[ad_1]

Liubomyr Vorona/iStock through Getty Pictures

Important Thesis & Background

The aim of this text is to guage the PIMCO Company & Revenue Technique Fund (NYSE:NYSE:PCN) as an funding possibility. It is a closed-end fund with a main goal “to hunt excessive present earnings, with a secondary goal of capital preservation and appreciation.”

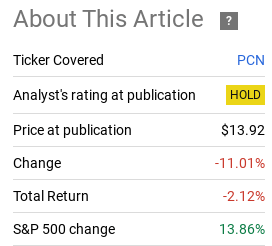

I cowl PCN a couple of instances a 12 months as a result of it has been a fund I’ve traded out and in of since I started my funding profession. When 2023 received underway, I noticed restricted worth in it and felt the market had loads of different alternatives to pursue. Trying again, I used to be right to keep away from this fund this calendar 12 months because the return since my February article has been unfavourable:

Fund Efficiency (In search of Alpha)

As regular, with a contemporary 12 months, I convey a contemporary set of eyes to every fund I cowl. This has led me again to PCN on condition that eleven months have handed since I’ve written about it and I needed to see if a change in ranking was warranted. After overview, I nonetheless consider this fund stays overpriced and that higher values exist elsewhere. As such, my “maintain” outlook will stay in place, and I’ll clarify why in additional element beneath.

The Premium Persists

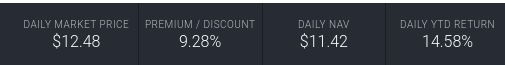

The primary and most evident level to make is that PCN’s market value stays a bit too wealthy for my blood. My followers know I draw back from funds buying and selling at extreme premiums and that features PCN. Whereas the premium has narrowed since my February article – when it sat round 15% – the present stage close to double-digits is simply not reflective of the worth I search for:

PCN’s Fast Stats (PIMCO)

The lengthy and in need of it from me is that PCN’s value, regardless of being cheaper than again in February, is just too costly for me to think about a “purchase” suggestion in isolation. There must be a number of different compelling attributes that may overcome this premium for my part. This alone has me leaning in direction of “maintain” at a minimal, which is in keeping with my normal outlook on CEFs and valuations that I’ve had over time.

Alternative In Excessive Yield Is Restricted

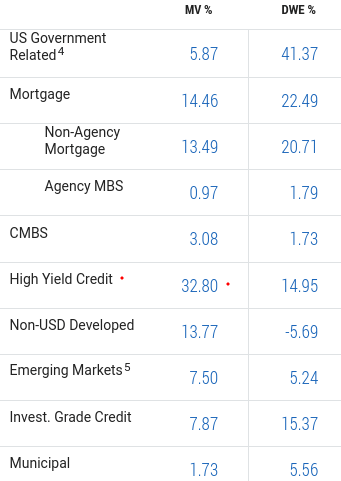

My subsequent subject shifts to a dialogue on PCN’s underlying holdings. In keeping with the fund’s technique over time, this can be a large play on the high-yield credit score sector. Whereas PCN holds a number of various kinds of securities, beneath IG-rated debt makes up over 38% of complete fund belongings:

PCN’s Sector Breakdown (PIMCO)

Which means that one would positively wish to be a “bull” on high-yield securities if they’ll purchase or maintain this fund. If you happen to aren’t optimistic in regards to the outlook for this sector, shopping for into this fund would not make a complete lot of sense.

Based mostly on the title of this text, readers have in all probability surmised I’m not a bull on the high-yield credit score sector in the interim. And that’s right. Whereas it has rallied not too long ago (and carried out typically nicely in 2023), I’ve considerations in regards to the go-forward potential. This stems from the truth that spreads are very slender in comparison with the place they’ve sat for the final 12 months and a half:

Excessive Yield Spreads (Yahoo Finance)

What this tells me is that the chance was a lot clearer up to now. Whereas spreads might slender additional – serving to to gas extra optimistic returns – historical past reveals us within the quick time period that we’re nearing a key resistance stage. Consumers are going to need to maintain coming in and being prepared to just accept a decrease and decrease stage of earnings on an adjusted foundation.

