[ad_1]

Viktor Aheiev/iStock through Getty Photographs

Many traders get into bother holding in style shares nicely after an inexpensive valuation disappears. The previous Wall Avenue adage is… you is usually a bull or a bear, however do not be a pig. Greed and vanity can work throughout a rising development, positive. It could possibly additionally get you right into a cycle the place you let main buying and selling/investing earnings evaporate over a yr or two. My buying and selling logic for Microsoft (NASDAQ:MSFT) shares is to loosen up now, because the Large Tech selloff is spreading quick throughout October.

Rising rates of interest as funding competitors, a slowing financial system, a valuation that does not make a lot sense vs. life like math, and an overhyped synthetic intelligence [AI] panorama in late 2023, make a severe case to liquidate on this week’s worth power. The strain to promote Microsoft has been rising day after day, week after week, since late summer season. For those who stay lengthy, simply bear in mind -50% worth declines should not unusual for the general fairness market and particular person names, particularly after years of wealth good points.

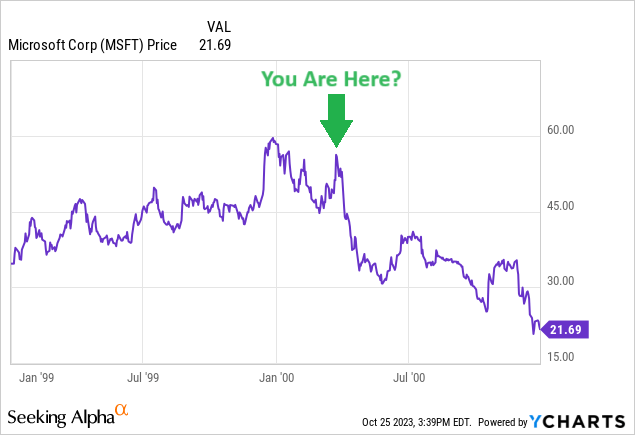

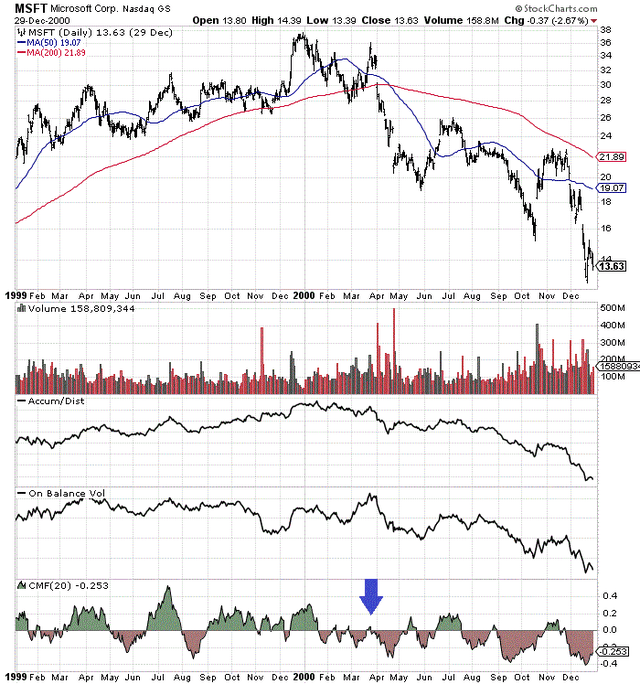

For instance, Microsoft declined -65% over 12 months between the tip of 1999 and 2000, on the finish of the Dotcom Tech increase. Imagine it or not, in the present day I discover loads of sentiment (overly optimistic), valuation (amazingly prolonged) and technical buying and selling (weak shopping for quantity with fading worth) similarities to the start months of 2000.

