[ad_1]

Morsa Photographs

Oscar Well being (NYSE:OSCR) is a US-based insurance coverage tech firm based in 2012. It focuses on the usage of know-how, comparable to telemedicine and clear declare pricing system, to assist create higher entry to insurance coverage for most individuals.

OSCR has been on a momentum over the previous 12 months, although if we zoom out a bit, the general share efficiency has been disappointing. After its IPO at a worth of $31 in 2021, OSCR briefly reached its all-time excessive of $35 earlier than plunging to merely $8 at 12 months’s finish. The inventory had principally traded sideways till the top of 2023, when it began to achieve some steam probably as a consequence of bettering unit economics and promising early progress in its new provider-sponsored enterprise line, +Oscar. The narrowing losses and raised FY outlook additionally helped enhance share worth additional, for my part.

Presently, OSCR is buying and selling at $15 worth degree, up over 109% over the previous 12 months. Nevertheless, OSCR nonetheless has misplaced over 50% of its worth since IPO.

I price OSCR a purchase. My 1-year worth goal of $18.6 presents about 24% upside from the present buying and selling worth of $14.9. I consider OSCR will profit from some catalysts to unlock progress and margin expansions in FY 2024.

Monetary Opinions

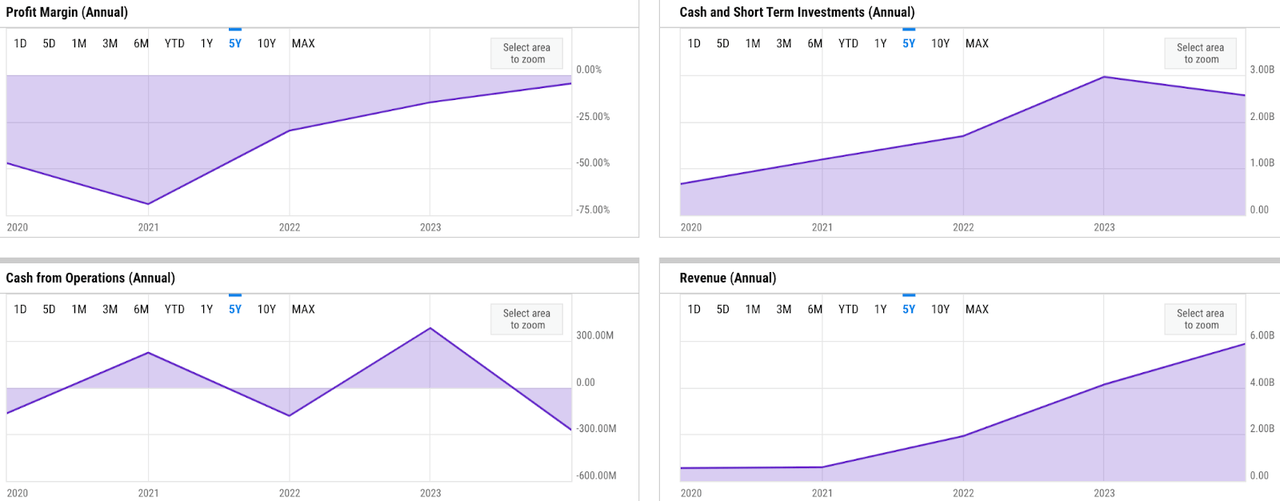

ycharts

Fundamentals are combined. Income progress has normalized to 42% in FY 2023, having seen triple-digit progress charges within the earlier two years. In the meantime, internet losses have narrowed considerably since IPO. In FY 2023, OSCR noticed a internet loss margin of -4.6%, a YoY enchancment by nearly an element of three. Nevertheless, money technology has been disappointing in comparison with prior 12 months’s, with OSCR just about shedding over -$272 million of money from its operations in FY 2023.

ycharts

OSCR has raised roughly $1.7 billion of money from debt and fairness issuance since its IPO, together with the IPO proceeds. Nevertheless, the comparatively stable working money circulation (OCF) generations, particularly in 2022 and 2020, have additionally contributed strongly to the general liquidity place. As such, the weak OCF efficiency in FY 2023 seems to have made a noticeable detrimental affect on liquidity, which was down by over 13% to only beneath $2.6 billion in FY 2023. In the meantime, the debt degree has been beneath management, as illustrated by the comparatively regular debt-to-equity (DE) ratio.

Catalyst

I consider OSCR stands to learn from a number of potential progress and profitability drivers that ought to assist ship its sustainable progress targets in FY 2024 and past. The continued power within the ACA market, pushed by the expanded subsidies into 2025, ought to assist OSCR to learn from elevated memberships via open and particular enrollments.

