[ad_1]

MicroStrategy is likely one of the best-performing US shares this 12 months, with a achieve of over 375%.

The inventory’s destiny is extra carefully linked than ever to that of Bitcoin after one other huge buy.

However can the corporate’s technique bear fruit over the long run?

Seeking to beat the market in 2024? Let our AI-powered ProPicks do the leg give you the results you want, and by no means miss one other bull market once more. Study Extra »

MicroStrategy (NASDAQ:) shares exploded to the upside on Wednesday, closing the common session up 11.06%, and including an extra 1.40% in after-hours buying and selling, taking its year-to-date good points to simply below 375%.

This is likely one of the finest performances of the complete US inventory market in 2023.

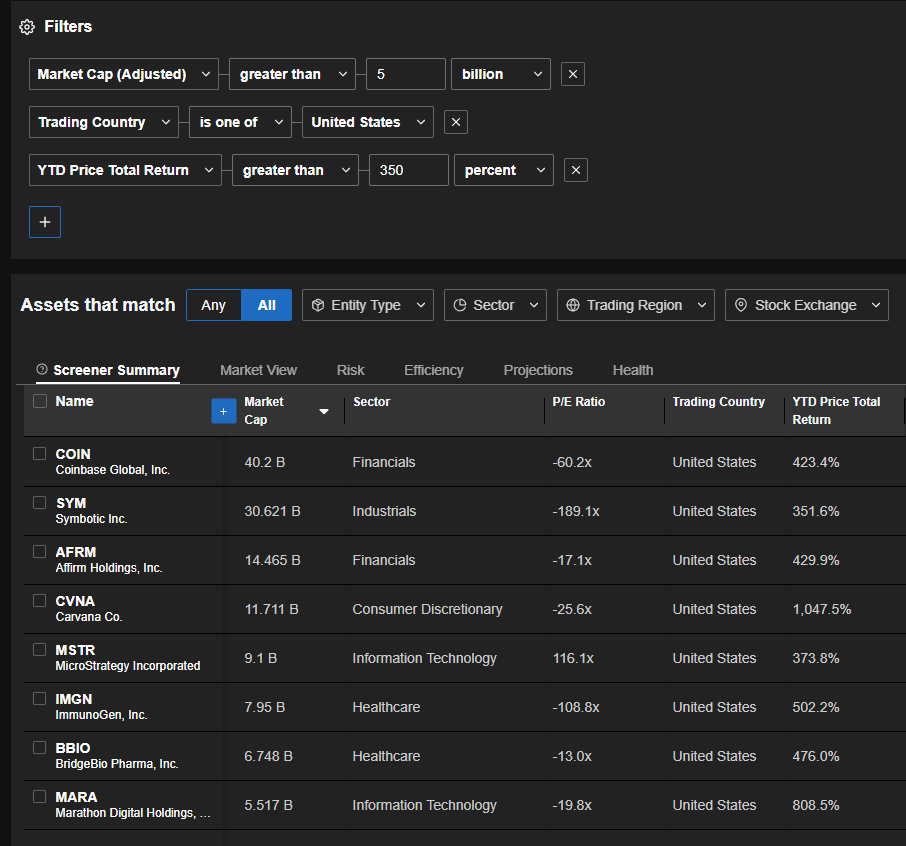

Certainly, a search on the InvestingPro screener confirmed us that MicroStrategy is the seventh best-performing inventory within the US this 12 months if we restrict the search to corporations with a capitalization of over $5 billion.

Now, this surge within the inventory is basically linked to the rise of this 12 months, as the corporate has been investing closely within the cryptocurrency for a number of years.

Supply: InvestingPro

What’s extra, our analysis on InvestingPro has proven us that different corporations whose fortunes are linked to crypto-currencies are additionally amongst this 12 months’s best-performing US shares.

This contains change platform Coinbase (NASDAQ:), whose inventory is up 423% this 12 months, or crypto miner Marathon Digital (NASDAQ:), whose inventory is up over 800%.

MicroStrategy’s destiny greater than ever linked to that of Bitcoin following one other huge buy

Do not forget that MicroStrategy, formally a software program firm, started accumulating Bitcoins in 2020, regularly accelerating the tempo and going as far as to tackle debt and challenge shares to purchase extra cryptocurrency.

