[ad_1]

Nvidia’s Q3 earnings exceeded expectations, prompting an preliminary 2.5% decline and later a rebound to shut at slightly below $500.

Q3 income of $18.12 billion, 12.5% above expectations, was pushed by sturdy progress within the knowledge heart and gaming segments.

Regardless of potential This fall challenges, Nvidia stays optimistic, with analysts forecasting upward revisions and a consensus share value goal of $642.

Unlock the potential of InvestingPro for as much as 55% off this Black Friday and by no means miss out on a market winner once more.

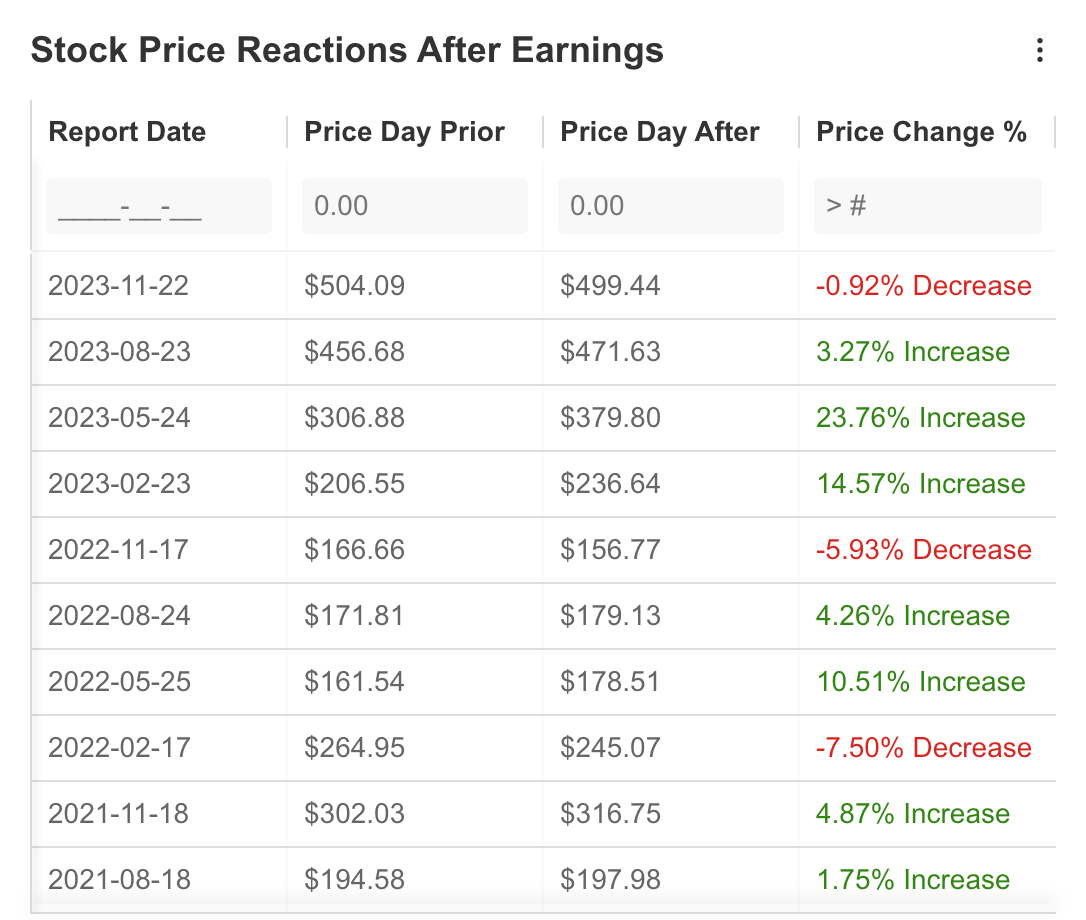

Regardless of Nvidia’s (NASDAQ:) Q3 considerably surpassing expectations, buyers initially selected to divest. Nvidia inventory has surged by 242% YTD to achieve the $500 mark, however the chipmaker’s earnings report triggered a 2.5% decline after the discharge.

Nevertheless, a shift occurred later within the day as patrons re-entered the market, and the inventory closed at slightly below the $500 threshold. This response contrasts with the corporate’s preliminary post-report actions earlier within the 12 months, the place NVDA inventory rallied following first-quarter outcomes.

This may be attributed to the corporate’s quarterly outcomes surpassing expectations and the partially pessimistic outlook offered by firm officers for the final quarter.

