[ad_1]

Daniel Bosma/Second by way of Getty Photographs

NextEra Vitality Inc. (NYSE:NEE) is an American vitality firm. Based in 1925, NextEra Vitality is now a $116 billion (by market cap) energy utility big that employs greater than 15,000 folks. By market cap, that is the biggest utility holding firm within the US.

NextEra Vitality studies outcomes throughout three segments: Florida Energy & Mild (FPL), 65% of FY 2023 income; NextEra Vitality Sources (NEER), 34%; and Company and Different, 1%.

FPL operates the biggest electrical utility enterprise in Florida, offering electrical energy to over 12 million folks throughout the state of Florida. FPL’s vitality combine is: 71% pure fuel, 21% nuclear, 5% photo voltaic, and three% different. Primarily based on electrical energy gross sales, FPL is the biggest utility within the US.

NEER is the world’s largest generator of renewable vitality from the wind and solar, and it’s additionally a world chief in battery storage. This can be a very distinctive enterprise that gives one thing to love for each conventional utility followers and buyers who need to be uncovered to the way forward for renewable vitality manufacturing.

NextEra Vitality is efficiently working an orthodox electrical utility enterprise and a renewable vitality enterprise at unmatched scale. For my part, that is the most effective of each the outdated and the brand new.

NextEra Vitality is aptly named, because it’s making ready for the following period of vitality by way of its investments in and utilization of photo voltaic and wind energy technology, together with battery storage. The world is slowly shifting towards newer types of vitality which are, rightly or wrongly, perceived to be cleaner and extra sustainable for society. What this implies is, utility corporations that may adapt to this variation would be the finest positioned to not solely survive however thrive.

On the similar time, the corporate is firmly grounded in actuality, utilizing confirmed assets corresponding to pure fuel to generate electrical energy for purchasers who rely on gaining access to dependable energy 24/7.

The all-of-the-above strategy has confirmed itself to be a successful technique for NextEra Vitality and its shareholders. In spite of everything, the entire thesis of investing in an influence utility firm revolves round the truth that we can’t stay in a modern-day society with out dependable entry to electrical energy. Since electrical energy is a non-negotiable want, an influence utility is of course blessed with captive clients and extremely recurring/seen income.

On high of all of this, NextEra Vitality’s FPL unit is favorably located in Florida. Florida has, for years, been one of many fastest-growing states within the US, and it’s additionally a jurisdiction that has traditionally had a constructive regulatory framework. That places FPL in a really advantageous spot for continued development via each buyer acquisitions and charge will increase.

NextEra Vitality is a uncommon case of a reliable utility with development traits – a best-of-both-worlds setup. This passage from Morningstar properties in on this: “NextEra Vitality’s high-quality regulated utility in Florida and fast-growing renewable vitality enterprise give buyers the most effective of each worlds: a safe dividend and industry-leading renewable vitality development potential.”

This unparalleled mixture has led to, and will proceed to result in, constant income, revenue, and dividend development.

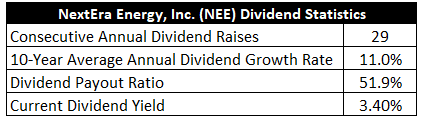

Dividend Progress, Progress Fee, Payout Ratio and Yield

To that time, NextEra Vitality has elevated its dividend for 29 consecutive years. This makes NextEra Vitality a vaunted Dividend Aristocrat – certainly one of solely three energy utility corporations which have achieved such standing.

You get uncommon consistency right here. And also you additionally get uncommon development. Certainly, the 10-year dividend development charge is 11%. A double-digit dividend development charge is almost unprecedented for a utility. Because of the expansion engines I already outlined, NextEra Vitality has been capable of hand out beneficiant dividend raises for years.

And the loopy factor is, you don’t even must sacrifice a lot yield right here. The inventory yields 3.4%. Certain, that’s not as excessive as another energy utilities on the market (virtually all of that are rising a lot slower than NextEra Vitality). Nevertheless it does simply beat the broader market. It’s additionally 130 foundation factors larger than its personal five-year common.

And with a payout ratio of 51.9%, which is almost completely balanced, the dividend may be very wholesome and poised for extra development forward.

I see nothing to dislike right here. You get yield, development, security, and consistency. It’s a really compelling bundle.

Income and Earnings Progress

As compelling as these metrics could also be, although, a lot of them are wanting into the previous. Nonetheless, buyers should all the time be wanting into the long run, as at the moment’s capital will get risked for the rewards of tomorrow. As such, I’ll now construct out a forward-looking development trajectory for the enterprise, which will probably be extremely helpful when the time comes later to estimate intrinsic worth.

I’ll first present you what the enterprise has accomplished over the past decade when it comes to its top-line and bottom-line development. I’ll then reveal an expert prognostication for near-term revenue development. Mixing the confirmed previous with a future forecast on this method ought to give us the knowledge we have to make an informed name on the place the enterprise is likely to be going from right here.

