[ad_1]

DNY59

The New 12 months obtained off to a little bit of a rocky begin as main indices (DJIA, S&P 500® and Nasdaq Composite) ended decrease for the primary week of the 12 months, marking the primary down week after a 9-week successful streak.

Within the continued 2023 pattern of “excellent news is dangerous information,” it was robust jobs knowledge out on Thursday and Friday that triggered worries that the US Federal Reserve would possibly wait longer to chop rates of interest.

As rates of interest are one of many largest drivers of market returns, a sizzling job market makes it much less seemingly that the Fed will lower charges within the close to time period, to the dismay of traders.

The US Bureau of Labor Statistics introduced on Friday that December Nonfarm Payrolls confirmed the economic system added 216,000 jobs; Wall Road economists had been anticipating a payroll acquire of 170,000.

Along with that, wages elevated greater than anticipated. Common hourly earnings rose by 0.4% in December, persevering with an upward pattern from This autumn 2023, and bringing the annualized development charge over that interval to 4.3%.[1]

Whereas that is nice for American staff, it isn’t nice within the eyes of the Fed. Chairman Jerome Powell has indicated in previous speeches that wage development round 3-3.5% is in line with the Fed’s 2% inflation goal, and we’re nonetheless operating a bit above that.[2]

One other huge driver of market returns, company earnings, take the principle stage later this week. With the current pullback in shares, traders might be trying to This autumn outcomes and 2024 outlooks for indications of improved development prospects for US companies.

At current, This autumn 2023 S&P 500 EPS development is anticipated to come back in at 1.3% in accordance with FactSet. This could be the second straight quarter of development after three down quarters.

Nonetheless, that determine has dropped greater than is often seen, beforehand anticipated to come back in at 8.1% in the beginning of Q3. This denotes a 6.8% share level drop vs. the typical of three.6% seen in 2022-2023.[3]

It is vital to do not forget that sell-side analysts observe company steering very intently when making their very own estimates, and that aggressive cuts to This autumn expectations are attributable to corporations themselves reducing estimates.

One profit, nonetheless, that drastically lowered current estimates is that corporations may have a decrease bar to surpass.

Company Uncertainty Seems to Be Easing – However Nonetheless too Early to Draw Conclusions

