[ad_1]

Editor’s observe: Searching for Alpha is proud to welcome Florian Muller as a brand new contributor. It is simple to turn out to be a Searching for Alpha contributor and earn cash to your greatest funding concepts. Energetic contributors additionally get free entry to SA Premium. Click on right here to search out out extra »

Armando Oliveira/iStock Editorial by way of Getty Photographs

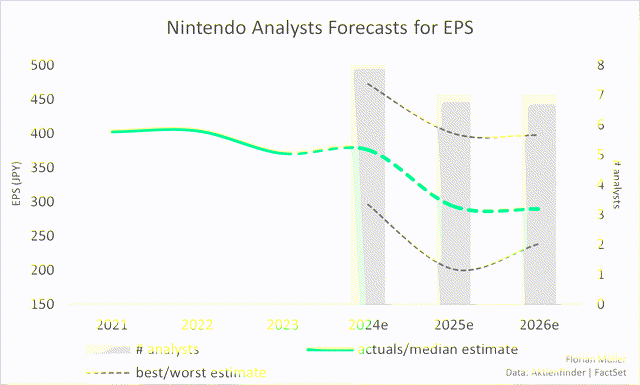

One may suppose that, no less than within the brief time period, Nintendo (OTCPK:NTDOF) (OTCPK:NTDOY) is just not a prime decide purely based mostly on earnings, given its anticipated enterprise contraction in keeping with the median analysts’ forecasts proven under. Some may declare that at greatest the corporate presents an interesting narrative for die-hard followers. As for myself, I’ve recognized compelling causes to stay loyal to my present place within the inventory. I’ll clarify these within the sections that observe.

Florian Müller | Information: Aktienfinder.internet, FactSet

About half of Nintendo’s software program gross sales are digital, which may probably maintain additional margin alternatives in the long run, offsetting declining revenues. Arguments like these, amongst others, have been exhaustively pressured in different analyses and maintain true for Nintendo. I, nonetheless, will base my evaluation on 4 key pillars:

How Nintendo leverages foreign money dangers How Nintendo generates worth from its money surplus Nintendo’s product excellence and Mental Property technique A reduced money circulate valuation

Navigating and Leveraging Forex Dangers

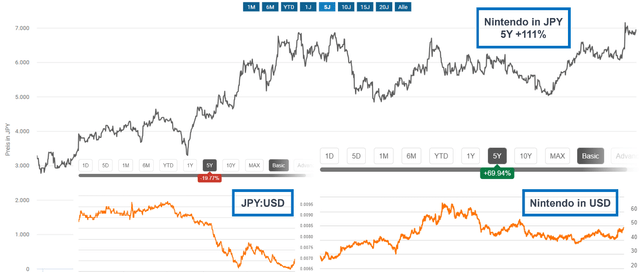

Up to now 5 years, Nintendo’s inventory, listed in Japanese Yen on the Tokyo Inventory Alternate, has surged by greater than 110%. Throughout the identical interval, the Japanese Yen has depreciated by virtually 20% towards the US Greenback – or conversely, the US Greenback has appreciated by 25 % towards the Japanese Yen. Consequently, US traders, when evaluated in US {Dollars}, have gained roughly 70% in Nintendo’s inventory over the past 5 years, versus the perceived 110%. A good portion of the positive aspects has been mitigated by the weakening Yen. Whereas this evaluation would not intention to extensively handle macro points resembling foreign money fluctuations, this instance vividly illustrates the foreign money danger related to the Japanese Yen and thus, related to Nintendo from the angle of an investor outdoors Japan.

Aktienfinder.internet, Searching for Alpha

Nonetheless, the corporate strategically leveraged this vulnerability in each their operations and non-operating extra money administration. With solely about 22% of its revenues not too long ago generated in Japan, 23% in Europe, and 44% in “The Americas”, the appreciating USD performed into the arms of the Japanese company when transformed into yen. In comparison with the earlier first half-year, Nintendo’s internet gross sales have elevated by 21.2%, or 139.3 million yen, with 36.8 million yen, or 5.6%, attributed solely to the weak yen. Conversely, a re-strengthening yen may exert strain on the gross sales facet.

