[ad_1]

US shares on Thursday moved decrease, with tech shares taking one other hit, after META (-3.80%) warned about promoting income in an unsure financial setting. In the meantime, Alphabet (GOOGL) fell one other -2.72% on Thursday, including to Wednesday’s decline, because it reported disappointing cloud income. Amazon fell -1.11% according to different tech shares, however rallied again over +2%, after Thursday’s shut, on a constructive earnings report.

Amazon’s internet gross sales jumped 13% y/y to succeed in $143.1 billion, surpassing analysts’ expectations. Within the three months ended 30 September, internet revenue skyrocketed 241% to $9.9 billion, with diluted earnings per share surging 235% to $0.94. Within the reported interval, working revenue surged 348% in comparison with the identical timeframe in 2022, amounting to $11.2 billion. On an annualised foundation, Amazon Internet Companies phase gross sales grew 12%, reaching $23.1 billion.

The USA500 index fell -1.11% to finish beneath the 4,200 mark, the USA30 fell -0.73% and the USA100 fell by -1.81% to its lowest stage since Could.

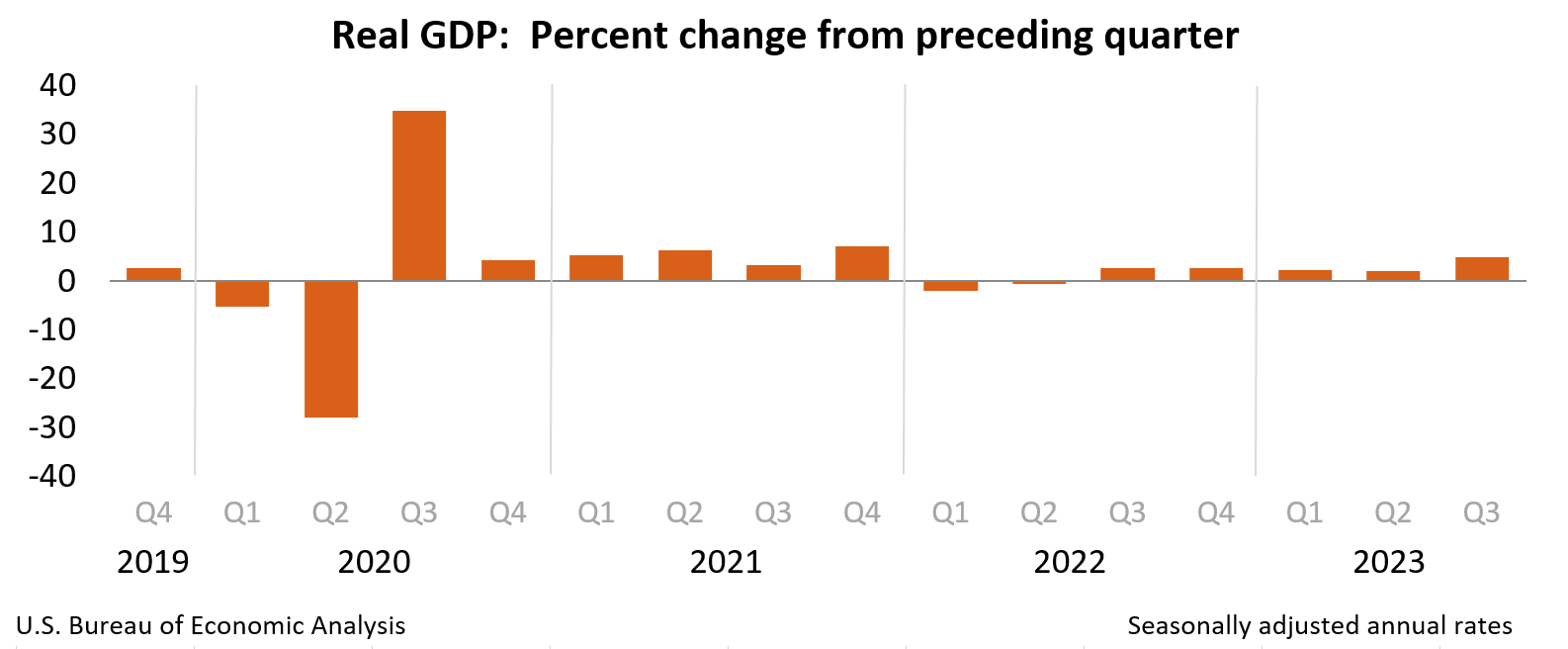

US GDP exceeds expectations with 4.9% progress in Q3

The US financial system carried out strongly in Q3 2023, with annualised GDP progress of 4.9%, surpassing estimates of 4.3% and displaying a marked enchancment from the two.1% seen within the earlier quarter. This sturdy actual GDP progress was pushed by a sequence of things, particularly there was a marked enchancment in areas reminiscent of shopper spending, personal stock funding, exports, state and native authorities spending, federal authorities spending and residential mounted funding. Nevertheless, these will increase had been barely held again by a decline in non-residential mounted funding. As well as, you will need to be aware that imports, which act as a deduction from the GDP calculation noticed a rise throughout this era.

The Fed’s Key Inflation Fee

The core PCE value index, excluding meals and vitality, rose by 2.4% yearly in Q3, down from 3.7% in Q2.Nevertheless, on nearer inspection, core costs remained subdued, falling at an annualised fee of two.1%.Beginning late final 12 months, Federal Reserve Chairman Powell shifted the main focus of inflation to core PCE companies, excluding housing, or superintendent companies.That is according to the Fed’s view that tight labour markets and rising wage progress are on the root of excessive inflation. Wages represent a excessive proportion of prices for service companies. Subsequently, supercore companies inflation ought to ease as wage pressures ease.

The supercore PCE inflation information within the third quarter confirmed value will increase of three.5% each year, larger than within the second quarter. The information confirmed that the Fed nonetheless has an extended approach to go to carry down inflation for this expenditure class, which incorporates healthcare, haircuts and hospitality.

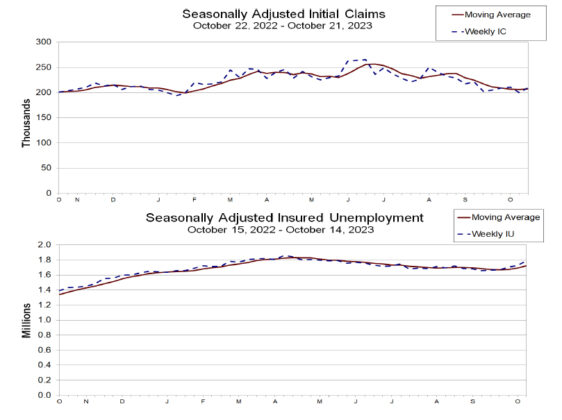

Preliminary claims for unemployment advantages rose by 10,000 to 210,000 within the week to 21 October. The four-week common of claims rose 1,250 to 207,500, close to the bottom stage in eight months. Nevertheless, ongoing jobless support claims rose 63,000 to 1.79 million, the best since Could.

The Commerce Division will launch month-to-month inflation information for September on Friday, which is a part of its private revenue and spending report. Q3 information implies that supercore companies inflation accelerated sharply in September, after weak figures within the earlier two months.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Academic Workplace – Indonesia

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link