[ad_1]

Maddie Meyer

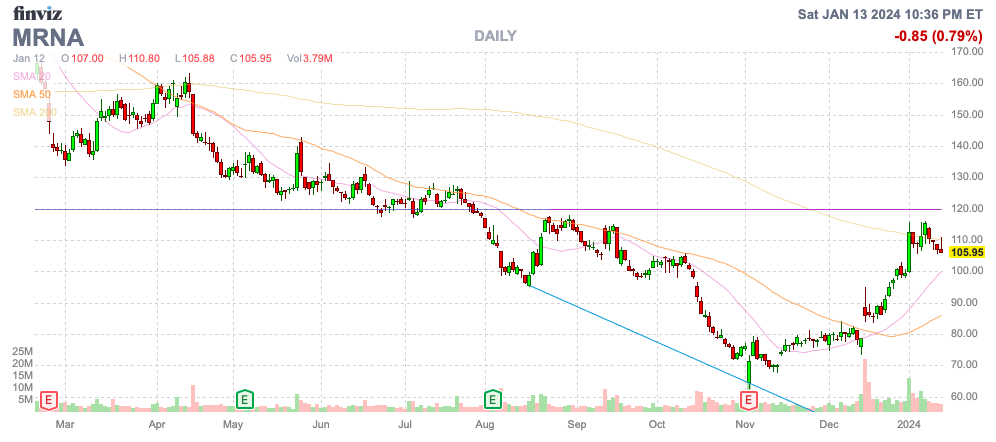

Together with the general inventory market, Moderna (NASDAQ:MRNA) had a giant liftoff in direction of the top of 2023. The biotech firm promoted a 2025 turnaround story, however the market jumped onto the extra bullish view far too quickly. My funding thesis stays Bearish on Moderna with extra Covid vaccine gross sales ache forward and questions relating to RSV vaccine gross sales.

Supply: Finviz

2025 Turnaround

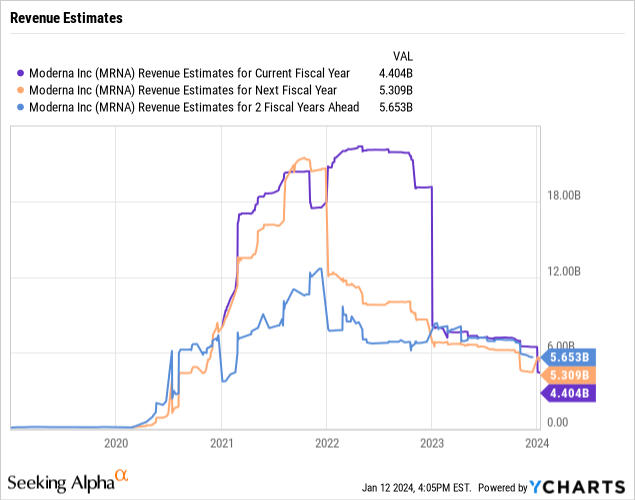

Whereas probably not information, the Moderna CEO issued a 2023 Shareholder Letter selling a greater income image in 2025. The biotech continues to face powerful comps with Covid vaccine gross sales slumping from the late 2021 peak of $7.2 billion in quarterly gross sales alone.

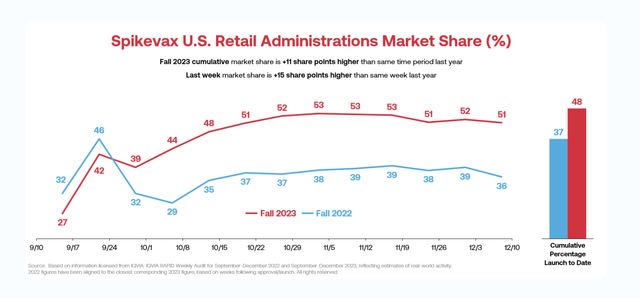

The corporate up to date steering for 2023 revenues to ~$6.7 billion, as the corporate truly took Covid vaccine market share from Pfizer (PFE). Spikevax now has over 50% market share in the U.S. market.

Supply: Moderna 2023 Shareholder Letter

Sadly although, Moderna seems to information in direction of a rebound in Covid vaccine gross sales in a view that endemic gross sales will develop from the low ranges to finish of 2023. Not solely that, the corporate seems to recommend extra market share will likely be taken in 2024 and past, although Pfizer is not more likely to simply roll over and let Moderna develop additional.