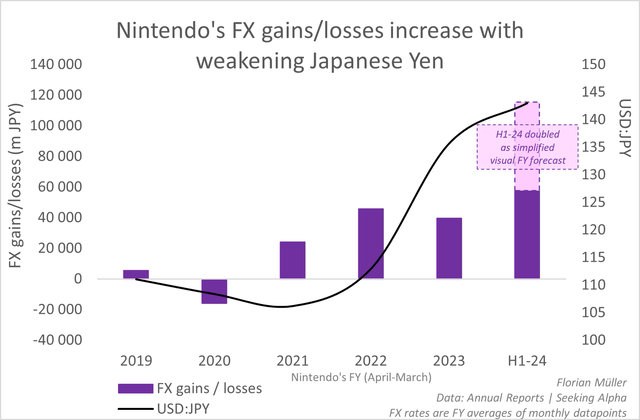

Moreover, cash-like belongings held by Nintendo in foreign currency resulted in non-operational international alternate positive aspects. I’ve visually proven how Nintendo’s non-operating earnings from investments in foreign currency outdoors of JPY have markedly elevated not too long ago. For instance, I’ve displayed the energy of the US Greenback alternate price alongside, which correlates with Nintendo’s positive aspects from foreign currency. This illustrates that the weak yen has performed into Nintendo’s hand not simply operationally, but additionally attributable to its excessive money surpluses and their short-term investments overseas.

Florian Müller | Information: Annual Stories, Searching for Alpha

Excessive Curiosity Charges? Sure, Please!

An funding in Nintendo appears to be a cushty place in each excessive and low-interest price environments. Whereas many indebted firms are battling growing curiosity bills, Nintendo sits on a considerable money (& equivalents) pile of greater than 2 trillion yen or $14 billion. This, in flip, is being lucratively invested as I’ll illustrate in a second. Whereas financial situations in lots of locations could also be slowing because of the rising rate of interest setting, Nintendo is ready to generate returns on its excessive liquidity reserves, bolstering its monetary energy. Thus, Nintendo is armed to the enamel, able to strategically allocate its money reserves when the time is true, particularly through the subsequent part of a brand new console launch or a possible shift in world financial insurance policies. Its strong liquidity place empowers Nintendo to finance future development initiatives independently and react swiftly to market adjustments and intense competitors.

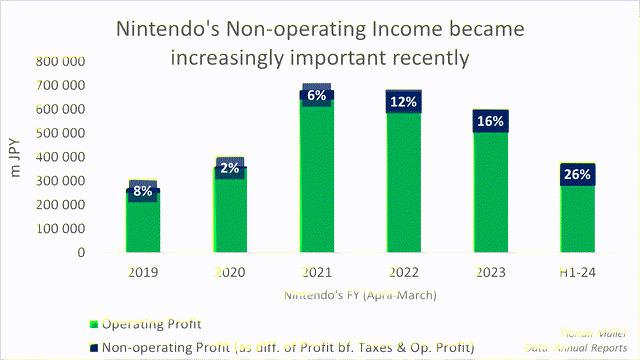

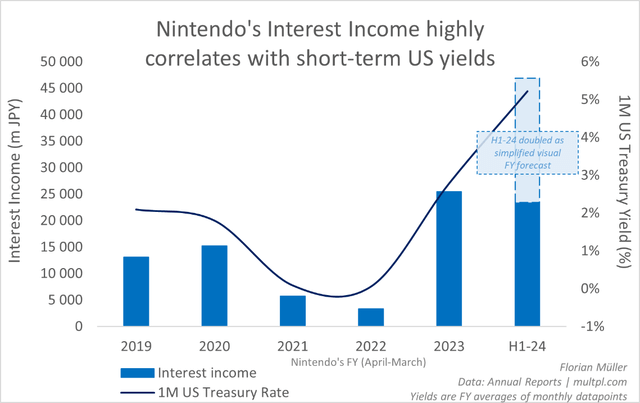

However already now, it’s evident how Nintendo’s administration strategically leverages its money surpluses to generate worth, recognizable by the rising non-operating revenue primarily fueled by international alternate positive aspects, as beforehand showcased, coupled with curiosity earnings.

