[ad_1]

by Fintech Information Singapore

January 25, 2024

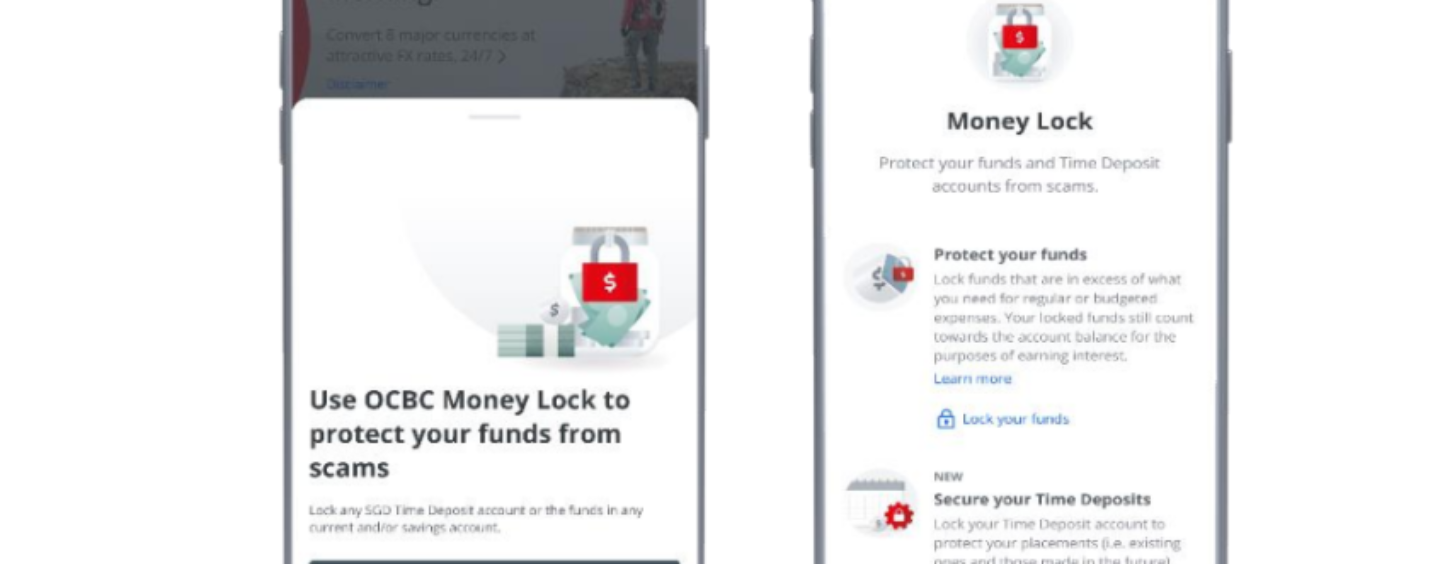

From January 31, OCBC Singapore is ready to increase its OCBC Cash Lock ‘kill change’ service to time deposits. This follows its profitable implementation for present and financial savings accounts in November 2023. The enhancement is a response to rising considerations over digital safety threats, similar to malware and phishing, which have turn into prevalent within the on-line banking area.

This function permits clients to limit digital entry to their accounts whereas persevering with to earn curiosity on their deposits. Since its launch, OCBC Cash Lock has seen vital engagement, with over 30,000 clients utilising the function for upwards of 33,000 accounts. The whole quantity of funds secured by this service has surpassed S$3.3 billion.

The extension of OCBC Cash Lock to time deposits coincides with the Lunar New 12 months, a interval historically marked by an uptick in such deposits. Information from the earlier 12 months indicated a notable enhance in time deposits through the first quarter, considerably outnumbering these within the second quarter.

The rationale behind this safety enhancement is the vulnerability of digital banking functionalities to fraudulent actions. Scammers regularly exploit digital channels to withdraw or modify the directions of time deposits. OCBC Cash Lock seeks to counter this by necessitating in-branch verification, for any alterations or withdrawals from time deposit accounts.

Commencing January 31, clients could have the ability to unlock their time deposit accounts at OCBC department ATMs, with an extra enlargement to all OCBC ATMs throughout the island slated for the top of February 2024. This unlocking course of would require a bodily card and PIN, akin to the process for present and financial savings accounts. Importantly, the unlocking of time deposit accounts is not going to be possible through the OCBC Digital app or OCBC Web Banking, thereby including one other layer of safety.

The utilization demographics of OCBC Cash Lock spans varied age teams and revenue ranges, indicating its attraction throughout a large buyer base, with a considerable proportion of customers opting to safe bigger sums. This means a prudent strategy by clients in direction of their digital banking safety, safeguarding bigger quantities whereas holding needed funds readily accessible.

Beaver Chua

Beaver Chua, OCBC’s Head of Anti-Fraud, Group Monetary Crime Compliance, remarked on the adoption of OCBC Cash Lock,

“We’re inspired by the present take-up of OCBC Cash Lock by our clients to safeguard their funds… With the roll out of OCBC Cash Lock for time deposits, clients have an added assurance that their hard-earned financial savings put in a time deposit account might be protected, even when scammers achieve unauthorised entry to their financial institution accounts digitally by phishing or malware scams.”

[ad_2]

Source link