[ad_1]

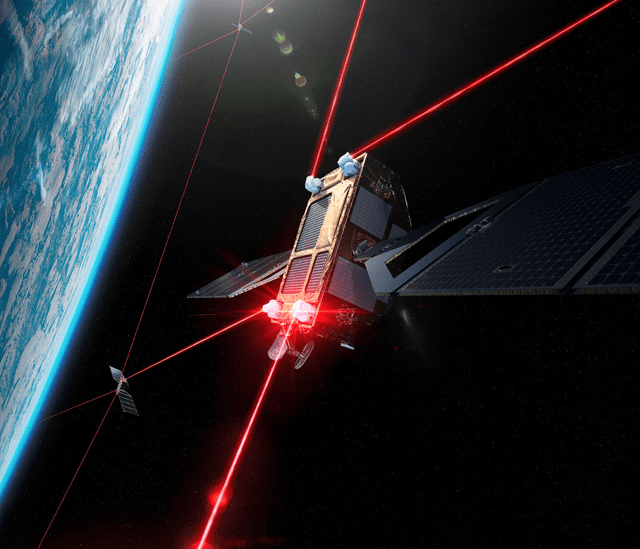

StationaryTraveller/iStock through Getty Photographs

Masking the aerospace and protection trade in addition to associated industries, I do not simply deal with the trade giants but additionally pay shut consideration to smaller firms in addition to firms that may be efficiently executing a turnaround to uncover worth. Generally, there certainly is worth and generally it seems the risk-reward profile just isn’t enticing for funding. On this report, I will probably be including Mynaric (NASDAQ:MYNA) to my protection to evaluate whether or not the corporate offers any worth for shareholders. I’ll accomplish that by discussing the corporate’s actions, finish market, enabling expertise, and purposes in addition to a extra basic have a look at the corporate together with a threat evaluation.

Mynaric: A Laser Communications Specialist

Primarily based in Germany, Mynaric develops laser communication expertise, which is primarily used within the aerospace and protection industries. At the moment, demand for laser communication and satellite tv for pc service primarily comes from authorities companies looking for to determine space-based communication networks. With that in thoughts, maintaining a tally of the US House Pressure and House Growth Company budgets is necessary. Mixed, the House Pressure and SDA have a $26.3 billion price range which was 7% larger than requested, and with growing demand for space-based options together with high-speed safe navy communications, we might see budgets enhance much more. Mynaric, though small by way of revenues, might additionally profit from growing protection budgets and technological development in different geographical markets akin to Europe and elevated demand for space-based communication options for industrial functions.

What Are The Benefits Of Laser Communications?

Laser communications enable for larger switch speeds of information and are over 300 occasions quicker than quick Radio Frequency or RF wave communications. The expertise has a smaller beam in comparison with RF, which makes intercepting alerts troublesome and even perhaps unimaginable with present expertise permitting for safe knowledge switch and communications making it extraordinarily appropriate for navy communications. On the industrial finish, laser communications opposite to RF beams license free that means that not like RF beams no separate license for every beaming location must be bought.

All in all, the expertise behind laser communications would enable for top pace and safe communications which might allow new technological purposes akin to predictive administration for industrial airplanes, laser quick alternate of information and communication for navy and industrial functions, earth commentary and connecting distant areas. I’d additionally with the present growth of superior hypersonics, quicker communications for hypersonic weapon programs and hypersonic protection turns into extra of a necessity than “good to have”. The subsequent-generation fighter jet will doubtless even be extra outfitted even higher with battlefield integration programs and be paired with drones for which laser communications might additionally show to be important.

Who Are The Clients Of Mynaric?

