[ad_1]

Oil costs steadied final week after an almost 20% decline since September, with anticipation constructing across the upcoming OPEC+ assembly. Hypothesis on potential output cuts deepening heightened market uncertainties. Nevertheless, a reported delay within the assembly to November 30 as a consequence of disputes over output targets has briefly allayed issues of recent provide shortages. At present, the USOIL contract trades at $74.59 per barrel, and Brent is at $79.63.

OPEC+ Outlook: Balancing Act Amidst Disputes

Market expectations on new OPEC+ output minimize targets diverge, with a consensus forming round Saudi Arabia probably extending its unilateral provide cutback of 1 million barrels a day into early 2024. This transfer goals to keep up present oil worth ranges regardless of lower-than-expected demand from China and a provide scarcity within the final quarter.

There’s lingering hypothesis that Saudi Arabia might contemplate a deeper output minimize to assist future plans amid decrease oil revenues. Nevertheless, the assembly delay, attributed to a disagreement over output quotas, suggests challenges in convincing different OPEC members to endorse deeper cuts.

US Power Panorama: Breaking Information Amidst Local weather Objectives

Concurrently, US Oil and gasoline manufacturing is poised to interrupt data this 12 months, contradicting local weather objectives. Regardless of local weather initiatives, federal forecasts anticipate a report 12.9 million barrels of crude oil manufacturing, doubling the output from a decade in the past. Gasoline manufacturing can be set to achieve report ranges, supported by new export terminals facilitating an export growth, significantly to Europe amid disruptions in Russian gasoline deliveries.

Whereas the EU and different “excessive ambition” nations push for a fossil gas phaseout at COP28, the US authorities expects strong oil and gasoline exercise to persist till 2050, constituting a 3rd of the world’s deliberate enlargement.

Gasoline Dynamics: Value Corrections Amidst Regional Elements

Gasoline costs within the US have dropped to their lowest in twelve weeks, pushed by ample storage and decrease demand. European gasoline costs have additionally corrected, with the Dutch TTF down over 12% in a month. Regardless of forecasts of elevated demand as a consequence of chilly climate in early December, excessive storage ranges and regional components have helped keep worth stability.

Spain, with probably the most LNG terminals in Europe is experiencing congestion as inventories stay excessive. Renewable vitality sources and a heat autumn have suppressed demand, with November seeing an 8.5% YoY lower in consumption.

USOIL Efficiency Amidst Financial Traits

Since reaching its peak at $89.80 in October, USOIL skilled a notable decline, breaking decisively beneath historic assist ranges. Final week, the value hit its lowest degree since July, at 72.33, although it managed to get well some losses. However, the asset has been in a downchannel since October, with the higher trendline and 61.8% Fib. degree of the $67.00-$93.92 upleg performing as a barrier to any upward motion.

A confirmed break of July’s backside at $72.33 might immediate additional downwards strain for USOIL and will open the doorways to 12 months bottoms, with instant assist on the $70 degree.