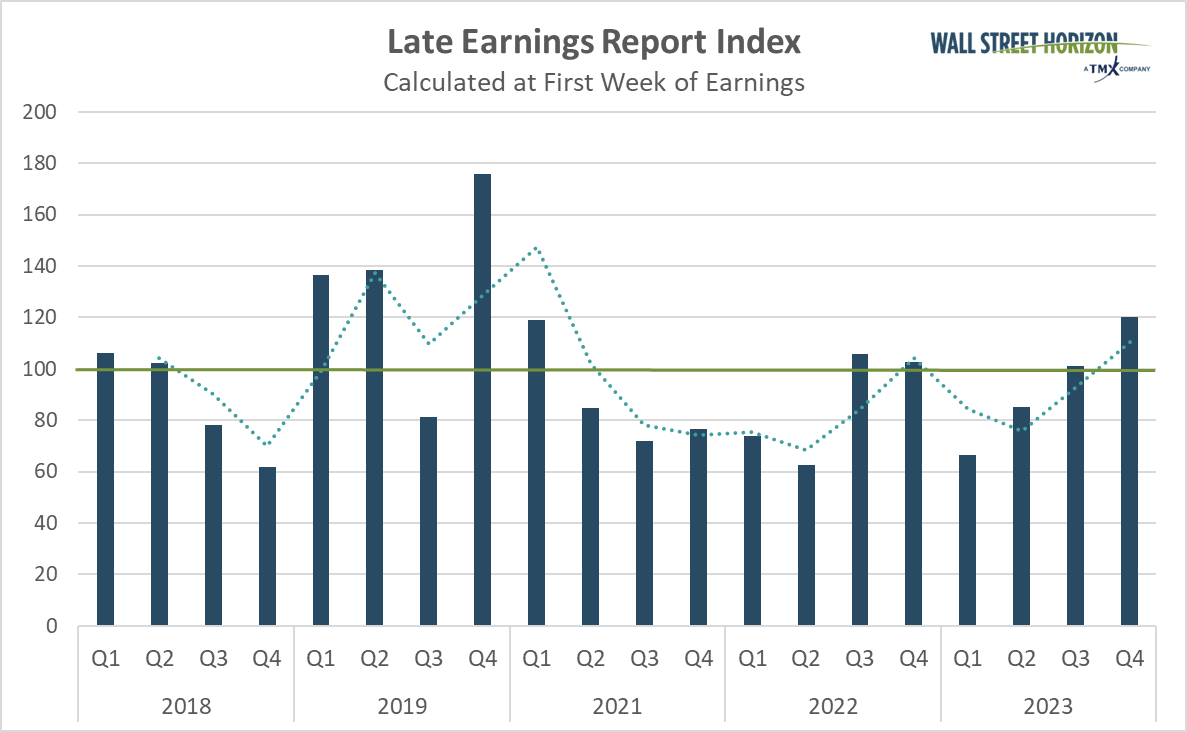

Regardless of reducing steering greater than typical for the upcoming quarterly outcomes,[4] companies have been delaying earnings lower than we usually see, as measured by our proprietary Late Earnings Report Index metric, and this can be a good factor.

The LERI tracks outlier earnings date modifications amongst publicly traded corporations with market capitalizations of $250M and better.

The LERI has a baseline studying of 100, something above that signifies corporations are feeling unsure about their present and short-term prospects. A LERI studying underneath 100 suggests corporations really feel they’ve a fairly good crystal ball for the close to time period.

The pre-peak LERI will not formally be calculated till Friday, January 12, when the large banks start to report, but it surely’s already displaying surprisingly robust company physique language in regards to the upcoming earnings season.

Within the face of a number of lingering headwinds from 2023, the LERI is pointing towards a constructive This autumn earnings season with a present studying of 62 (knowledge collected in Q1), the bottom in our 9 years of accumulating this knowledge.

Notably, extra corporations are scheduling their earnings bulletins considerably sooner than regular in comparison with the variety of corporations who’re pushing their announcement dates again considerably.

Remember, nonetheless, that this quantity will seemingly rise into the tip of the week, as extra corporations affirm late dates because the earnings season rolls on.