NextEra Vitality moved its income from $17 billion in FY 2014 to $28.1 billion in FY 2023. That’s a compound annual development charge of 5.7%. I’m searching for mid-single digit top-line development from a reasonably mature enterprise like this. NextEra Vitality delivered.

In the meantime, earnings per share grew from $1.40 to $3.60 over this 10-year interval, which is a CAGR of 11.1%. So we will see how EPS development is sort of exactly in keeping with dividend development over the past decade, displaying extraordinarily tight management from administration.

Wanting ahead, CFRA is projecting an 8% CAGR for NextEra Vitality’s EPS over the following three years. This will transform a contact excessive, but it surely’s actually not that far off from what NextEra Vitality’s administration is guiding for over the close to time period.

Right here’s an excerpt from the corporate’s most up-to-date earnings launch: “For 2025 and 2026, NextEra Vitality expects to develop 6% to eight%, off the 2024 adjusted earnings per share vary. This interprets to a variety of $3.45 to $3.70 for 2025 and $3.63 to $4.00 for 2026. NextEra Vitality additionally continues to anticipate to develop its dividends per share at a roughly 10% charge per 12 months via a minimum of 2024, off a 2022 base.”

Seeing as how NextEra Vitality has been constantly hitting its marks for years now, I see no motive to start out doubting administration now. It’s been a well-run operation for so long as I’ve been investing (going again greater than 10 years). For my part, NextEra Vitality is ready up very properly for each the close to time period and the long run.

Price declaring is that this passage from CFRA: “Long term, we have now a constructive outlook on the rising Florida financial system and low buyer charge uncertainty via 2026. We additionally observe tailwinds for NEER’s renewables backlog and FPL’s Actual Zero 2045 emissions goal from IRA clear vitality tax credit.”

It’s this one-two punch that’s serving NextEra Vitality uniquely properly.

That is, arguably, the most effective energy utility enterprise within the US. If we take administration’s phrase to coronary heart, the following few years ought to see ~10% dividend development. And also you’re getting a near-3.5% yield to start out with. Very difficult to discover a higher mixture of development and yield than that.

Monetary Place

Shifting over to the stability sheet, NextEra Vitality has an excellent, however not wonderful, monetary place. The long-term debt/fairness ratio is 1.1, whereas the curiosity protection ratio is barely over 3.

These are fairly frequent numbers for a utility, and I’d say the stability sheet is the one space during which NextEra Vitality seems to be like nearly each different energy utility on the market.

That stated, it’s unsurprising to see this. In spite of everything, constructing out vitality infrastructure requires numerous spending – funded largely by debt – and NextEra Vitality is almost assured by regulators to earn a return on its investments (via larger energy charges).

Profitability is powerful. Return on fairness has averaged 11% over the past 5 years, whereas web margin has averaged 20.6%. NextEra Vitality’s returns on capital aren’t tremendous excessive in absolute phrases, but it surely does beat a lot of the different vitality utilities I comply with.

Essentially talking, NextEra Vitality might be the most effective energy utility enterprise within the US. And the corporate does profit from sturdy aggressive benefits, together with economies of scale, a geographic monopoly, a novel construction, a good geographic footprint, and a constructive regulatory construction that virtually ensures some stage of revenue.

In fact, there are dangers to think about.

Litigation, regulation, and competitors are omnipresent dangers in each {industry}.

Regulation is a double-edged sword. Regulators permit for utilities to make an affordable revenue, the place revenue scales with prices, placing a revenue ground in place. On the flip facet, as a result of electrical energy is critical and there’s typically just one energy supplier in anybody geographic space, regulators set up a revenue ceiling by limiting the charges a utility can cost.

This can be a uncommon {industry} during which competitors at an area stage doesn’t exist, as NextEra Vitality runs native monopolies throughout its territory. Nonetheless, clients may change into future opponents by producing energy on the website of consumption (by way of photo voltaic).

NextEra Vitality’s FPL is captive to the regulatory construction and inhabitants development of Florida, however Florida is at present probably the greatest attainable states to run a regulated utility.

Illustrating this level, Morningstar states: “The corporate’s below-average retail charges have garnered comparatively favorable remedy within the already-constructive Florida regulatory jurisdiction. [FPL] enjoys above-average returns on fairness, forward-looking charge changes, and computerized common base-rate changes for investments upon completion. We anticipate future returns to be decrease however nonetheless be above most different utilities.”

Publicity to nuclear is current. Pure catastrophe danger can be current, particularly since Florida is susceptible to hurricanes.

The economics surrounding renewables are nonetheless questionable, and it stays to be seen how economically profitable NEER will finally be.

Total, most of those dangers are fairly abnormal for an influence utility enterprise.

And the valuation additionally appears to be fairly abnormal, although NextEra Vitality is, in some ways, extraordinary…

Valuation

The P/E ratio of 15.6 is roughly in keeping with lots of the US energy utilities on the market. However I’d argue that NextEra Vitality ought to get a premium.