Previous to the J.P. Morgan Healthcare Convention, Moderna rotated and guided to 2024 revenues of simply $4.0 billion with the forecast for development in 2025 and the expectations to interrupt even by 2026. The present estimates have This autumn’23 revenues of $2.4 billion, which truly seems low.

The difficulty right here is that 2024 will likely be one other brutal 12 months. Moderna is guiding to revenues dipping $2.7 billion this 12 months whereas additionally forecasting the RSV vaccine launches this 12 months.

The market hasn’t caught as much as this steering with 2024 income targets nonetheless up at $4.4 billion. The true query is whether or not Moderna can truly keep 2024 Covid gross sales within the $4+ billion vary contemplating such little demand this Fall.

The biotech must develop income by $1.3 billion in 2025 to achieve the present consensus targets of $5.3 billion. The RSV vaccine seems an aggressive goal at $1+ billion.

Aggressive RSV Vaccine Market

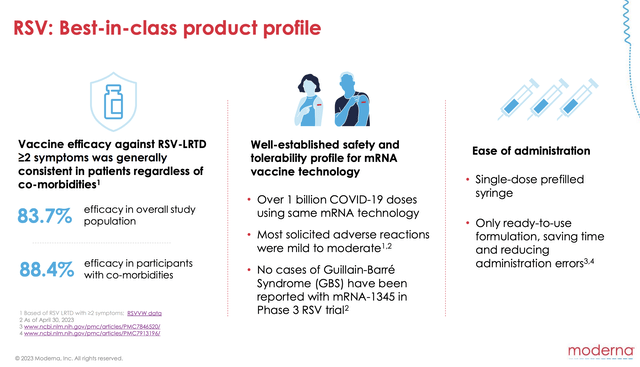

The vaccine for the prevention of RSV-associated decrease respiratory tract illness (RSV-LRTD) and acute respiratory illness (ARD) already has a number of opponents and Moderna suggests the pre-filled syringe would be the finest product out there available on the market. The vaccine competes with Pfizer and GSK plc (GSK) and our view is that Moderna would possibly run into some model points with customers disenchanted in how the Spikevax has carried out.

Moderna promotes the mRNA vaccine know-how as having a well-established security and tolerability profile, however the Covid vaccine demand collapsed this 12 months.

Supply: Moderna Q3’23 presentation

GlobalData forecast the RSV market reaches $9 billion by 2029 with GSK main the market with $2.5 billion in gross sales. Arexvy acquired first approval serving to general gross sales, however Moderna is forecast to bypass Pfizer’s Abrysvo and attain gross sales of $2.4 billion over time.

GSK hit $860 million in RSV vaccine gross sales in Q3 alone, simply surpassing analyst estimates and Pfizer’s gross sales stage. The biopharma firm neatly highlights the vaccine’s 94.6% efficacy in older adults with some underlying medical circumstances. Contemplating older adults account for 95% of RSV infection-related hospitalizations, Arexvy might have a stronghold available on the market earlier than Moderna has its drug available on the market.

Our view nonetheless questions whether or not Moderna can seize a lot market share after coming into the market a season after Arexvy. To not point out, Moderna hasn’t gotten FDA approval for the RSV vaccine, although Part 3 trial information was promising.

The inventory has seen the market cap leap to over $40 billion once more and the gross sales steering for 2024 is barely $4 billion. The market and inner forecasts for 2024 seem aggressive leaving restricted upside surprises wanted to take care of the present inventory worth.

Moderna has some promising medicine for past 2025, however the present headwinds and presumably disappointments with the Covid and RSV vaccine gross sales will hamper any inventory rally.

Takeaway

The important thing investor takeaway is that Moderna faces a troublesome 2024 with full-year Covid gross sales reflecting the step-down in demand that occurred in 2023. The market now seems too constructive on RSV gross sales for 2024 and with out booming demand in a really aggressive market already, Moderna may not see the anticipated gross sales rebound in 2025.

Traders will likely be sensible to not chase the latest rally within the inventory and watch for the weak 2024 to completely hit Moderna.

[ad_2]

Source link