This does not current a good risk-reward backdrop. Add in the truth that PCN fees a premium to personal it, I do not see the worth. Why overpay for a sector that’s wanting like it could be close to a peak? Laborious for me to make that case and definitely helps clarify why a impartial ranking is smart to me for now.

The Market Is Too Passive For Me

My second concern is a macro-one. That is associated to the final calm that has presided over the markets for the previous few months. We now have seen each shares and bonds rally – with none significant pullback since October. Whereas “good” for traders (myself included!) it ties again to my broader fear that issues might have gotten a bit carried away. When beneficial properties are available too far, too quick, I get cautious as a rule.

To amplify this, check out the VIX index. This measure of volatility reveals that the broader market is extraordinarily passive and hardly pricing in any stage of go-forward threat or shock to the market:

VIX Index (Bloomberg)

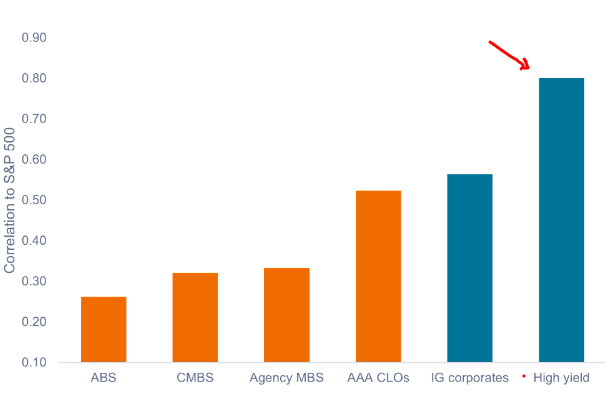

So – why does this matter to a fund like PCN? As a result of PCN is a leveraged, risk-on play that can virtually definitely see a spike in volatility if the “market” reveals volatility as nicely. We all know this as a result of, as simply talked about, PCN has a number of below-IG high quality debt. This high-yield nook of the market tends to be very correlated with equities. Whereas there may be nonetheless some key diversification between the 2 asset courses, over time the power of the correlation is evident and nicely above what different fixed-income sectors supply:

Correlations To Shares (S&P 500) (FactSet)

My takeaway right here is that the VIX cannot stand at all-time low ranges ceaselessly. There’s sure to be an uptick in market volatility and doubtless prior to later. If that occurs shares will see some swings, and the high-yield credit score sector shouldn’t be prone to keep away from that. Which means PCN will see some swings by extension. This means to me that ready for a greater entry level within the fund is totally justifiable.

Revenue Story Stays A Concern

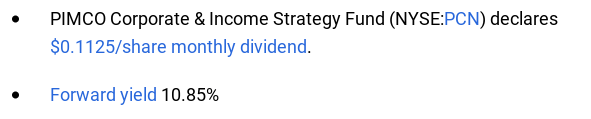

One other essential aspect of PCN is the fund’s earnings stream. A lot of the high-yield market presents a double-digit yield and that’s mirrored in PCN’s present payout. At slightly below 11%, that is positive to draw loads of curiosity from retail traders:

Present Distribution (PCN) (In search of Alpha)

The issue I’ve shouldn’t be within the stage of earnings – this registers as fairly excessive to me, after all. The problem is with sustainability. PCN’s earnings metrics have not been very sturdy this calendar 12 months and the December report reveals that there hasn’t been a number of progress within the quick time period:

UNII Report (PIMCO)

As you may see, PCN is deep within the crimson when it comes to its UNII steadiness and the protection ratios point out this is not going to alter any time quickly. Whereas I’m not one to over-exaggerate the danger of a distribution reduce, the actual fact is these numbers don’t encourage a lot confidence.

In the end, it comes right down to the worth proposition for me. Reverting to the premium value, the earnings metrics definitely do not point out the premium is warranted. An 11% yield sounds nice, however provided that the fund can preserve it would an affordable quantity of certainty. I do not see that being the case right here, so that is one other attribute that retains me away from being a purchaser.