Supply: InvestingPro

In its Q3 outcomes, the corporate reported income of $18.12 billion, 12.5% above InvestingPro expectations. The corporate’s revenue per share was additionally introduced as $4.02, exceeding the expectation by 18%. Thus, the corporate reached 206% year-on-year income progress and continued its sturdy outlook within the second quarter within the final quarter.

Trying on the distribution of the corporate’s income, it was seen that knowledge heart revenues had a big share with $14.5 billion. Gross sales to cloud suppliers accounted for the biggest share of the higher-than-expected knowledge heart income progress. The corporate almost doubled its gross sales within the gaming phase in comparison with final 12 months, producing $2.86 billion in income.

The primary consider Nvidia’s upward pattern all year long was the demand for synthetic intelligence, which positively affected many sectors. The truth that corporations flip to synthetic intelligence software program and Nvidia affords the mandatory {hardware} on this discipline is seen as the largest issue within the exponential improve in income.

Talking about synthetic intelligence, Jensen Huang, founder and CEO of Nvidia, stated that their sturdy progress was triggered by the transition from general-purpose to accelerated computing and the synthetic intelligence business. Huang additionally added that corporations will proceed to put money into synthetic intelligence at a fast tempo, and he thinks they may preserve their progress momentum on this space.

Administration Optimistic Regardless of Export Restrictions

As well as, the corporate stated in a post-earnings assertion that it expects among the US Authorities’s restrictions on exports to hinder This fall earnings. The US authorities introduced new licensing necessities for exports to some nations akin to Saudi Arabia, the United Arab Emirates, and Vietnam, together with China. Nvidia is nonetheless optimistic concerning the problem and expects its fast progress in different areas to offset the potential lack of income.

This may occasionally have brought about unease amongst some buyers, because the share value fell barely after the earnings report and demand didn’t decide up rapidly in response to the sturdy positive aspects. This, in fact, will be interpreted as shopping for the expectation and promoting the conclusion throughout the quarter.