StockCharts.com – Microsoft, 1999-2000 Value Adjustments, Creator Reference Level

Do not say such can not occur once more! If we’re on the cusp of a multi-year recession, the place Microsoft is headed towards snowballing disappointment from operations, a -50% or higher decline will not be unimaginable. For prudent traders, why not take some chips off the desk? Present “projected” progress charges from the enterprise are above common, however the valuation is already discounting years of fine instances forward. What if a recession blunts future enterprise outcomes?

Trying on the macroeconomic backdrop, my view is that is good because it will get for longs. I’m downgrading my intermediate-term view from final November’s Maintain to Promote. For a 12-month outlook, I anticipate MSFT to commerce flat to decrease throughout 2024.

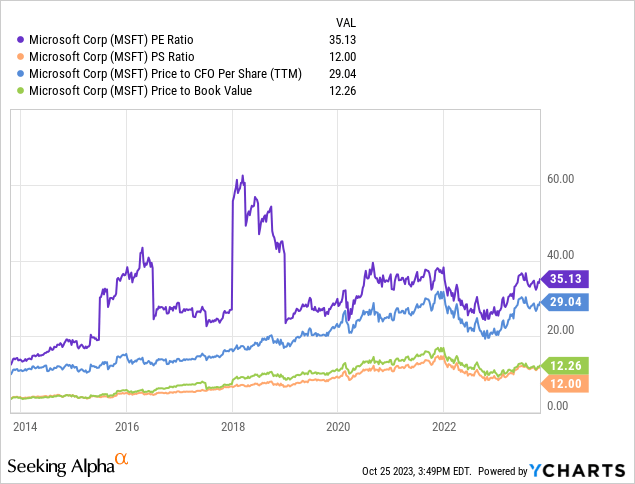

Excessive Valuation = Nothing Can Go Incorrect

In some respects, the overvaluation downside at Microsoft isn’t any worse than late 2021’s peak. I do not know if that is a lot comfort given worth to trailing earnings (35x), gross sales (12x), money circulation (29x), and guide worth (12.2x) are every DOUBLE the degrees of 10 years in the past, throughout the remaining months of 2013. For positive, these stats are within the growth-stock class.

YCharts – Microsoft, Value to Primary Enterprise Fundamentals, 10 Years

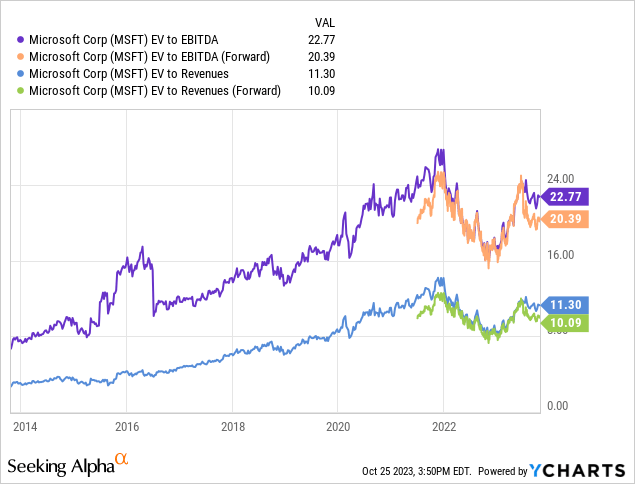

Once we embrace altering money and debt ranges through the years, enterprise valuations are a fair bigger stretch vs. a decade in the past. EV to fundamental money EBITDA has steadily risen from 8x to 22x in the present day. EV to gross sales has climbed from lower than 4x to 11x. In different phrases, if Wall Avenue put the identical valuation multiples on firm outcomes as late 2013, the present inventory quote can be a minimum of -50% decrease, within the $150 to $175 vary.

