[ad_1]

deliormanli

Pharvaris (NASDAQ:PHVS) is within the course of, section 3 particularly, of growing a molecule that can have the ability to deal with acute hereditary angiodema, in addition to present a prophylactic remedy to keep away from extreme episodes the place HAE may cause asphyxiation. There’s nonetheless fairly a whole lot of work to be achieved, and we imagine the obtainable liquidity solely covers a portion of R&D wants. Then there’s average dilution within the firm’s future as effectively. Whereas the capital markets ought to enhance within the interim, so we aren’t apprehensive about acute liquidity issues, we nonetheless really feel the valuation is full as getting a $2 billion market dimension, which is the TAM proposed by the corporate, requires us to think about the entire world’s incidence of HAE at fairly heft costs per affected person. Contemplating that Pharvaris’ oral remedy, whereas sensible, won’t at all times be probably the most acceptable, the formidable market sizing in our view makes PHVS truthful worth at greatest. Go.

Innovation and product

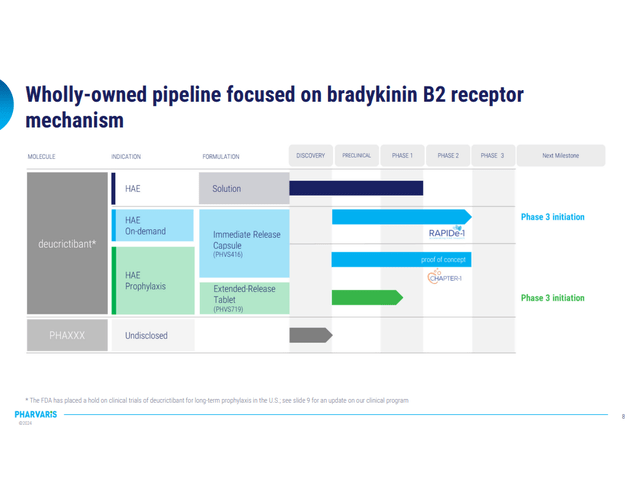

Pharvaris is an organization which is within the medical phases of creating fairly straight ahead product, easy and dependable. The trials have been on medical maintain for a yr, however since June 2023 they’ve resumed enrollment and Section 3 is underway.

Section 3 (Company Pres 2023)

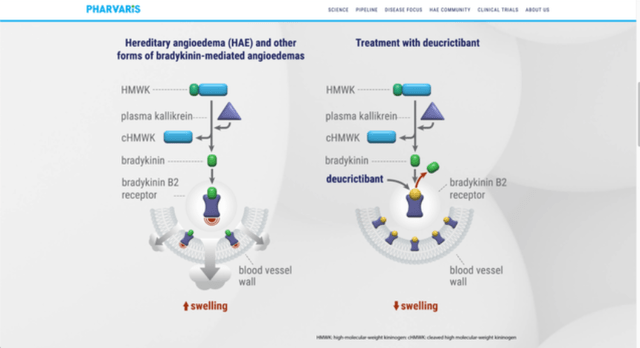

The product known as Deucrictibant and it’s a direct B2-receptor antagonist. The market is people who find themselves affected by Hereditary angioedema (HAE), a illness which happens as an issue of C1-inhibitor protein (both lack of it, or manufacturing of a dysfunctional protein). This illness is kind of disagreeable from sufferers’ perspective. On account of uncontrolled exercise of plasma kallikrein molecule, due to the C1-inhibitor drawback, extreme quantity of molecule within the pathway, bradykinin, has been gathered, which then results in painful swelling of a number of tissues in our physique.

HAE will be doubtlessly life-threatening, as a result of swelling and subsequently blockage of air pathways. That is one of many the explanation why this illness must be handled as quickly as attainable. In that method, oral B2-receptor antagonist which Pharvaris made appears to be good resolution for the issue, particularly if we need to keep away from injection pathway of administration, which tends to be solely strategy. Its mechanism of motion is by blocking connect website of bradykinin on the B2-receptor, subsequently blocking bradykinin to trigger signs of the illness. As a result of simplistic motion mechanism it’s fairly apparent what the drug can achieve this it might be affordable to hope for a extra simple medical trial.

They’re providing two principal remedies for HAE by means of oral utility: On-demand remedy and Prophylactic remedy. Because the title suggests, on-demand remedy is for assaults which have already occurred, by administering the capsule which has an immediate-release impact. Prophylactic remedy’s purpose is to stop prevalence of the assault, so for that goal they made extended-release pill, which objective is to take care of therapeutic ranges of the product within the plasma for longer time frame (as much as 72 h) so much less frequent administration can be wanted.

For each remedy approaches, the corporate claims that their product reveals simpler outcomes, with much less dosage focus wanted in comparison with few different oral merchandise that are at present in use.

Mechanism (Pharvaris Web site (pharvaris.com))

Monetary Feedback

This product is not very complicated, these antagonists have been used prior to now, and we really feel that there must be a marketplace for this extra sensible resolution. Nevertheless, the market should still be too small contemplating present market caps. We’ve got a burden within the US of round $44k per individual yearly, making an allowance for the assorted severities of HAE. As a result of rarity of the illness, affecting just a few thousand individuals within the US, the market sizing solely get to round $320 million within the US. In Europe, with double the inhabitants, however half the per capita prices, we estimate a few $320 million marketplace for Europe as effectively, getting us to a complete of $640 million. The entire developed world might be round $900 million conservatively, together with Japan and others. Together with the entire world and utilizing European and US prevalence charges, we get round $2 billion in marketplace for HAE, assuming a median $10k annual illness burden.

With the market cap at round $1.45 billion for Pharvaris, which may sound fairly engaging, however their medicine are in section 3 which suggests nonetheless a fairly large excellent burden to finalize the medicine. Section 3 is probably the most complicated section, and possibly round solely midway achieved for the trial if being beneficiant. Which means the burden excellent, assuming a whole lot of financial savings between the sluggish launch and fast launch mechanisms in analysis expense, goes to be giant, most likely round half of the $2 billion rule of thumb for growing a drug. They’ve $440 million that covers a few of the $1 billion estimate of excellent R&D burden. Observe that the corporate has spent round $140+ million solely on improvement primarily based on all obtainable public filings, so assuming simply one other $1 billion is giving them a whole lot of credit score. Then there’s the additional matter of excellent dilution, the place there’s the reservation of round 9% of shares excellent for compensation underneath EQC, which might develop as a lot as 4% yearly of the shares thereby excellent. It isn’t an enormous dilution burden nevertheless it provides to the significant improvement burden nonetheless excellent.

The $2 billion market dimension is kind of beneficiant already, as we needed to dig in exterior of the big developed markets which can be often the main target of commercialization. There’s additionally the matter that they will not take the entire market regardless, as there’ll nonetheless be want for injections as a modality of sufferers who’re already experiencing a extreme asphyxiating episode. There’s an impressive improvement burden as effectively.

Whereas they’ve fairly a bit in runway capital, round $440 million, which might get them midway or extra to the end line, we really feel that the R&D wants and the dilution, on prime of a tenuous market sizing, makes this truthful worth at greatest. Not compelling for worth in our view.

[ad_2]

Source link