[ad_1]

dima_zel

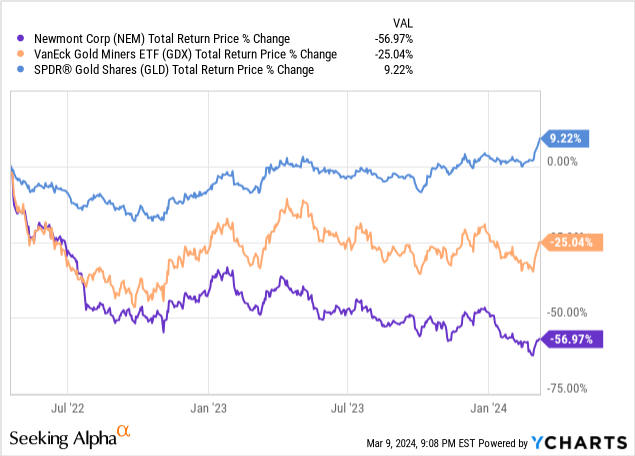

Newmont Company (NYSE:NEM) has been taken to the cleaners in recent times, massively underperforming Gold (GLD) and the broader gold mining index (GDX) since NEM inventory peaked in April 2022:

Nonetheless, its ahead outlook appears to be like very vibrant proper now and its CEO Tom Palmer lately signaled extraordinarily bullish sentiment on NEM inventory, stating:

It is a once-in-a-generation purchase for anybody who’s considering of placing just a few {dollars} into gold fairness…Newmont inventory is sitting at an excellent shopping for value… and as we ship on our commitments, you possibly can benefit from the experience up with us.

On this article, we’ll share six explanation why we agree with NEM’s CEO that the inventory is an especially enticing purchase proper now.

#1. The Stability Sheet Is Sturdy And Getting Stronger

NEM’s steadiness sheet is at present in stable form, with $6.1 billion in complete liquidity, a enterprise that’s producing free money stream, and really sturdy credit score scores (BBB+ from S&P and A- from Fitch). Furthermore, its steadiness sheet is about to enhance even additional within the coming two years as it’s promoting six of its belongings to be able to generate $2 billion in proceeds, about half of which can be used to cut back internet debt and enhance its liquidity to $7 billion, together with $3 billion in complete money available. This can put the corporate on very sturdy monetary footing and provides it the pliability it wants to purchase again inventory aggressively and make different investments opportunistically.

#2. Large Synergies Projected In The Close to Future

NEM additionally expects to generate vital synergies within the close to future, projecting a complete of $1 billion by means of ~$500 million in annual synergies from its Newcrest acquisition and a further ~$500 million in annual synergies from productiveness enhancements. On condition that they’re projected to generate between $6.5 billion and $8.5 billion in EBITDA shifting ahead, these synergies can be a really significant enchancment to the corporate’s backside line.

#3. They Have The Most Spectacular Gold Mining Portfolio In The World

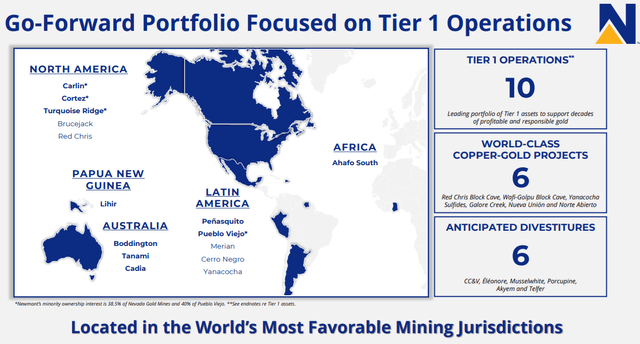

With their deliberate sale of six tier-two belongings within the close to future, NEM’s pro-forma portfolio will encompass 10 tier-one gold mines together with six high-quality copper mines.

NEM Portfolio (Investor Presentation)

Furthermore, these mines can be virtually completely concentrated in low-risk mining jurisdictions with a mere 6% of its gold reserves and none of its copper reserves being situated in Africa. Of equal significance, practically two-thirds of its gold and copper reserves can be situated in North America, Australia, or Papua New Guinea. When mixed with its scale and steadiness sheet power, NEM can have one of many lowest threat profiles within the mining trade.

#4. Operational And Free Money Movement Enhancements Coming Up

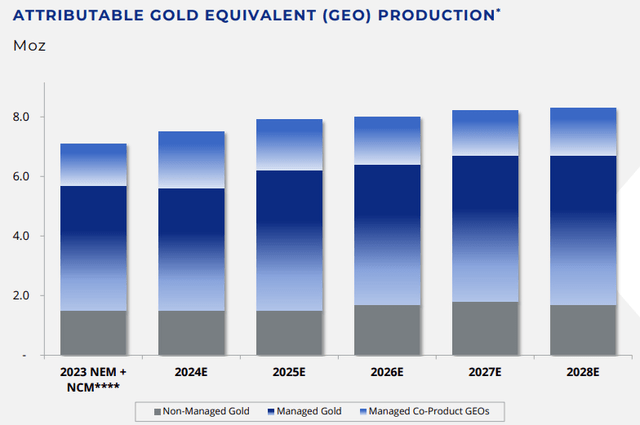

On prime of its enhanced threat profile, working effectivity and productiveness enhancements seem extremely doubtless in NEM’s future, as its Gold Equal Ounce manufacturing in its tier-one portfolio is predicted to extend meaningfully within the coming years:

