[ad_1]

“Subsequent Factor You Know” is a track co-written and recorded by American nation music singer Jordan Davis. It was launched on February 21, 2023. It was nominated for the Nation Music Affiliation Award for Single, Music and Video of the Yr on the 57th Annual Nation Music Affiliation Awards. (wikipedia)

I selected this track because the theme for this week’s article as a result of the lifetime development he outlines within the track jogs my memory of while you apply a disciplined confirmed framework to your investing course of and then you definitely WAIT and let it play out because it all the time does. Generally sooner, typically later, however it all the time works over time when the framework is right.

As I’ve acknowledged many occasions, when it comes, it comes suddenly. All you’ll be able to management is the method – not the timeline. Some investments attain intrinsic worth in six months and a few take 36+. The hot button is shopping for sturdy confirmed money generative companies when they’re briefly impaired after which sitting in your palms till they’re totally valued.

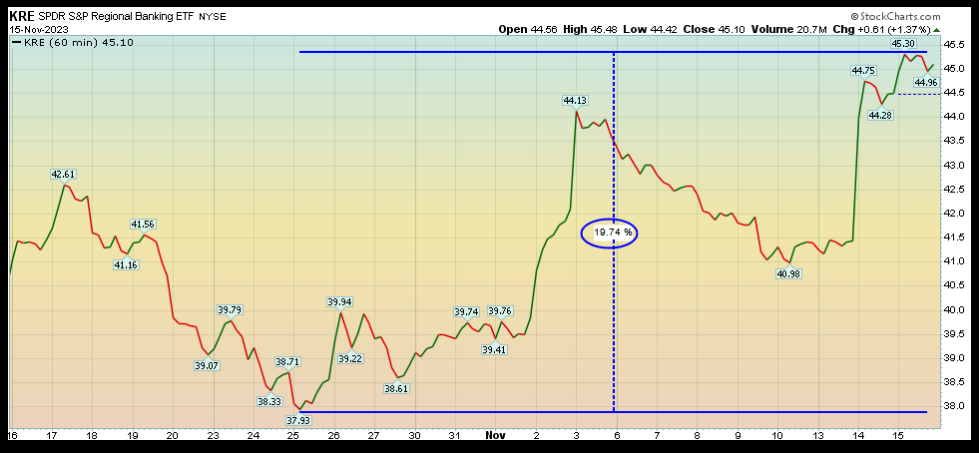

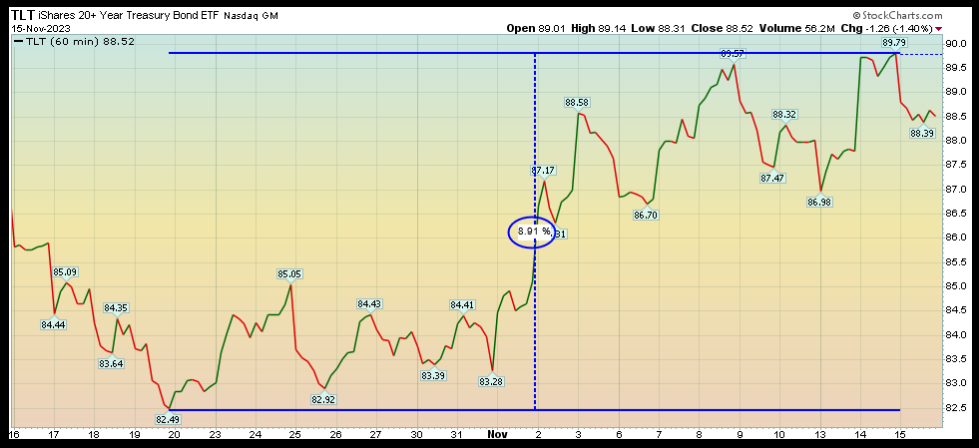

