[ad_1]

Inventory market sentiment improved, and Asian equities bounced, alongside positive factors in European and US futures. Earnings studies helped tech shares to stabilise, forward of extra key US information. The ten-year Treasury yield is up 3.2 bp at 4.88%, after sturdy GDP numbers yesterday. Eurozone bonds in the meantime continued to search out patrons, after the ECB successfully confirmed yesterday that within the central situation charges have peaked. The schedule for the re-investment of PEPP redemptions was additionally left untouched, which helped peripherals to outperform and spreads to return in. US economic system expanded at its quickest tempo in virtually 2 years within the newest signal of the nation’s financial resilience.

Inventory markets: Wall Avenue shut in pink for a 2nd session. The US100 has cratered -2.05%. The US500 has dropped -1.28% and is -3.2% decrease, with the US30 down -0.77% at this time and -1.9%. Over the previous 5 classes the indexes are posting declines of -4.75%, -3.2%, and -1.9%, respectively. Right now, inventory sentiment improved.

Asian shares rose after sturdy Q3 gross sales at Amazon helped drive a restoration in investor sentiment following weak outcomes from different expertise teams earlier within the week.

Amazon (+5.36% after hours) sees greatest income since 2021.

Meta (+0.95% after hours) advert income (+23%) fuels blowout Q3, $11.6 billion in income.

Elon Musk simply misplaced $28 billion as Tesla (+1.25% after hours) took a beating.

USDIndex has misplaced altitude barely to 106.36 after climbing to 106.894, simply shy of the 107.000 degree from October 3 that was the very best since late 2022.

USDJPY is holding the 150.00 degree, persevering with to check the MoF after finance minister Suzuki warned that authorities have been intently watching forex strikes “with a way of urgency.”

EURUSD misplaced floor on the ECB’s stance, buying and selling at 1.0544, although contained in the day’s 1.0574 to 1.0524 vary.

USDCAD stays above at 1.3810 after the BoC’s announcement .

GOLD flat however near 1998 (greater than 2-months highs).

USOIL recovered to $85 after a fall on account of an increase in US crude stockpiles and a climb within the US Greenback.

Right now: US PCE deflator, private consumption, College of Michigan sentiment (October), Exxon, Chevron earnings.

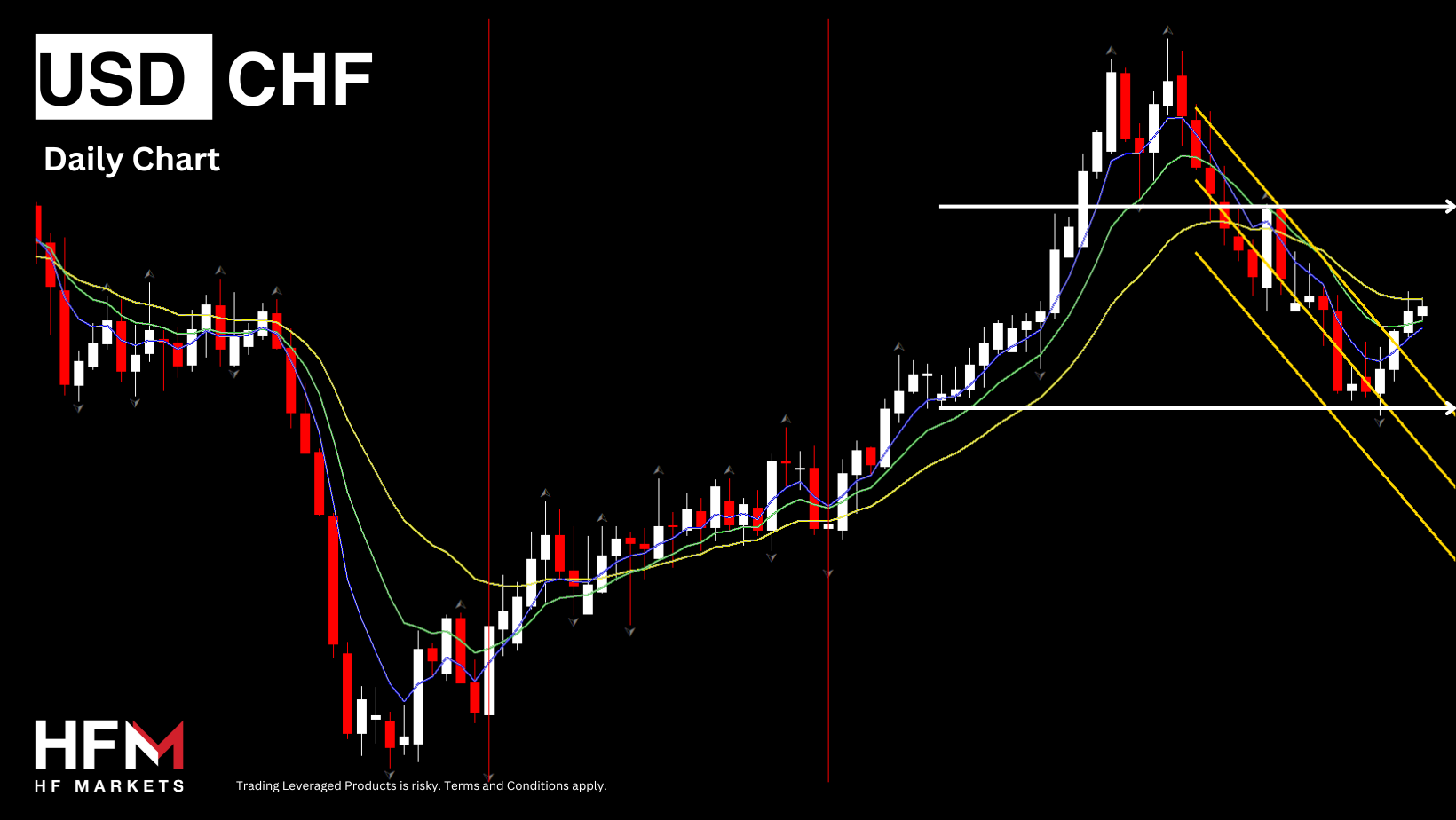

Attention-grabbing Mover: USDCHF broke descending channel and extends larger for a 4th day in a row.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a common advertising and marketing communication for info functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link