[ad_1]

Palantir just lately hit two-year highs at $21.85, fueled by optimistic components like authorities income, and a $1 billion buyback program

Regardless of a partial pullback tied to lower-than-expected offers with the UK Nationwide Well being Service, PLTR’s Q3 earnings surpassed expectations, prompting a 26% share worth enhance

Analysts anticipate a good outlook for Palantir, with projections of elevated income and earnings, anticipating a 20% annual income progress for the following two years.

Missed out on Black Friday? Safe your as much as 60% low cost on InvestingPro subscriptions with our prolonged Cyber Monday sale.

Palantir (NYSE:) is a key participant within the synthetic intelligence house and has been garnering investor consideration. Within the latter half of this yr, the Denver, Colorado-based firm’s inventory gained vital momentum and ultimately made new two-year highs at $21.85 final week.

A partial pullback from this peak was attributed to the considerably lower-than-expected scale of Palantir’s anticipated take care of the UK Nationwide Well being Service.

Nonetheless, persistent optimistic components, together with the corporate’s ongoing collaborations, substantial income from authorities companies regardless of disruptions, a steady uptick in industrial gross sales, and the announcement of a $1 billion buyback program, keep excessive expectations for PLTR.

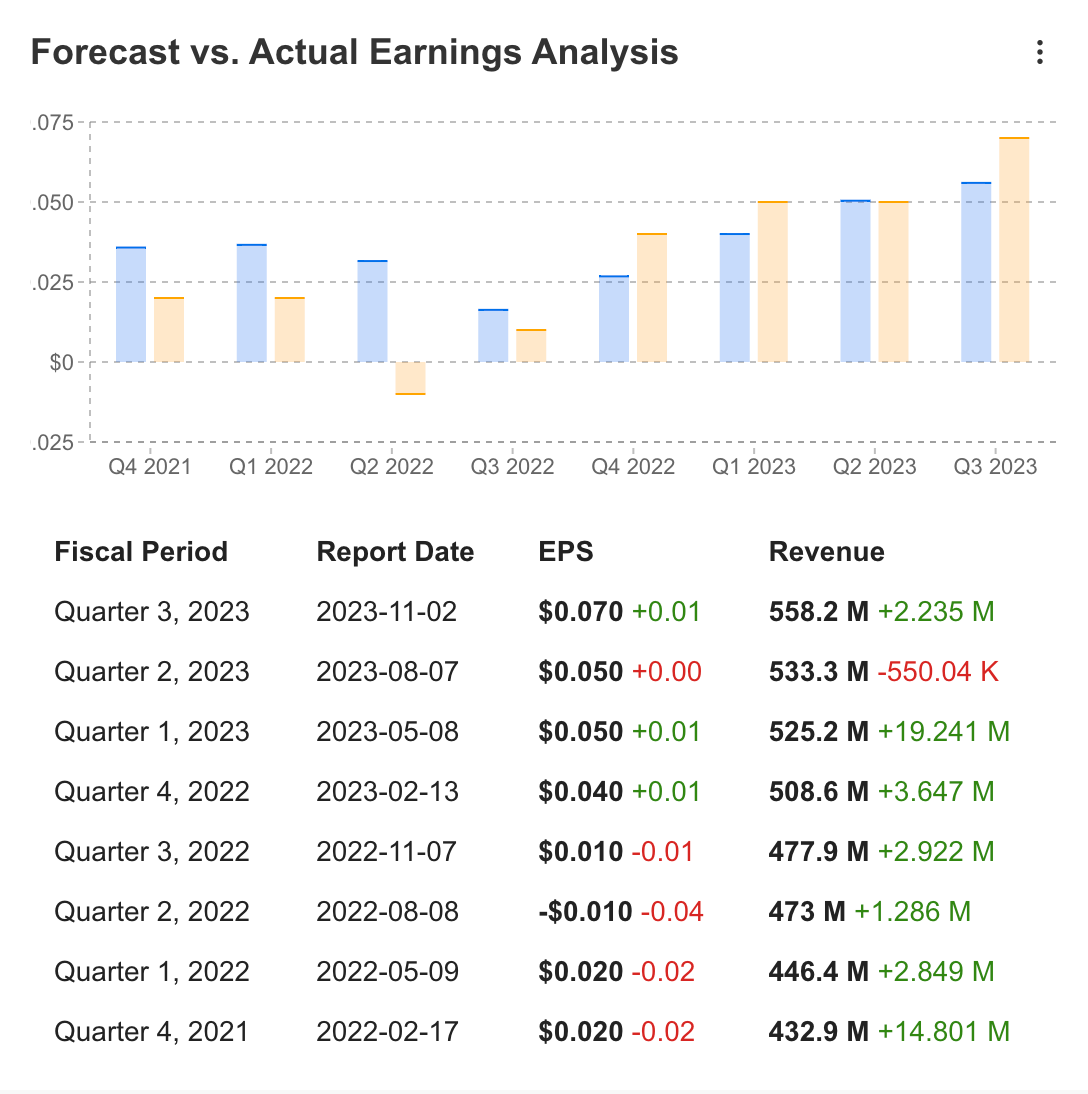

Furthermore, the third-quarter exceeded expectations, sparking a considerable surge within the share worth. Palantir posted an earnings per share of seven cents with a income of $558.2 million in Q3, surpassing EPS expectations by 25%.

Within the wake of those monetary outcomes, the preliminary response to PLTR shares was a outstanding 26% enhance.

Supply: InvestingPro

Following the optimistic figures, 12 analysts additionally revised their estimates for Palantir upwards. Accordingly, within the final quarter earnings report, which is predicted to be introduced on February 14, the EPS estimate is 0.076, whereas quarterly earnings are anticipated to be $ 603.2 million.

Supply: InvestingPro

Palantir’s Elementary Outlook: A Deep Dive into Income, Revenue, and Market Dynamics

Palantir’s income for 2023 is estimated to be over 2.22 billion {dollars}, whereas its earnings per share are anticipated to achieve 25 cents a yr. Analysts’ long-term forecasts for the following 2 years is that Palantir will enhance its income by 20% yearly to three.2 billion {dollars} by the tip of 2025.

Supply: InvestingPro

The truth is, wanting on the historic information on InvestingPro, it may be thought of a optimistic improvement that the corporate’s quarterly earnings have exceeded expectations in each interval since 2021, apart from the 2nd quarter of 2023.

Supply: InvestingPro

The corporate, which has improved financially this yr, additionally ended the downward momentum in income progress within the final quarter outcomes. With 16% year-over-year income progress in Q3, Palantir continued to extend its income, signaling an enchancment in income progress, and offsetting the lack of momentum within the earlier quarter.

