[ad_1]

Karen Ducey/Getty Photos Information

In my earlier evaluation of Pacific Biosciences of California (NASDAQ:PACB), I targeted on the potential impression of their upcoming Revio platform. Since then, the launch has taken place and we have seen the preliminary market response. With the discharge of their 3Q23 earnings, a reassessment of the corporate’s place and prospects is now well timed.

Income Progress

Within the third quarter of 2023, Pacific Biosciences disclosed a marked income surge of 72% year-over-year, hitting $55.7 million. This era marked the primary occasion of the corporate’s quarterly income crossing the $50 million threshold. A big contributor to this progress was the cargo of 52 Revio devices, setting a brand new firm file and boosting the overall put in base of Revio programs to 129 as of September thirtieth.

Income from consumables additionally noticed an uptick, reaching $16.9 million. A key spotlight was the accelerated gross sales tempo of Revio consumables, surpassing that of Sequel II/IIe consumables extra rapidly than anticipated, signaling speedy market adoption. Moreover, the improved utilization of Revio was evident, with an elevated variety of cells getting used per system, suggesting a ramp-up in manufacturing utilization. The info output from the Revio fleet for the quarter outstripped the height output of the complete Sequel II/IIe fleet, demonstrating the brand new platform’s potential.

A noteworthy metric was the annualized consumable pull-through price for Revio, recorded at 483,000. This price, a measure of consumable utilization, stood at a promisingly excessive stage. Nonetheless, given the comparatively early stage of the product’s lifecycle, it stays to be seen if this price will likely be sustained in the long run.

PacBio’s third-quarter earnings name highlighted one other key metric: the adoption of their Revio system, significantly amongst new prospects. Over 40% of Revio system orders have been from new PacBio prospects, underscoring the platform’s aggressive edge and attraction within the genomic sequencing market. This uptake by new customers signifies Revio’s potential to attract customers from different sequencing applied sciences.

Furthermore, there exists a substantial alternative for PacBio to transform current prospects utilizing Sequel II/IIe programs to the newer Revio platform. At present, lower than 30% of the roughly 300 Sequel II/IIe prospects have transitioned to Revio, suggesting a major untapped market inside their current buyer base.

To supply some colour, one notable new buyer, Helix, has integrated the Revio system to bolster its inhabitants genomics enterprise. Helix’s purpose is to combine long-read sequencing capabilities into its current platform, which is already engaged in large-scale applications all through the US.

One other attention-grabbing case is the Youngsters’s Mercy Hospital in Kansas Metropolis. The hospital reported that Revio has enabled them to streamline checks, improve effectivity, enhance remedy charges, and notably scale back turnaround occasions. A hanging achievement with Revio is the flexibility to ship ends in simply two weeks utilizing five-based HiFi sequencing, a major development from the prolonged intervals required by a number of legacy checks.

Upcoming Enhancements to Revio Platform

Because the addressable marketplace for PacBio expands, the corporate is intensifying efforts to reinforce the usability of its Revio platform. A number of key enhancements have been launched or are within the pipeline, aimed toward bettering general efficiency and person expertise.

Preload Characteristic: A easy but pivotal enhancement is the preload function. This enables customers to arrange for his or her subsequent sequencing run whereas the present one is underway, considerably boosting the instrument’s throughput and effectivity. Originating from the Sequel IIe platform, the tailored DNA preloading function is tailor-made to the client’s pattern, stopping SMRT cell overload and facilitating extra assured and elevated DNA loading, thereby yielding higher and extra constant outcomes.

Assist for Shorter Libraries: The forthcoming replace will prolong Revio’s compatibility to libraries shorter than 3 kilobases. This broadens its software scope, making it appropriate to be used in areas like AAV, Iso-Seq, and 16S microbial sequencing.

Versatile Run Occasions: One other enhancement consists of the introduction of versatile run occasions. Customers can have choices for 12-hour and 30-hour run occasions, accommodating varied lengths of DNA inserts. This flexibility permits for extra tailor-made and environment friendly sequencing operations.

Run Preview Characteristic: A future replace is ready to introduce a run preview function. It will allow customers to view the statistics of their sequencing run after the preliminary 4 hours, aiding in higher planning and optimization for subsequent runs.

Within the coming 12 months, PacBio is ready to introduce vital enhancements within the pattern preparation course of, leveraging know-how acquired from Circulomics. This initiative is aimed toward bettering measurement choice on the SMRT cell, which is a vital side of their sequencing methodology. These developments are anticipated to allow customers to attain increased sequencing output per SMRT cell and persistently produce longer learn lengths.

To help these developments, PacBio has entered into collaborations with main automation suppliers, together with Hamilton, Integra, Revvity, and Tecan. These partnerships are targeted on totally automating pattern preparation protocols for each the Revio and Sequel II/IIe programs, streamlining the method and doubtlessly rising effectivity.

Moreover, earlier within the month, PacBio launched the PacBio Entire Genome Sequencing Variant Pipeline (WGS Variant Pipeline). This pipeline represents a standardized computational method that amalgamates over ten distinct secondary and tertiary evaluation instruments right into a singular, easy-to-use workflow. Designed to be user-friendly, the WGS Variant Pipeline caters to people with different ranges of bioinformatics experience, thereby simplifying entry to HiFi entire genome sequencing. This improvement marks a major step in making superior genomic sequencing extra accessible and user-friendly.

