[ad_1]

The Financial institution of Mexico selected to maintain its highest benchmark coverage charge at 11.25%, as anticipated, at its November 2023 assembly. This determination, the fifth consecutive pause, follows a sequence of 15 charge hikes since June 2021. Though annual headline inflation eased barely in October to 4.26% from 4.45% in September, it stays excessive. Inflation expectations in 2023 stay unchanged, provided that fast convergence to the goal vary isn’t anticipated within the close to future. The central financial institution reiterated its dedication to its core mandate, highlighting its ongoing efforts to create a low inflation atmosphere, and can hold an in depth watch on inflationary pressures and associated variables. The stance of financial coverage is aligned with the course wanted to realize the three% inflation goal.

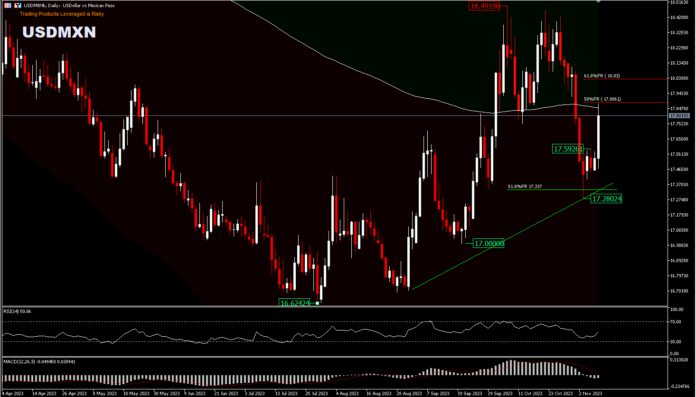

USDMXN was buying and selling round 17.50 ranges previous to the information launch, and surged strongly by 1.9%, approaching the 50% retracement degree (from October peak drawdowns of 18.49 and 17.28) on the time of writing. The Peso strengthened in opposition to the US Greenback at the beginning of the month, however held above the 61.8percentFR (from 16.62-18.49 retracement) and sideways for 4 days, as traders anticipated Banxico would stay steadfast in its tight financial coverage.

Sturdy labour and financial knowledge gave room for the Central Financial institution to take care of a hawkish stance. Mexico’s enterprise confidence indicator elevated for the second consecutive month, reaching its highest degree since 2014 at 54. As well as, the manufacturing PMI recovered from a contraction in September to 52.1 in October. GDP progress surpassed forecasts, growing by 3.3% from a yr earlier within the third quarter, whereas the unemployment charge fell to 2.9%.

Technical Evaluate

USDMXN’s rise on Thursday [09/11] was seen caught on the 200-day EMA and 50percentFR, which might be as a result of information impact. Nonetheless, judging from the financial knowledge, Mexico is probably going to enhance. Additional beneficial properties above the 200 EMA will possible check the 61.8percentFR degree round 18.03 for the remainder of the week. A transfer to the draw back could be blocked by the intraday resistance of 17.59 and a transfer beneath the help of 17.28 would go away the spherical determine of 17.00 to be focused by market individuals. Nonetheless, a transfer above 18.49 might be the beginning of a medium-term pattern.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or ought to be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.

[ad_2]

Source link