[ad_1]

Traders ought to brace for extra volatility subsequent week because the inventory market faces a pair of serious market-moving danger occasions.

U.S. CPI inflation information and the Federal Reserve’s remaining coverage assembly of the 12 months will likely be in focus.

Taking that into consideration, subsequent week will likely be key in figuring out the Fed’s coverage strikes via 2024.

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Subsequent week is predicted to be one other risky one, as buyers brace for 2 of the largest financial occasions that stay for 2023.

On the financial calendar, an important will likely be Tuesday’s U.S. report for November, which is forecast to indicate annual CPI continues to chill.

In the meantime, the Federal Reserve will announce its fee at its final assembly of the 12 months on Wednesday. No motion by the central financial institution is seen because the almost certainly end result, as buyers consider the Fed is all achieved tightening.

Taking that into consideration, the week forward guarantees vital actions, and its affect will seemingly ripple via the inventory marketplace for months to come back.

Right here’s what to be careful for:

Tuesday, December 12: U.S. CPI Report

With buyers now firmly anticipating a Fed fee lower in March, subsequent week’s U.S. CPI inflation information takes on added significance.

As per Investing.com, the is forecast to inch up 0.1% on the month after a flat studying in October. The headline annual inflation fee is seen rising 3.1%, slowing from a 3.2% annual tempo within the earlier month.

A cooler-than-expected print, which sees the headline determine fall to three% or beneath, would add to the rate-cut fervor, whereas a surprisingly sturdy studying would seemingly maintain stress on the Fed to keep up its struggle in opposition to inflation.

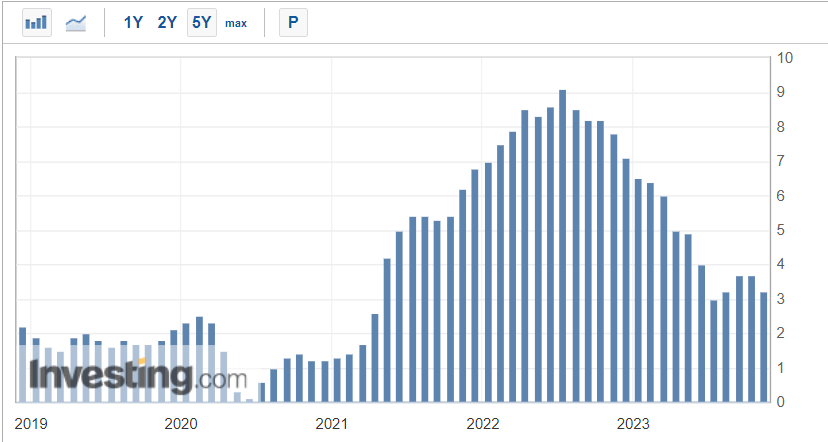

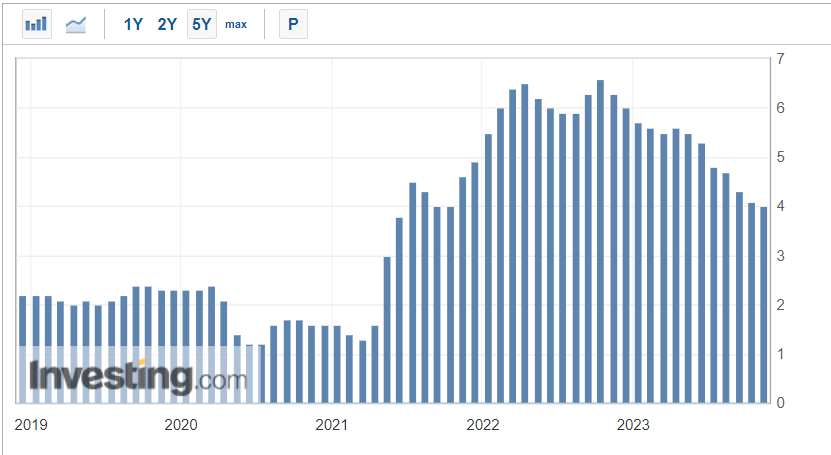

As seen within the chart beneath, U.S. inflation has come down significantly because the summer season of 2022, when it peaked at a 40-year excessive of 9.1%, amid the Fed’s aggressive rate-hiking cycle.

In the meantime, the November index – which doesn’t embody meals and power costs – is predicted to rise 0.2% within the month, matching the identical improve in October. Estimates for the determine name for a 4.0% acquire, the identical as within the earlier month.

The core determine is intently watched by Fed officers who consider that it supplies a extra correct evaluation of the long run path of inflation.

I consider the information will add to additional indicators that inflation is cooling and bolster the view that rates of interest could have peaked.

In feedback made final week, Fed Chairman Jerome Powell vowed to maneuver “fastidiously” on charges, describing the dangers of going too far with tightening as “extra balanced” with dangers of not mountaineering sufficient to regulate inflation.

Taking that into consideration, the U.S. central financial institution is probably going achieved elevating charges and will start to chop them as quickly as the primary quarter of 2024 as inflation continues to fall again in the direction of the two% goal the Fed considers wholesome.

Wednesday, December 13: Fed Choice, Powell Information Convention

Including to the intrigue subsequent week is the extremely anticipated Federal Reserve assembly, the place the long run path of rates of interest and financial coverage changes may hold within the stability.

