[ad_1]

Feverpitched

Matterport’s (NASDAQ:MTTR) enterprise continues to develop, regardless of weak circumstances in its core actual property market, indicating broader adoption of its subscription resolution. The introduction of Property Intelligence might additionally present a tailwind in coming years. Matterport’s losses stay massive although, and the corporate has made little progress in the direction of profitability in latest quarters. Whereas losses are largely the results of non-cash bills, buyers are being considerably diluted.

The final time I wrote about Matterport in October 2023, I urged that the weak demand atmosphere and Matterport’s massive working bills made the inventory dangerous, regardless of a seemingly engaging valuation. I imagine that this example is more likely to persist till the housing market normalizes, however it’s unclear how or when this may occur.

Market

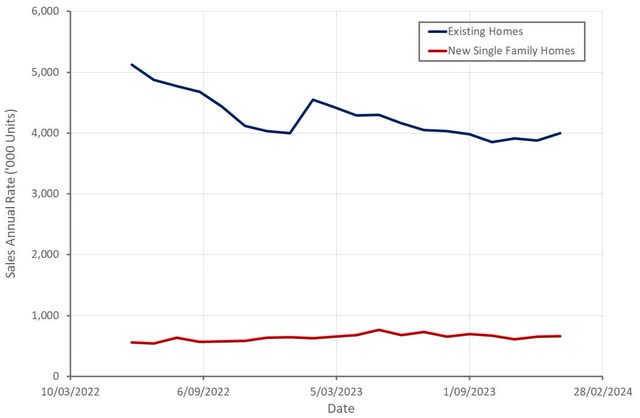

Round half of Matterport’s subscription income comes from the residential actual property sector, which is a big drag on the enterprise in the mean time. US dwelling gross sales have been down nearly 19% YoY within the fourth quarter, on the again of a pointy rise in rates of interest. Regardless of this, Matterport nonetheless managed to extend its residential actual property subscription income by 14% YoY. This case might not be all unhealthy, although, because it could possibly be pressuring brokers to safe new listings and display worth added to purchasers. Digital twins are more likely to grow to be extra commonplace over time as they function a advertising and marketing device and expedite transactions. Brokers that don’t use a majority of these instruments threat being left behind.

Many massive corporations in the actual property area are leaning into a majority of these capabilities, which ought to help demand. Redfin (RDFN) is attempting to create a greater expertise for patrons, which incorporates 3D scans of all properties listed by Redfin brokers. Redfin has been taking market share and is listed as a Matterport buyer.

Zillow (Z) has actively constructed out its vendor options in recent times. Zillow not too long ago acquired ARIA, a software program supplier to actual property photographers throughout the US. ARIA’s platform capabilities and community of third-party actual property photographers will assist allow the corporate to scale ShowingTime’s itemizing showcase product. Zillow additionally affords 3D dwelling excursions by its 3D Houses app. The app permits customers to create a digital twin utilizing their smartphone or a 360-degree digicam.

Opendoor (OPEN) makes use of a broad vary of information to try to precisely value properties with its algorithm. Pricing may be tough, although, significantly as Opendoor spreads into new markets which can be much less amenable to correct predictions (higher housing inventory heterogeneity, and so forth.). Whereas there isn’t a indication that Opendoor at present makes use of 3D scans, this might in the future present an extra supply of information.

Determine 1: US Dwelling Gross sales (Created by writer utilizing information from The Federal Reserve)

Exterior of residential actual property, Matterport’s enterprise continues to develop quickly. In line with McKinsey, 70% of C-Suite know-how leaders are evaluating digital twins. Specifically, journey and hospitality is a crucial sector for Matterport, with an estimated 50% of journey and hospitality organizations anticipated to implement digital twins by 2025.

Matterport Enterprise Updates

Whereas the demand atmosphere is at present mushy, Matterport continues to develop, primarily by mapping out extra areas. The corporate now has 38 billion sq. toes beneath administration, up 36% YoY, and roughly 11.7 million digital twins, a 27% improve YoY. That is offering sturdy subscription development, however Matterport’s information remains to be beneath monetized. In help of realizing extra worth from its information, Matterport not too long ago launched Property Intelligence, a set of AI-powered options and new capabilities for digital twins. Property Intelligence offers automated measurements, layouts, enhancing, and reporting capabilities.