Certainly, it sometimes does get a premium. Its personal five-year common P/E ratio is 40.5, though that’s clouded by unstable GAAP earnings.

If we take a look at the money stream a number of of 10.1, that’s seven turns decrease than its personal five-year common of 17.1.

And the yield, as famous earlier, is considerably larger than its personal current historic common.

So the inventory seems to be low cost when fundamental valuation metrics. However how low cost may it’s? What would a rational estimate of intrinsic worth appear like?

I valued shares utilizing a dividend low cost mannequin evaluation. I factored in a ten% low cost charge and a long-term dividend development charge of seven.5%.

That development charge is on the upper finish of what I permit for when working with a utility, however NextEra Vitality’s eminence qualifies it.

That is fairly a bit decrease than the place the near-term dividend development expectation is at, however I wouldn’t anticipate that 10% dividend development charge to persist indefinitely. It can virtually definitely sluggish in coming years, and that explains the short-term nature of that prime steerage.

I’m not predicting any sort of development collapse. Fairly, a gradual slowdown, culminating into a couple of share factors per 12 months does appear doubtless from my vantage level. However with the current compression in multiples, which drove the yield larger, that slowing is greater than priced in.

The DDM evaluation provides me a good worth of $80.41. The explanation I exploit a dividend low cost mannequin evaluation is as a result of a enterprise is finally equal to the sum of all the long run money stream it will probably present.

The DDM evaluation is a tailor-made model of the discounted money stream mannequin evaluation, because it merely substitutes dividends and dividend development for money stream and development. It then reductions these future dividends again to the current day, to account for the time worth of cash since a greenback tomorrow just isn’t price the identical quantity as a greenback at the moment. I discover it to be a reasonably correct method to worth dividend development shares.

Regardless of what I believe was a cautious tackle valuation, the inventory nonetheless seems to be very low cost. However we’ll now evaluate that valuation with the place two skilled inventory evaluation companies have come out at. This provides stability, depth, and perspective to our conclusion.

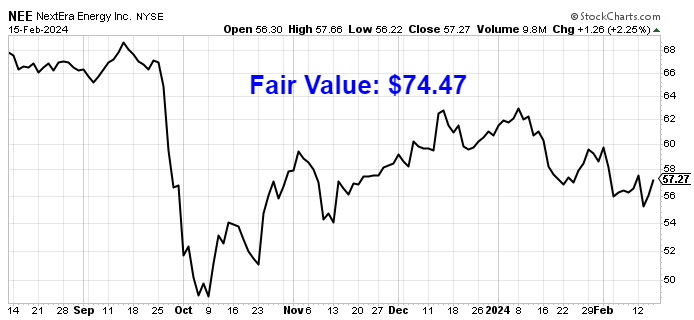

Morningstar, a number one and well-respected inventory evaluation agency, charges shares on a 5-star system. 1 star would imply a inventory is considerably overvalued; 5 stars would imply a inventory is considerably undervalued. 3 stars would point out roughly honest worth. Morningstar charges NEE as a 4-star inventory, with a good worth estimate of $74.00.

CFRA is one other skilled evaluation agency, and I like to check my valuation opinion to theirs to see if I’m out of line. They equally charge shares on a 1-5 star scale, with 1 star that means a inventory is a Robust Promote and 5 stars that means a inventory is a Robust Purchase. 3 stars is a Maintain. CFRA charges NEE as a 4-star “Purchase”, with a 12-month goal value of $69.00.

I got here out on the excessive finish this time round, which surprises me. Averaging the three numbers out provides us a ultimate valuation of $74.47, which might point out the inventory is probably 25% undervalued.

NextEra Vitality Inc. is, arguably, the most effective energy utility enterprise within the US. It has a lock on probably the greatest geographic areas within the US, and its renewables facet of the home is the biggest on the planet. With a market-beating yield, a reasonable payout ratio, a double-digit long-term dividend development charge, practically 30 consecutive years of dividend will increase, and the potential that shares are 25% undervalued, this Dividend Aristocrat might be probably the greatest long-term funding candidates out there for dividend development buyers.

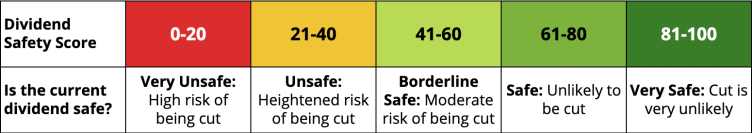

Observe from D&I: How secure is NEE’s dividend? We ran the inventory via Merely Protected Dividends, and as we go to press, its Dividend Security Rating is 90. Dividend Security Scores vary from 0 to 100. A rating of fifty is common, 75 or larger is great, and 25 or decrease is weak. With this in thoughts, NEE’s dividend seems Very Protected with a not possible danger of being lower.

Disclosure: I’m lengthy NEE.

Authentic Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.

[ad_2]

Source link