Certainly, yesterday’s rise got here in response to the announcement that the corporate had as soon as once more made a large buy of Bitcoin, for over $600 million.

Following this newest acquisition, MicroStrategy now owns over 189,000 Bitcoins bought at a median unit value of $31,168, for a complete worth of.

On condition that BTC is presently buying and selling at round $43,000, the corporate is presently sitting on a treasure trove of over $8.1 billion price of BTC, with a latent achieve of over $2.2 billion.

The corporate’s long-term plans stay unclear, and the arrival of Bitcoin ETFs poses a risk

It must be stated that, in the intervening time, MicroStrategy’s gamble on Bitcoin, although repeatedly criticized, has paid off. In the long term, nevertheless, the corporate’s outlook could possibly be bleaker.

Certainly, with the corporate’s software program enterprise displaying little progress and losses, and given its huge accumulation of BTC, its inventory is now primarily a guess on Bitcoin.

As such, the inventory ought to proceed to rise if Bitcoin additionally continues to rise, which most analysts imagine is probably going, primarily due to the SEC’s approval of Bitcoin spot ETFs, anticipated in early January.

Certainly, consultants imagine that Bitcoin ETFs will allow huge inflows of latest capital into the crypto market, by providing a regulated technique of investing immediately in BTC.

Nonetheless, whereas the anticipated bullish impression on the Bitcoin value is a optimistic issue for MicroStrategy, the launch of those merchandise will increase the query of the inventory’s relevance within the eyes of traders since it is going to be in direct competitors with Bitcoin ETFs as a automobile for publicity to the crypto market.

So, whereas MicroStrategy’s destiny in 2024 will probably be carefully linked to that of Bitcoin, and an increase appears possible, the corporate should determine what to do with its Bitcoins to spice up its core enterprise or discover a new avenue of improvement.

Analysts and valuation fashions name for warning on MicroStrategy

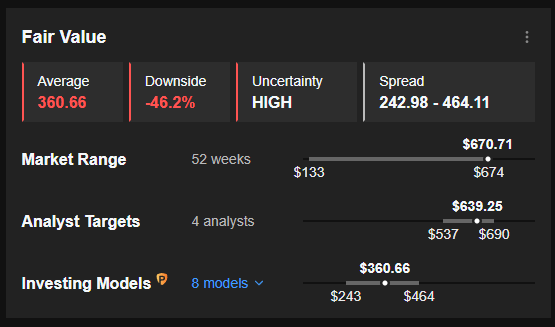

The research of analyst forecasts and valuation fashions for the inventory is but another excuse to be cautious about MicroStrategy.

The info accessible on InvestingPro exhibits that the analysts who observe the inventory have a median goal value of $639.25, or 4.8% beneath the present share value.

MicroStrategy Honest Worth

Supply: InvestingPro

The InvestingPro Honest Worth, which synthesizes 8 acknowledged monetary fashions, is much more pessimistic, coming in at $360.66, greater than 46% beneath Wednesday’s closing value.

Lastly, the evaluation of MicroStrategy’s monetary well being primarily based on InvestingPro knowledge additionally warrants warning, with an total rating of 1.95.

Conclusion

Though MicroStrategy’s guess on Bitcoin has paid off the inventory has a great probability of constant to rise in 2024, if BTC additionally rises.

However there’s appreciable uncertainty surrounding the corporate’s longer-term future, whereas the arrival of Bitcoin ETFs will make the inventory comparatively much less engaging as a way of gaining cryptocurrency publicity for traders.

***

In 2024, let arduous selections grow to be straightforward with our AI-powered stock-picking instrument.

Have you ever ever discovered your self confronted with the query: which inventory ought to I purchase subsequent?

Fortunately, this sense is lengthy gone for ProPicks customers. Utilizing state-of-the-art AI know-how, ProPicks supplies six market-beating stock-picking methods, together with the flagship “Tech Titans,” which outperformed the market by 670% during the last decade.

Be part of now for as much as 50% off on our Professional and Professional+ subscription plans and by no means miss one other bull market by not figuring out which shares to purchase!

Declare Your Low cost At present!

Disclaimer: The creator doesn’t personal any of those shares. This content material, which is ready for purely instructional functions, can’t be thought of as funding recommendation .

[ad_2]

Source link

Add comment