[ad_1]

Asian markets bought off after a weaker shut on Wall Avenue on Friday. Mainland China bourses underperformed as traders stay dissatisfied with official help measures and the shortage of additional fee cuts. Futures are below strain throughout Europe and the US, amid indicators that conflict jitters are easing as traders watch diplomatic efforts to comprise the Israel-Hamas battle. The ten-year Treasury yield has backed up 5.1 bp to 4.97%, the German 10-year fee is up 2.9 bp and the 10-year JGB yield jumped 2.6 bp. Oil and gold declined this morning pushed by considerations concerning the sustained interval of elevated rates of interest and tensions within the Center East.

USDIndex turns under 106, EURUSD extends to 1.0593. The VIX climbed to the best since March and the banking stresses.

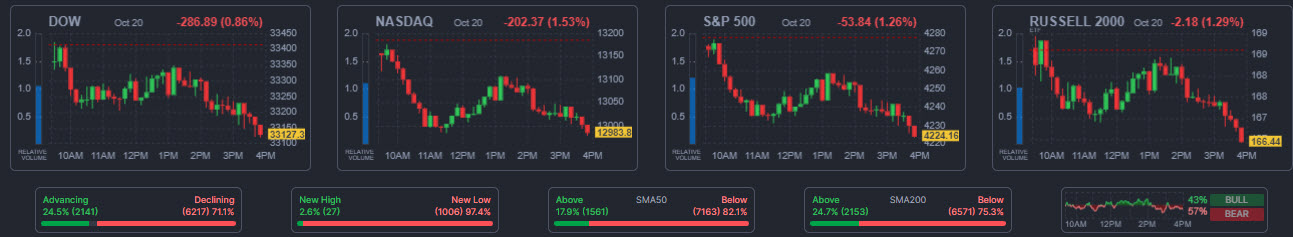

Shares: China’s tech gauge drifts to file lows since its inception greater than three years in the past, worn down by considerations over larger US charges’ influence on world liquidity and a weak export outlook. The US100 plunged -1.53% to 12,983, under 13k for the primary time since Could. The US30 was off -0.86%. A flight to high quality boosted demand for Treasuries, particularly after the dovish studying on Chair Powell’s feedback.

Earnings season ramps up this week, with a slew of huge tech titans slated to report, i.e. Alphabet, Amazon, Meta and Microsoft.

USOIL corrected to $86.80 per barrel and Gold recovered to $1981 as threat aversion recedes for now.

BTCUSD noticed its greatest weekly acquire since June. At present at 30540.

Fascinating Mover: US500 (-1.53%) to 4236, breaking under the 200-day shifting common so as to add to the bitter tone, with fast help ranges at 4200 and 4130.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link