[ad_1]

The vacations bought a bit of cheerier amid indicators that the key central banks have come to the top of their aggressive tightening postures. Regardless of protestations from policymakers on the contrary, the markets are actually constructing within the begin of fee cuts in 1H 2024. These hopes underpinned the most effective November’s on report for bonds and shares, and helped increase gold to a brand new report excessive!

Financial Indicators & Central Banks:

The market sentiment stays unsure, as Chair Powell didn’t provide a lot pushback to expectations that fee cuts are the subsequent transfer on the agenda or that there was a large easing in monetary circumstances in November.

The US November payrolls report on Friday is essential for market expectations of fee cuts.

Analysts anticipate a mushy touchdown for the US economic system, with constructive however below-potential progress within the subsequent six quarters.

BofA notes a constructive outlook for rising markets, that are experiencing traditionally constructive returns after the final Fed hike.

Market Developments:

Fed Chair Powell reminded traders the financial institution just isn’t in a rush to chop charges and yields are off Friday’s lows.

Treasuries and Gold declined from session highs. Yields rose throughout numerous tenors in Treasuries, with the 10-year buying and selling round 4.23%.

Asian shares confirmed blended outcomes, with positive aspects in Australian and Korean shares, whereas Japanese equities fell. JPN225 closed down 0.6% at 33,231.27 after earlier sliding as a lot as 1.22%. European and US inventory futures remained secure.

Monetary Markets Efficiency:

The USDIndex nudged larger with Treasury yields and is at 103.43.

EURUSD broke under 1.09, indicating a potential reversal of the 2-month rally, nevertheless 1.0820-1.0865 stays the important thing assist space.

USDJPY dipped to 146.22, reaching a virtually 3-month excessive towards the US Greenback. At present although, it has reverted some positive aspects, as speculation about an eventual unwinding of the Financial institution of Japan’s insurance policies added strain on the Yen.

Gold down from all-time highs above $2,100, benefiting from decrease yields.

Oil costs confronted challenges on account of doubts about OPEC+ sustaining output cuts, excessive US manufacturing, and rising rig counts. UKOIL eased to $78.37 a barrel, whereas USOIL fell to $73.63. Geopolitical tensions within the Center East added to market concerns.

Bitcoin surpassed $41,000, reaching its highest degree since April 2022. Bitcoin’s rebound continued, reaching $41,746, with expectations of interest-rate cuts and potential ETF approvals. Smaller tokens like Ether and Dogecoin additionally skilled positive aspects.

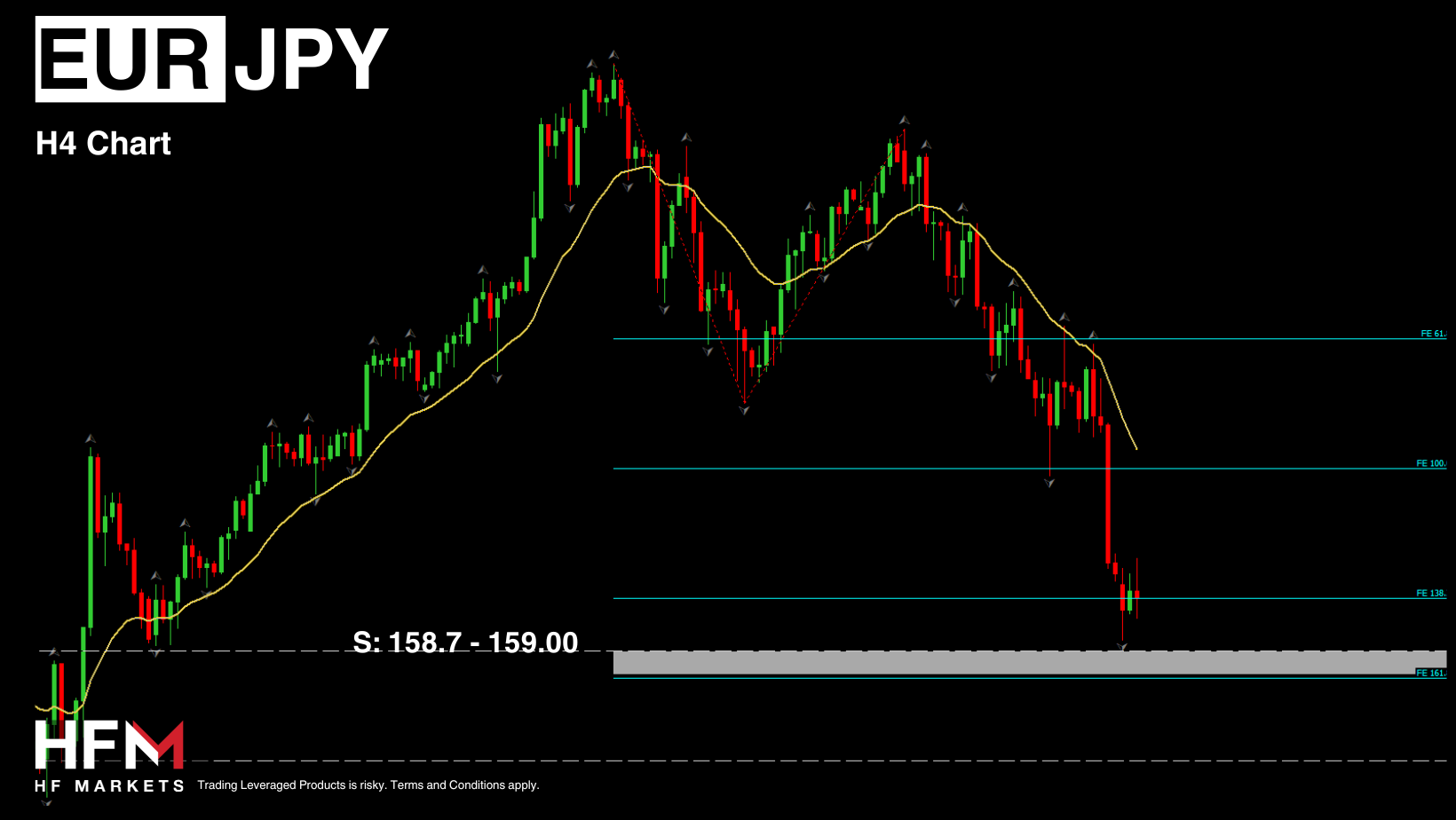

Key Mover: EURJPY down by 1.92%. Subsequent Assist ranges: 159 and 158.50.

This week:

Traders are intently watching financial indicators, together with Australian progress, Chinese language inflation, and US non-farm payrolls knowledge.

The Reserve Financial institution of Australia is anticipated to keep up a hawkish stance.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is supplied as a common advertising communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link