Treasured Metals Rally: Gold and Silver Shine Amidst Financial Traits

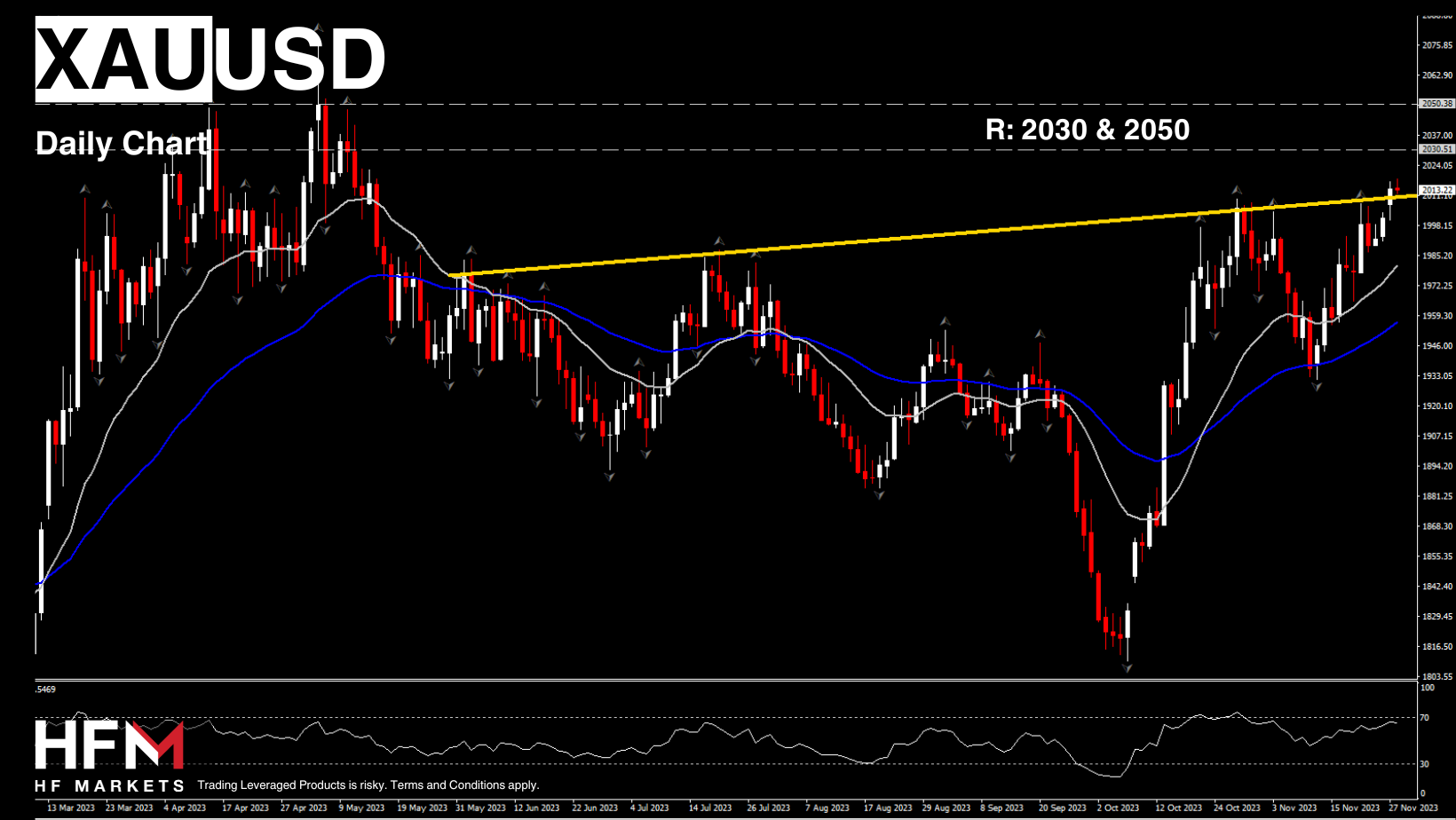

Gold (XAUUSD) and Silver (XAGUSD) are experiencing heightened demand, with silver up over 6% up to now month. Bullion is buying and selling inside $2,010-2,017 per ounce, reaching ranges not seen since early Might. The continuing US Greenback correction has been underpinning demand as markets are more and more satisfied that Fed charges have peaked and price cuts on the agenda in 2024. Non-interest bearing bullion has benefited and is buying and selling at ranges not seen since Might.

The present upward development in Gold costs is pushing in direction of a 6-month excessive and stays effectively above the day by day easy transferring averages. From a technical perspective, the RSI strengthened its bullish bias above impartial line, indicating additional potential bullish momentum within the upcoming classes. Within the occasion of a continued upward motion, the market might purpose for the two,030 and a couple of,050 resistance degree.

Conversely, failure to increase additional and a pullback to the 2000 degree might see the value of gold retreating in direction of the 1,980 degree which is a confluence of the 20-day EMA and Might-October 2023 Resistance degree. Beneath this degree, consideration might flip to the 50-day EMA and November’s backside at 1,954 and 1,930, respectively, earlier than probably reaching the 50% Fibonacci degree at 1,910 (October’s upleg).

Silver has been outperforming during the last month and lifted almost 6% amid issues over provide shortages amid forecasts of rising demand for industrial silver. The Silver Institute warned of a 2% drop in international mined silver manufacturing this 12 months. Growing investments in photo voltaic panels, energy grids, and 5G networks proceed to assist demand expectations. Therefore within the occasion of a continued upward motion, Silver subsequent instant resistance ranges are at 25 and 25.45.

Silver has been outperforming during the last month and lifted almost 6% amid issues over provide shortages amid forecasts of rising demand for industrial silver. The Silver Institute warned of a 2% drop in international mined silver manufacturing this 12 months. Growing investments in photo voltaic panels, energy grids, and 5G networks proceed to assist demand expectations. Therefore within the occasion of a continued upward motion, Silver subsequent instant resistance ranges are at 25 and 25.45.

Click on right here to entry our Financial Calendar

Andria Pichidi

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency shouldn’t be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link