however slid to 103.82 on the shut.

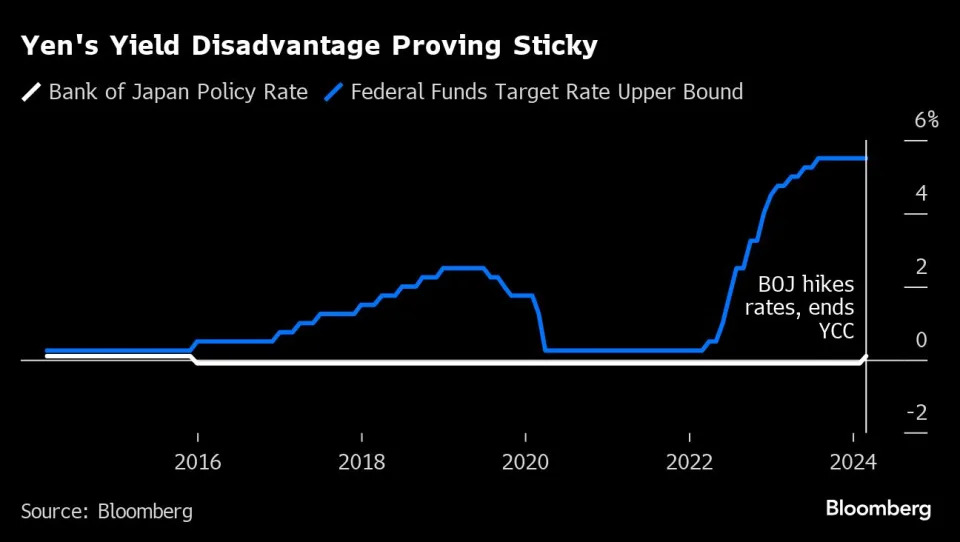

USDJPY is at 151.57 spiking to 4-month highs whereas EURJPY spiked to a 16-year peak after the Financial institution of Japan ended adverse rates of interest with out clear steering on additional hikes.

A stronger than anticipated German ZEW investor confidence studying failed to spice up the Euro considerably. Cable is holding barely under the 1.27 mark.

Gold flattened for a third day in a row and USOIL fell to $82.24 from $83.

Bitcoin continued to tug again from its current report excessive, falling over 5% at one level. Shares of crypto-linked corporations Coinbase (COIN) and Marathon Digital (MARA) misplaced floor alongside the token.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a normal advertising and marketing communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link