[ad_1]

Steven Puetzer/The Picture Financial institution through Getty Photographs

We beforehand lined Palantir Applied sciences Inc. (NYSE:PLTR) in November 2023, discussing the administration’s good advertising and marketing method for AIP, with it more likely to speed up its top-line and buyer base expansions.

With the nascent generative AI SaaS market nonetheless ripe for immense development, we continued to fee the inventory as a Purchase after a average pullback.

On this article, we will focus on why we’re selecting to downgrade the PLTR inventory as a Maintain right here, attributed to the huge baked-in premium noticed in its inventory valuations and pulled ahead upside potential within the inventory costs.

Whereas we stay satisfied about its long-term prospects, we imagine that it might be wiser to attend for a average pullback to its earlier resistance degree of $17s to greenback value common.

The Generative AI Funding Thesis Has Gone Overboard With PLTR

For now, PLTR has a top-line beat in its FQ4’23 earnings name, with revenues of $608.35M (+8.9% QoQ/ +19.6% YoY) and adj EPS of $0.08 (+14.2% QoQ/ +100% YoY).

A lot of its top-line tailwinds are attributed to the rising demand for its business choices, notably the AIP, naturally contributing to its sturdy business revenues of $284M (+13.3% QoQ/ +31.8% YoY).

Whereas PLTR’s authorities revenues have proven indicators of development deceleration at $324M (+5.3% QoQ/ +10.5% YoY) by the most recent quarter, it seems the return in business spending could also be greater than sufficient to steadiness the headwinds.

The identical could also be noticed within the rising complete Remaining Efficiency Obligations [RPO] of $1.24B (+25.8% QoQ/ +27.7% YoY) – principally within the long-term RPO of $600M (+40.1% QoQ/ +31.5% YoY), increasing adj gross margins of 84% (+2 QoQ/ +2 YoY), and Internet Retention Greenback of 108% (+1 QoQ/ -7 YoY).

Mixed with the accelerating general buyer rely to 497 (+44 QoQ/ +130 YoY), it’s plain that there’s sturdy demand for its SaaS choices, marking the re-start of its excessive development development as extra corporations put money into their generative AI capabilities throughout a supposed international comfortable touchdown.

PLTR’s backside line tailwinds are additionally attributed to deceleration noticed in its working bills development to $433.92M (+5.7% QoQ/ +2.7% YoY) in FQ4’23.

That is partly aided by means of its steadiness sheet at a time of elevated rates of interest, with $44.41M in internet curiosity revenue (+22.9% QoQ/ +302.2% YoY) and slowing share rely development to 2.35B (+1.2% QoQ/ +6.8% YoY) by the most recent quarter.

It seems that the PLTR administration has delivered on its promise to handle the beforehand extravagant stock-based compensation, considerably aided by the yet-to-be-utilized $1B share repurchase program.

With a rising $3.67B of internet money in steadiness sheet (+11.8% QoQ/ +39.5% YoY) and virtually zero debt, we will perceive why the market has cheered because it has, additional aided by the hype surrounding generative AI.

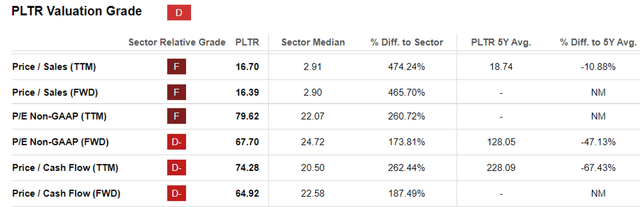

PLTR Valuations

Looking for Alpha

Nonetheless, whereas we could also be PLTR’s shareholders ourselves, it’s obvious that at FWD P/E valuations of 67.70x and FWD Value/ Money Circulation of 64.92x, the inventory has been overly inflated. That is in comparison with its 1Y imply of 57.53x/ 68.97x and sector median of 24.72x/ 22.58x, respectively.

Even when we’re to match its valuations to different generative AI performs, corresponding to Microsoft (MSFT) at 34.70x/ 27.42x, Nvidia (NVDA) at 56.38x/ 90.94x, and CrowdStrike (CRWD) at 102.28x/ 42.18x, it’s obvious that the generative AI SaaS hype could have gone overboard at this level.

