[ad_1]

Revenue-taking on overbought circumstances was the overall rational after bond bulls overzealously introduced ahead Fed fee cuts to the spring, and aggressively priced in 50 bps in easing by mid-year. The blended alerts from the information on retail gross sales, PPI, and the Empire State didn’t present a lot course. Treasuries gave again about half of Tuesday’s CPI-inspired rally as yields climbed about 7 bps throughout the curve.

In the meantime, President Biden and Chinese language chief Xi Jinping adopted a much less contentious tone at their summit, although deep US-China disagreements stay.

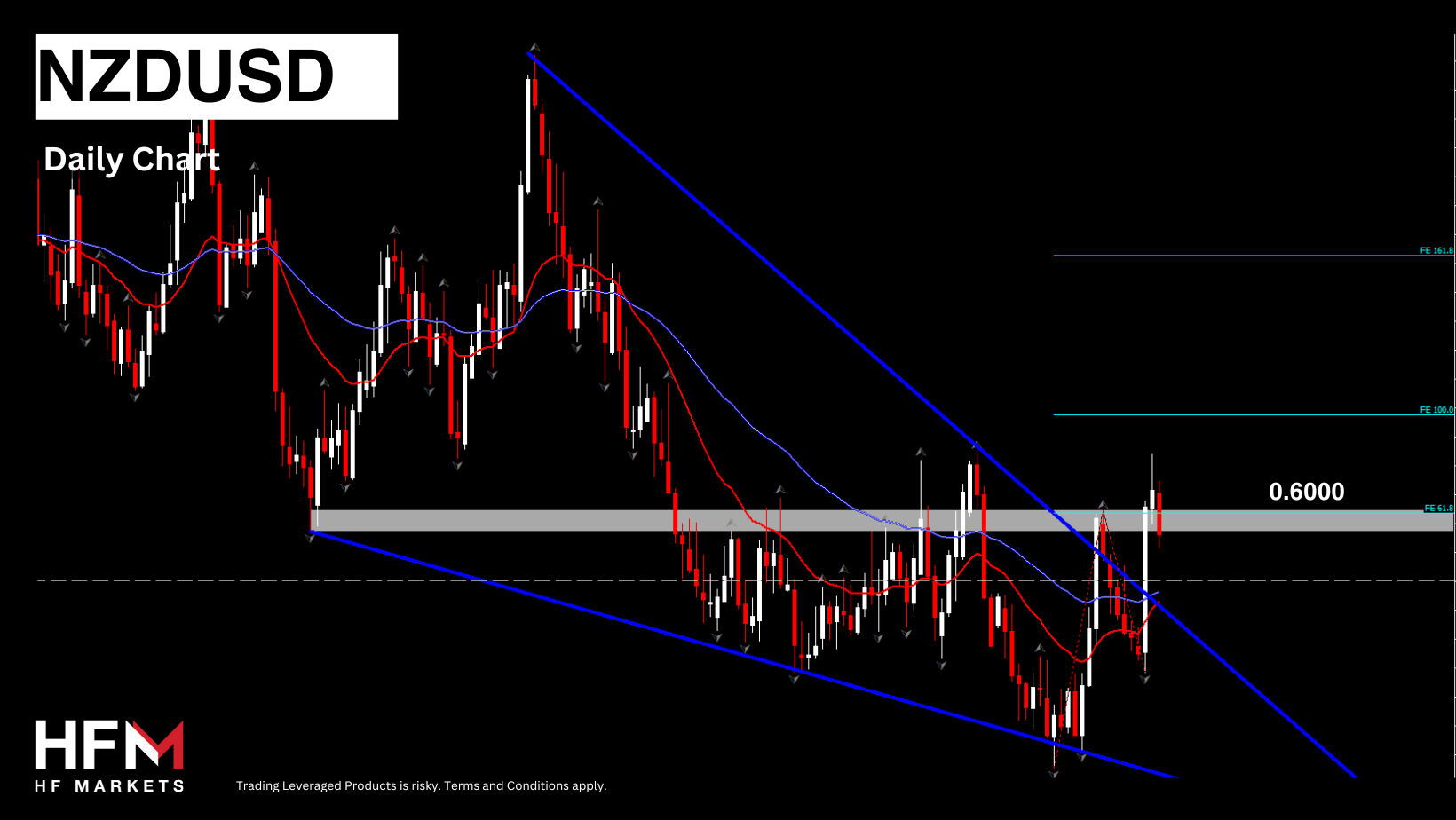

Fascinating Mover: NZDUSD (-0.74%) holds floor above 4-months descending channel. Key assist at 0.5940 and Key Resistance at 0.6000.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication accommodates, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link