[ad_1]

NFP Key Factors

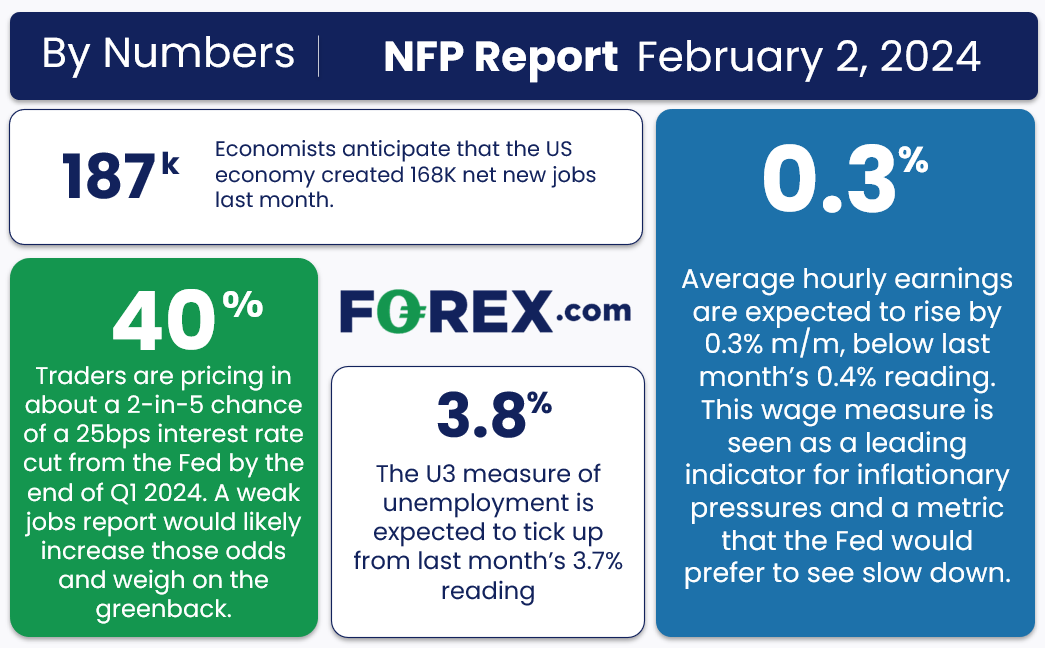

NFP report expectations: +187K jobs, +0.3% m/m earnings, unemployment at 3.8%

Main indicators level towards an nearly dead-on expectations studying on this month’s NFP report, with headline job development within the 165K-215K vary

The current consolidation within the US Greenback Index and the Fed’s renewed knowledge dependence might result in a more-volatile-than-usual response within the US greenback.

When is the January NFP Report?

The January NFP Report can be launched on Friday, February 2, at 8:30 ET.

NFP Report Expectations

Merchants and economists count on the NFP report to point out that the US created 187K internet new jobs, with common hourly earnings rising 0.3% m/m (4.1% y/y) and the U3 unemployment price ticking as much as 3.8%.

NFP Overview

Tomorrow brings the primary NFP report overlaying 2024 knowledge, and primarily based available on the market’s expectations, the roles market could have gotten off to a powerful begin to the brand new yr:

Supply: StoneX

Within the wake of Wednesday’s FOMC assembly, I count on jobs (and inflation) knowledge to tackle a renewed significance for merchants. Fed Chairman Powell famous that the central financial institution doesn’t essentially must see bettering financial knowledge to begin chopping rates of interest, simply extra of the identical stable knowledge that we’ve seen over the past six months; nonetheless, he additionally famous {that a} slowdown within the labor market might immediate earlier rate of interest cuts, implying that the subsequent few jobs experiences can be significantly essential.

NFP Forecast

As common readers know, we concentrate on 4 traditionally dependable main indicators to assist handicap every month’s NFP report, however given the vagaries of the calendar this month, the ISM Providers PMI report received’t be launched till Monday, leaving simply three main indicators of word:

The ISM Manufacturing PMI Employment part ticked right down to 47.1 from 47.5 final month.

The ADP Employment report confirmed 107K internet new jobs, a considerable lower from final month’s downwardly-revised 158K studying.

Lastly, the 4-week shifting common of preliminary unemployment claims held regular at 208K, primarily unchanged from final month.

Weighing the info and our inside fashions, the main indicators level to an nearly dead-on expectations studying on this month’s NFP report, with headline job development probably coming in someplace within the 165K-215K vary, albeit with an even bigger band of uncertainty than normal given the present international backdrop.

Regardless, the month-to-month fluctuations on this report are notoriously troublesome to foretell, so we wouldn’t put an excessive amount of inventory into any forecasts (together with ours). As at all times, the opposite facets of the discharge, prominently together with the closely-watched common hourly earnings determine which got here in at 0.4% m/m in the newest NFP report.

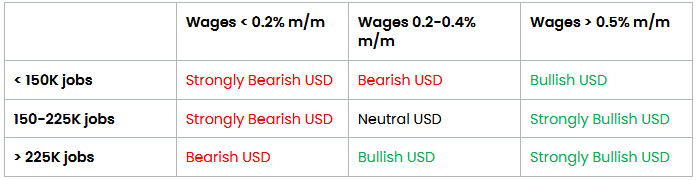

Potential NFP Market Response

As we element beneath, the noticed a powerful rally to begin the brand new yr however has largely consolidated in a good vary over the past couple of weeks, leaving a comparatively impartial outlook towards the forex heading into the roles report. That mentioned, the current consolidation and the Fed’s renewed knowledge dependence might result in an outsized transfer within the on the again of this month’s NFP studying.

US Greenback Technical Evaluation – DXY Day by day Chart

US Greenback Index-Day by day Chart

US Greenback Index-Day by day Chart

Supply: TradingView, StoneX

Trying on the broad US Greenback Index (DXY), essentially the most related technical consideration is the tight 2-week consolidation between 103.00 and 103.80. The highest of this vary is marked by DXY’s 200-day EMA and the 50% Fibonacci retracement of the November-December drop, representing a key confluence of resistance ranges that bulls must overcome within the occasion of a powerful jobs report.

Whereas the present technical and basic backdrop doesn’t essentially provide a powerful directional bias forward of the NFP report, it presents a probably clear medium-term setup: If DXY breaks out above 103.90 on the again of a powerful jobs report, the trail to 104.60 and even the mid-105.00s is comparatively clear, whereas a delicate jobs report and a break beneath 103.00

Authentic Put up

[ad_2]

Source link