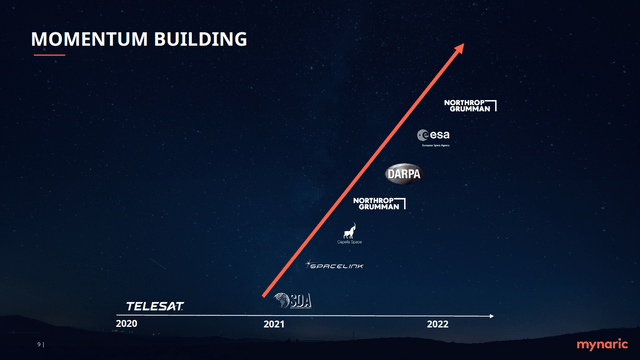

Mynaric AG

The shopper base for Mynaric doubtlessly is a mixture of industrial and authorities clients with an addressable market of $20 billion, however for now could be largely targeted on authorities clients. Northrop Grumman (NOC), which I analyzed in a separate report, is among the many clients of Mynaric and lately positioned an order valued $25 million supporting the SDA’s Tranche 2 Transport Layer-Beta program. In November, the corporate introduced a $6 million contract with an unidentified buyer for the CONDOR Mk3 terminals for which verification was accomplished in September this 12 months. Different clients embrace DARPA, SDA and ESA from which it obtained funds to research terabit pace connectivity. Industrial clients embrace Northrop Grumman and Capella House each of which offer services to the federal government or authorities companies. SpaceLink additionally signed with Mynaric in 2021 and L3Harris (LHX) made a strategic funding within the firm final 12 months. So, we see lots of excessive profile clients and likewise word the real-life examples of excessive pace communications enabled by StarLink used within the navy operations of Ukraine within the Russo-Ukrainian Struggle.

Revenues Are Not Instant For Mynaric

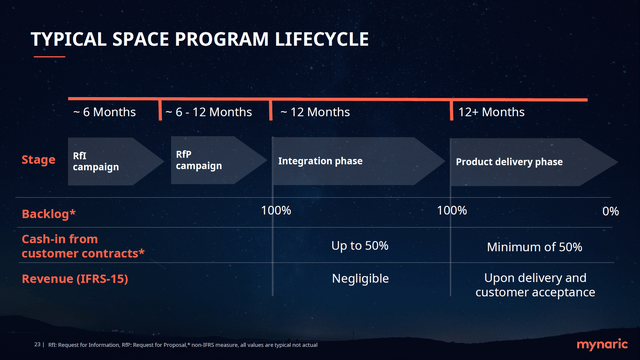

Mynaric AG

Mynaric has lots of potential if we see the use instances and enabling nature in finish markets. The fact, nonetheless, is that the interpretation to revenues could be quite gradual. Within the preliminary section which could be as much as 18 months the request for data and request for proposal are issued adopted by an award at which stage an order could be added to the backlog. After the award, there may be an integration section through which section Mynaric can obtain as much as 50% of consumers’ pre-delivery funds which isn’t acknowledged as income or in the very best case a small portion. The stability of the money is due on supply and buyer sign-off at which case an order is faraway from the backlog and acknowledged as income. All the course of from Request for Data to income recognition realistically might take years much like what we see for protection and industrial airplane applications.

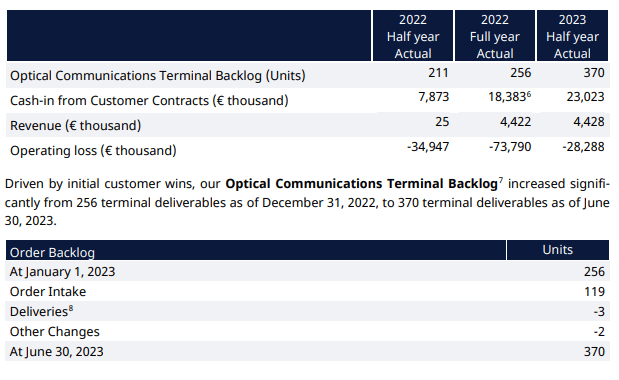

Mynaric AG

Mynaric at present is engaged on securing contracts and ramping manufacturing, which permits higher value amortization and likewise consists of typical studying curve results enhancing the unit prices for manufacturing of its communication terminals. Continued additions to the backlog enable for larger manufacturing charges permitting important discount in unit prices pushed by higher value amortization and scale benefits. So, the backlog is vital for the corporate proper now. Within the first half of 2023, backlog grew to 370 models up virtually 50% from the beginning of the 12 months and cash-in from clients elevated by barely lower than $5 million and by greater than $15 million year-over-year. Vital to notice is that the H1 2023 revenues already exceeded FY2022 revenues.

Mynaric May Be An Engaging Take Over Candidate

Relying on whether or not regulatory approval could be obtained I view Mynaric as a precious acquisition goal for Northrop Grumman and L3Harris Applied sciences. Northrop Grumman is already a buyer of Mynaric, in order that they know the worth the enterprise provides to theirs. With actions in hypersonics, hypersonics protection and the battlefield airborne communications node or BACN, I might see why Northrop Grumman in some unspecified time in the future can be curious about buying all the enterprise. L3Harris Applied sciences may be within the firm as it’s also lively in missile protection options in addition to crucial communications for which laser communications might present worth. What must be saved in thoughts is that Mynaric operates below a license from the German Aerospace Heart or DLR to commercialize the excessive pace connectivity effort.

Within the aerospace communication section, we do see that ViaSat accomplished the acquisition of Inmarsat earlier this 12 months and CACI accomplished the acquisition of SA Photonics in 2021 and Eutelsat and Oneweb agreed to mix final 12 months. So, there may be lots of M&A exercise within the communication house.