There Has To Be Some Good Information, Proper?

By way of this overview, I’ve touched on numerous components that I consider help my determination to not purchase into PCN. However I all the time really feel the necessity to steadiness any article I write with execs and cons. I consider that units me aside from lots of the bloggers on the market and I’ll preserve the consistency in my strategy within the new 12 months as nicely.

With respect to PCN, the place is the excellent news? Properly, for one the fund may be very diversified past the high-yield credit score sector. Whereas home, beneath IG-rated debt is a heavy allocation within the portfolio, that also leaves two-thirds of the securities discovering a house elsewhere. About 20% of the holdings are in non-US debt, each developed and rising markets and one other 15% is in mortgage-backed securities.

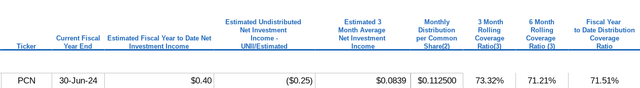

Of specific curiosity to me is the EM-backed allocation. The profit right here is that whereas US-backed high-yield credit score spreads are slender, EM-backed high-yield spreads have a transparent unfold benefit that has been rising within the quick time period:

Further Unfold (EM Credit score over US excessive yield) (World Financial institution)

After all, EM credit score has distinctive dangers. There are typically extra geo-political considerations, credit score threat will be elevated, and foreign money fluctuations add an additional layer of complexity. So I’d personally want extra compensation for diving into this sector over high-yield credit score inherently. However the truth that spreads look traditionally huge and have widened not too long ago suggests to me there may be worth right here. This makes their inclusion in PCN’s portfolio a profit for my part.

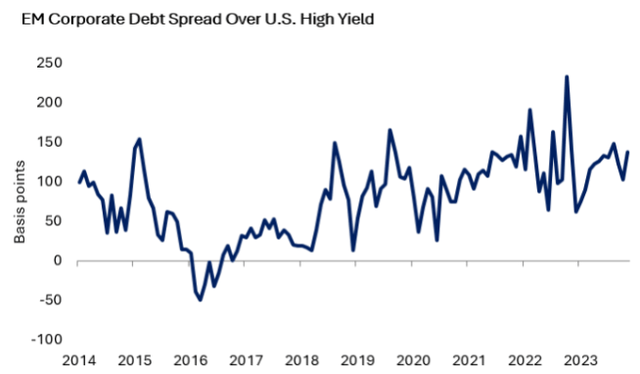

Company Issuance Subdued

One other optimistic for PCN pertains to a macro-development we’re witnessing within the company credit score market. Particularly, as charges have risen, firms have been reluctant to tackle a number of new debt. This has been aided by extra fiscal prudence and – maybe most significantly – the fact that corporations binged on low cost debt whereas it was accessible for years. The online consequence was that as rates of interest have risen, internet bond issuance has not seen a number of progress:

Company Bond Issuance (By Yr) (International) (S&P International)

This helps to help the underlying values of current company bonds as a result of provide has been comparatively tight in comparison with prior years. Whereas there isn’t a assure as to what 2024 will convey, the macro-environment in the interim is supportive of valuations for lots of the securities in PCN’s portfolio. On condition that world issuance has been regular, this impacts each the US and non-US belongings inside this CEF. This pattern might definitely regulate subsequent 12 months, however for now, I view this backdrop positively.

Backside-line

PCN hasn’t provided a lot to traders this 12 months and that may be a story I do not see altering within the subsequent few months. The fund’s premium to NAV is way too excessive, particularly after I contemplate that the earnings metrics are weak and high-yield company spreads are slender (which is the fund’s largest sector by weighting).

There’s excellent news to steadiness this out – corresponding to modest progress in new bond issuance globally and high-yield alternatives exterior the US, which PCN has taken benefit of. Nonetheless, I feel that the following quarter is prone to see an uptick in volatility that can problem PCN’s complete return. In consequence, I see no purpose to improve my outlook now and can maintain the “maintain” ranking in place as we glance to start 2024. This implies readers ought to strategy any new positions very selectively right now.

[ad_2]

Source link