[ad_1]

USD/JPY ANALYSIS & TALKING POINTS

Weak Japanese financial knowledge dampens optimism round BoJ coverage shift.Fed to maintain charges at present ranges however will inflation add to NFP and bolster hawkish bets?Key assist zone beneath menace.

Supercharge your buying and selling prowess with an in-depth evaluation of the JAPANESE YEN outlook, providing insights from each elementary and technical viewpoints. Declare your free This fall buying and selling information now!

Advisable by Warren Venketas

Get Your Free JPY Forecast

JAPANESE YEN FUNDAMENTAL BACKDROP

The Japanese Yen ended the week on a unstable be aware after being pushed and prodded from the Asian session right through to the a lot awaited Non-Farm Payroll (NFP) report. Japanese GDP considerably missed estimates and the QoQ print fell into damaging territory thus heightening recessionary fears transferring ahead. This may increasingly preserve the Financial institution of Japan’s (BOJ) extra cautious to tighten financial coverage regardless of excessive ranges of inflation.

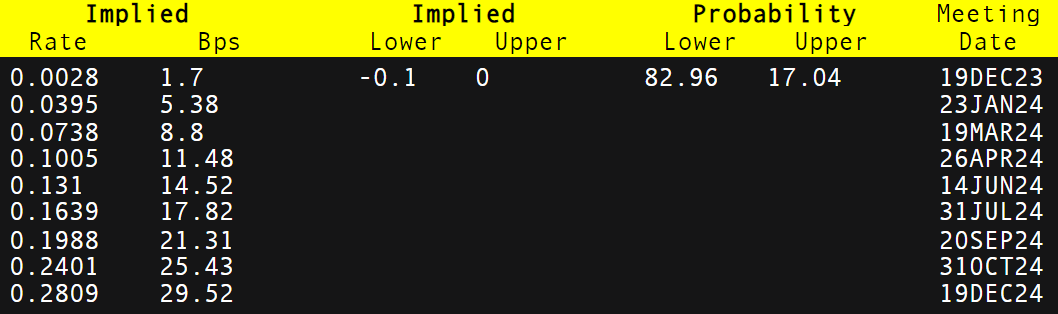

Though we’ve seen the BoJ Governor Ueda trace at a coverage shift, I don’t anticipate something main from the December assembly with out easing the market into it. Information dependency is extra essential than ever for the Japanese central financial institution as strong further assist for inflation and labor knowledge is required to push the BoJ into altering their present stance. Cash markets worth in an rate of interest hike round September/October 2024 (confer with desk beneath) which dietary supplements my expectation for no drastic modifications simply but.

BANK OF JAPAN INTEREST RATE PROBABILITIES

Supply: Refinitiv

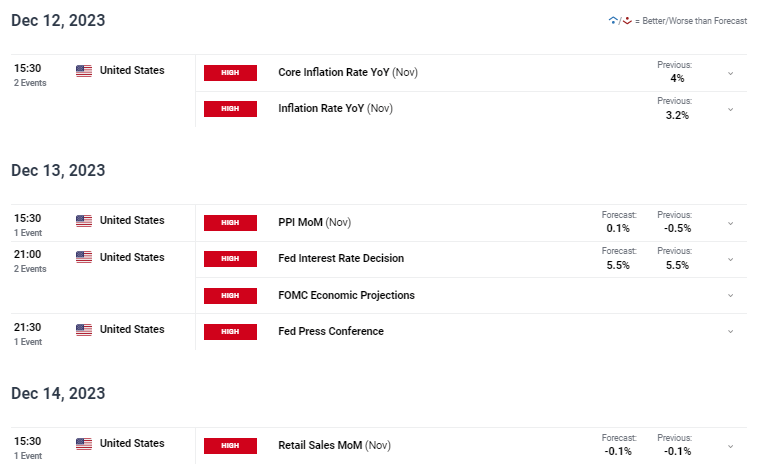

With no Japanese particular knowledge scheduled subsequent week (see financial calendar beneath), the US will come into focus. After an upside shock through the NFP report on all metrics, the dollar could additional its ascendency ought to inflation beat forecasts. That being stated, the Federal Reserve is prone to preserve charges on maintain however may pair with a hawkish narrative from Fed Chair Jerome Powell to take care of a restrictive financial coverage surroundings. US PPI and retail gross sales will spherical off the excessive impression knowledge for the week forward of the next week’s BoJ price announcement.

USD/JPY ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

Wish to keep up to date with probably the most related buying and selling data? Join our bi-weekly publication and preserve abreast of the most recent market transferring occasions!