Matterport additionally plans on introducing generative AI performance to allow house owners to reimagine an area. Genesis combines Property Intelligence with Generative AI to automate design, planning, and property administration. Genesis permits digital twins to be simply manipulated in dimensionally correct, photorealistic 3D, with use circumstances together with:

Inside Design Design & Development Power Effectivity Upkeep & Repairs Security & Safety

Matterport additionally not too long ago initiated a beta program for a software program improve that will increase the precision of its 3D fashions and simplifies skilled as-built modeling. Matterport can also be increasing its presence within the building business. The corporate not too long ago launched a CAD File add-on which permits the conversion of Matterport digital twin level clouds into editable CAD drawings.

Matterport not too long ago entered right into a multi-year collaboration with Vacasa. Vacasa operates a trip rental administration platform in North America, Belize, and Costa Rica. It additionally offers providers to purchase and promote trip properties by its community of actual property brokers. Matterport’s digital twin capabilities shall be built-in into Vacasa’s advertising and marketing materials and property administration.

Matterport additionally not too long ago entered right into a partnership with Visiting Media, a supplier of options for property administration groups and channel distribution efforts. Visiting Media helps 1000’s of motels, and Matterport will now be its most well-liked 3D know-how vendor. Whereas these developments are optimistic, Matterport already has monumental scale, and it’s tough to see any of those transferring the needle for its enterprise.

Matterport serves a various group of consumers throughout areas like actual property, AEC, amenities administration, journey & hospitality, and insurance coverage. Round 25% of the Fortune 1000 are already Matterport prospects. Buyer focus is low, with lower than 10% of Matterport’s subscription income coming from its ten largest prospects.

Partnerships look like a rising a part of Matterport’s technique, which isn’t stunning given the lengthy tail of potential customers that it’s attempting to succeed in. Matterport now has relationships with corporations like Autodesk, Amazon Internet Providers, and Procore. The corporate’s direct gross sales pressure is attempting to co-sell its options with companions.

Determine 2: Instance Prospects (Matterport)

Monetary Evaluation

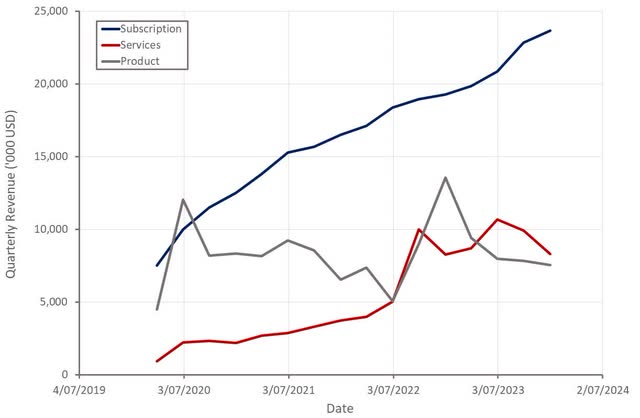

Matterport’s income was 39.5 million USD within the fourth quarter of 2023, down roughly 4% YoY. This decline was pushed by a 44% YoY drop in product income, on account of a tough comparable interval in 2022 when the Pro3 digicam was first launched. Black Friday and Cyber Monday promotions assisted unit gross sales, and these have been prolonged by the rest of the 12 months, elevating questions concerning the power of underlying demand.

Subscription income was 23.7 million USD within the fourth quarter, up 23% YoY. Subscription income now represents 60% of complete income, which is supportive of each margins and income stability. Exterior of actual property, subscription income elevated 20% in 2023, demonstrating the diversification of Matterport’s enterprise.

Matterport expects 39-41 million USD within the first quarter of 2024, a 5% improve on the midpoint. Subscription income is predicted to be 24-24.2 million USD, up 22% YoY on the midpoint. For the complete 12 months, Matterport expects 13% income development and 20% subscription income development.

Determine 3: Matterport Income (Created by writer utilizing information from Matterport)

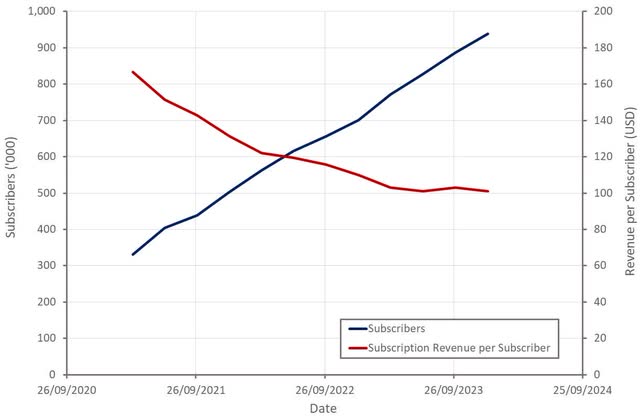

Matterport now has 938,000 subscribers, up 34% YoY, with paid subscribers rising by 13%. Enterprise and SMB subscription plans have been each up by greater than 20% YoY within the fourth quarter. Greater than 120 prospects now have over 50,000 USD in ARR, up 30% YoY.