Supply: InvestingPro

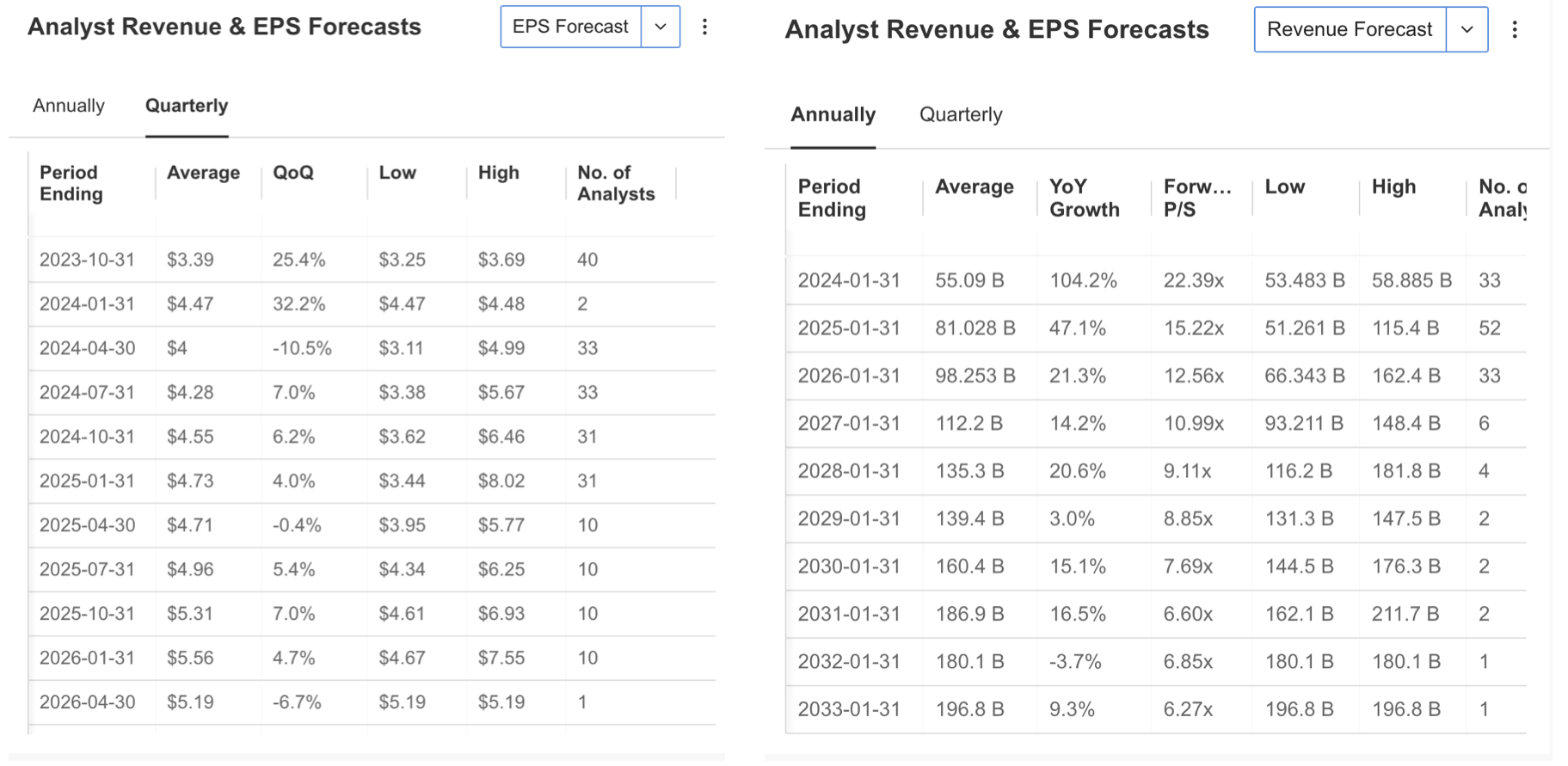

If we verify the This fall forecasts on InvestingPro; we will see that 39 analysts have revised their expectations upwards within the final 3 months. Accordingly, EPS expectations for This fall outcomes, that are anticipated to be introduced on February 15, are estimated at $4.47, up 32%. The year-end income forecast is at the moment projected at $81 billion, up 47% year-on-year. Nevertheless, analysts are more likely to revise their estimates upwards throughout the related interval.

Nvidia’s Monetary Well being Stays Stable

In accordance with Nvidia’s monetary scenario on an annual foundation, the corporate’s outstanding constructive facets are listed as follows within the abstract data compiled on the InvestingPro platform:

Sturdy returns within the final month

Dividend funds supported by sturdy earnings

Money movement is adequate to cowl curiosity bills

Continued improve in internet revenue

The 2 warning indicators for NVDA inventory are that the inventory at the moment has a excessive P/E ratio and the value motion is kind of risky. As a result of the corporate’s 5-year beta common of 1.67 is a vital indicator that the value volatility is excessive in comparison with the market.