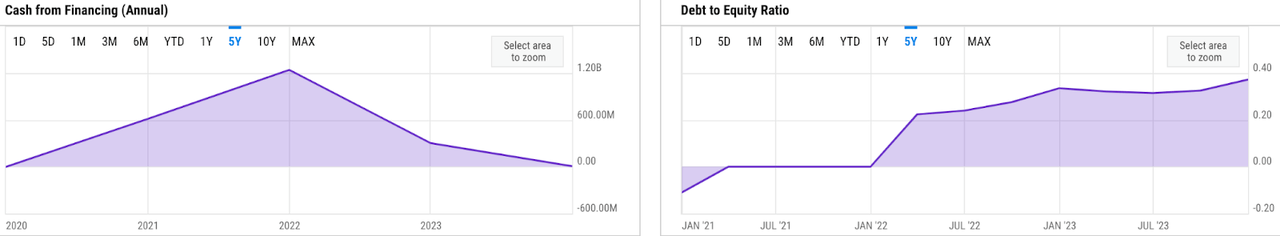

white home gov

In 2024, market enrollment reached a file excessive of over 21 million, which has helped OSCR to surpass its earlier projection and to count on over 1.3 million members. Successfully, the robust enhance in memberships shouldn’t solely unlock future progress alternatives but in addition margin expansions.

In my view, the longer term progress alternatives lie in probably stronger retention at scale. The important thing to stronger retention could be higher member expertise, which I consider OSCR may ship as a consequence of its stable know-how functionality. At present, OSCR stays the one insurance coverage tech participant with a full stack platform that has developed and totally owned its claims, member-facing, and provider-facing methods, differentiating it from its opponents. Consequently, this permits OSCR to successfully streamline bottlenecks and leverage wanted insights and new know-how to create higher expertise.

As an example, the administration has indicated that OSCR will probably be deploying AI extensively to assist obtain its aim to drive higher member expertise through the This fall earnings name:

We enhanced our member companies IVR and launched an AI-powered safe messaging characteristic. Self-service options like these make it quicker and simpler for members to get the solutions they want and permit our care staff to assist extra complicated member wants. Whereas membership elevated this open enrolment, name quantity remained regular, name abandonment charges decreased and member satisfaction elevated. We’re making our superior member expertise and revolutionary know-how out there to others within the well being care system, enabling the next high quality expertise for customers and driving higher engagement outcomes and enterprise efficiency for shoppers.

Supply: This fall earnings name.

Moreover, the general shift in membership combine in the direction of youthful demographics will function a margin enlargement driver, for my part. As commented by the administration in This fall earnings name, OSCR noticed a noticeable enhance in youthful members:

however general, once we take a look at the demographics and type of the morbidity of the group that we’re seeing, I’d characterize it as, primary, it is youthful and so, we definitely with this progress have seen, youthful members coming in additional than a little bit greater than a 12 months youthful when it comes to the overall inhabitants.

Supply: This fall earnings name.

The youthful demographics ought to ideally drive margin enlargement because of the probably decrease general healthcare prices for OSCR. As an example, there’s decrease chance for youthful folks to make high-cost insurance coverage claims. Furthermore, additionally it is extra probably for the premiums to be extra predictable throughout the youthful segments, which ought to enhance underwriting’s unit economics, in my view.

Threat

One of many main danger components to my thesis could be the opportunity of ACA subsidies being eliminated beneath the brand new administration publish US election. This subject was additionally introduced up through the This fall earnings name, as requested by one of many analysts:

I get a whole lot of questions on the Inexpensive Care Act subsidies, and there are some authorities estimates on the market of, if the subsidies had been to go away, what would occur to the market dimension and so simply questioning, one, when you have any feedback on what you’d count on it to do to the market, possibly relative to love what your mixture of members seem like relative to who’s utilizing the APTCs.

Supply: This fall earnings name.

Although the administration seems to have anticipated the much less splendid situations, I’d count on that subsidies elimination, if any, to nonetheless end in a substantial strain to the general enterprise.

One other danger issue to contemplate could be the relatively elevated share worth degree immediately, which can probably enhance share worth volatility. As per my earlier overview, OSCR is at present buying and selling close to $15, already up by over 64% YTD. In my view, the scenario at current may recommend that a whole lot of the upside might need been priced in.

