[ad_1]

lcva2

Funding Thesis

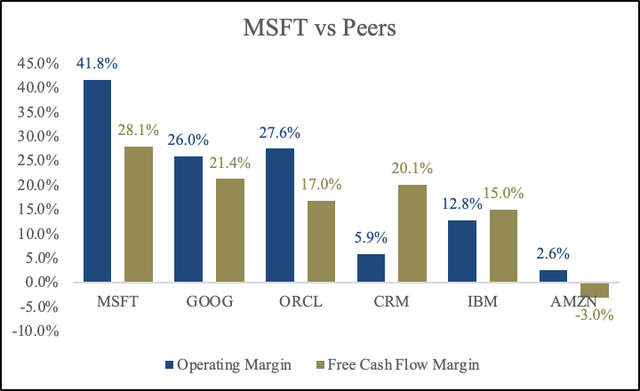

Microsoft (NASDAQ:MSFT) is likely one of the greatest companies on the market. The corporate is well-diversified, has glorious administration, and robust financials. Not like most software program firms, MSFT’s diversified product set goals at enterprise effectivity, collaboration, cloud transformation, and enterprise intelligence. An enormous portion of income is recurring and underpinned by a big and constant buyer base. MSFT enjoys increased margins than friends (ORCL), (CRM), (GOOG), (IBM), and (AMZN) resulting from its price benefit. (Figures under are from 2022)

Created by the creator

Earlier than I spend money on a enterprise, I’ve a guidelines, and one of many objects on that guidelines is to search for how administration is compensated. Are their views aligned with these of shareholders? If the CEO has enormous inventory possession and will get compensated in inventory or choices, that reinforces my confidence. Mr. Nadella owns greater than 1,337,768 shares of MSFT value over $400 million. In 2022, his compensation was ~$55 million. Of it, $42 million was in inventory. Mr. Nadella has been with the corporate since 1992 and was appointed CEO in 2014. He shifted the corporate from primarily promoting software program licenses and upkeep contracts to cloud computing. He invested closely in Azure, which paid off. These days, enterprises are realizing the potential of cloud computing, and Azure is well-positioned to capitalize on this continued shift resulting from its dominant place.

To this point, Mr. Nadella has achieved a superb job operating the corporate, and I count on that to proceed. Beneath his management, income, and EPS have compounded at 11% and 15%, with Azure fueling most of that development (clever cloud phase income skilled 18% development previously eight years). The corporate’s moat, derived from its community impact, price benefit, and switching prices, has protected the enterprise and enabled a wonderful return on invested capital (29% 5-year common). Plus, The corporate has strong steadiness sheet with sturdy liquidity and low leverage.

Enterprise Abstract

Co-founded by Invoice Gates and Paul Allen in 1975. Microsoft affords numerous companies, together with cloud-based options that present prospects with software program, companies, platforms, and content material, in addition to resolution help and consulting companies. The corporate’s merchandise embrace working techniques, collaboration functions, enterprise options, and video video games. Microsoft operates in 190 nations by three segments: productiveness and enterprise processes, clever cloud computing, and extra private computing.

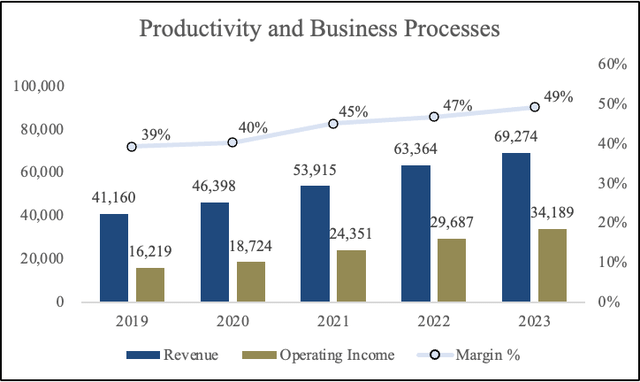

Productiveness and Enterprise Processes (33% of income) comprise services in MSFT’s productiveness, communication, and knowledge companies portfolio. Choices within the phase embrace Workplace 365 subscriptions, LinkedIn, Dynamics 365, and extra. As you may see, the phase’s margins have been constantly enhancing, up by 10%, or 1000 bps, over the previous 5 years partially resulting from pricing energy in Workplace 365 subscriptions.