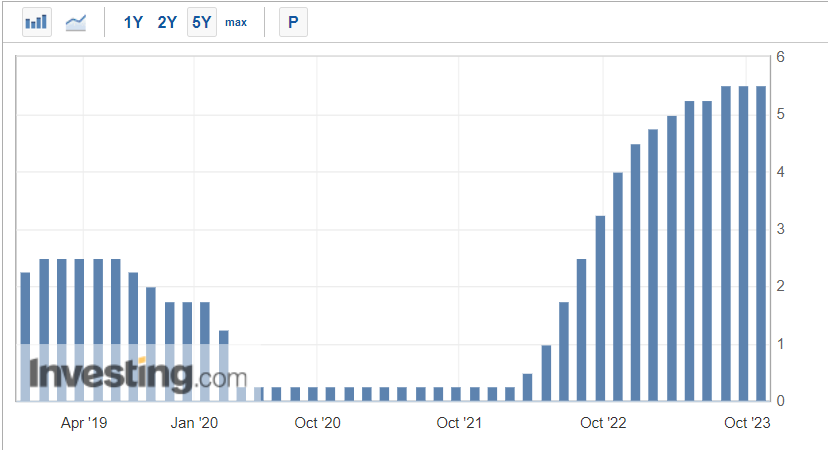

After elevating borrowing prices by 525 foundation factors since March 2022, the Fed is extensively anticipated to maintain rates of interest unchanged for the third assembly in a row as policymakers assess indicators of financial softening.

As of Friday morning, there’s a 99% probability of the U.S. central financial institution holding charges at present ranges, in response to the Investing.com . That would go away the benchmark Fed funds goal vary in between 5.25% and 5.50%.

As at all times, many of the focus will likely be on Fed Chair Powell, who will maintain what will likely be a intently watched shortly after the discharge of the FOMC assertion.

Hypothesis concerning the Fed’s method to inflation, rates of interest, and potential coverage shifts has been rife in latest weeks, intensifying as financial information continues to current a blended image.

Past the anticipated coverage resolution and Powell press convention, Fed officers may even launch new forecasts for rates of interest and financial progress, generally known as the ‘dot-plot’, as buyers develop more and more sure that the Fed is completed mountaineering.

Powell stated final week it was clear that U.S. financial coverage was slowing the economic system as anticipated, with a benchmark in a single day rate of interest “nicely into restrictive territory.”

The Fed chief famous, nevertheless, that policymakers are ready to tighten coverage additional if deemed applicable.

Whereas the Fed is all however sure to carry off on mountaineering charges subsequent week, the upcoming assembly holds the potential for signaling adjustments within the central financial institution’s methods concerning the course of future financial coverage actions.

Many available in the market have highlighted the fragile stability the Fed should strike – a problem of taming inflationary pressures with out tipping the economic system right into a recession.

As such, I consider that Powell will reiterate his dedication to shifting ahead fastidiously with further coverage firming whereas acknowledging that the Fed has made vital progress in bringing down inflation because the economic system hits a comfortable patch.

Traders largely consider the Fed is unlikely to boost charges any additional and have began to cost in a collection of fee cuts starting subsequent spring.

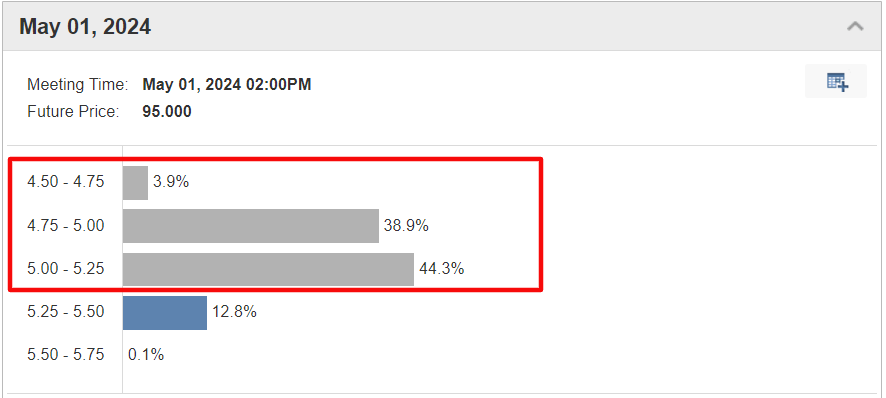

As seen beneath, there’s a roughly 90% probability of a fee lower on the Fed’s Might 2024 assembly, whereas odds for March stand at virtually 65%.

Any indications or shifts within the Fed’s tone throughout subsequent week’s FOMC assembly may set off vital market actions and investor sentiments.

Taking that into consideration, market individuals are suggested to stay vigilant, train warning, and diversify portfolios to hedge in opposition to potential market fluctuations.

You’ll want to take a look at InvestingPro to remain in sync with the market pattern and what it means on your buying and selling.

With InvestingPro’s inventory screener, buyers can filter via an unlimited universe of shares primarily based on particular standards and parameters to determine low cost shares with sturdy potential upside.

You may simply decide whether or not an organization fits your danger profile by conducting an in depth elementary evaluation on InvestingPro in response to your individual standards. This fashion, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you may join InvestingPro, one of the vital complete platforms available in the market for portfolio administration and elementary evaluation, less expensive with the largest low cost of the 12 months (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost As we speak!

Disclosure: On the time of writing, I’m lengthy on the , and the through the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Expertise Choose Sector SPDR ETF (NYSE:). I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic surroundings and firms’ financials. The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

[ad_2]

Source link