Supply: InvestingPro

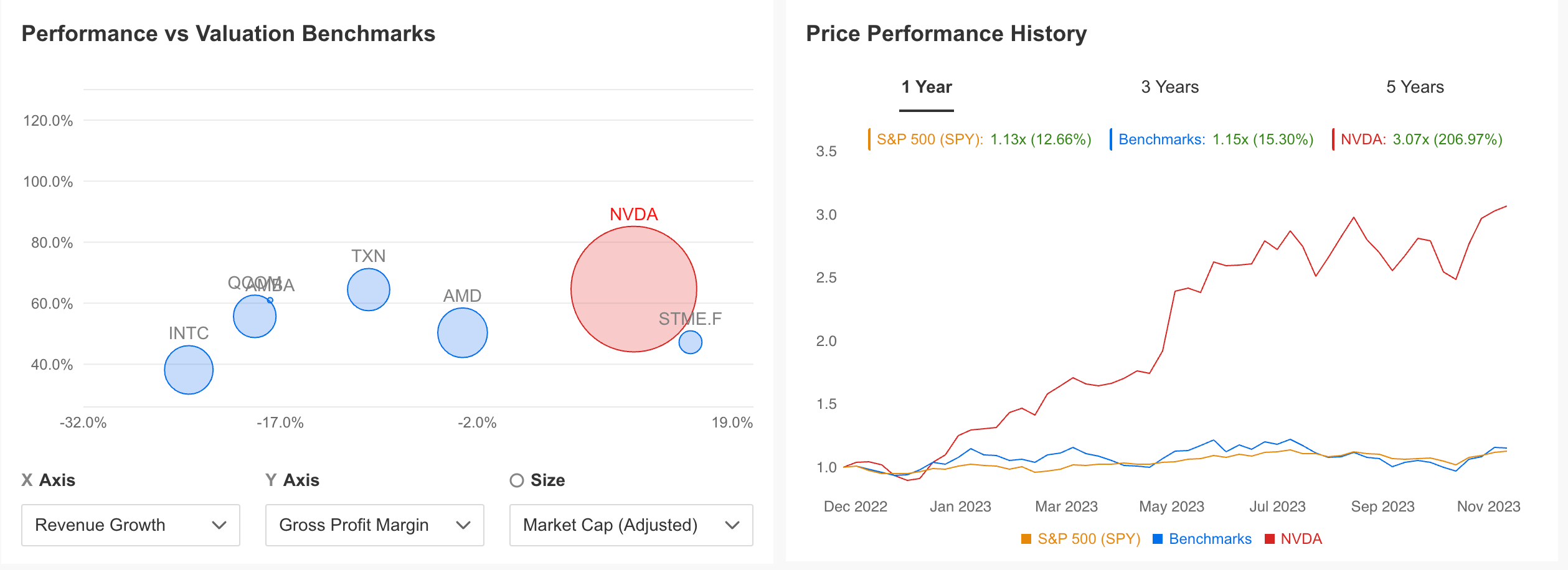

After we evaluate Nvidia with peer corporations within the business in response to income progress and gross revenue margin, we will see that the corporate is in an advantageous place. This sturdy outlook can be mirrored within the efficiency of the share value. As will be seen within the chart under, NVDA inventory outperformed the and competitor common by 3 occasions on an annual foundation.

Supply: InvestingPro

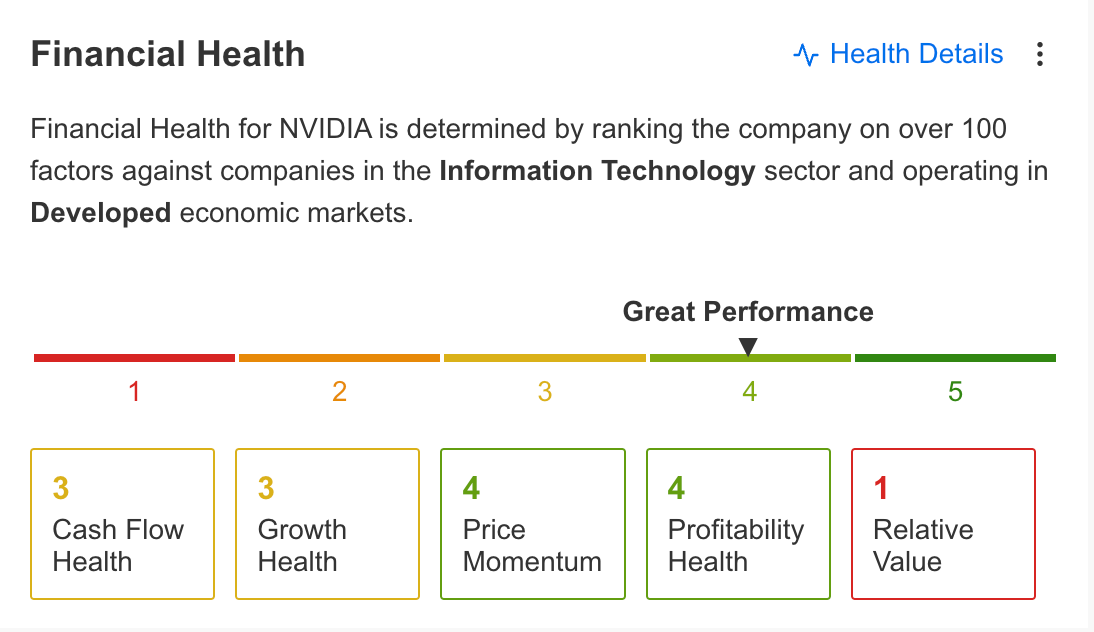

As well as, the corporate’s monetary well being has a powerful efficiency with a rating of 4 out of 5. Money movement and progress objects proceed to carry out properly, whereas value efficiency and profitability well being stay the corporate’s strengths.

