[ad_1]

by Fintechnews Switzerland

January 12, 2024

Monetary intermediaries, together with card schemes and issuing banks, are taking part in a vital position within the use and promotion of latest fee strategies in Switzerland. A 2023 analysis by the Swiss Nationwide Financial institution (SNB) revealed that the principles and requirements set by these intermediaries are impacting utilization and frequency of contactless funds.

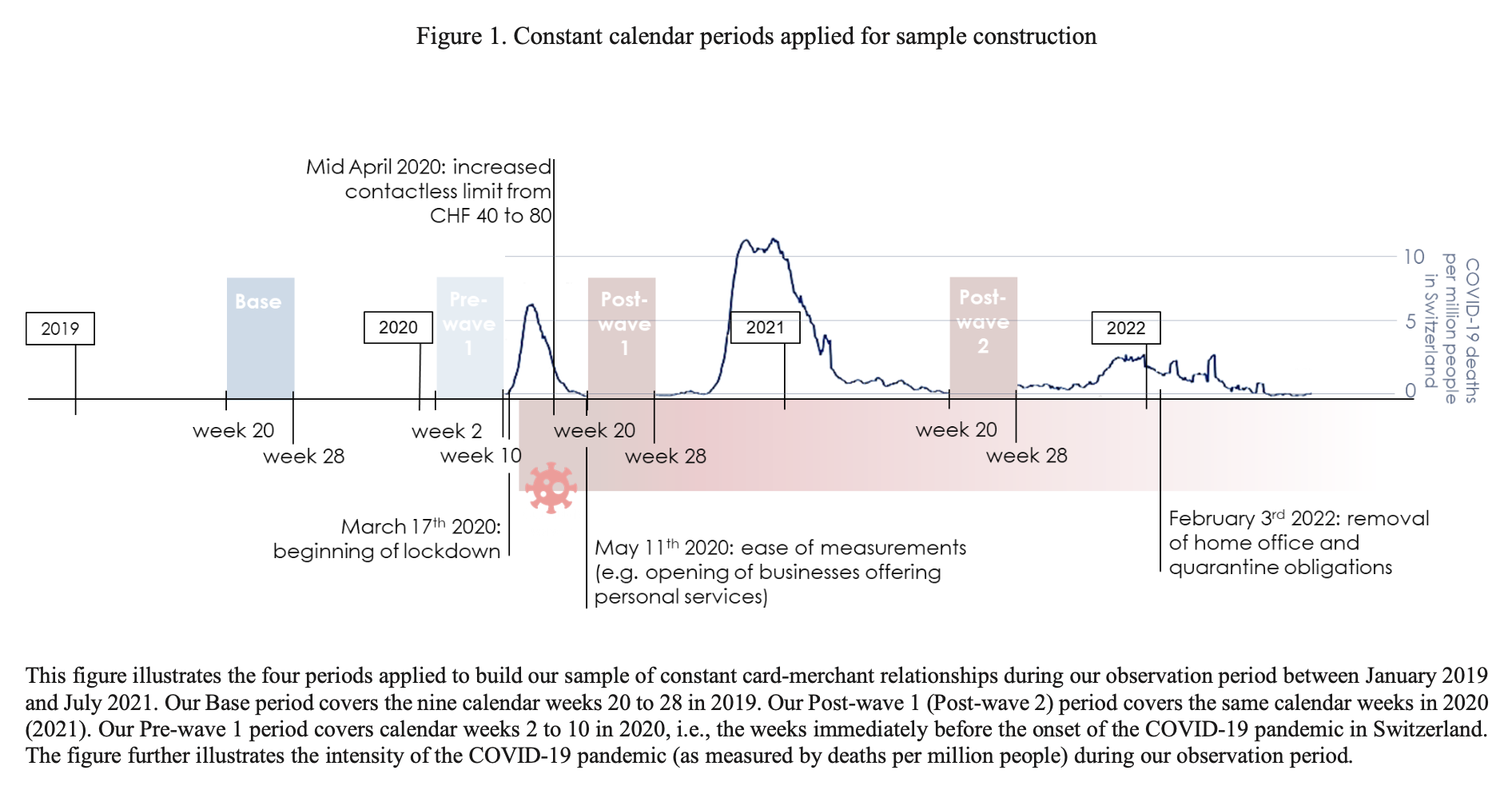

The findings, shared in a brand new report titled “Client adoption and use of economic know-how: “faucet and go” funds”, are primarily based on an evaluation of anonymized, transaction-level information for greater than 400,000 fee playing cards and virtually 18,000 retailers in Switzerland between 2019 and 2021. The examine checked out information retrieved throughout 4 completely different intervals, evaluating contactless fee utilization in 2019 (Base interval), in the course of the weeks instantly earlier than the onset of COVID-19 in Switzerland (Pre-wave 1), in the course of the first wave of COVID-19 and after contactless limits have been elevated (Submit-wave 1), and in the course of the second wave of COVID-19 (Submit-wave 2).

