[ad_1]

AutumnSkyPhotography

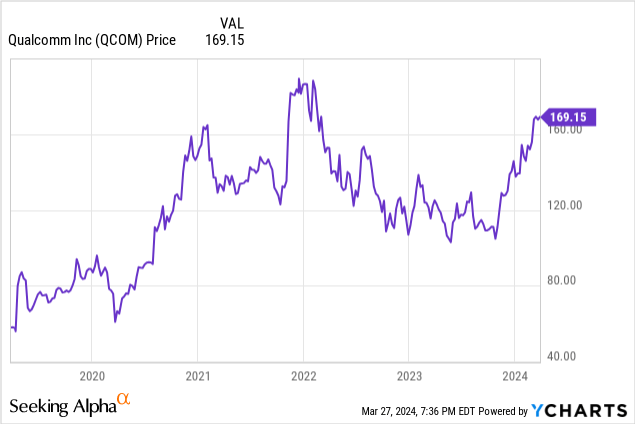

After a substantial downdraft in QUALCOMM Integrated’s (NASDAQ:QCOM) inventory worth for the reason that starting of 2022 as a result of a declining cell phone market, traders began waking as much as its potential alternative in generative Synthetic Intelligence (“AI”) close to the tip of 2023. Though the corporate might not be a go-go development inventory, when traders started wanting round for corporations that would profit from the proliferation of generative AI, they discovered Qualcomm promoting for a superb worth and an enormous alternative for offering chipsets that may run AI algorithms regionally on a tool relatively than some far-away cloud. The inventory began rising after closing at $103.59 on October 25, 2023, and has by no means appeared again.

On January 8, 2024, Cathie Wooden and Ark Make investments began shopping for Qualcomm for 2 of their ETFs. On January 12, 2024, Citi Analysis upgraded the inventory to a purchase, elevating the goal worth to $160 from $110. The day Citi raised the goal, the inventory was buying and selling round $140. So, the corporate’s constructive attributes are not flying below the radar. Its closing worth on March 27, 2024, proven on the chart above, is up 63% from its closing worth on October 25, 2023. After the sharp rise in inventory worth during the last 5 months, some might marvel in the event that they missed the boat on this one. Nevertheless, though some would possibly query the valuation, I imagine traders nonetheless have the potential upside in Qualcomm to purchase it on the present worth.

This text will focus on Qualcomm’s authentic core wi-fi enterprise and its alternatives past the wi-fi business. It is going to additionally focus on its first quarter fiscal yr (“FY”) 2024 outcomes, evaluate its valuation and some dangers, and clarify why traders ought to contemplate shopping for the inventory on the present worth.

A pacesetter in wi-fi know-how

Qualcomm is an early innovator in wi-fi applied sciences; the corporate began its journey in wi-fi in 1985. The corporate owns many patents very important to a lot of in the present day’s most generally used cell communications requirements. In Qualcomm’s FY 2023 10-Ok, it describes itself the next means,

“We’re a worldwide chief within the growth and commercialization of foundational applied sciences for the wi-fi business, together with 3G (third era), 4G (fourth era) and 5G (fifth era) wi-fi connectivity, and high-performance and low-power computing together with on-device synthetic intelligence (AI).“

The wi-fi enterprise served Qualcomm effectively for a few years. For the reason that firm had its preliminary public providing at $0.33 in 1991, the inventory was up 51,151.52% to $169.13 on March 27, 2023. The cell phone market was nonetheless in wholesome development mode till 2016, when world smartphone gross sales peaked, in accordance to Statista. The worldwide smartphone has matured, and, at greatest, low single-digit development lies forward of the business. One of many largest causes Qualcomm is diversifying into different markets is that administration needs to enter greater development and fewer mature markets to spice up income development. Let us take a look at a few of the markets the place Qualcomm plans to diversify.

New development markets

Qualcomm has entered a number of promising markets adjoining to its core wi-fi enterprise that would produce important development for years to come back. These development markets embody Cellular AI chips, superior automotive applied sciences, the Web of Issues (“IoT”), Edge Computing, Generative AI inferencing server chips, and wearable know-how.

Administration’s philosophy for deciding to fabricate AI chips for the above purposes is rooted in the concept that most AI inferencing in the present day nonetheless happens within the cloud. Nevertheless, for AI to change into really helpful and proliferate, AI knowledge crunching will ultimately must occur on native gadgets for a number of causes. A few of these causes embody:

Latency: The time it takes for knowledge to journey to the cloud and for inferencing chips to reply and knowledge packets to return takes too lengthy for real-time purposes reminiscent of autonomous autos, manufacturing facility automation, and medical gadgets, the place fast responses are important. Decrease energy consumption: AI chips in lots of IoT, edge, smartphones, and wearables purposes function on batteries. These purposes require chips with low energy to keep away from draining battery energy too quickly. Knowledge privateness and safety: Personal knowledge stays on the gadget, decreasing the flexibility of cloud suppliers to mine person knowledge and lowering the specter of hackers accessing person info. Decreased Value: Many native purposes carry out duties that do not require all of the computational energy of chips positioned within the cloud, whose power-intensive chips would run up prices. The native chips Qualcomm designs use far much less energy, decreasing the price of inferencing. Offline functionality: Native AI chips can nonetheless carry out duties when or the place the Web shouldn’t be accessible.