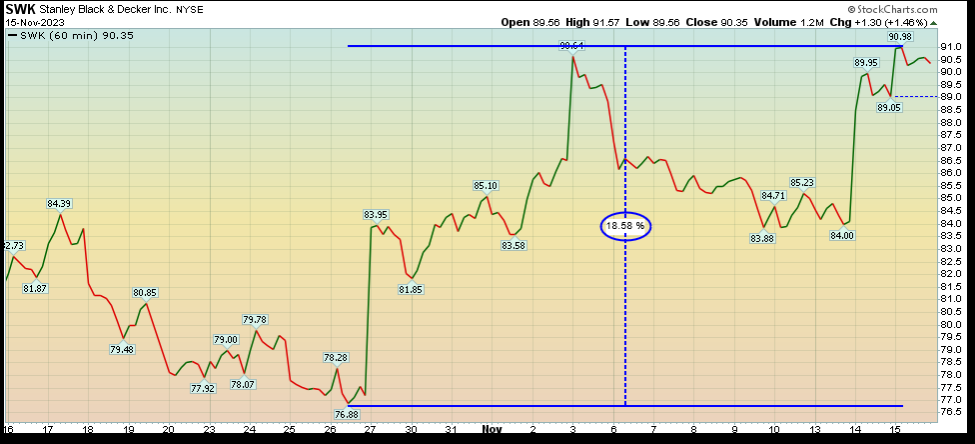

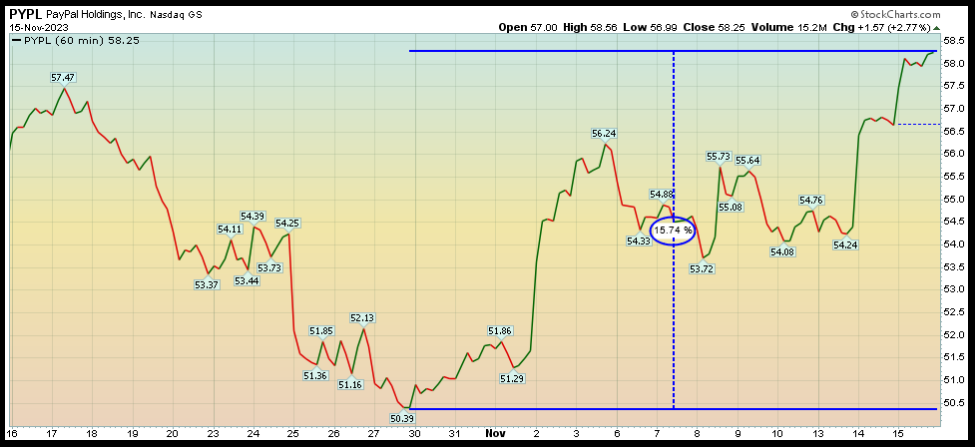

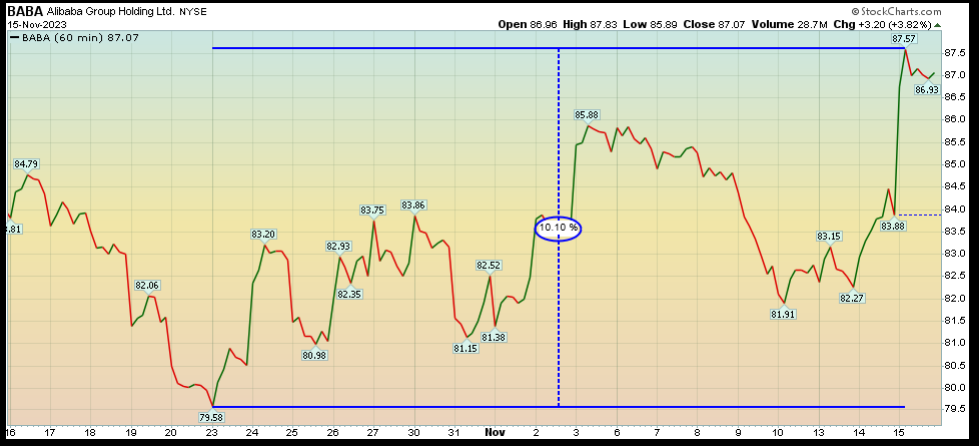

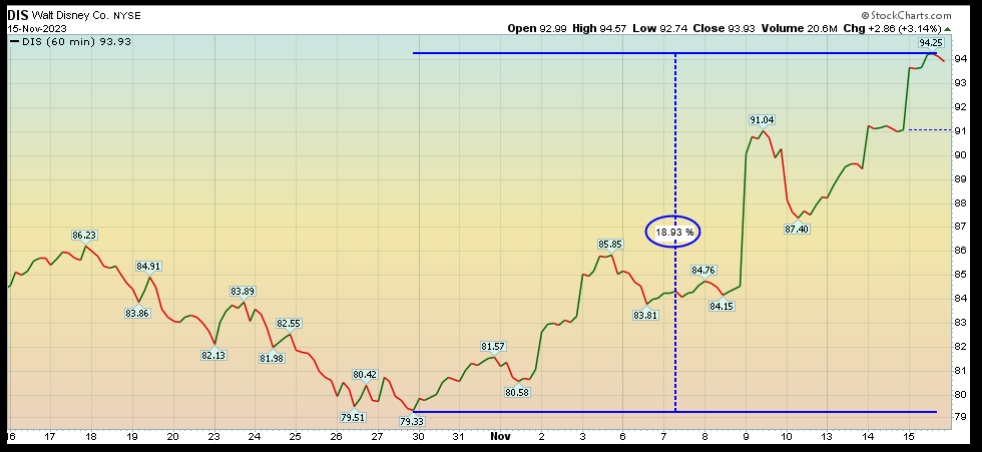

Listed below are numerous the positions/concepts we now have mentioned in on our weekly podcast|videocast(s) and in public media appearances:

The perfect half is, that as a lot because it’s been good to see all of those names transfer aggressively in the previous few weeks – NOT ONE OF THEM IS NEAR OUR PRE-DETERMINED TARGET OF INTRINSIC VALUE. “Each battle is gained or misplaced earlier than it’s ever fought” – Solar Tzu – The Artwork of Conflict. In different phrases, most of those names are JUST GETTING GOING and nonetheless have many extra months or years of runway earlier than reaching totally valued standing (and are offered). Should you suppose you “missed it” you’re mistaken. Nearly all of these have simply began leaving the station…

Fox Enterprise

On Wednesday I joined Charles Payne to debate two turnaround conditions. One that’s in the course of its turnaround – Cooper Normal, and one whose turnaround is simply starting – Advance Auto Elements (NYSE:). Because of Charles, Nick Palazzo and Kayla Arestivo for having me on:

Watch in HD straight on Fox Enterprise

Right here have been my “Present Notes” forward of the section:

2 Key Investing Themes For 2024

We’ve two main funding themes for 2024 that we outlined in our particular presentation to Accredited Traders on the MoneyShow this week. This presentation is price its weight in gold should you take note of a few of the key charts within the center. Because of Debbie Olsen, Mike Larson, Kim Githler and Shelly Coyle for having me on:

Full MoneyShow Energy Level Presentation Obtain

CGTN America

Because of Phil Yin and Toufic Gebran for having me on CGTN America on Tuesday evening to debate inflation and its implication on the Fed and markets. Phil all the time asks the perfect questions so that you positively need to watch this one:

CNBC Indonesia

I joined Ade Nurul Safrina on CNBC “Closing Bell” Indonesia on Tuesday to debate Rising Markets, the US Greenback and extra. Because of Safrina and Fitria Anggrayni for having me on:

And at last, I joined Jillian Glickman on Inventory.app final week to debate Alibaba (NYSE:), VF Corp (NYSE:) and Advance Auto Elements. Test it out right here:

Sentiment & Positioning

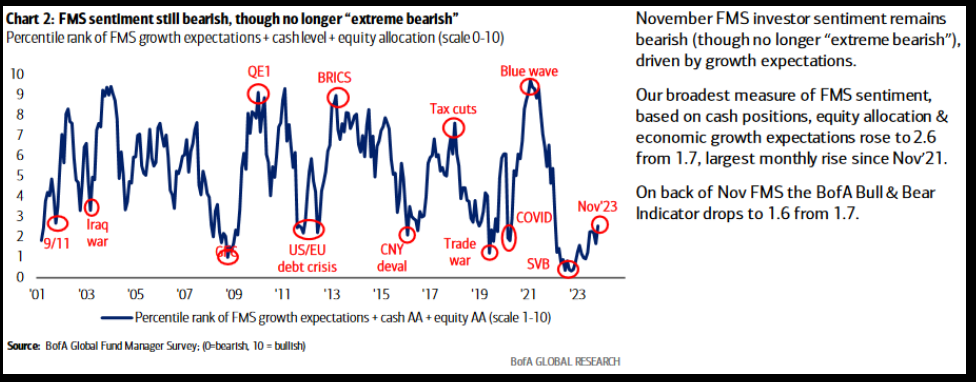

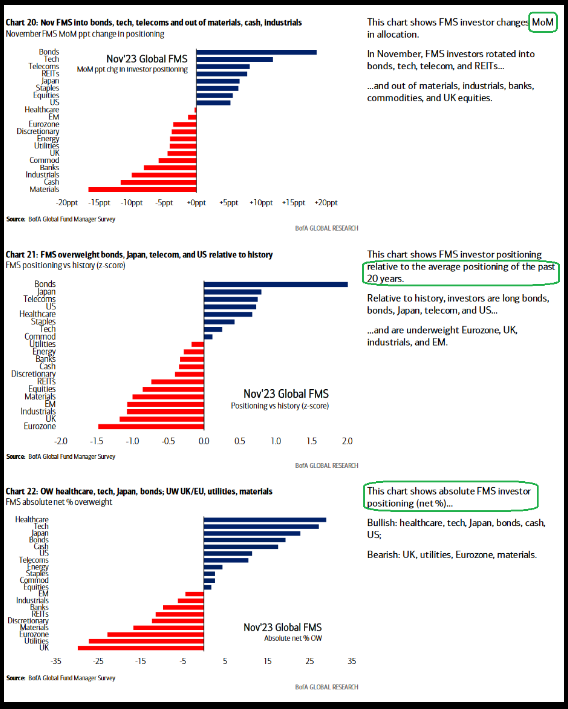

This Tuesday, Financial institution of America (NYSE:) printed its month-to-month “Fund Supervisor Survey.” I posted a abstract right here:

Right here have been the three key factors:

1. Managers are nonetheless extra pessimistic than they have been on the March 2020 Pandemic Lows and March 2009 Nice Monetary Disaster lows. Markets will proceed to climb the “Wall of Fear” till these managers are compelled again in in opposition to their will. All the time bear in mind, “opinion follows development.” As value strikes up and they’re pushed again in, they are going to be simply as assured of their new bullish thesis as they presently are with their bearish one.

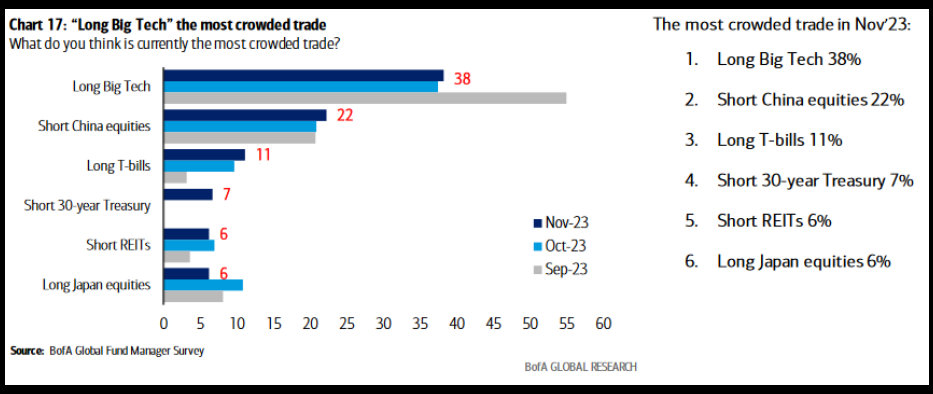

2. Managers love T-Payments and Money. They hate Rising Markets, China, REITS, UK and BANKS. Take the opposite facet:

FMS buyers

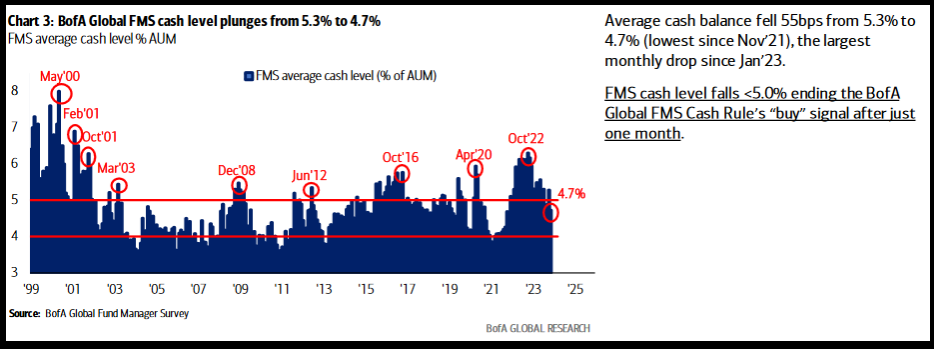

3. Managers are STARTING to come back out of money because the markets get away from them, however they’re nonetheless too underweight threat property and should chase:

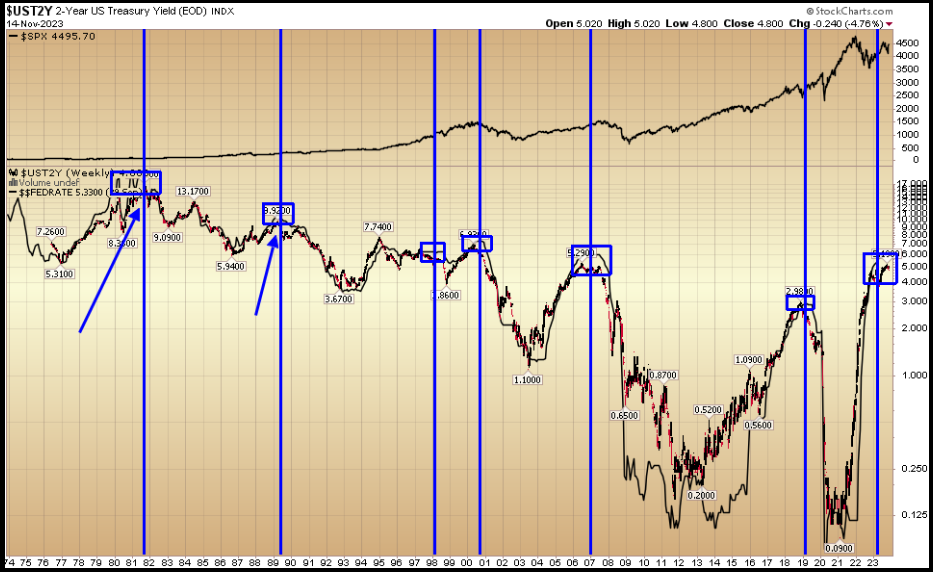

2 yr yield as sign…

As you’ll be able to see beneath, traditionally when the 2 yr yield (in pink/black) trades beneath the Fed Funds Price (in strong black), the 2 yr yield wins. Which means, the Fed is compelled to chop – as they’re too restrictive and destroying the economic system.

Most market contributors undergo from “recency bias” and can have a look at the latest few occasions to substantiate that cuts will imply dangerous issues for the market and economic system. Nevertheless, should you look again a bit additional you will note in 1982 (early cycle) and 1989 (mid cycle) this (cuts) was executed with no deleterious results to the markets or economic system. Simply the other, it was an accelerant to get issues going:

Now onto the shorter time period view for the Common Market:

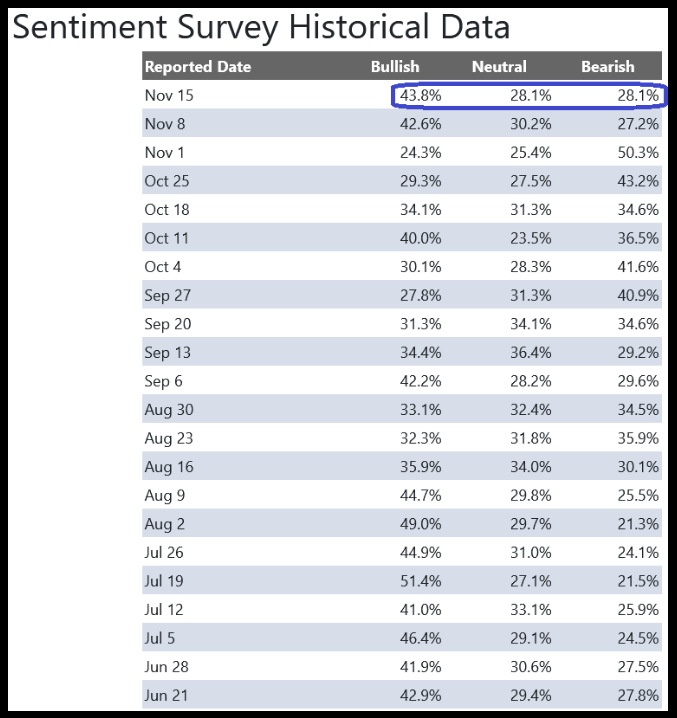

On this week’s AAII Sentiment Survey outcome, Bullish P.c (Video Clarification) ticked as much as 43.8% from 42.6% the earlier week. Bearish P.c additionally ticked as much as 28.1% from 27.2%. Retail buyers are beginning to get giddy. This stage can keep elevated throughout main strikes (see beneath), however be open minded to just a little give-back in markets (within the quick time period) to knock the knowledge out of their thoughts earlier than shifting larger.

