[ad_1]

NicoElNino

India is definitely not an economic system to be missed. Touted as one of many fastest-growing economies, India has been a direct beneficiary of worldwide tensions with China economically, with its inventory market doing fairly nicely in 2023. India has persistently proven sturdy financial progress over time, making it one of many fastest-growing main economies on the planet. With a big and younger inhabitants, India’s home consumption is predicted to proceed driving financial progress.

For these trying to acquire publicity, the Invesco India ETF (NYSEARCA:PIN) supplies a wonderful window to faucet into this progress potential. PIN is a fund that goals to duplicate the efficiency of the FTSE India High quality and Yield Choose Index. This index consists of Indian equities which were filtered primarily based on yield and high quality indicators. The fund’s funding technique is to take a position at least 90% of its complete property within the securities that make up this index. PIN is a wonderful alternative for traders trying to acquire publicity to the Indian market whereas emphasizing high quality and yield.

Breakdown of ETF’s Holdings

PIN’s portfolio contains diversified collection of Indian equities. Its holdings are unfold throughout varied sectors, with important allocations to financials, data expertise, and shopper discretionary. The range of its holdings permits the fund to faucet into the expansion of assorted sectors of the Indian economic system. High holdings embody:

Reliance Industries Ltd (8.66% of Fund) – Reliance Industries, an Indian multinational conglomerate, operates throughout varied sectors, together with petrochemicals, refining, and telecommunications. HDFC Financial institution Ltd (8.00% of Fund) – HDFC Financial institution, one in every of India’s main non-public sector banks, presents a variety of monetary companies all through the nation. Infosys Ltd (5.47% of Fund) – Infosys, a world pioneer in next-generation digital companies and consulting, empowers purchasers in 46 international locations to navigate their digital transformation. Tata Consultancy Companies Ltd (3.88% of Fund) – TCS, with over 50 years of expertise, is a famend IT companies, consulting, and enterprise options group, partnering with a number of the world’s largest companies of their transformation journeys. Larsen & Toubro Ltd (2.38% of Fund) – L&T, a outstanding conglomerate, excels in expertise, engineering, development, manufacturing, and monetary companies, working globally.

Sector Composition and Weightings

The center class in India is increasing quickly, resulting in elevated disposable incomes and better consumption ranges. This development is predicted to proceed, creating a good setting for companies throughout varied sectors, similar to shopper items, retail, and companies. The ETF’s sector composition is skewed in the direction of sure sectors, with essentially the most important allocations to Financials (18.34%), Info Expertise (14.35%), and Client Discretionary (12.07%). Different sectors represented within the portfolio embody Power, Industrials, Supplies, Healthcare, Utilities, and Client Staples. I feel the Monetary weighting is essential provided that the extra the economic system grows, the extra that sector particularly ought to profit.

Peer Comparability

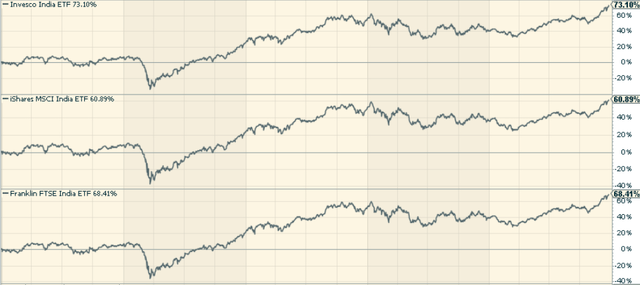

Within the area of India-focused ETFs, PIN stands out for its high quality and yield emphasis. Different related ETFs embody the iShares MSCI India ETF (INDA), and the Franklin FTSE India ETF (FLIN). Whereas all these funds provide publicity to the Indian market, PIN’s emphasis on high quality and yield is a differentiator. PIN has carried out higher due to this extra basic focus.

stockcharts.com

Execs and Cons of Investing in PIN

Investing within the Invesco India ETF comes with sure benefits and potential drawbacks. On the one hand, the fund supplies publicity to one of many fastest-growing economies globally, with a concentrate on high-quality shares. Moreover, with its concentrate on yield, the fund can provide traders a possible earnings stream.

Alternatively, investing in PIN additionally entails publicity to the dangers inherent within the Indian economic system, similar to political instability, foreign money fluctuation, and potential regulatory adjustments. Moreover, the fund’s expense ratio of 0.78% is barely greater than a few of its rivals.

Conclusion

The Invesco India ETF presents a sexy funding alternative for these trying to faucet into the potential of the Indian market. With its concentrate on high quality and yield, the fund presents a focused strategy to investing on this vibrant and quickly rising economic system. Whereas there are dangers concerned, the potential for prime returns makes PIN a compelling consideration for any investor trying to diversify their portfolio with rising market publicity.

[ad_2]

Source link