Should you hearken to sufficient commentary on AI from Qualcomm administration, the time period “Pervasive AI” would possibly pop up. A pervasive AI world implies that companies will embed AI applied sciences into on a regular basis services and products. On this world, nearly each service or product you employ or work together with can have AI embedded within the core performance. In the course of the JPMorgan {Hardware} & Semis Administration Entry Discussion board on August 16, 2023, Chief Monetary Officer Akash Palkhiwala mentioned the next (emphasis added):

So if you consider pervasive AI, whether or not it is a copilot for an workplace utility, or whether or not it is a copilot or AI getting used on prime of content material that’s being created by customers all these use circumstances requires AI to be on the gadget. And so we simply assume there’s a complete set of use circumstances that demand the necessity for AI to be on the gadget. We have now actually sturdy know-how, we predict that permits that. In fact, now we have the CPU. We have now the GPU and each of these cores can do generative AI. However extra importantly, what is going on to be essential within the longer-term in our minds is to have a really low energy neural processing engine that may do AI on the gadget. And if you are going to do pervasive AI that occurs a number of occasions each minute, it must be extraordinarily low energy and the benefit of getting our neural processor is it may allow use circumstances like that.

Supply: JPMorgan {Hardware} & Semis Administration Entry Discussion board Transcript.

Pervasive AI is one other option to say that AI-enabled wearables and IoT gadgets will ultimately change into ubiquitous. CFO Akash Palkhiwala later says in that very same convention that the use circumstances in a pervasive AI world will break down into three broad classes: “client, enterprise, and industrial.” Nobody actually is aware of how massive the chance will change into and the way a lot of the market Qualcomm can seize.

When analysts and even firm income and earnings estimates, it is essential to do not forget that they could be underestimating the long run development potential in a pervasive AI world the place a future use case not but imagined might make the chance way more important than anybody can at present estimate. That is the upside in some new development areas Qualcomm has entered or will enter.

One space traders ought to monitor is autos. Automotive producers are quickly turning autos into computer systems on wheels, and this enterprise aligns with Qualcomm’s imaginative and prescient of enabling a pervasive AI world. The corporate has a number of merchandise designed for the auto market. Since its enterprise began within the wi-fi market, Qualcomm has constructed a full suite of wi-fi options for this section, together with 5G, Bluetooth, C-V2X (Mobile Car-to-All the pieces), and Wi Fi.

Qualcomm web site

Qualcomm additionally supplies the automotive’s computing system interface by way of a digital cockpit full of customized options for each the motive force and passengers. These options embody driver monitoring techniques, security and safety cameras, high-resolution shows, Wi Fi and Bluetooth techniques, premium audio with noise cancellation techniques, infotainment techniques, AR, and generative AI.

Qualcomm web site

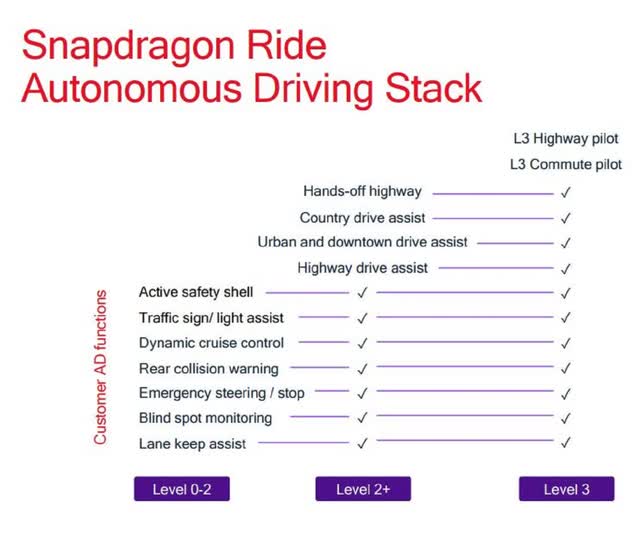

Additionally included in auto income is Superior Driver Help Methods (“ADAS”), which is a security and driver help function that’s beginning to change into frequent on new autos. ADAS options embody emergency braking, adaptive cruise management, lane help (helps robotically preserve a automotive in its lane), lane departure warning (alerts driver because the car crosses lane markers), excessive beam management, driving monitoring, and extra. The platform makes use of a number of cameras, radar, lidar, C-V2X, maps, and an on-board laptop. The next picture from Snapdragon Journey Platform Presentation reveals a few of the options that Qualcomm’s system consists of:

Snapdragon Journey Platform Presentation

Qualcomm’s main collaboration accomplice for creating ADAS as much as degree 3 driving is BMW (OTCPK:BMWYY). Different corporations Qualcomm has collaborated with are Renault (OTCPK:RNSDF, OTCPK:RNLSY) and Cariad, the software program arm of the Volkswagen Group (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY).