Florian Müller | Information: Annual Stories

Nintendo’s latest notable improve in curiosity revenue from its substantial money reserves strongly correlates, as an illustration, with short-term US capital market yields. Thus, Nintendo has been capable of considerably profit non-operationally from the elevated rate of interest setting overseas, leveraging its excessive money holdings.

Florian Müller | Information: Annual Stories, multpl.com

Understating its Product Excellence

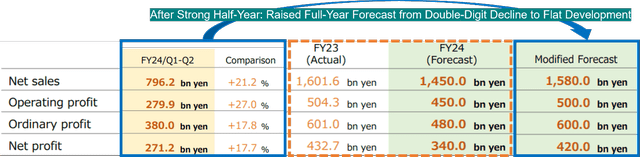

On the finish of the primary quarter of 2024, which concluded in June, Nintendo reported extremely strong development figures, with income and revenue surging by 50 to over 80 % in comparison with the earlier 12 months’s quarter. Nonetheless, the administration was at first sustaining its annual forecasts, which anticipated a decline of almost 10 % in income and over 20 % in earnings. These forecasts may solely be an expression of understatement, particularly because the first quarter alone has already achieved 30 to 50 % of those objectives. Supported by the latest launch of Tremendous Mario Bros. Surprise, whose evaluations are overwhelming in varied gamer and informal gaming boards, I might not have anticipated a major decline, substantial sufficient to not surpass the modest annual targets. Unsurprisingly, the administration has now lastly revised the forecasts upwards with the newest quarterly outcomes.

Tailored from Nintendo Q2/2024 Earnings Presentation

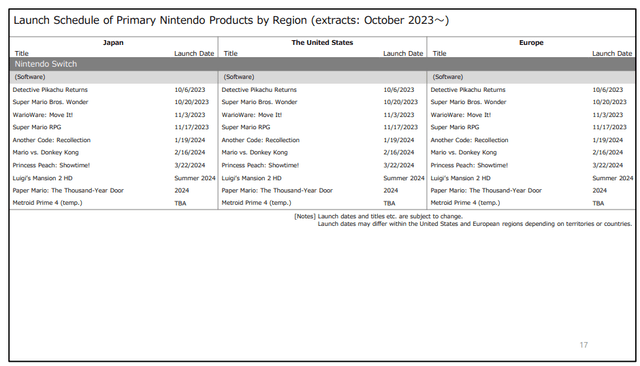

Nonetheless, this new forecast nonetheless implies a weaker second half of the 12 months. Given its numerically and qualitatively strong pipeline and the vacation season forward, it is arduous to actually imagine within the slowdown projected by the administration for the rest of the 12 months. As an alternative, this forecast appears as soon as once more conservative. The dividend, nonetheless, initially estimated to drop by 20 % to 147 Yen, will as an alternative stay virtually flat at 181 JPY for the total 12 months. The interim dividend has already been paid.

Nintendo Q2/2024 Earnings Presentation

Analyst estimates had persistently remained barely greater within the median when in comparison with the administration’s estimates and nonetheless exceed the modified forecast at this time. This may very well be as a result of analysts could be contemplating the ripple results of the Tremendous Mario Bros. Film, opposite to Nintendo’s indication earlier this 12 months, that they themselves do not issue these results into their monetary forecasts.

However even the flat growth over the present fiscal 12 months could be notably pleasing, provided that its blockbuster console Nintendo Swap is already in its seventh 12 months since launch, with many eagerly anticipating its successor. Up till the fiscal 12 months 2021, console gross sales had seen vital development, additionally fueled by the COVID-induced gaming surge. Nintendo’s product excellence is confirmed by the steadily growing variety of devoted avid gamers far past 100 million folks up till at this time, at the same time as console gross sales noticeably declined not too long ago on a fiscal 12 months foundation. Administration stays reserved about asserting a Subsequent-Gen console. Their major focus stays on nurturing and increasing the Swap universe. Nonetheless, ongoing efforts for future {hardware} are underway. Linked to that could be a hopeful improve in annual analysis and growth spending from 102 billion yen in FY 2022 to a forecasted 130 billion yen in FY 2024.