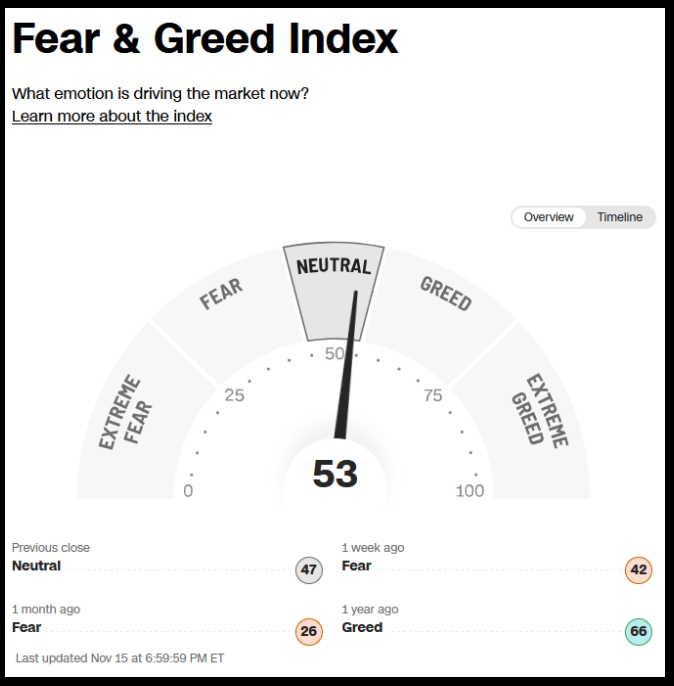

The CNN “Worry and Greed” moved up from 40 final week to 53 this week. Traders are impartial. You possibly can learn the way this indicator is calculated and the way it works right here: (Video Clarification)

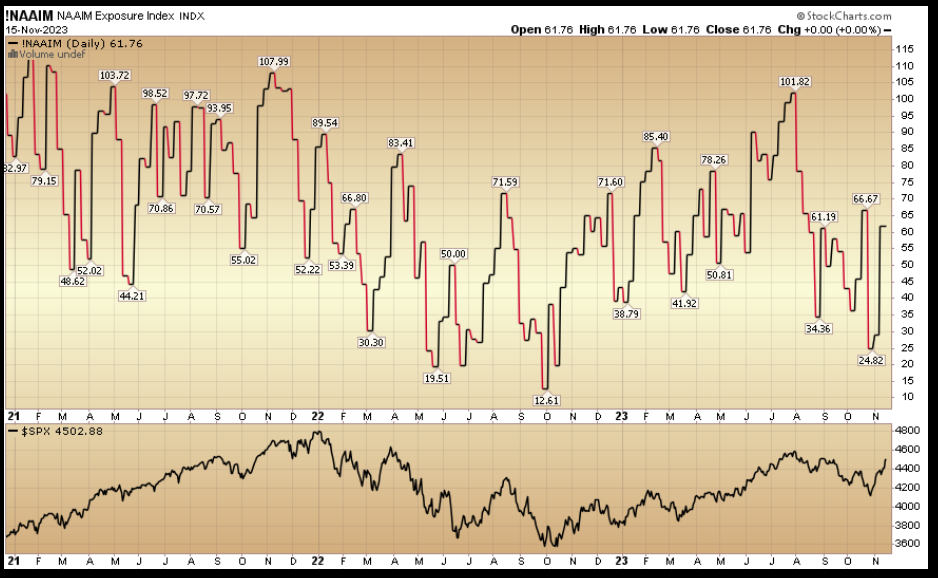

And at last, the NAAIM (Nationwide Affiliation of Energetic Funding Managers Index) (Video Clarification) moved as much as 61.75% this week from 29.17% fairness publicity final week. The yr finish chase goes to proceed in coming weeks:

This content material was initially printed on Hedgefundtips.com.

[ad_2]

Source link