[ad_1]

bjdlzx

Peyto (OTCPK:PEYUF) administration has one of the best “seat in the home” to evaluate an acquisition. However they can’t realistically put every little thing they know within the presentation to shareholders. This administration, in contrast to many I comply with, is now revealing some factors which might be most likely as vital if no more vital than among the causes given on the time of the Repsol (OTCQX:REPYF) deal. These causes “put a lock” on the upside whereas sharply decreasing the draw back threat. Whereas some traders fear concerning the debt ratio for a usually conservative administration, it’s starting to seem that administration knew the best way to take care of that debt ratio rapidly from the very starting.

Exercise Comparability

Administration is now highlighting the distinction in exercise ranges for this sizable (however nonetheless) bolt-on acquisition. Not many acquisitions this dimension will be referred to as bolt-on. Even much less accommodates one of the best acreage that administration has lengthy needed.

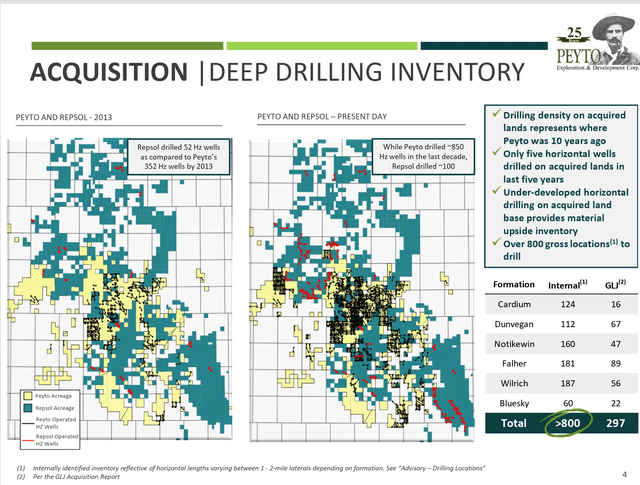

Peyto Comparability Of Drilling Exercise Ranges (Peyto Company Presentation January 2024)

Repsol administration confirmed that this was a noncore asset. Subsequently, this administration “needed out”. Now we’re going to discover out simply how badly they needed out.

The primary vital element is simply 5 wells within the final 5 years. That backs up administration’s assertion that this was noncore. However for Peyto it additionally implies that the manufacturing was older and previous the upper decline charges. Peyto may properly have projected decrease decline charges into the long run because the “curve flattens” as properly manufacturing ages. Meaning much less capital is required to take care of manufacturing.

But it surely additionally implies that the associated fee per MCF climbs as manufacturing ages as a result of the identical belongings are amassing much less manufacturing from older manufacturing. Usually, the way in which to repair that’s to do precisely what Peyto administration plans to do. That’s, you convey extra close by manufacturing on-line to refill that idle capability and the general prices head proper again down.

Peyto will possible convey on-line wells utilizing the most recent expertise that can outperform something Repsol did due to the dearth of current exercise. Reworks to additional cut back older manufacturing prices are possible as properly.

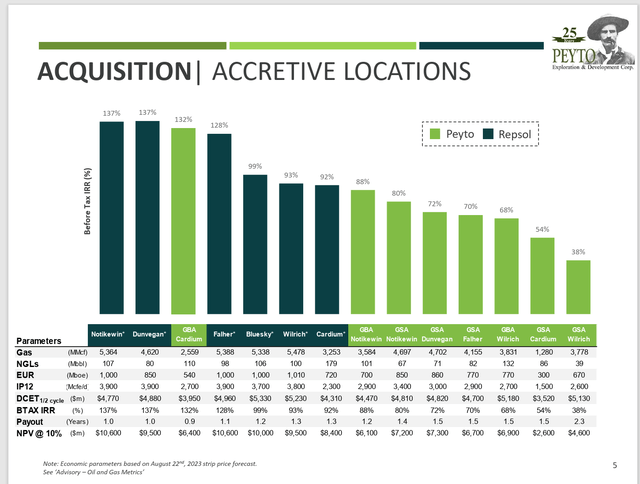

Peyto Comparability To Acquired Acreage Profitability By Location (Peyto Company Presentation January 2024)

Administration had talked about earlier that the acquired acreage would decrease prices. Traders can now see by location why that’s the case. The Repsol acreage is on common higher than the Peyto acreage. The acquisition subsequently raises the standard of drilling prospects whereas possible decreasing the company breakeven, as administration has lengthy implied.

That is one other approach of stating what administration stated the primary time as a motive for this being a superb acquisition.

However the hot button is with these higher ROI’s proven above, the event of the superior returns will enhance the margin at varied commodity costs. That’s going to be a lift to income at a time when the trade solely sees weak commodity costs sooner or later. The opposite massive deal is that this acquisition produces roughly 25% liquids, which is far greater than the Peyto company common. Peyto was averaging very roughly 11% liquids within the present fiscal 12 months (when every little thing was transformed to BOE).