Supply: InvestingPro

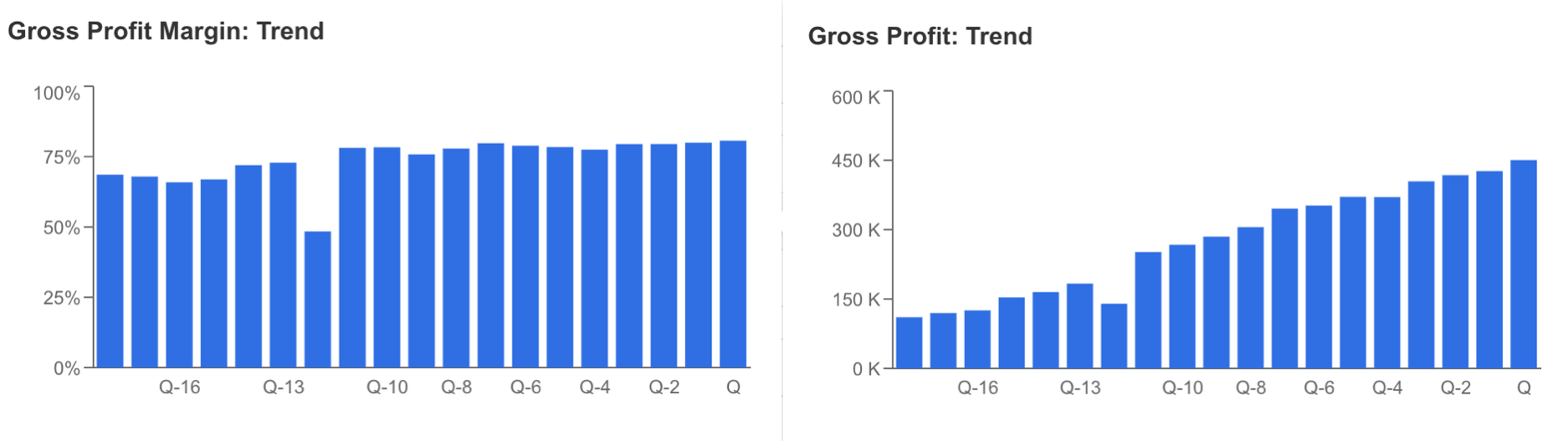

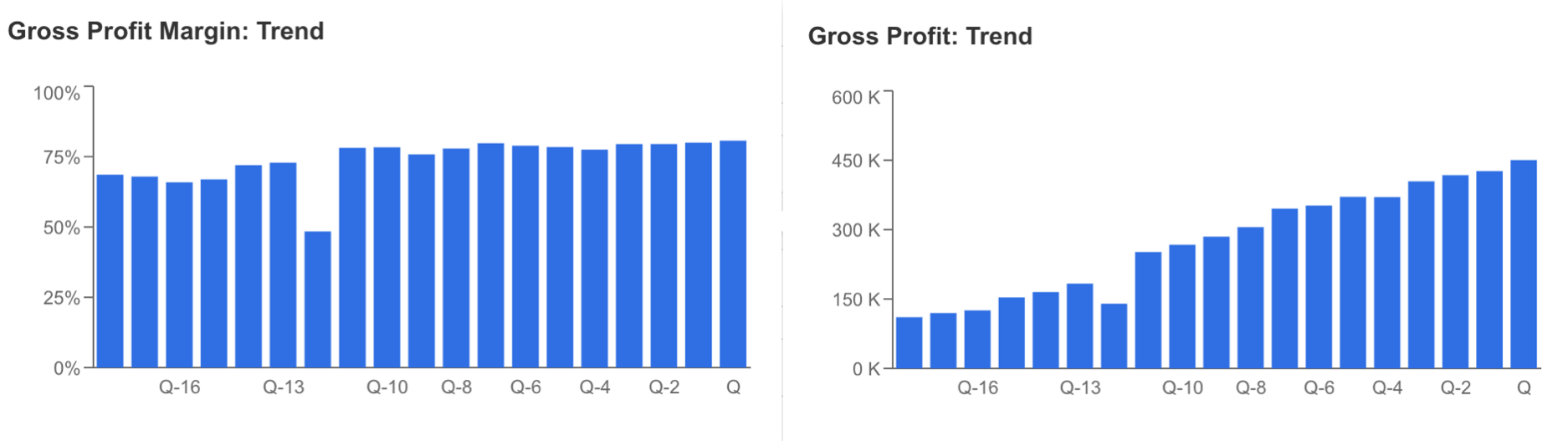

The corporate can be poised to shut the yr in revenue, with spectacular margins in addition to upward momentum in gross margin, sustaining gross margin above 75%.

Supply: InvestingPro

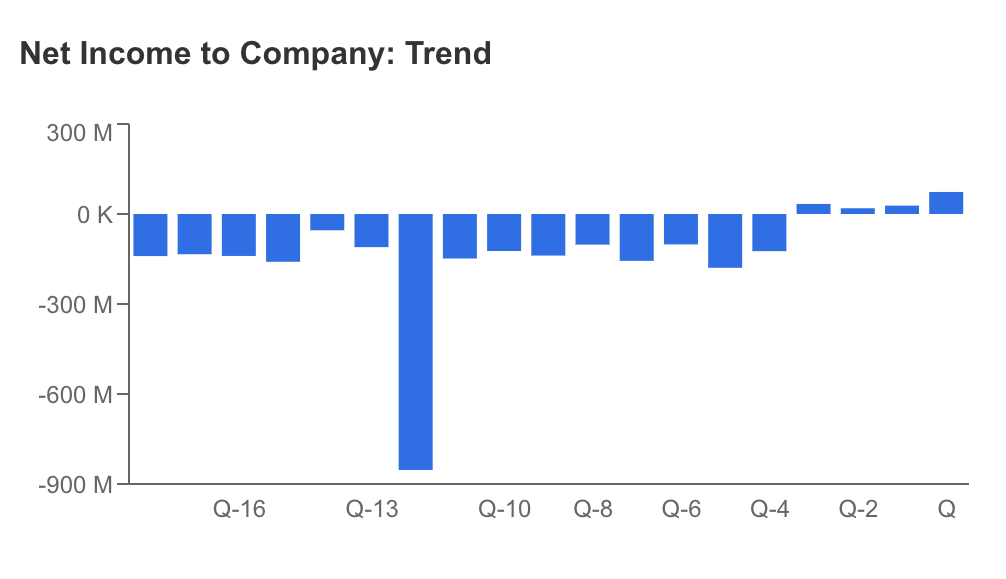

Palantir has constantly maintained its profitable operations since its IPO and began to report quarterly revenue for the primary time this yr. Within the final quarter, Palantir reported a web revenue of 73.4 million {dollars}, in comparison with a web lack of 123.9 million {dollars} in the identical interval final yr.