With the hype going into overdrive, we’re reminded by the same development beforehand noticed in the course of the heights of hyper-pandemic euphoria in November 2021, with the following correction being extraordinarily painful.

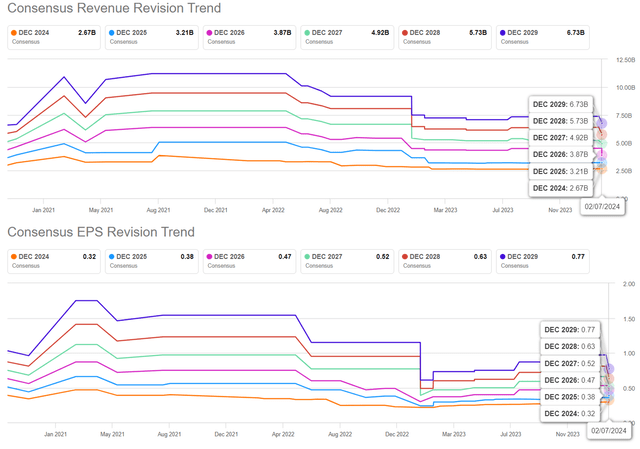

The Consensus Ahead Estimates

Tikr Terminal

That is particularly because the consensus ahead estimates for PLTR has been persistently downgraded to a prime/ backside line CAGR of +20.3%/ +23.2% by means of FY2026.

These numbers are notably moderated, in comparison with the earlier estimates of +26.4%/ +28.4% and historic top-line development of +30.1% between FY2018 and FY2023, respectively.

Whereas the administration’s FY2024 midpoint income steerage of $2.656B (+19.3% YoY) appears to be accelerating in comparison with FY2023’s development at $2.22B (+16.7% YoY), these numbers are nonetheless pale compared to the +47.2% YoY development recorded in FY2020.

Because of the overly inflated valuations and decelerating development development, it seems that traders should rein of their exuberance, with the market already pulling ahead a lot of PLTR’s upside potential.

Based mostly on the consensus FY2026 adj EPS estimates of $0.47 and its 1Y P/E imply of 57.42x, there seems to be a minimal upside potential of +13.9% to our long-term value goal of $26.90 as properly.

So, Is PLTR Inventory A Purchase, Promote, or Maintain?

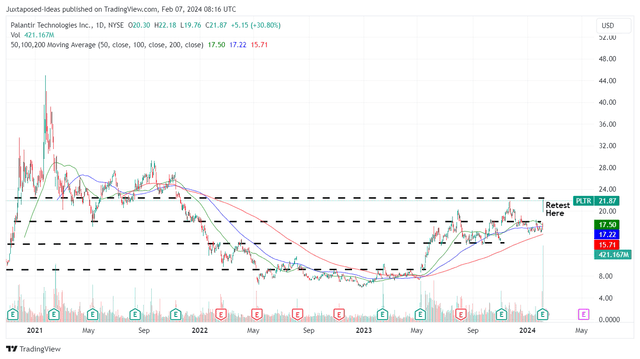

PLTR 3Y Inventory Value

Buying and selling View

On the one hand, PLTR has peaked once more with it showing to interrupt out of its 50/ 100/ 200 day transferring averages, whereas retesting its earlier resistance degree of $20s.

Regardless of the rise and fall development noticed after three of its earlier incomes calls, it is usually obvious that the inventory has been capable of maintain its upward momentum since Might 2023, with it charting newer highs/ newer lows and the $17/ $18s more likely to be its subsequent ground.

However, the mixture of the lifting market sentiments, cooling inflation, Fed’s potential pivot by H1’24, and the more and more grasping inventory market index pose large uncertainties to the sustainability of PLTR’s overly premium valuations and rising trajectory within the near-term.

Right here is the place the quote, “the development is your buddy till the tip when it bends” could also be extremely relevant. With the uptrend seemingly gaining momentum, we may even see the inventory’s rise proceed for a bit of longer, triggering short-term buying and selling earnings.

Nevertheless, we imagine that there could also be near-term volatility forward, with the inventory market more likely to pullback after a lot of the earnings season hype has been moderated.

Because of the potential volatility, we favor to prudently fee the inventory as a Maintain right here, with traders higher off observing for decrease entry factors in line with their greenback value averages and danger urge for food.

Don’t chase this rally right here.

[ad_2]

Source link