YCharts – Microsoft, Enterprise Valuations, 10 Years

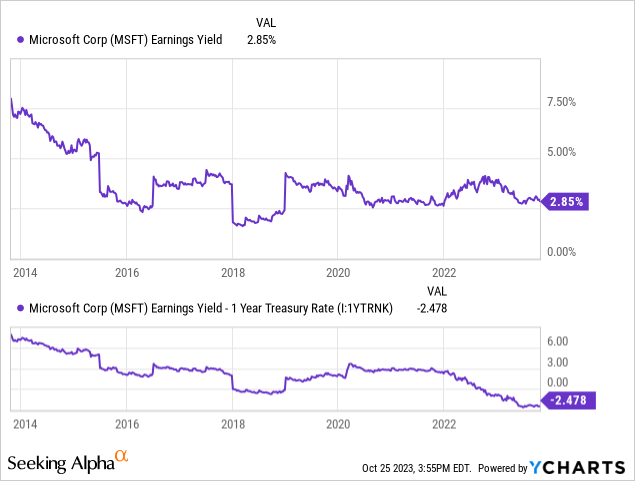

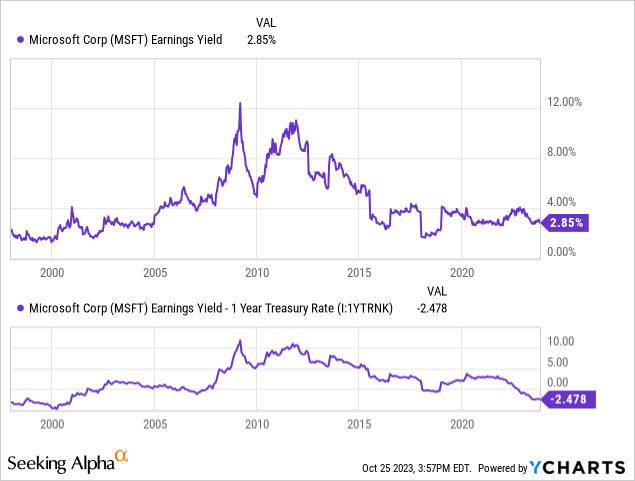

Sadly, the rate of interest bounce because the finish of 2021 is now highlighting a unprecedented disconnect between Microsoft’s earnings yield (or free money circulation yield not pictured) and short-term funding yields out there from “risk-free” Treasury Payments. If I can seize a assured return of cash plus a assured 5%+ return on my cash, why do I wish to personal an organization delivering much less in returns with NO ensures?

I’ve been explaining this conundrum for Large Tech traders because the center of 2021. Whereas the nominal earnings yield of two.85% from Microsoft doesn’t look a lot completely different than late 2015, a relative comparability to the 1-year Treasury fee is wickedly unhealthy at a detrimental -2.47%. This adjusted quantity to risk-free money investments is the worst because the Nineties tech increase peak into 2001. (Keep in mind this text’s introductory chart?)

YCharts – Microsoft, Earnings Yield vs. 12-Month Treasury Invoice Charge, 10 Years

YCharts – Microsoft, Earnings Yield vs. 12-Month Treasury Invoice Charge, 25 Years

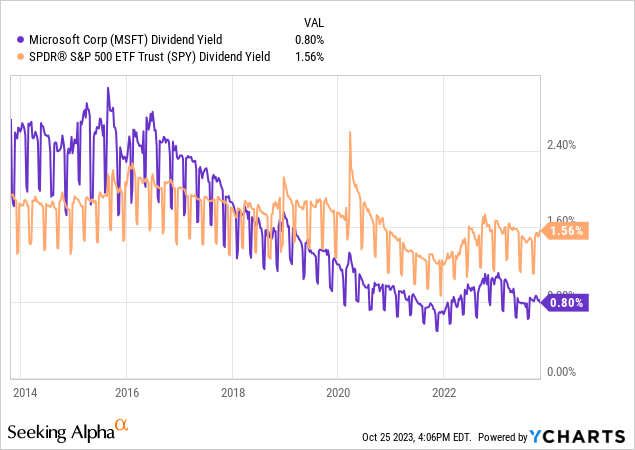

Microsoft did not pay a dividend till 2003. At the moment’s relative dividend yield stands at one-half the equal fee of the S&P 500 index, primarily the worst setup since 2005. Given 40% of all long-term inventory market good points within the S&P 500 have come from dividend yield during the last 70 years (4% money yield, 6% worth appreciation to create 10% annual returns), the trailing fee of 0.8% is a whole failure. And, when seen in opposition to CPI inflation of 4% or Treasury securities producing 5%, Microsoft seems extremely overvalued.