NEM Manufacturing Profile (Investor Presentation)

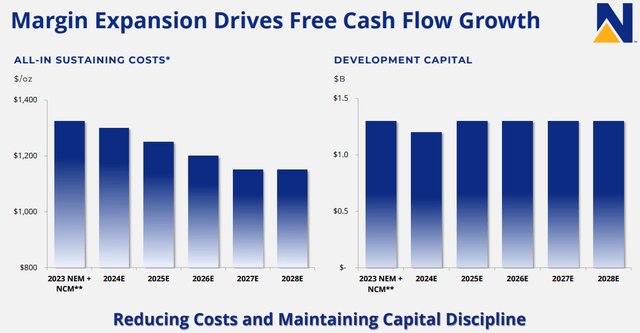

Furthermore, on account of its anticipated synergies, improved asset high quality, and different investments in effectivity enhancements, NEM’s all-in sustaining prices are anticipated to fall meaningfully whereas its growth capital spending ought to stay fairly secure, doubtless resulting in increasing margins for the corporate on a gold value impartial foundation:

NEM Effectivity Enhancements (Investor Presentation)

#5. Very Bullish Outlook For Gold And Copper

That being stated, we count on gold and copper costs to soar within the coming years. As we detailed in a current article, gold will doubtless proceed its current sturdy efficiency on account of:

The Federal Reserve ending its rate-hiking cycle and starting to chop charges Continued sturdy central financial institution shopping for of gold Hovering geopolitical dangers and tensions A possible weakening of the financial system A reversion to the imply of its valuation relative to the inventory market The continued decline of the U.S. Greenback

Copper, in the meantime, ought to carry out nicely as a result of:

Demand is hovering as a result of inexperienced power transition The worth of the U.S. Greenback is predicted to proceed to say no Manufacturing is affected by mining disruptions and is unlikely to have the ability to meet demand for the foreseeable future

#6. NEM Inventory Is Very Undervalued And Is Set To Purchase Again Inventory Aggressively

Final, however not least, NEM inventory appears to be like very undervalued proper now, as its CEO lately emphasised. With a $1 billion inventory buyback lately introduced, it seems that administration is able to put its cash the place its mouth is.

Furthermore, the inventory is buying and selling in-line with its NAV proper now regardless of traditionally buying and selling at a 30% premium to its NAV, implying ~30% near-term upside for the inventory. If gold and copper costs proceed to rise, nonetheless, it would get pleasure from even additional upside.

NEM Inventory Dangers

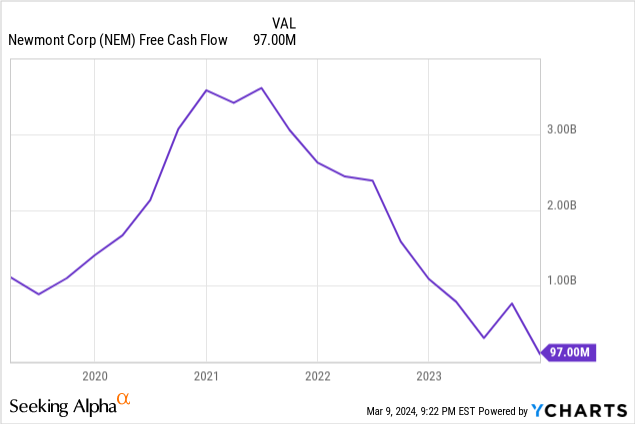

That being stated, no inventory is risk-free and NEM definitely has a previous that’s doubtless leaving many traders in “present me” mode. Along with its steep inventory value underperformance, NEM’s administration lately reduce its dividend, doubtless destroyed per share intrinsic worth by means of the Newcrest acquisition, and generated shockingly little free money stream final yr relative to its complete manufacturing capability.

Furthermore, it’s having to digest a serious acquisition and likewise faces some execution threat because it seeks to promote six tier two belongings and get first rate worth for them. As gold analyst John Ing identified:

Typically with these acquisitions, you purchase different folks’s issues…I simply ponder whether that is going to work out long term…Whenever you get to a sure dimension, they’re going to have one thing like 21 mines in about 10 jurisdictions, and that is quite a bit to handle.

Investor Takeaway

NEM certainly appears to be like like a generational shopping for alternative proper now and – whereas the corporate might want to show to the market that it will probably deal with its new and improved portfolio, get enticing pricing for its non-core belongings that it’s promoting, and successfully harvest its projected synergies – its sturdy steadiness sheet, world-class portfolio of belongings, enhancing operational and manufacturing profile, and bullish outlook for gold and copper costs mix with its considerably discounted inventory value to make it seem poised to ship substantial complete return outperformance within the years to return. In consequence, it’s one among my largest positions in the intervening time and I charge it a Sturdy Purchase.

[ad_2]

Source link