Valuation / Pricing

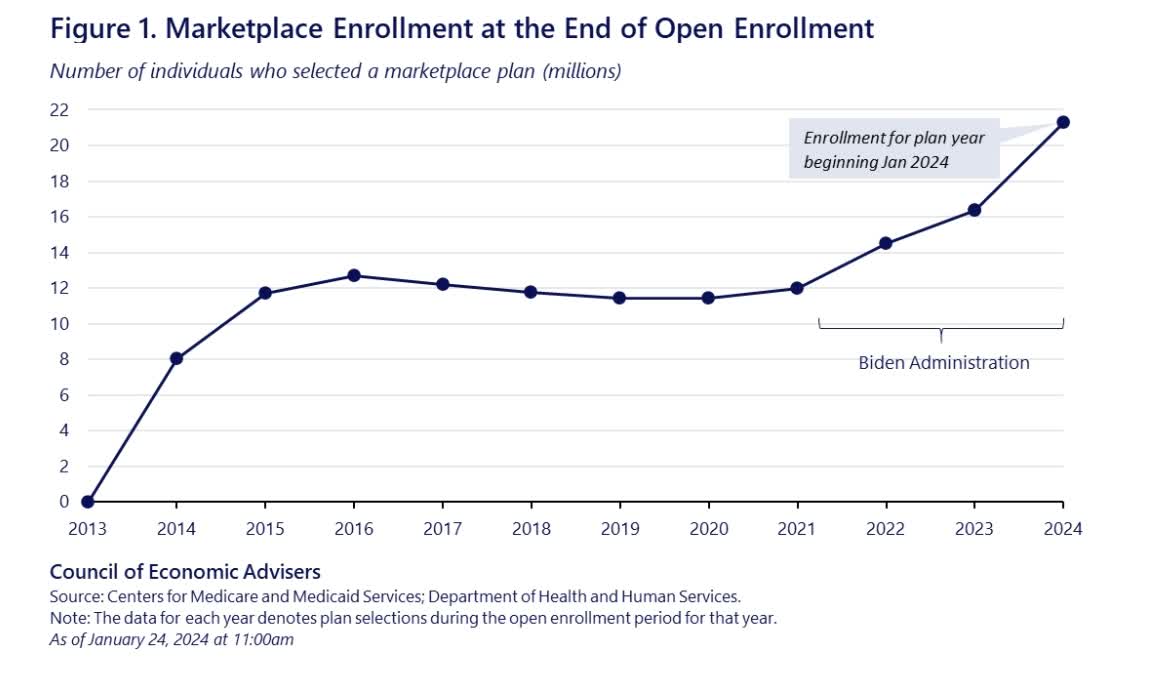

My goal worth for OSCR is pushed by the next assumptions for the bull vs bear situations of the FY 2024 projection:

Bull state of affairs (70% chance) assumptions – I count on OSCR to attain an FY 2024 income of $8.4 billion, a 43% progress, in step with the market’s estimate. I assume a ahead P/S to stay at 0.56x, implying a share worth appreciation to $20.

Bear state of affairs (30% chance) assumptions – OSCR to ship FY 2024 income of $8.2 billion, lacking the low finish of the market’s income estimate by about -1%. I assign OSCR a ahead P/S of 0.4x, projecting at greatest sideways worth motion into FY 2024.

personal evaluation

Consolidating all the data above into my mannequin, I arrived at an FY 2024 weighted goal worth of $18.6 per share, projecting a possible upside of about 24%. I’d price the inventory a purchase.

As a aspect notice, my task of 70-30 weighted chance for bull and bear situations is usually because of the robust catalysts at current, which I consider will increase the chance of OSCR hitting the higher finish of the market’s estimate.

Moreover, OSCR additionally stays the extra engaging possibility in comparison with its friends comparable to Clover Well being (CLOV) or Brilliant Well being (NEUE), in my view, principally as a consequence of its higher monetary place and outlook. OSCR is simply barely valued greater than CLOV and NEUE, which each commerce at 0.16x and 0.03x P/S. Nonetheless, it’s worthwhile to contemplate that each one of those gamers are nonetheless buying and selling beneath 1x immediately, demonstrating the broader lack of market confidence. With that in thoughts, OSCR stays the corporate greatest positioned to exceed market expectation, in my view.

Conclusion

OSCR seems to be benefiting from a number of catalysts which will probably assist drive margin expansions and progress in FY 2024. Continued power in ACA enrollment presents a key progress driver. Furthermore, the shift in the direction of youthful demographics within the membership combine also needs to unlock margin expansions because of the projected decrease general healthcare prices and regular premiums. My 1-year worth goal of $18.6 presents a possible upside of 24%. I price the inventory a purchase.

[ad_2]

Source link