Worth Creation By means of Mental Property

Nintendo could be steadily decreasing its reliance on {hardware} gross sales, whereas the energy of its mental property and the recognition of its franchises come to the forefront. Segments involving mental property, which embrace income from the movie, enjoying playing cards, and merchandise, contribute lower than 7.5% to the corporate’s whole income. Nonetheless, in comparison with the earlier 12 months’s half, these segments have greater than doubled, indicating their vital potential as long-term development drivers. Wanting ahead, Nintendo has introduced to be engaged on a live-action movie of The Legend of Zelda, one other one in every of Nintendo’s extremely common franchises in addition to Tremendous Mario.

“We don’t intend to easily set a numerical gross sales goal for our cellular and IP associated enterprise after which intention for that. The usage of Nintendo IP requires extraordinarily cautious supervision so we do not negatively have an effect on the picture folks have of our IP or hurt the emotional attachment they’ve shaped with it from enjoying our video games. Whereas we all the time attempt to attain the utmost outcomes attainable in every initiative, we don’t imagine that setting numerical targets resembling income for the IP associated enterprise is suitable.”

“The Tremendous Mario Bros. Film,” launched since April, has shattered data with virtually $1.4 billion in field workplace earnings, making it probably the most profitable online game movie ever. Surpassing hits like “Minions,” it is monitoring to rival main animations like Disney’s “Frozen” and has even outperformed blockbuster franchises like Jurassic Park. Regardless of combined important evaluations, the movie’s huge recognition displays the enduring attract of the Nintendo franchise. By strategically showcasing Nintendo in cinemas, the administration goals to have interaction new followers and rekindle curiosity amongst former lovers. The movie’s optimistic impression on the “Cell and Mental Property (IP)” section is boosting this fiscal 12 months’s efficiency.

Nintendo’s enlargement into the analog world contains two Tremendous Nintendo Worlds, paying homage to Disneyland. The primary debuted in Common Studios Japan, Osaka, in early 2021, adopted by one other in Common Studios Hollywood in February 2023. These ventures, impressed by Disney’s theme park success, trace at promising non-gaming avenues for Nintendo’s long-term enterprise. Nintendo would not function these theme parks themselves as a result of they lack the experience for it. As an alternative, they accumulate licensing charges for them.

Nintendo’s Valuation & Money Strongly Validate its Share Worth

After having mentioned the qualitative features that make Nintendo an interesting funding regardless of anticipated contraction, I intention to quantify this by means of a traditional firm valuation, calculating Nintendo’s honest worth.

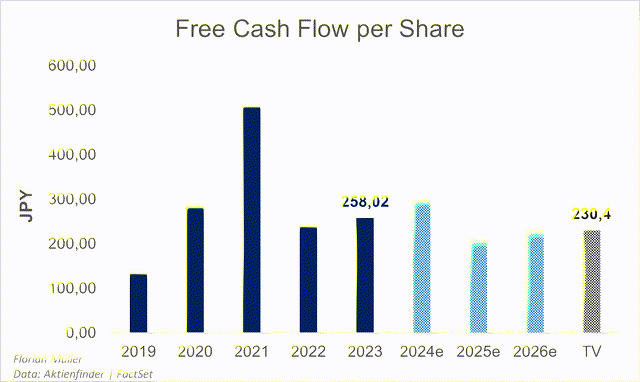

To derive Nintendo’s honest worth by means of a simplified Discounted Money Stream mannequin, I make the most of Free Money Stream projections sourced from Aktienfinder.internet, drawing on median analyst estimates till the fiscal 12 months’s finish in 2026, based mostly on FactSet’s database. I efficiently cross-verified the precise figures from the final 5 years for this metric (Free Money Stream) with these from Searching for Alpha. The Free Money Stream has stabilized at a conservative degree in comparison with the latest Nintendo Swap growth however stays comfortably excessive when considered from a historic perspective. Subsequently, I am utilizing the Free Money Stream of 2026 because the Free Money Stream for the Terminal Worth.