YCharts – Microsoft vs. S&P 500 ETF, Trailing Dividend Yield, 10 Years

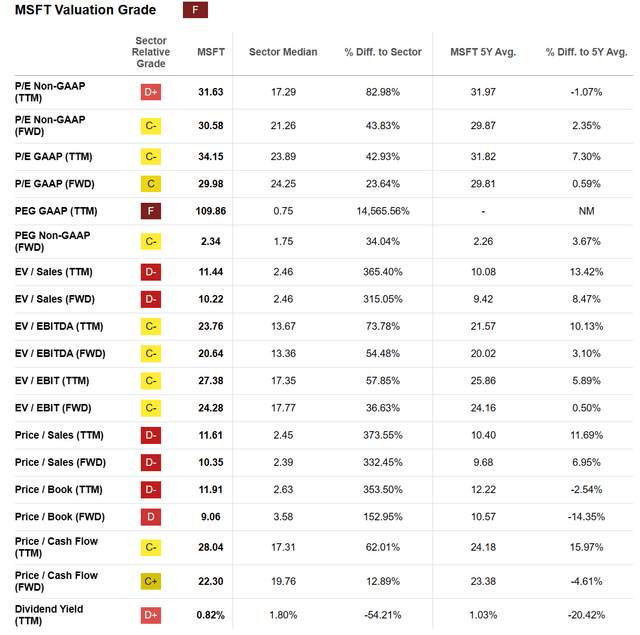

Looking for Alpha’s Quant system offers Microsoft an “F” Valuation Grade. When evaluating the corporate’s underlying enterprise metrics vs. friends and opponents on the costs paid to personal each inventory, MSFT shares can solely be labeled as an “keep away from” (wanting purely at elementary statistics).

Looking for Alpha Desk – Microsoft, Valuation Grade, Made October twenty fifth, 2023

Fading Momentum on Buying and selling Chart

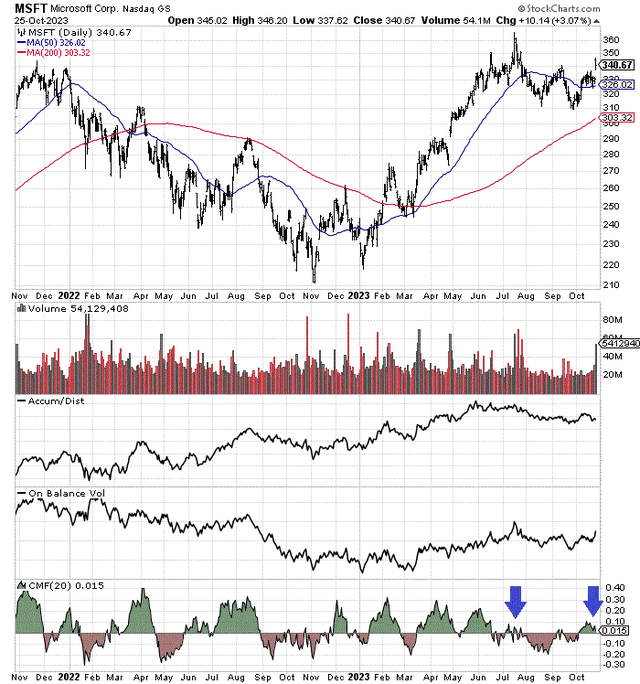

One other situation I’ve with shares is fading purchase momentum. The inventory quote did pop not too long ago on robust Q1 FY 2024 outcomes launched October twenty fourth.