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX group

Subscribe to Publication

USD/JPY TECHNICAL ANALYSIS

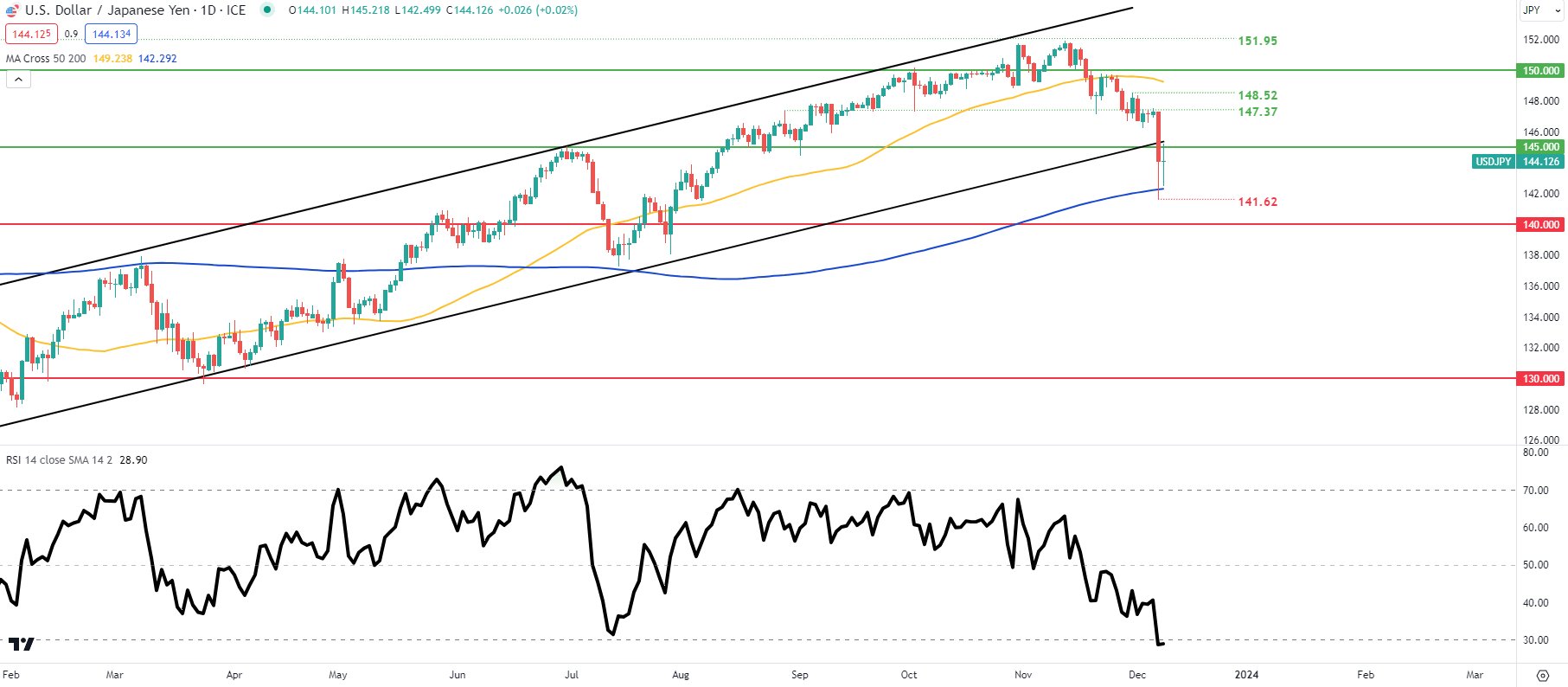

USD/JPY DAILY CHART

Chart ready by Warren Venketas, IG

Each day USD/JPY worth motion above exhibits bears seeking to breach the longer-term channel assist zone. Help was discovered across the 200-day transferring common (blue) because the pair strikes into oversold territory on the Relative Power Index (RSI). A weekly shut in an round channel assist/145.00 psychological deal with is not going to affirm a draw back bias and will spark a pullback for the USD.

Key resistance ranges:

148.52147.37Channel support145.00

Key assist ranges:

IG CLIENT SENTIMENT: MIXED

IGCS exhibits retail merchants are presently web SHORT on USD/JPY, with 68% of merchants presently holding brief positions (as of this writing).

Curious to find out how market positioning can have an effect on asset costs? Our sentiment information holds the insights—obtain it now!

Change in

Longs

Shorts

OI

Each day

-5%

9%

4%

Weekly

10%

-17%

-10%

Contact and followWarrenon Twitter:@WVenketas

component contained in the component. That is most likely not what you meant to do!

Load your utility’s JavaScript bundle contained in the component as a substitute.

[ad_2]

Source link