[ad_1]

koto_feja/E+ by way of Getty Photos

Introduction

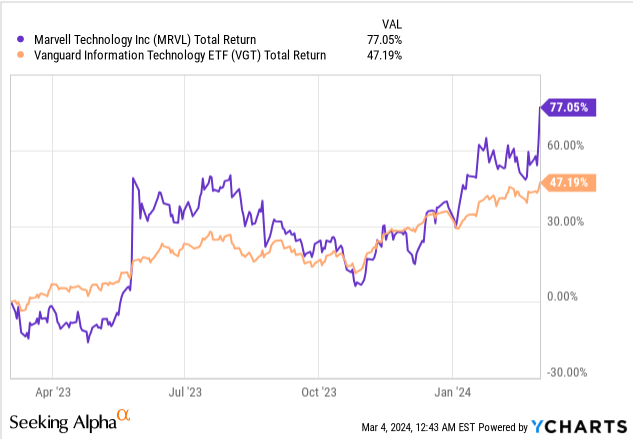

Over the previous 12 months, the inventory of Marvell Know-how, Inc. (NASDAQ:MRVL), the fabless semi provider that gives information infrastructure options that energy the information financial system, has been on a tear; while U.S. tech shares, in normal, have generated strong returns of 47% on common throughout this era, Marvel has notched up way more spectacular returns of 77%!

YCharts

In one other few days, MRVL should take care of a possible catalyst that might assist drive additional outperformance (or vice-versa); the catalyst in query, is the corporate’s This autumn 2024 outcomes (be aware that MRVL follows a Jan ending fiscal), that are resulting from be revealed on the seventh of March, post-market hours.

Listed below are a few of the key speaking factors that might dominate the earnings occasion

Earnings-Associated Concerns

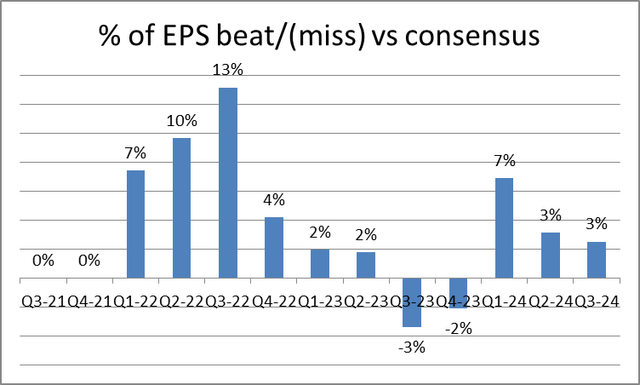

If one is to go by MRVL’s monitor report throughout earnings season, buyers don’t must get overly tensed; MRVL, is after all, not worthwhile on a GAAP foundation, however on a non-GAAP foundation, over the previous three years, it has missed bottom-line estimates on solely two separate events.

On two different cases, it met road estimates, and on each different event, it has crushed consensus numbers. All in all, on common, this can be a firm that usually delivers a bottom-line beat of +3% on common (over 13 quarters).

Searching for Alpha

For the upcoming quarter, the expectation is for an EPS determine of $0.46.

On the highest line, be aware YoY development has been coming in adverse for the previous 3 quarters (Q1 -8.7%, Q2-11.6%, Q3-7.7%), however we might lastly see a shift right here (though not by a lot) with consensus taking a look at $1.42bn on the highest line (this might symbolize marginal constructive development of simply 0.1%).

A serious driver of subdued prime line development is MRVL’s enterprise networking enterprise, which has had to deal with extra stock buildup within the channels for some time now. In Q3 it was down each yearly (-28% YoY) and sequentially (-17% QoQ), and administration implied that though they’ve carried out their finest to curtail their very own stock place, antagonistic demand situations are nonetheless stunting the expansion of this enterprise. In This autumn as effectively, one can anticipate a sequential decline right here (though the diploma of weak point might not be as robust as what was seen in Q3) and even looking forward to the subsequent fiscal, development will solely probably are available in at mid-or low-single digits.

The opposite main section that might expertise weak point is Marvel’s provider portfolio. To date, this enterprise has demonstrated wholesome resilience (in Q3 it was up by 15% qoq), pushed by underlying energy within the wi-fi enterprise, and the 5G rollout impact has lingered as effectively. Wanting forward, we don’t imagine this theme has sufficient legs, and we’d anticipate a slowdown in This autumn.

Nonetheless, regardless of the doom and gloom of the enterprise and provider segments, buyers will be very optimistic about developments within the information heart aspect of MRVL’s enterprise (which is at the moment serving as the principle driver of investor enthusiasm for the inventory).

Within the final quarter, we noticed the normal cloud infrastructure aspect of the information heart section present indicators of life, however crucially, it’s the AI-related enterprise momentum that’s now calling for a drastic re-adjustment of expectations to the upside (again in 2021, administration had pegged the AI-related whole addressable market, or TAM, at solely $800m by FY25 however now they anticipate to comfortably beat that determine). Till lately a lot of the expectations right here have been centered round MRVL’s high-speed optical communication options, however what has been inflicting constructive surprises has additionally been the demand for MRVL’s customized silicon portfolio. All in all, after rising at a tempo of 20% sequentially in Q3, the information heart aspect of the enterprise ought to develop at 30% in This autumn.