Florian Müller | Information: Aktienfinder.internet, FactSet

My analysis on Nintendo’s WACC (Weighted Common Price of Capital) settles at a worth of seven.7%. This determine displays the elevated various funding alternatives within the risk-free area attributable to globally rising bond yields and is supported by Fairness Danger Premia per nation as revealed by the famend Prof. Damodaran. Contemplating Nintendo’s income distribution primarily in mature markets, there aren’t any vital nation dangers on prime of the Fairness Danger Premium. Statistically, Nintendo’s barely lower-than-market-average volatility – expressed in its Beta issue – contributes to protecting Nintendo’s WACC from being excessively excessive. I derived Nintendo’s Beta issue from a 10-year month-to-month regression towards the Nikkei 225, adjusted utilizing the Blume technique. This calculation yielded a Beta issue of round 0.8 to 0.9. Debt financing prices are negligible attributable to Nintendo’s low degree of debt.

I’m making use of a terminal development price of three.9% into perpetuity, based mostly on the convergence assumption. Inside this assumption, I presume that newly invested capital yields neither extra nor lower than its required value of capital of seven.7%. Moreover, I assume that fifty% of Nintendo’s Free Money Stream is reinvested, aligning with Nintendo’s latest 50% dividend payouts and the absence of serious debt obligations.

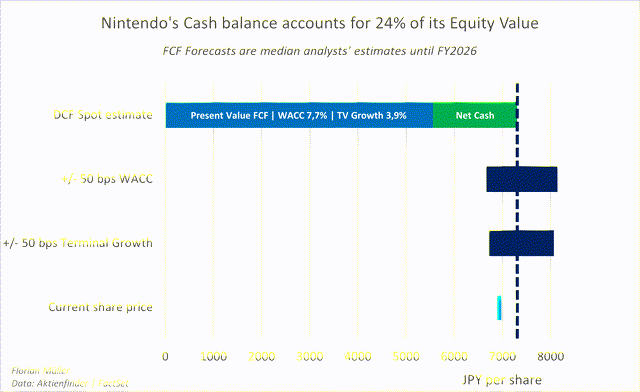

Florian Müller | Information: Aktienfinder.internet, FactSet

Utilizing these parameters, I’ve calculated the current worth of Free Money Flows for Nintendo at roughly 5,560 JPY per share (equal to 38 USD at present charges). Nonetheless, what’s essential right here is Nintendo’s substantial money reserves, totaling an extra virtually 1,745 JPY per share, internet of a negligible quantity of debt. When factoring in internet money, the overall fairness worth reaches 7,305 JPY per share (equal to 50 USD at present charges), barely surpassing the present share value of roughly 6,900 JPY. Whereas this valuation hinges on my assumptions, it is evident that Nintendo’s surplus money considerably bolsters its enterprise worth, contributing over 30% on prime of it and thus representing 1 / 4 of its fairness worth.

Weak Spots of This Thesis

Nintendo’s present strengths in benefiting from a weak yen and excessive rates of interest may face dangers if these situations reverse, affecting their non-operating revenue and the worth of their money reserves. Moreover, the corporate’s reliance on the recognition of its franchises is a cornerstone of its success. Nonetheless, overexploiting these IPs may danger diluting their worth over time. The absence of a transparent roadmap for a brand new console, and its potential success, poses a common danger given the continued dominance of the present platform as the first income driver. Any uncertainty surrounding the long run console technique could impression market confidence and Nintendo’s development trajectory. Buyers ought to contemplate this alongside the corporate’s dependence on established IPs when assessing its long-term prospects.

Concluding Insights: Nintendo’s Enduring Worth

In essence, Nintendo’s adept dealing with of foreign money dangers, leveraging of money reserves, and efficient use of mental property trace at its resilience and development potential. Regardless of near-term projections, the corporate’s adaptability, innovation, and robust monetary basis counsel promising prospects. The Discounted Money Stream valuation signifies Nintendo’s surplus money considerably bolsters its worth, providing stability amidst market fluctuations. Whereas short-term issues exist, encompassing the superior life cycle of the Swap console with out an introduced successor mannequin, a probably devaluing money foundation in declining rate of interest eventualities, and foreign money fluctuations, Nintendo’s administration of the latter and its strategic initiatives make it a compelling long-term funding.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.

[ad_2]

Source link