Supply: Wall Road Horizon

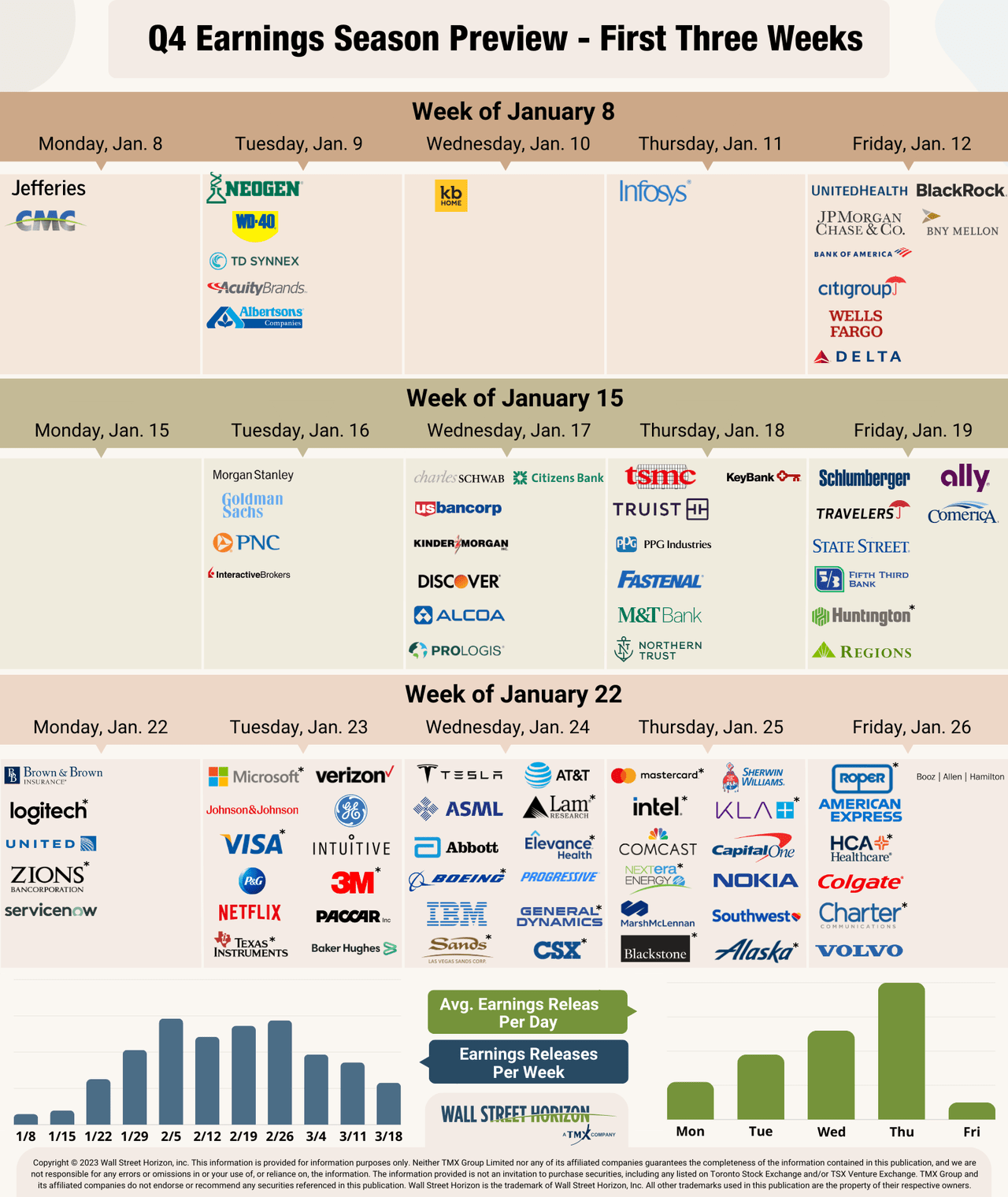

Up This Week: Huge Banks

In its typical trend, This autumn earnings season will start with the large banks, with JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC) and Financial institution of America (BAC), reporting on Friday.

Traders might be wanting in direction of financial institution CEO feedback for indicators of a resilient economic system and affirmation of a smooth touchdown in 2024.

Two metrics of curiosity will seemingly be mortgage loss provisions and lending exercise. Traders will seemingly wish to see that provisions for credit score losses have normalized, as an indication that banks see fewer short-term defaults and financial dangers in 2024.

They’re going to even be on the lookout for indicators of bettering lending exercise, which has remained suppressed attributable to larger rates of interest and tighter lending requirements.

Two potential brilliant spots could also be funding banking exercise and softening yields.

Finally month’s Goldman Sachs U.S. Monetary Companies Convention, banking executives indicated that dealmaking circumstances are bettering because the rate of interest atmosphere normalizes, and that goes for each IPO and M&A exercise.[5]

Additionally, decrease YoY bond yields ought to have helped lower the quantity banks must fork over for deposits to compete with larger yielding devices.

