[ad_1]

Nevertheless, there’s concern that its present buying and selling costs would possibly exceed its precise worth, making many hesitant to purchase at present ranges.

Let’s discover an easy methodology to spend money on Nvidia whereas additionally lowering the chance in case it drops.

Investing within the inventory market and need to get essentially the most out of your portfolio? attempt InvestingPro. Enroll NOW and benefit from as much as 38% off for a restricted time in your 1-year plan!

Nvidia (NASDAQ:) is a high choose amongst traders and it is apparent — simply take a look at its market cap, which is now value greater than the complete German inventory market.

Robust demand for the inventory is obvious from its outstanding surge of +223% over the previous 12 months, highlighting its recognition with traders.

However let’s not oversimplify by attributing every part to its spectacular efficiency alone.

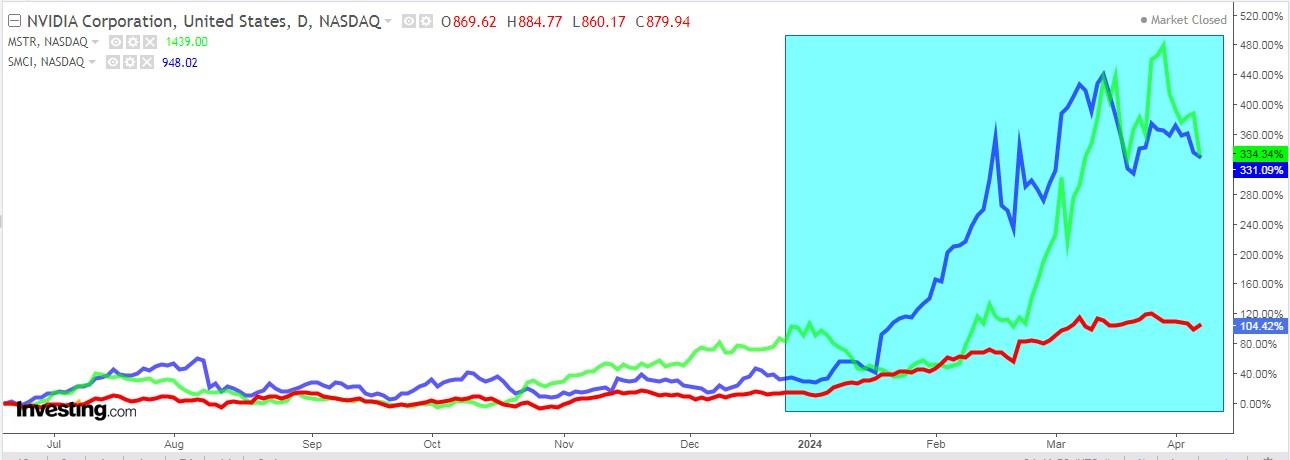

Nvidia’s YTD rise of +76% is notable, but two different shares are outpacing it by a large margin: Tremendous Micro Pc (NASDAQ:) with a staggering +227% return and MicroStrategy (NASDAQ:) with features of +140%.

Beneath is a comparability chart of the three shares’ efficiency in 2024, with Nvidia represented by the crimson line.

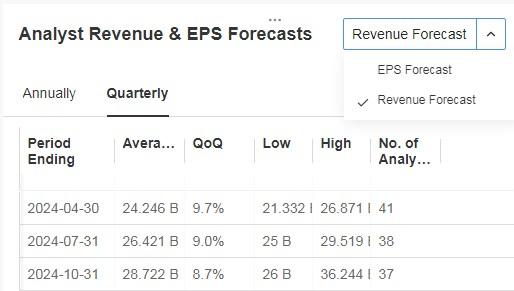

Nvidia reviews outcomes on Could 22. The next chart reveals precise income forecasts for the remaining three quarters of 2024 (up 9.7%, 9% and eight.7% respectively).

Supply: InvestingPro

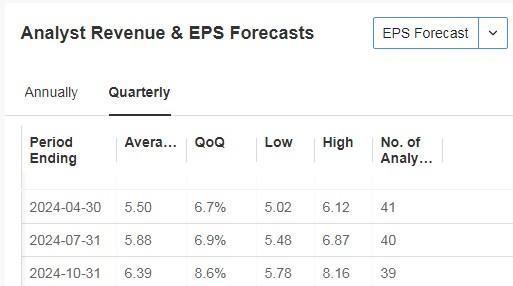

As for EPS (earnings per share) for the following three quarters, the forecasts are for a rise of 6.7%, 6.9% and eight.6% respectively.

Supply: InvestingPro

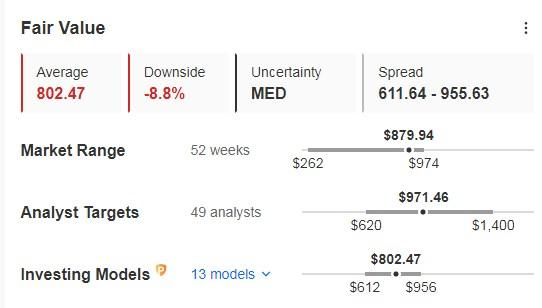

The market consensus provides it potential at $971.46 from $871.33 on the shut of the final buying and selling session. In distinction, InvestingPro fashions estimate that it trades above its goal worth of $784.