Dangers for Mynaric: Competitors And Dilution

Mynaric AG

Whereas it’d look like Mynaric operates a excessive burden market with an distinctive product, to me it looks as if the technological idea just isn’t ultracomplex. I’ve studied aerospace engineering and in second 12 months programs, you might be already being skilled in sizing satellites together with industrial tools sizing and budgeting, so I’ve little doubt that aerospace giants do possess the information to supply air and space-based laser communications. The record of firms that Mynaric identifies as potential or current rivals is lengthy. Firms akin to Amazon and SpaceX might decide to develop their very own laser communications resolution and within the aerospace sector, the record of rivals is lengthy with names akin to Airbus (OTCPK:EADSF), Thales (OTCPK:THLEF), Ball Aerospace, Basic Atomics and Honeywell (HON). Moreover, QinetiQ (OTCPK:QNTQF) and Hensoldt (OTCPK:HAGHY) already market laser communication options whereas the corporate has already recognized that established aerospace giants might enter the market and compete with Mynaric extra efficiently as a result of their current and longstanding relationship with clients. So, Mynaric can hardly be referred to as distinctive in that sense or uniquely outfitted. With a decrease burden than some may anticipate, doubtlessly buying the corporate will even be a operate of timeline and growth prices of in-house constructed laser communication expertise and tools in comparison with buying Mynaric.

One other threat I see for shareholders is shareholder dilution. Since 2017, the share rely of Mynaric has doubled and in September 2023 the corporate stuffed a prospectus permitting the corporate to promote American Depositary Shares representing 5 million extraordinary shares. So, the dilution threat is actual.

Moreover, the corporate may very well be topic to dangers that render the corporate unable to fabricate communication terminals at a low sufficient value to show a revenue or present a price aggressive product. These dangers embrace the present challenges within the aerospace provide chain and better labor and materials prices. From demand facet, though not anticipated, demand may very well be inadequate to help larger manufacturing charges which might enable quicker studying and stronger value discount and higher value amortization. All of those parts might finally drive the corporate to difficulty much more inventory.

Is Mynaric Inventory Value Your Consideration?

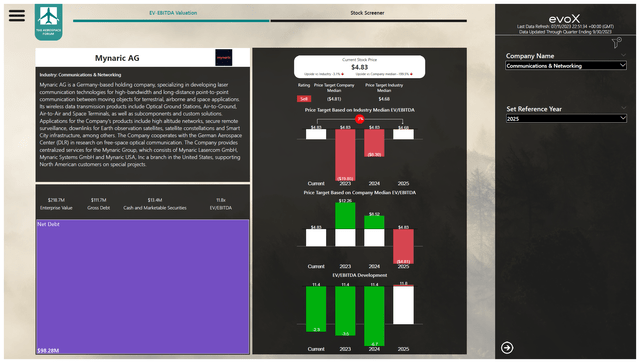

The Aerospace Discussion board

Mynaric inventory is one that’s arduous to evaluate. There are two causes for that. The primary is that the corporate has been engaged on maturing its expertise. It was spun off from the German Aerospace Heart to commercialize and in that course of IPO’d in Germany in 2017 however has not been worthwhile since. Consequently, the corporate’s EV/EBITDA has been unfavorable for some years now and the corporate EV/EBITDA consequently just isn’t a particularly helpful solution to worth the enterprise and you could possibly even say that EV/EBITDA assessments aren’t the fitting solution to do it both. Disregarding the corporate median EV/EBITDA and the Promote rating which can be partially pushed by firm EV/EBITDA valuation, the trade EV/EBITDA would recommend that Mynaric inventory is kind of pretty valued incorporating shareholder dilution this 12 months together with the sale of 20 million ADS and a mix of debt and additional dilution within the years to come back.

So, we do see truthful worth for the inventory however not a robust purchase case pushed by enticing risk-reward mechanisms.

Conclusion: Mynaric Engaging Enterprise, Unattractive Worth For Shareholders

I’ve little doubt that Mynaric will in some unspecified time in the future be worthwhile, the actual query is how a lot shareholders will probably be diluted within the course of and what the aggressive panorama will seem like by that point. So, it’s hardly a sexy purchase as there are simply too many uncertainties. Nonetheless, we do see Mynaric gaining traction which is a giant constructive and there’s a motive why the corporate can rely on curiosity in its merchandise from high-profile clients. So, I’d mark the inventory as a maintain or doubtlessly a really speculative purchase because the upside might doubtlessly over the long term be extra rewarding than the draw back threat.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please pay attention to the dangers related to these shares.

[ad_2]

Source link