Created by the creator utilizing 10-Okay

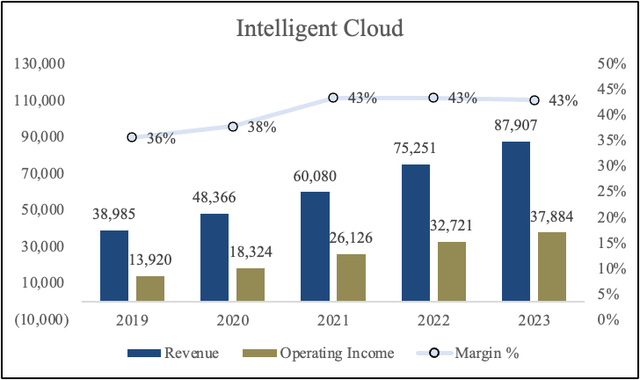

Clever Cloud (41% of income) contains the corporate’s public, personal, and hybrid server merchandise and cloud companies that energy fashionable companies and builders. This phase is especially comprised of Azure; different cloud companies embrace SQL Server, Home windows Server, Visible Studio, System Middle, and extra. This division is by far the largest contributor to MSFT’s high line. As extra companies upgraded to the cloud, this phase went from contributing 31% to whole income in 2019 to 41% in 2023. I imagine there’s nonetheless extra development to be realized within the phase because the shift to cloud computing continues.

Created by the creator utilizing 10-Okay

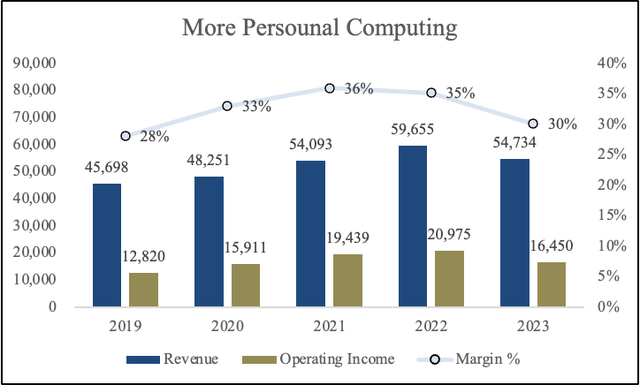

Extra private computing (26% of income) consists of services that put prospects on the middle of the expertise with our know-how. Merchandise embrace Home windows, gaming (“Xbox”), search (“Bing”), and units (Floor and PC equipment). This phase skilled the least development out of the opposite segments. I imagine the Activision (ATVI) deal will unlock new development potential within the phase, particularly gaming.

Created by the creator utilizing 10-Okay

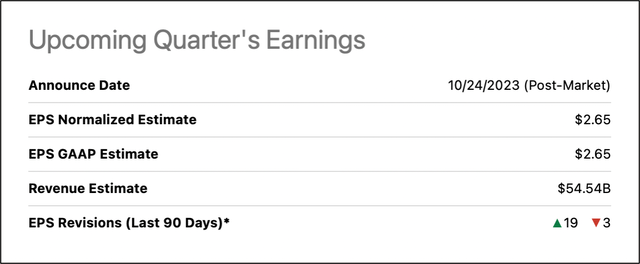

Upcoming Earnings

MSFT will report first-quarter earnings on October twenty fourth after the market shut. Consensus estimates are $2.65 EPS and $54.52 billion in income. Representing a 13% and 9% enhance year-over-year. The massive query is, will the corporate beat these estimates? I haven’t got a crystal ball, however my two cents is that MSFT has beat expectations for the previous 4 quarters (barely missed on income in Q2 23). Nonetheless, within the final two quarters, MSFT has crushed earnings resulting from rising curiosity from enterprises on AI and the continued cloud transition. I imagine the corporate is certainly heading heading in the right direction, however even when they miss and the inventory finally ends up dipping, this would possibly provide long-term traders the possibility to purchase a high-quality firm at a lovely worth.