But, precise momentum seems to have peaked between Could-July. Indicators such because the Accumulation/Distribution Line and On Steadiness Quantity haven’t superior greater for months. In actual fact, the 20-day Chaikin Cash Circulate calculation is highlighting a rotten span of web quantity shopping for throughout a 1-month worth acquire over elements of September and October (blue arrow). Solely the July worth prime outlined a worse CMF quantity over the entire chart interval drawn beneath.

StockCharts.com – Microsoft, 2 Years of Each day Value & Quantity Adjustments, Creator Reference Factors

You possibly can evaluate in the present day’s weak spot in these 3 momentum indicators and the value sample to the 2000 interval beneath. I’m considering we’re sitting in an identical place to March 2000. (Word: costs are adjusted for 20 years in inventory dividends paid beginning in 2003.)

StockCharts.com – Microsoft, Each day Value & Quantity Adjustments, 1999-2000, Creator Reference Level

Closing Ideas

If we do not expertise a recession subsequent yr, and rates of interest come down significantly, Microsoft might keep round present pricing and even be capable to rise a bit of (+10% to +20% for a complete return below any bullish state of affairs in my opinion). But, bulls are relying on nothing breaking. Assuming rates of interest stay elevated and earnings/gross sales disappoint in 2024, appreciable draw back might develop into actuality, as in the present day’s ultra-bullish optimism over Microsoft is confirmed “too good to be true.”

I might use the better-than-expected earnings report this week as a wonderful alternative to lock-in some to all your good points. I firmly imagine costs below $300 are coming quickly, as I place the chances of recession close to 100% transferring into 2024. The logic for a recession is piling up… from the inverted Treasury yield curve for over a yr, to uncommon declines in complete financial institution credit score and the M2 cash provide flattening mortgage creation since summertime, to an surprising bounce in crude oil (and inflation) on Center East turmoil in October.

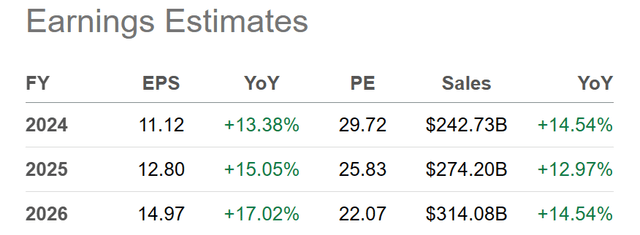

Present analyst projections of gross sales and earnings progress charges within the 15% vary yearly the subsequent few years is feasible, however not throughout a recession in my analysis. Microsoft’s $2.5 trillion market cap is gigantic, which means outsized progress vs. the general financial system in a stagnation to contraction part can be fairly troublesome to realize. Consequently, the fiscal yr (ending in June) consensus numbers forecast into 2026 beneath might show overly rosy. I’m considering 10% progress charges in a gentle recession and 5% in a deep one will be the “velocity restrict” for working enterprise good points.

Looking for Alpha Desk – Microsoft, Analyst Estimates for FY 2024-26, Made October 25ht, 2023

And, if you’re affected person, $250 for a share worth low in 2024 appears solely potential throughout a recession. A -30% worth decline from an overvalued favourite is sort of widespread traditionally throughout common Wall Avenue bear markets of -20% for the S&P 500. At that time, the chance/reward setup might argue for brand new purchases, as a bull market finds its footing. At $250, with some minor enterprise progress a part of the story throughout the subsequent 12 months, a P/E nearer to 20x would supply a lot smarter worth from this mega-cap sized enterprise. We would even get declining rates of interest by subsequent summer season to help a run to all-time MSFT highs throughout 2025.

I fee MSFT a Promote till the valuation story improves, and shouldn’t have any curiosity in holding a place.

Thanks for studying. Please take into account this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is really useful earlier than making any commerce.

[ad_2]

Source link