Extra liquids give some insulation to weak pure fuel costs. It really helps to guarantee that this acquisition is an early success. Extra importantly, “purchase straw hats in January” applies. Peyto acquired these leases at a time of weak pure fuel costs mixed with a forecast for a heat winter. Higher years possible lie forward, with numerous North American export capability below building. Subsequently, irrespective of the primary few years, this deal may show to be an enormous plus as North America joins the a lot stronger world pure fuel market pricing.

This Leads To

The next statements have been made by administration.

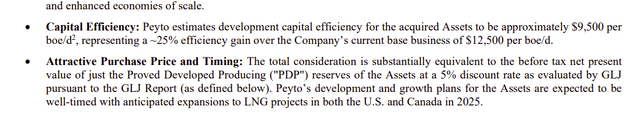

Peyto Statements Of Acquisition Benefits (Peyto Repsol Acreage Acquisition Press Launch)

Word that administration is absolutely emphasizing the unique presentation from a unique angle to spotlight some extra the reason why it is a nice deal. From this specific assertion, if administration has paid for all proved developed producing reserves now as the acquisition worth, then future drilling areas for proved undeveloped reserves are free.

As I famous in a earlier article, that is roughly $3 million per location cheaper than some paid for Permian drilling areas again in the course of the increase years. This firm has an enormous price benefit over many United States rivals, the place paying for undeveloped areas is frequent.

Administration additionally famous within the newest presentation that the mixed entity has supporting infrastructure that’s roughly 52% used. Regardless of how that’s calculated, it’s administration’s approach of stating that the infrastructure will assist appreciable manufacturing progress and not using a main capital mission for a while to come back. That is excellent news as a result of administration believes that the acquired acreage can assist about 100,000 BOED finally with superior profitability in comparison with the corporate common earlier than the acquisition.

Potential Tailwinds

When shareholders surprise how administration decides an acquisition will be accretive from the beginning, the above concerns weigh closely in that call. Extra importantly, although administration mentions that the debt ratio will go to a “stretched” 1.5. There seems to be sufficient methods to convey that ratio down quick by merely rising manufacturing from superior return areas that mainly got here free of charge with the deal.

Administration is now within the place of changing (for instance) 80% IRR present manufacturing that’s naturally declining with 130% IRR manufacturing that prices much less in accordance with the presentation. If sufficient of those wells are drilled, then prices ought to start to say no over time and margins at varied promoting costs will likewise increase over time.

On condition that many traders see weak pricing for the foreseeable future, that is precisely the sort of acquisition that must be made at a time like this. Administration would disagree with numerous traders in that administration most likely sees stronger costs for the trade sooner or later as extra export capability turns into purposeful.

There may be additionally a superb probability that the inexperienced revolution aids pure fuel demand progress by way of the demand for ethane and propane for the quickly rising plastics market. Pure fuel itself is the selection uncooked materials for the quickly rising hydrogen market.

Shareholders will profit instantly from the decrease price of manufacturing of the acquired acreage. Lengthy-term shareholders will possible profit from stronger commodity costs. One other upside in the long run is the persevering with expertise advances that permit for extra manufacturing at decrease prices.

Dangers

Administration may very well be unsuitable about decrease manufacturing prices as soon as growth begins.

Bolt-on acquisitions have a a lot greater success fee than different acquisitions. However they will fail to supply anticipated outcomes.

Peyto has a comparatively new president on the helm. A scarcity of expertise can show pricey in a scenario like this. There are others across the CEO that may decrease this “new individual” threat. But it surely nonetheless exists.

The upper debt ratio will increase the monetary threat of failure. Ought to there be unexpected points with the acquisition that require extra money than anticipated, there may very well be a inventory providing that might dilute excellent shares.

Oil and pure fuel pricing is at all times risky and therefore a threat on this trade.

Conclusion

The inventory stays a powerful purchase as this administration has lengthy proved themselves in a position to navigate the trade headwinds. This can be a firm that has gone by way of many downturns with out write-offs at market bottoms. That may be a very uncommon accomplishment for any administration.

The inventory worth seems to worth extra pricing weak spot and little to no optimistic impact of the acquisition. Administration did what many administration books state to do. That’s, buy or increase when costs are weak. But, the market is in no temper to reward a basic “guide” transfer.

Administration is very more likely to present important outcomes just by growing the acreage. That ought to result in appreciable appreciation. Any cyclical pricing restoration can be icing on the cake. Over 5 years, stronger commodity costs and manufacturing progress may properly end in a uncommon inventory worth triple from present ranges.

Conservative traders could not just like the debt ratio at present ranges, whereas earnings traders may be involved concerning the stage of threat. Different traders ought to discover this an fascinating proposition.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.

[ad_2]

Source link

Add comment