From Genomics to Multiomics

PacBio has been aiming to rework itself right into a extra multiomic firm. A multiomic method integrates knowledge from varied organic layers just like the genome, epigenome, transcriptome, and proteome, offering a extra complete understanding of biology and illness. With the flexibleness and elevated throughput of the Revio system, mixed with HiFi single-molecule detection capabilities, PacBio is starting to appreciate this purpose. The Revio is envisioned as a flexible instrument – a “multi-omic Swiss Military Knife” – for numerous purposes in genomics and past.

A latest preprint by researchers from the College of Washington and different establishments showcased how the Revio system might produce knowledge on 4 high-quality ‘omes’ (genome, methylome, chromatin epigenome, and transcriptome) utilizing only one Revio SMRT cell.

In a research involving a participant from the Undiagnosed Illness Community, knowledge from every of those ‘omes’ helped clarify a number of of the participant’s phenotypes. This illustrates the effectiveness of utilizing a synchronized, single long-read multi-omic take a look at to uncover unexplained uncommon circumstances, versus conducting a number of separate checks.

Valuation & Dangers

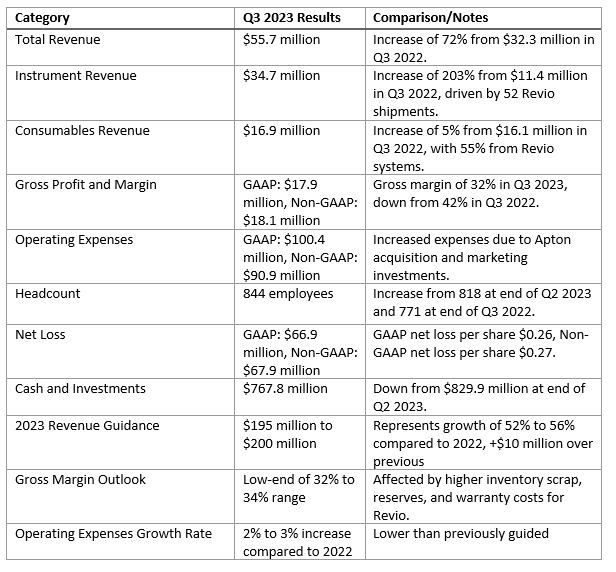

In its newest earnings name, PacBio revised its 2023 income forecast upward, now estimating between $195 million and $200 million. This marks a 52% to 56% enhance from 2022, surpassing earlier long-term projections. A abstract of key variable tendencies is supplied beneath.

Writer compilation primarily based on PACB financials

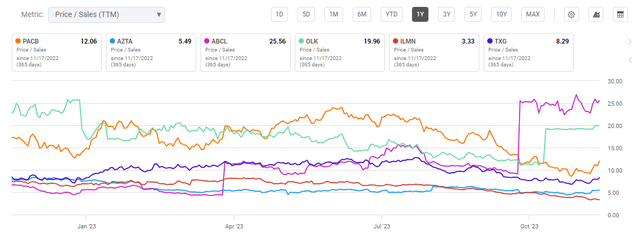

Present Revio gross sales figures are notable, aligning with the sooner optimistic evaluation. Ongoing enhancements to the Revio platform recommend the potential for additional gross sales progress. The corporate’s trajectory signifies doable earlier-than-anticipated achievement of the $500 billion income purpose by 2026. Such an end result might doubtlessly affect a reevaluation of PacBio’s gross sales a number of within the wider market. The next chart illustrates how investor perceptions can shift considerably over a 12-month interval on this business.

Looking for Alpha

Nonetheless, PacBio faces clear challenges. The present trajectory of gross sales progress, whereas promising, is just not a certainty. Speedy progress in early-stage corporations typically encounters sudden hurdles. The effectiveness of deliberate enhancements to their choices stays to be confirmed, and there is a danger that these enhancements may not drive gross sales progress as anticipated, doubtlessly resulting in monetary and useful resource inefficiencies.

Furthermore, the corporate’s operational bills (OpEx) are nonetheless excessive. With an estimated money burn of round $200 million per 12 months and present property close to $880 million, product launch intervals sometimes exert vital strain on an organization’s money reserves and might result in spikes in OpEx. Whereas PacBio’s present money place seems stable, a discount in money burn can be a optimistic indicator, significantly if the corporate can enhance income from high-margin consumables and companies.

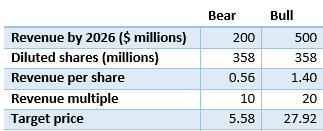

General, the situations beforehand outlined for PacBio appear to be unfolding. The chance of the corporate reaching 20 occasions a number of on a projected $500 million income is rising.

Writer computations

I imagine that the market might finally alter its valuation of PacBio, doubtlessly resulting in a inventory worth round a projected median state of affairs of $16. The long run stays unsure, however present tendencies recommend that the corporate’s technique and market place could also be aligning extra carefully with these expectations.

[ad_2]

Source link