[ad_1]

Kameleon007

Funding motion

I beneficial a purchase ranking for Moody’s (NYSE:MCO) once I wrote about it the final time, as I anticipated the slowdown in progress was coming to an finish and progress ought to enhance shifting ahead. The restoration in progress ought to kickstart robust earnings progress momentum. Based mostly on my present outlook and evaluation of MCO, I like to recommend a purchase ranking. MCO 3Q23 efficiency was very encouraging, outpacing my earlier DCF mannequin assumptions. I imagine the medium-term outlook for MCO stays very engaging, and MCO shouldn’t have any points rising according to or higher than my expectations. Notably, administration’s medium-term outlook has expectations increased than my mannequin, making my assumptions appear conservative.

Assessment

MCO reported 3Q23 income of $1.472 billion, representing 15.5% y/y progress. Consolidated EBITDA margins expanded 560 bps to 44.6%, and EPS outperformed consensus by $0.13, $2.43 vs. $2.30. There’s a lot to love about MCO’s latest outcomes, which makes me reiterate my purchase ranking for MCO as its enterprise efficiency is best than my DCF expectations. The robust efficiency momentum is especially promising when considered from a segmental perspective.

Moody’s Traders Service [MIS] grew 18% y/y, with progress of 24.9% in company finance, 15.6% in monetary establishments, 25% in undertaking, public & infrastructure finance, and 1% in structured finance. Additionally, the quantity of rated world debt issuance rose by 12%. Income from MIS transactions additionally elevated by 31.1%, whereas recurring income elevated by 4.8%. The outlook for this phase stays very promising over the near-to-mid-term as nicely. In response to MCO’s yearly refinance report, whole non-financial company debt due within the US and EMEA will attain $4.4 trillion within the subsequent 4 years, a ten% improve. To me, this can be a large signal that the refinancing pipeline is wanting good for the quick to medium time period, which ought to proceed to assist progress. One other notable takeaway from 3Q23 is that there’s a 27% improve in US speculative debt that’s going to mature over the subsequent 5 years. I imagine this can be a main alternative for MIS, which additional helps the medium-term progress outlook.

However, Moody’s Analytics [MA] income elevated 13.3% y/y in 3Q, with progress of 14.9% in Resolution Options, 10.4% in Analysis & Insights, and 13.6% in Information & Data. Given the rising geopolitical points, that are resulting in extra sanctions, I imagine the demand for KYC options will solely rise from right here. Given {that a} quarter of MA’s total new buyer progress within the final 12 months got here from KYC, I see this “new demand” as a lovely alternative for administration to cross-sell different MA options. The statistics are encouraging. Presently, out of roughly 15,000 clients, solely roughly 20% make the most of KYC options. It might be straightforward for MCO to upsell further options that customers may require as a part of the gross sales pitch for the KYC options.

Following up on my tackle MCO AI investments, I believe the progress is optimistic. Administration is constant its push with the generative AI technique. Particularly, administration is aiming to launch a Analysis Assistant product powered by MCO’s LLM. This product shall be supplied as a complement to CreditView within the MA phase. As well as, MCO is enhancing Analysis Assistant’s capabilities and integrating MCO knowledge into Microsoft Groups by means of a plug-in, all whereas strengthening its partnership with MSFT. They’re additionally forming a partnership with Google to develop LLM-powered AI functions for monetary professionals. Though it’s difficult to incorporate all of those results in a monetary mannequin, I’m happy with MCO’s progress up to now. I’d proceed to trace administration feedback across the generative AI technique and whether or not there’s an uptake in underlying merchandise. As an illustration, the CreditView affect might be tracked through Analysis & Insights (a sub-segment of MA) progress.