Determine 4: Matterport Subscribers (Created by writer utilizing information from Matterport)

Matterport’s web greenback enlargement price has picked up in latest quarters, however the firm has urged that round half of this is because of value will increase.

Determine 5: Matterport Internet Greenback Enlargement Fee (Created by writer utilizing information from Matterport)

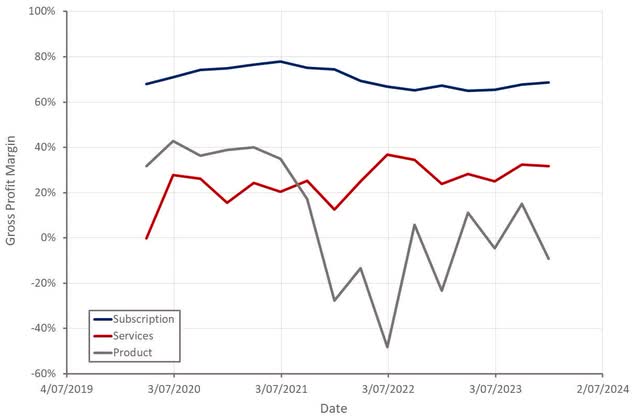

Matterport’s gross revenue margin continues to enhance because the subscription enterprise grows. This has been assisted by value will increase and decrease cloud internet hosting prices. Whereas Matterport’s product margins are up from latest lows, they’re nonetheless close to zero, with Matterport providing reductions to drive volumes.

Determine 6: Matterport Gross Revenue Margins (Created by writer utilizing information from Matterport)

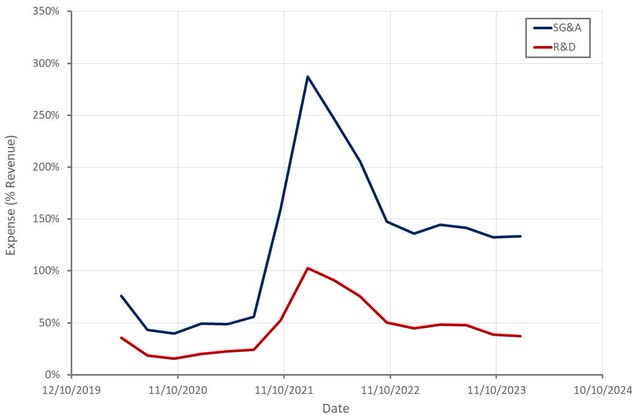

Matterport’s working revenue margin is slowly enhancing, however the firm has an extended strategy to go to succeed in breakeven. Non-GAAP working bills have been 38.2 million USD within the fourth quarter, down 12% YoY, with the discount pushed largely by R&D.

Whereas Matterport’s losses are massive and have proven little signal of enchancment with scale, the corporate nonetheless has over 400 million USD of money, money equivalents, and short-term investments, and money burn is approaching zero. Traders nonetheless face heavy dilution, although, until Matterport can considerably cut back the burden of stock-based compensation.

Determine 7: Matterport Working Revenue Margin (Created by writer utilizing information from Matterport) Determine 8: Matterport Working Bills (Created by writer utilizing information from Matterport)

Conclusion

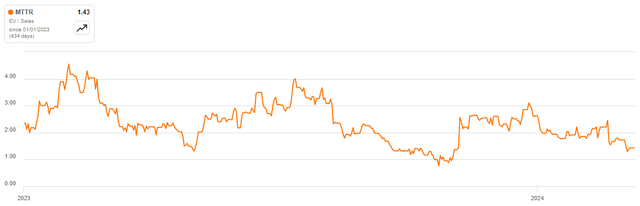

When it comes to income, Matterport has transitioned from a {hardware} firm to a software program firm over the previous few years, and that is but to be mirrored within the firm’s valuation. If Matterport can reaccelerate income development and start making real progress in the direction of GAAP profitability, there may be important room for a number of expansions. To some extent, an funding in Matterport is a guess on a housing market restoration, although, that means the corporate could possibly be going through demand headwinds for years.

Determine 9: Matterport EV/S A number of (supply: Looking for Alpha)

[ad_2]

Source link