created by the creator

Valuation

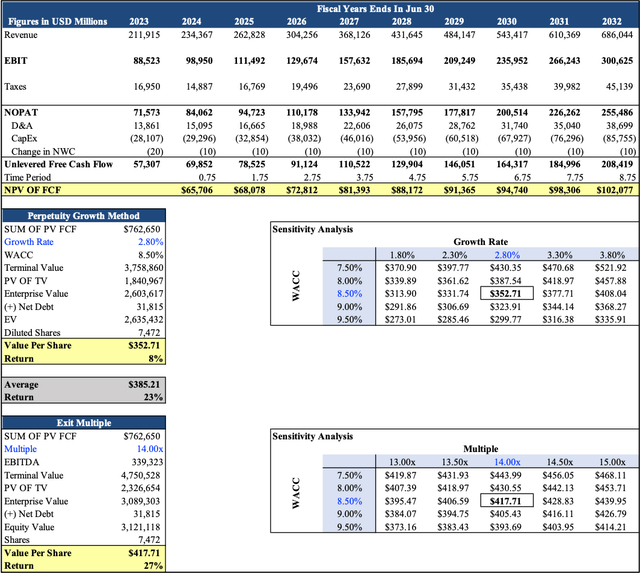

MSFT’s inventory is up by 36% on the time of this writing ($328), however my DCF suggests there’s nonetheless a 13% upside. The corporate is buying and selling at a ahead PE of 30.09x the FY24 consensus of $11.01 and 26.17x the FY2025 consensus of $12.65. On a trailing free money stream foundation, the inventory yields over 2.5% relative to its enterprise worth.

My base situation consists of whole income rising by 14% from 2024–2032. This development is underpinned by 11.72% in productiveness and enterprise processes, 17.89% in clever cloud pushed by enterprises shifting to the cloud, and eight.54% in additional private computing pushed by new merchandise and worth will increase. I’ve gross margin increasing by 160 bps over the identical time interval because the clever cloud makes up extra of the whole income.

I used a WACC of 8.50%, a development charge of two.80%, and a 14.00x EV/EBITDA a number of. Different assumptions embrace a 12.50% R&D Margin, 11% S&M margin, 3.2% G&A Margin, and a 15% tax charge. I arrived at worth per share of $352 utilizing the perpetuity development methodology and $417 utilizing the exit a number of methodology, Taking the common of each strategies, I arrived at a worth per share of $385, translating right into a 23% return from the worth of this writing.

Created by the creator

My draw back situation consists of whole income rising 13% from 2024–2032. This development is underpinned by 10.72% in productiveness and enterprise processes, 16.89% within the clever cloud, and seven.54% in additional private computing. I’ve a gross margin increasing by 60 bps over the identical time interval. I used a WACC of 8.50%, a development charge of two.50%, and a 13.00x EV/EBITDA a number of.

Different assumptions embrace a 13.50% R&D Margin, 12% S&M margin, 4.2% G&A Margin, and 17% tax charge. I arrived at worth per share of $270 utilizing perpetuity development methodology and $329 utilizing the exit a number of methodology, Taking the common of each strategies, I arrived at a worth per share of $299, translating right into a 4% draw back from the worth of this writing.

Dangers/Mitigates

Competitors is fierce within the rising cloud enterprise, Each firm is making an attempt to compete with giants corresponding to AWS and Azure. Opponents within the subject embrace CRM, ORCL, GOOG, AMZN, and extra. One other threat is harsh financial circumstances, which is able to pressure firms to chop spending on know-how. MSFT could be very acquisitive and the corporate has had some flops previously such because the $7.5 billion write-off for Nokia units and Providers. Comparable dangerous acquisitions sooner or later may dilute capital return.

On October eleventh, MSFT acquired a tax invoice for $28 billion from the IRS for the years 2004-2013, The quantity is not a small one even for conglomerate like MSFT, However the firm is interesting the tax invoice and has mentioned that the IRS has not accounted for the $10 billion that was paid. This problem would possibly take years to resolve however I assumed I ought to point out it.

Takeaway

In brief, MSFT is a big software program firm led by a top-tier administration staff. I imagine the corporate affords traders a protected haven in occasions of uncertainty for 2 causes: the big buyer base and diversified enterprise. As for a valuation, utilizing a 9-year DCF, I arrived at a worth per share of $385, implying a 23% return. Though, the corporate is at present buying and selling a 30x FWD P/E, I imagine it is nonetheless low cost contemplating its main place, nice administration, and robust money stream technology

[ad_2]

Source link