Calendar intervals utilized for pattern building, Supply: Client adoption and use of economic know-how: “faucet and go” funds, Swiss Nationwide Financial institution, August 2023

An evaluation of the information uncovered a big improve within the adoption and use of contactless funds following the onset of the COVID-19 pandemic with the share of contactless transactions rising by 17% factors from 44% in the course of the Base interval in 2019 to 61% in the course of the Submit-wave 1 interval in 2020. In the beginning of the pandemic, the rise in contactless funds was 4 instances greater than the development development previous to the pandemic outbreak.

The share of playing cards that have been used a minimum of as soon as in contactless funds (adoption charge) additionally elevated between the 2 intervals, rising by 18% factors from 68% in the course of the Base interval to 86% in the course of the Submit-wave 1 interval.

Share of contactless transactions and adoption of contactless transactions, Supply: Client adoption and use of economic know-how: “faucet and go” funds, Swiss Nationwide Financial institution, August 2023

In Switzerland, the “tap-and-go” restrict was doubled from CHF 40 to CHF 80 in April 2020 as a response to the COVID-19 outbreak. This improve was coordinated by the principle intermediaries within the Swiss fee trade, together with card schemes, card-issuing banks and acquirers, in dialog with the authorities.

Outcomes of the evaluation uncovered a considerable causal impact on the usage of paytech after a rise within the contactless cardholder verification restrict, revealing appreciable development in the usage of contactless funds for playing cards that benefited most from the upper “tap-and-go” restrict.

Furthermore, transactions that have been newly eligible for “tap-and-pay” (CHF 40-80) recorded a stronger development in contactless funds than transactions that have been both beforehand eligible (under CHF 40) or remained ineligible (above CHF 80).

Between the Base and the Submit-wave 1 intervals, the share of contactless transactions elevated by 24% factors for transactions within the vary between CHF 40 and CHF 80, in comparison with 16% for under CHF 40 transactions and 18% factors for above CHF 80 transactions.

Impact of tap-and-go restrict on contactless funds: within-card evaluation, Supply: Client adoption and use of economic know-how: “faucet and go” funds, Swiss Nationwide Financial institution, August 2023

These findings present key insights on how policy-makers and fee system intermediaries ought to proceed to spice up utilization of prompt fee methods and central financial institution digital currencies (CBDCs), the report says, revealing that it’s vital to supply handy id verification for retail funds when selling new fee devices. Particularly, the outcomes recommend that the worth restrict for immediate verification of funds will have an effect on the depth of use by customers who undertake the know-how.

The rise of contactless funds

Outcomes of the examine are in keeping with these of different analysis which discovered appreciable development in cashless funds in Switzerland. A 2022 examine performed by SNB revealed a shift from money to cashless fee strategies within the nation, with cellular fee apps specifically selecting up steam.

The analysis, which studied greater than 22,000 transactions and polled some 2,000 Swiss residents between August and November 2022, revealed that money was utilized by the inhabitants in 36% of transactions, a determine that’s decrease than the 43% and 70% charges noticed in 2020 and 2017, respectively. These numbers present that utilization of money in Switzerland has been declining over the previous years however that money stays nonetheless some of the used fee strategies for day-to-day purchases.

Quantity share by fee methodology in Switzerland, Supply: Fee Strategies Survey of Non-public People 2022, Swiss Nationwide Financial institution, August 2022

On the different finish of the spectrum, cashless fee devices continued to witness elevated adoption with cellular funds apps recording the strongest improve. In 2022, 68% of respondents indicated proudly owning a cellular fee app, representing a greater than sixfold improve from 2017. Utilization of cellular fee app additionally grew, rising from a quantity share of 5% in 2020 to 11% in 2022.

Possession of cashless fee devices, Supply: Fee Strategies Survey of Non-public People 2022, Swiss Nationwide Financial institution, August 2022

To deal with rising client desire and utilization of cellular funds, Swiss retailers are quickly integrating these new strategies into their fee choices. A 2023 examine performed by the Zurich College of Utilized Sciences and the Administration Heart Innsbruck revealed that Swiss on-line retailers are embracing cellular wallets at a quick tempo, with native participant Twint but in addition Apple Pay and Google Pay witnessing sturdy traction.

In 2023, Twint was the second most built-in fee methodology amongst Swiss on-line retailers behind bank cards (90%), with 4 out of 5 (79%) Swiss on-line retailers polled indicating supporting the cellular fee app.

Twint is a cellular fee methodology in Switzerland that enables customers to attach their checking account or card by means of an app to make funds on-line and at brick-and-mortar shops. The service claims greater than 5 million customers and says it carried out a complete of 386 million transactions in 2022. Established in 2016, Twint is owned by a few of Switzerland’s largest banks, together with UBS, PostFinance, Raiffeisen, Banque Cantonale Vaudoise, Zürcher Kantonalbank in addition to Swiss inventory market operator SIX and French fee firm Worldline.

Featured picture credit score: edited from freepik

[ad_2]

Source link