Valuation

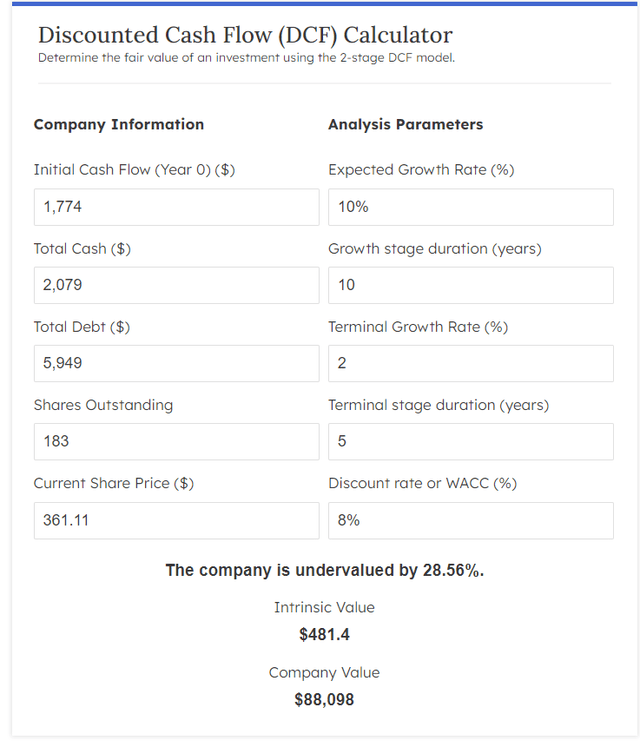

Finmasters MCO

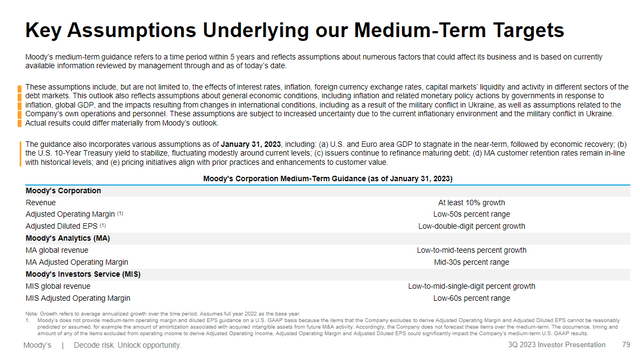

I imagine MCO has no points rising as I modeled in a DCF mannequin. My core assumptions stay the identical for MCO. I count on FCF to develop by 10% over the expansion interval (10 years), adopted by a 2% progress within the terminal 12 months (the terminal stage length is 5 years). Truthfully, this can be a conservative assumption if we evaluate it to administration’s mid-term steering. They’re anticipating income progress of at the least 10% and adjusted diluted EPS to develop at low double-digit p.c. Traditionally, MCO has transformed internet earnings to FCF at a really excessive price (nearly 100%). Additionally, keep in mind that MCO has a historical past of returning money to shareholders. Shares excellent have decreased from 208 million in FY14 to 183 million in FY22 (-1.6% a 12 months). As such, if we assume the low double-digit share progress outlook for EPS is ~11 to 12%, together with a low-single-digit share buyback tempo, from an FCF per share perspective, we may simply see mid-teens progress (which beats my 10% progress expectation).

Threat and remaining ideas

Administration anticipates that the US, European, and Chinese language economies will proceed to decelerate within the coming months. As well as, the administration is anticipating a rise in default charges. My fundamental concern is that some traders could promote their MCO inventory if the corporate’s financials turn out to be extra unstable within the close to future.

In conclusion, I stay bullish on MCO after reviewing the 3Q23 efficiency, which has surpassed my expectations and demonstrated robust progress momentum. Moody’s Traders Service [MIS] and Moody’s Analytics [MA] showcased spectacular progress in numerous segments, with MIS benefiting from rising world debt issuance and an increasing refinancing pipeline. MA’s progress, notably in KYC options, presents an attractive alternative for cross-selling and growth. Furthermore, MCO’s strides in AI growth, evident within the Analysis Assistant product and partnerships with Microsoft and Google, bode nicely for future progress.

[ad_2]

Source link