Supply: InvestingPro

The corporate’s money movement scenario can be amongst its optimistic elements. In response to the newest information, InvestingPro’s money movement rating for Palantir, whose money place on its stability sheet is above its debt, is affected as excellent efficiency with 4 out of 5.

Among the many most vital developments that contributed to Palantir’s spectacular efficiency this yr was the launch of its “Synthetic Intelligence Platform”. The platform, which has seen a rise in customers all year long, has began to generate a brand new income stream for the corporate.

The AI firm elevated its authorities revenues by 12% to $308 million this yr, however this quantity fell wanting forecasts. Luckily, a 23% enhance in personal firm income helped increase this line merchandise from $234 million to $251 million. This reveals that industrial market income is catching up with authorities income. Thus, by diversifying its income objects, the corporate is beginning to obtain a more healthy construction by avoiding the chance of income focus.

The partnerships and acquisitions that the corporate has established inside the framework of its progress plans are additionally crucial. Final yr, Palantir acquired a three way partnership in Japan that sells the corporate’s software program, making Japanese insurance coverage firm Sompo its largest buyer. Palantir additionally just lately expanded its collaboration with with a cloud computing initiative for presidency companies.

The corporate additionally has a partnership with IBM (NYSE:) to assist enterprises undertake AI software program quicker. Along with these optimistic acquisitions and collaborations, a problem for the corporate is the upcoming renewal of contracts with the US Authorities. Though the corporate continues to extend its portfolio of personal firm prospects, about 60% of its income comes from authorities companies.

However, though the corporate introduced a $1 billion buyback program, it has not but began shopping for shares. Nonetheless, in circumstances of potential share worth retracement, the corporate’s begin of share purchases could also be an element supporting the worth.

One other expectation concerning Palantir inventory is the inclusion of PLTR within the S&P 500, which was additionally talked about by the corporate’s CEO Alex Karp after the Q3 earnings report. If PLTR is included within the index, it may considerably enhance demand for this inventory.

Truthful Worth: Is the Inventory Presently Overvalued?