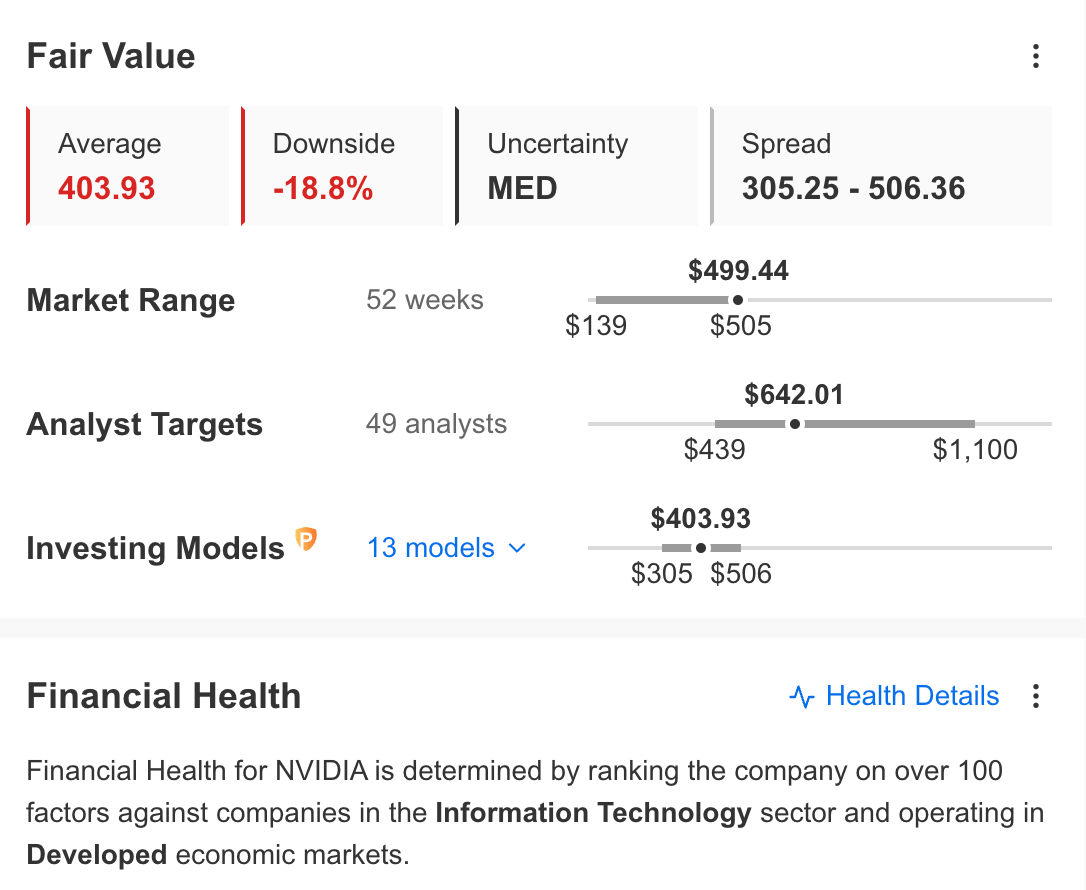

Analysts forecasting the value of NVDA inventory additionally predict that the upward pattern might proceed within the subsequent one-year interval. Accordingly, the consensus forecast of 49 analysts is that the share value might rise to $ 642.

Supply: InvestingPro

In accordance with InvestingPro’s honest worth evaluation, the calculation made with present monetary fashions predicts a correction in direction of $403, whereas we may even see an upward correction within the forecast over the past quarter after monetary outcomes exceeded expectations.

Nvidia Inventory: Technical Outlook

When wanting on the NVDA share from a technical standpoint, the primary hanging look is that the share value has began to maneuver horizontally within the Fibonacci growth space in response to the long-term outlook.

The share, which entered an uptrend in October final 12 months, gained worth quickly till the primary half of this 12 months after which began to lose momentum in addition to sustaining its pattern. Based mostly on the final downtrend, it’s seen that the horizontal outlook was realized within the vary of Fib 1,272 – Fib 1,618.

Then again, NVDA, which recorded a brand new file excessive of $ 505 this week, is within the means of turning its final resistance at a mean of $470 into help. If patrons handle to maintain the share value above this value, we will see that the pattern might flip up once more and transfer in direction of $ 700.

Nevertheless, the truth that the lack of income for export restrictions in This fall was above expectations might make buyers nervous and we may even see that the inventory might return to its motion within the channel in response to the information movement that might proceed till the tip of the 12 months.

Accordingly, if NVDA realizes a weekly shut under $470, the typical of $430 will be adopted as an intermediate help. If this help is damaged, the value might fluctuate under $ 400.

This means an elevated danger of the beginning of the correction part in NVDA. We will see {that a} potential medium-term correction might proceed to the degrees of 280 – 300 {dollars}.

Nevertheless, the corporate’s sturdy outlook and technical outlook counsel that an upward transfer is extra seemingly than a correction.

***

Missed the Final Market Winner? No Drawback, Get a Second Probability This Black Friday!

We all know how arduous it may be to overlook the boat on high-flying shares that have been simply ready to be scooped up.

That is why, this Black Friday, we’re providing you an as much as 55% low cost on InvestingPro subscription plans. Know first, know higher, and ensure to by no means miss out on a winner once more.

Black Friday Sale – Declare Your Low cost Now!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought of as funding recommendation.

[ad_2]

Source link

Add comment