Supply: InvestingPro

Only a few days in the past, Saxo Financial institution cautioned that the hype surrounding synthetic intelligence, evident within the hovering inventory costs of corporations like Nvidia and Novo Nordisk (NYSE:), could also be overstated on account of inflated firm valuations.

Whereas some traders are hesitant to purchase Nvidia shares at these excessive costs, they nonetheless need to capitalize on any potential features. At first look, it may appear difficult to revenue from Nvidia’s inventory surge with out really shopping for its shares.

Nevertheless, there’s a resolution.

As an alternative of investing instantly in Nvidia, there are ETFs obtainable that supply vital publicity to Nvidia together with different semiconductor shares. This strategy permits for a diversified portfolio and minimized danger. Let’s discover a few of these ETF choices:

1. VanEck Semiconductor

The VanEck Semiconductor ETF (NASDAQ:) consists of semiconductor corporations from numerous components of the world which are listed in the USA.

The ETF fees a charge of 0.35%. Any dividends earned by the ETF are reinvested.

This ETF is sort of massive, managing $1.669 billion in property. It was established on December 1, 2020, and relies in Eire.

Over the previous 3 years, it has yielded 85.45%, whereas its 1-year yield stands at 69.64%. A few of its high holdings embody:

Nvidia (it has the biggest weighting, 11.39%).

Broadcom (NASDAQ:)

ASML Holding NV (AS:) ADR (NASDAQ:)

Taiwan Semiconductor Manufacturing (NYSE:)

AMD (NASDAQ:)

Intel (NASDAQ:)

Qualcomm Included (NASDAQ:)

Texas Devices (NASDAQ:)

Utilized Supplies (NASDAQ:)

Lam Analysis (NASDAQ:)

2. iShares Semiconductor

The iShares Semiconductor ETF (NASDAQ:) has an honest stage of diversification is current on this product because it holds near 125 securities in whole.

Its expense ratio is 0.35%, and the fund manages about $1.2B in property. The YTD returns are 15%.

The highest holdings embody:

Nvidia with 8.72%.

Broadcom Inc. with 8.07%.

Superior Micro Gadgets, Inc. with 6.94%.

QUALCOMM Included with 6.65%.

Intel Company with 5.50%.

Micron Know-how (NASDAQ:), Inc. with 5.35%.

Microchip Know-how Included (NASDAQ:) with 4.08%.

3. iShares MSCI World Semiconductors ETF

The iShares MSCI World Semiconductors UCITS ETF USD Acc (LON:) consists of semiconductor corporations from 23 developed and 24 rising markets.

The annual charge is 0.35% and dividends are accrued and reinvested within the ETF.

It manages 1.05 billion, was born on August 3, 2021, and relies in Eire.

The 1-year yield is 57.57%. The principle shares with the best weight are:

Broadcom

ASML

Nvidia (its weight is 8.07%)

AMD

TSM

QUALCOMM

Texas Devices

Utilized Supplies

Intel

Lam Analysis

4. HSBC Nasdaq World Semiconductor (HNSC)

The HSBC NASDAQ World Semiconductor UCITS ETF USD (LON:) replicates the Nasdaq World Semiconductor index which is comprised of corporations from all over the world working within the semiconductor trade.

The annual charge is 0.35% and dividends are accrued and reinvested within the ETF.

It’s a small ETF created on January 25, 2022, and is domiciled in Eire.

Its 1-year yield is 62.51%. The shares with the best weight are:

Nvidia: its weight is 9.21%.

ASML

Broadcom

AMD

TSM

QUALCOMM

Utilized Supplies

Texas Devices

Intel

Lam Analysis

The European Union and the USA have agreed to increase their cooperation agreements for 3 years.

These agreements intention to determine points inside chip provide chains and carefully monitor China’s dominance in much less superior chips present in on a regular basis merchandise.

It’s estimated that round 60% of latest chips getting into the market within the coming years will likely be produced in China.

——

Are you investing within the inventory market? To find out when and the best way to get in or out, attempt InvestingPro.

Take benefit HERE & NOW! Click on HERE, select the plan you need for 1 or 2 years, and benefit from your DISCOUNTS.

Get from 10% to 50% by making use of the code INVESTINGPRO1. Do not wait any longer!

With it, you’re going to get:

ProPicks: AI-managed portfolios of shares with confirmed efficiency.

ProTips: digestible data to simplify a considerable amount of advanced monetary information into just a few phrases.

Superior Inventory Finder: Seek for one of the best shares primarily based in your expectations, bearing in mind lots of of economic metrics.

Historic monetary information for 1000’s of shares: In order that basic evaluation professionals can delve into all the main points themselves.

And plenty of different companies, to not point out these we plan so as to add within the close to future.

Act quick and be part of the funding revolution – get your OFFER HERE!

Disclaimer: The writer doesn’t personal any of those shares. This content material, which is ready for purely academic functions, can’t be thought-about as funding recommendation.

[ad_2]

Source link