Supply: InvestingPro

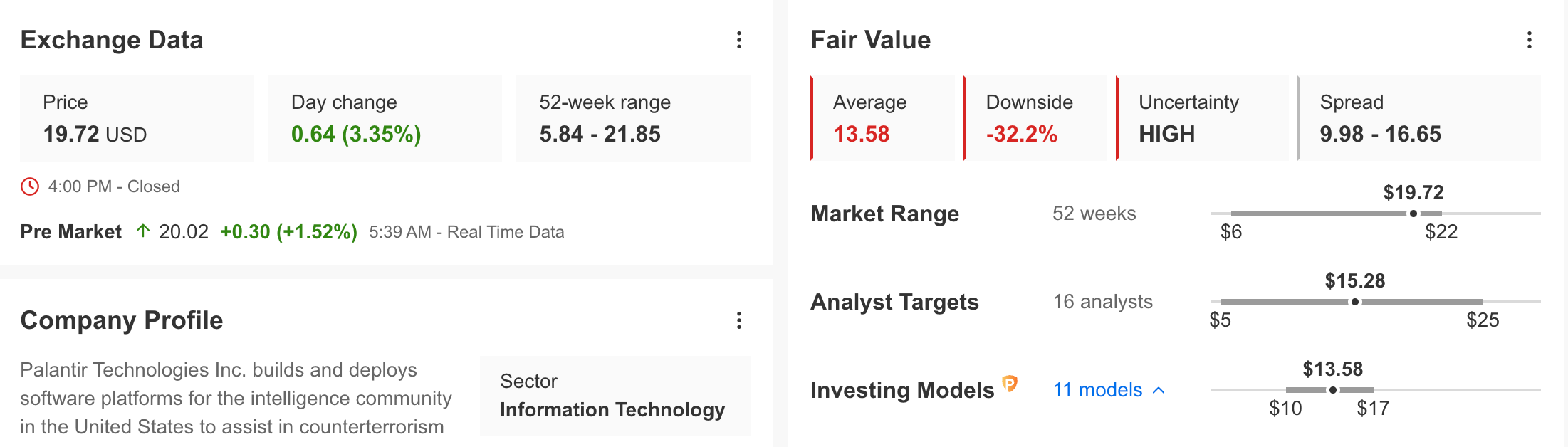

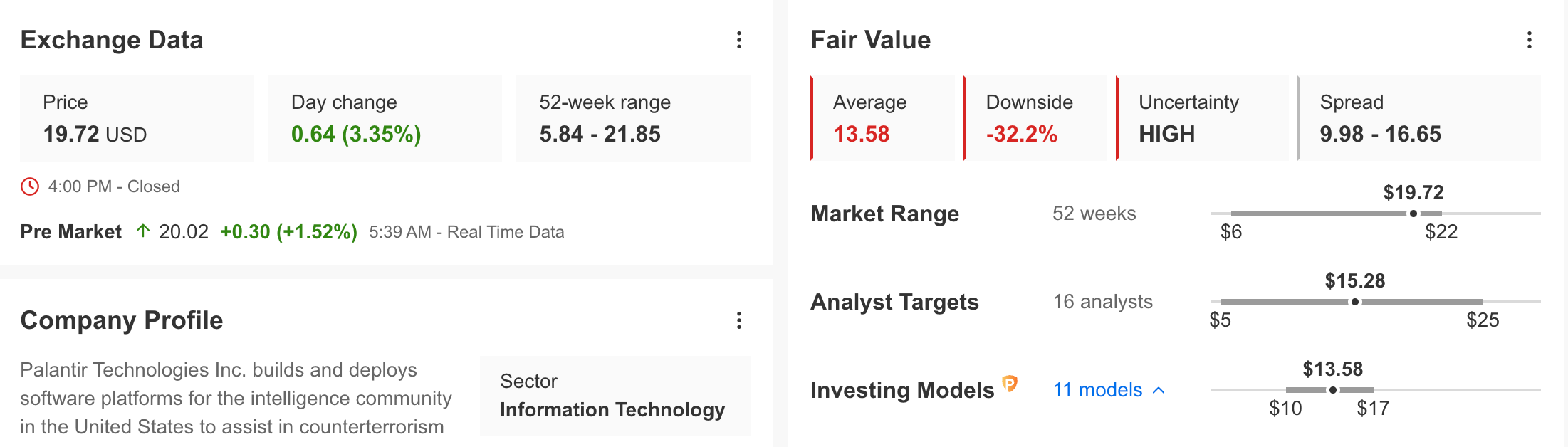

If we verify the truthful worth evaluation of PLTR onInvestingPro; we see a bearish expectation for PLTR. The calculation made based on 11 monetary fashions on InvestingPro reveals that the inventory is at the moment overvalued by 31% in excessive uncertainty and its truthful worth is $ 13.58. The consensus forecast of 16 analyses is that PLTR’s truthful worth is within the $15 band.

Palantir Technical View

Assessing PLTR shares from a technical perspective reveals their excessive volatility, as indicated by a beta exceeding 2.

After remaining horizontal within the $ 20 – $ 30 band for a very long time after the IPO, PLTR entered a downward pattern as much as $ 5. In the beginning of this yr, the share, which began to be in demand quickly with the help of synthetic intelligence, reached as much as $ 20 this month, the decrease band of the channel motion within the 2020 – 2021 interval. This degree additionally corresponds to the Fib 0.618 perfect correction worth primarily based on the deep downtrend.

Due to this fact, if the PLTR inventory, which I predict is at a crucial juncture, can not exceed the $ 20 resistance on the weekly shut, it might make a correction of this yr’s uptrend and we might even see a pullback in the direction of $ 14. If this worth zone, which was defended within the Could – September interval, is damaged within the potential decline, it might turn into potential for the retreat to proceed as much as the $ 11 space.

Nonetheless, in a optimistic situation, if patrons can overcome the $ 20 barrier, we are able to see that the upward momentum may proceed in the direction of the $ 35 – $ 43 area, with the $ 25 – $ 30 vary being an intermediate resistance.

***

You possibly can simply decide whether or not an organization is appropriate to your danger profile by conducting an in depth elementary evaluation on InvestingPro based on your individual standards. This manner, you’ll get extremely skilled assist in shaping your portfolio.

As well as, you may join InvestingPro, some of the complete platforms available in the market for portfolio administration and elementary evaluation, less expensive with the most important low cost of the yr (as much as 60%), by making the most of our prolonged Cyber Monday deal.

Declare Your Low cost Now!

Disclaimer: The writer doesn’t personal any of those shares. This content material is solely for academic functions and can’t be thought of as funding recommendation.

[ad_2]

Source link

Add comment