Supply: Wall Road Horizon

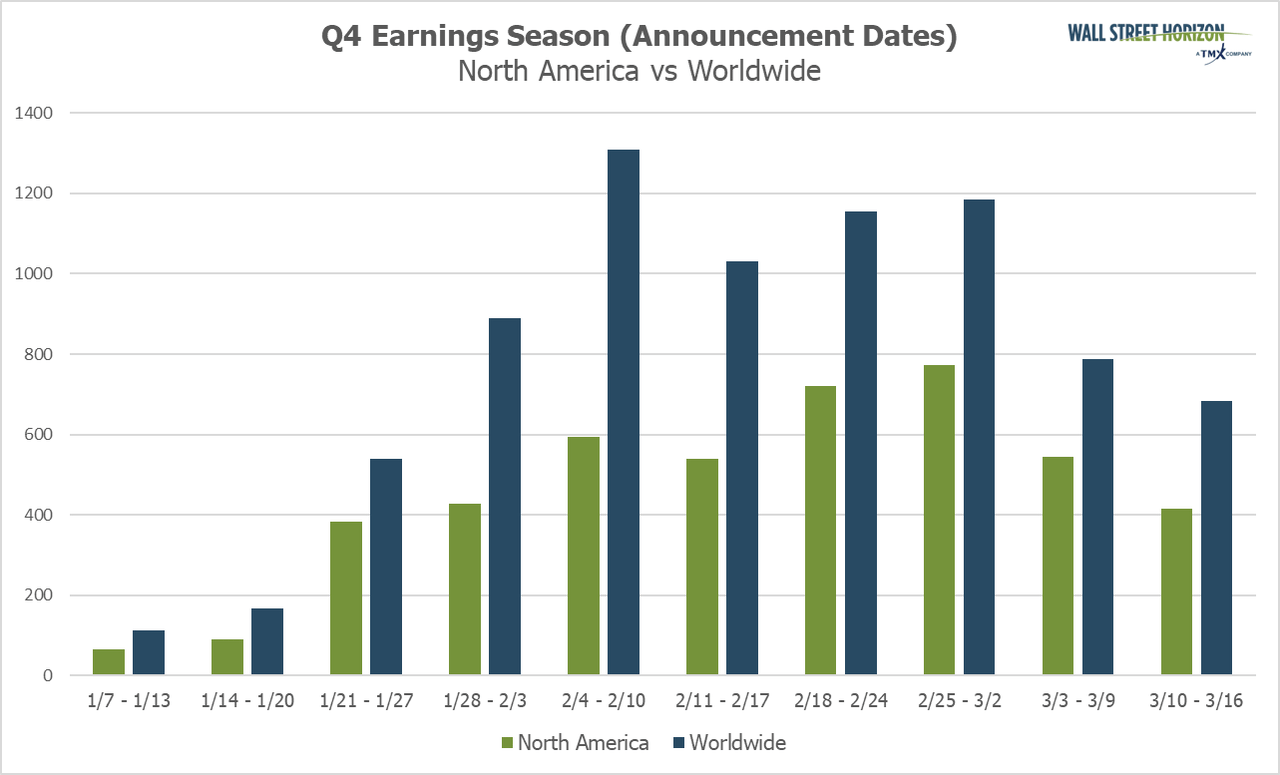

This autumn Earnings Wave

This season, peak weeks will fall between January 29-March 1, with every week anticipated to see over 1,000 experiences. Presently, February 22 is predicted to be probably the most lively day with 599 corporations anticipated to report.

To this point, solely 32% of corporations have confirmed their earnings date (out of our universe of 10,000+ world names), so that is topic to vary.

The remaining dates are estimated primarily based on historic reporting knowledge. Remember, the This autumn reporting season is all the time a bit extra extended, usually stretching over 4 or 5 peak weeks reasonably than the standard three peak weeks seen in Q1-Q3.

Supply: Wall Road Horizon

1 Employment Scenario Abstract, U.S. Bureau of Labor Statistics, January 5, 2024

2 Opening Remarks, Federal Reserve, Jerome H. Powell, October 19, 2023

3 Earnings Perception, FactSet, John Butters, January 5, 2024

4 Earnings Perception, FactSet, John Butters, January 5, 2024

5 International banks forecast improved funding banking outlook, Reuters, Saeed Azhar, Tatiana Bautzer, December 5, 2023

Unique Submit

[ad_2]

Source link