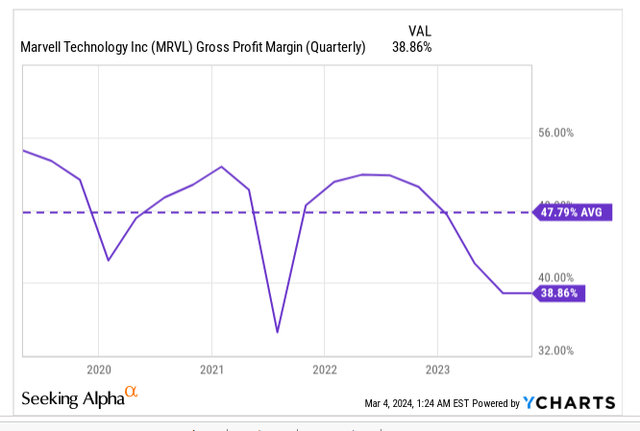

Now this may increasingly not instantly replicate on the gross margin profile, however subsequent yr onwards as customized silicon takes up a bigger share of the general combine, there’s an opportunity that MRVL’s gross margin development might stall. In Q3, gross margins had dropped to 38.8%, nearly 1000bps decrease than the 5-year common, however administration prompt {that a} cross-functional effort to optimize the price construction would assist gross margins transition effectively forward of that stage in This autumn (anticipated This autumn vary of 48.2%-50.7%). Even on the OPEX entrance, the place issues have been trending up for 3 straight quarters, one might lastly see a pivot decrease by round 2% sequentially (anticipated determine of $680m)

YCharts

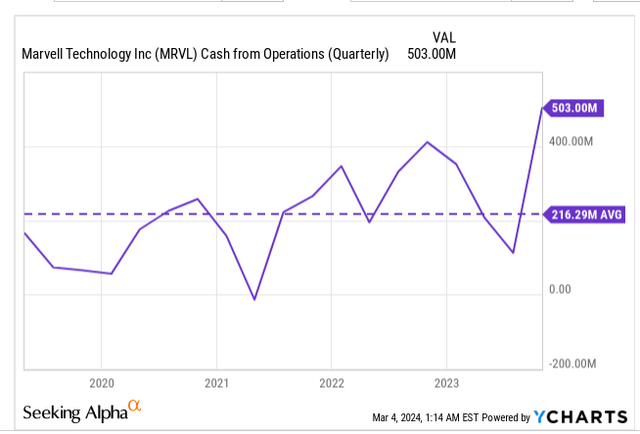

One space the place buyers might not wish to get too carried away is the working money circulate technology in This autumn, the place final quarter’s studying was effectively past the norm (half a billion of working money in only one quarter, when this agency usually solely generates a bit of over $200m per OCF on common).

YCharts

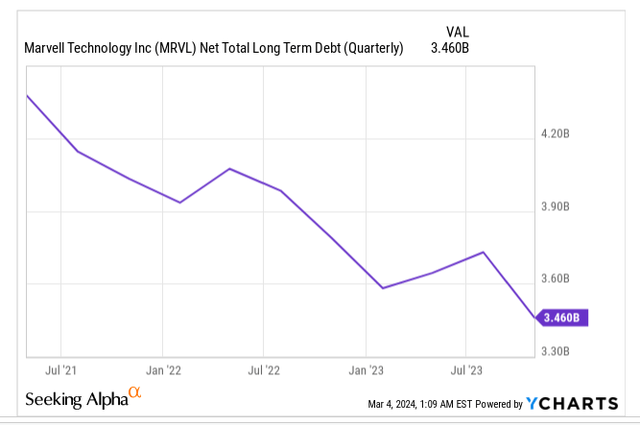

A normalization of the money circulate place shouldn’t be seen as overly regarding, as MRVL has already been doing fairly effectively to convey down its stage of debt, and stretch its maturities. For context over the past 3 years, internet long-term debt is down by 20%, and the agency doesn’t have any main maturities due till 2027 (when $959m is due)

YCharts

Closing Ideas: Valuation and Technical Concerns

AI-related tailwinds ought to do a world of excellent for MRVL’s information heart section, however buyers shouldn’t additionally neglect that different key cogs, such because the enterprise and provider companies are nonetheless prone to are available in weak, and keep that method over the subsequent few quarters.

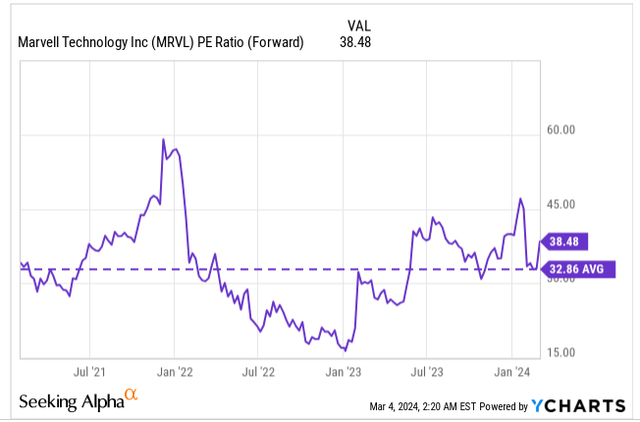

YCharts

In gentle of that, we don’t really feel too snug with shedding out a heightened ahead P/E of 38.5x, which additionally interprets to a +17% premium over the inventory’s 5-year rolling common of 32.9x.

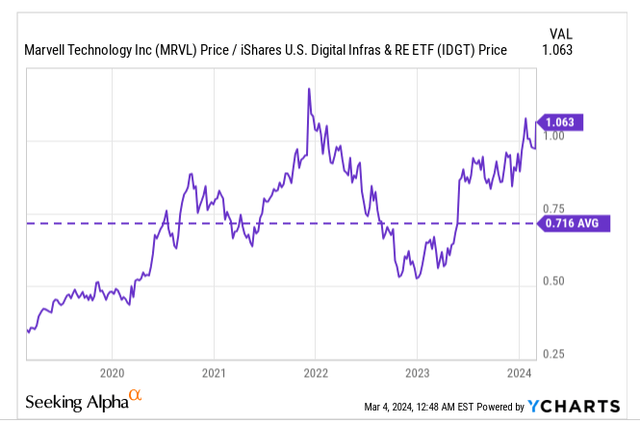

Our optimism on the MRVL inventory can be tempered by the thesis that the inventory is unlikely to enchantment to buyers who’re on the lookout for rotational alternatives within the digital information infrastructure house. The chart under supplies some context on how comparatively overbought the MRVL inventory appears to different shares which might be anticipated to play a key position within the progress of information digitization and AI (the present relative energy ratio is sort of 50% larger than the 5-year common).

YCharts

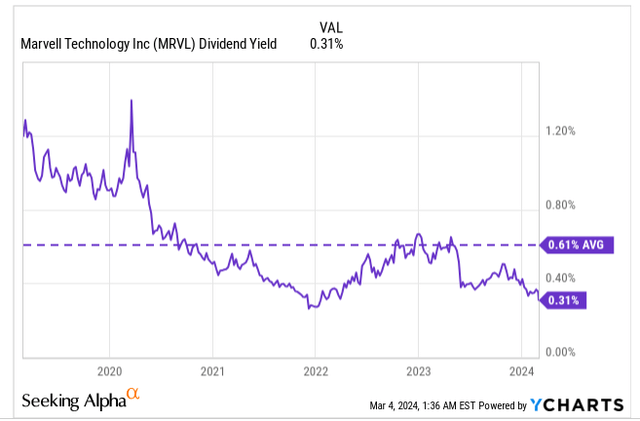

Then the dividend narrative might solely be a secondary issue however be aware that MRVL has been paying dividends for 11 years now, and the unsavory variance between the present determine and the 5-year common (it’s at the moment solely half pretty much as good as what you’ve been getting on common) is one more reason to not get too enthusiastic right here.

YCharts

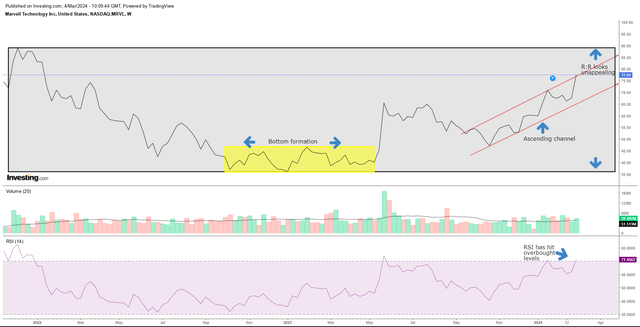

Lastly, additionally think about the developments on MRVL’s personal standalone weekly chart. Marvell final peaked on the sub $95 ranges again in late 2021, after which we noticed a fast descent. Between Oct 2022, and Could 2023, the worth then confirmed indicators of bottoming out (near the $34 ranges), and that’s when one ought to ideally have jumped in.

Since then we’ve seen an uptrend, a pullback, adopted by yet one more steeper uptrend (which is what’s at the moment in play).

The MRVL inventory might effectively proceed to learn from bullish momentum, however inside its broad peak-to-trough vary ($95-$35), a recent lengthy place on the $78 stage represents poor risk-reward.

Additionally think about that the present uptrend is going down inside a steep ascending channel, and the inventory has simply hit the higher boundary of this channel. Compounding points, you even have the RSI indicator which has simply hit the overbought territory.

Investing

Even when Marvell Know-how, Inc. performs a binder throughout earnings and delivers compelling steering, we don’t imagine it will be too smart to deploy one’s assets at these elevated ranges. The inventory is a HOLD.

[ad_2]

Source link