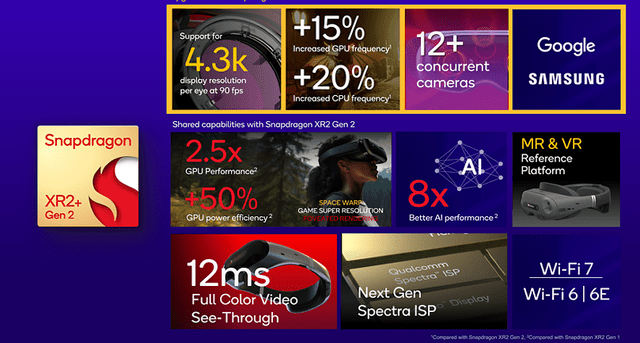

The final Qualcomm enlargement space that I’ll focus on on this article is Digital Actuality (“VR”), Augmented Actuality (“AR”), and Combined Actuality (“MR”) chips — an space traders ought to monitor because the market has excessive income development potential. AR know-how overlays digital pictures onto a real-world view however limits customers from interacting with the digital components of their imaginative and prescient. MR know-how additionally overlays interactive digital components right into a real-world view, besides customers can work together with these components. The distinction between AR and MR is the extent at which an individual can work together with the digital pictures. Final, VR know-how creates a 100% simulated interactive 3D surroundings.

Let’s evaluate a couple of of essentially the most important gamers within the house. First, there may be Meta Platforms (META), whose main imaginative and prescient seems to be a totally immersive digital world expertise referred to as the metaverse. This expertise largely takes place on the corporate’s proprietary VR {hardware}. Later, the corporate developed MR headsets (Quest Professional) and AR glasses (Ray-Ban). Meta and Qualcomm shaped a partnership the place Meta will use customized Snapdragon XR platforms and collaborate to develop future applied sciences for constructing the metaverse. If the metaverse pans out and turns into as massive as Meta CEO Mark Zuckerberg thinks it could possibly be, this partnership could possibly be a possible development driver sooner or later.

Subsequent is Alphabet’s (GOOGL, GOOG) imaginative and prescient for AR, MR, and VR. Over time, Google has developed many AR, MR, and VR {hardware} tasks. The corporate has reportedly discontinued all of them, with the most recent cancellation being Venture Iris, Google’s try to supply AR glasses. It cancelled Venture Iris in 2023. Numerous information retailers have reported that Alphabet just lately tried to create a partnership with Meta, the place Alphabet needed Meta’s AR, MR, and AR {hardware} to make use of the Android XR software program platform. Nevertheless, Meta rejected that deal. As a substitute, Google collaborates with Samsung (OTCPK:SSNLF) and Qualcomm to develop an AR and VR platform.

Qualcomm web site

Different important Qualcomm AR/MR/VR clients embody HTC Company (OTC:HTCKF) and Pico Interactive, owned by ByteDance (BDNCE), the guardian firm of TikTok.

Final is Apple (AAPL), which launched Imaginative and prescient Professional in February 2024. Prospects can use Imaginative and prescient Professional as an MR or VR headset, though the corporate does not promote the know-how as being in both class. As a substitute, the corporate calls Imaginative and prescient Professional a “spatial computing” gadget. In keeping with one publication, as a substitute of utilizing Qualcomm chips like a couple of of its rivals, Apple makes use of its proprietary M2 Silicon chip and its purpose-built R1 graphics processor. I included Apple right here as a result of its AR/MR/VR options could possibly be a major competitor to different corporations within the house utilizing Qualcomm options.

The above markets are all potential high-growth areas, one motive some traders are keen to offer Qualcomm a better valuation.

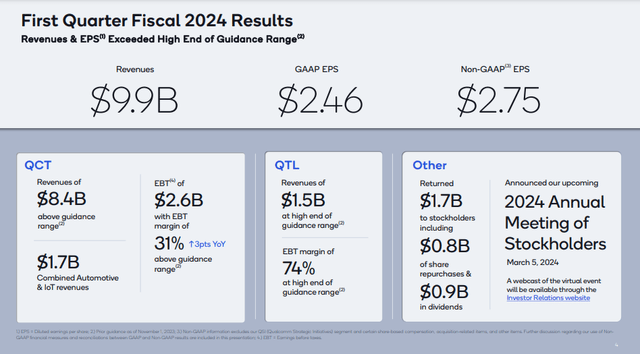

Glorious first quarter FY 2024 earnings outcomes

The picture under reveals Qualcomm’s first quarter FY 2024 highlights breaking out the corporate’s two reporting segments: QCT (Qualcomm CDMA Applied sciences) and QTL (Qualcomm Expertise Licensing). QCT represents income generated from {hardware} and software program primarily based on Qualcomm’s 3G, 4G, and 5G mental property offered to clients for utilization in cell gadgets, IoT gadgets, edge networking merchandise, automotive techniques, and different gadgets. QTL is the corporate’s world mental property licensing program.

Qualcomm First Quarter FY 2024 Investor Presentation.

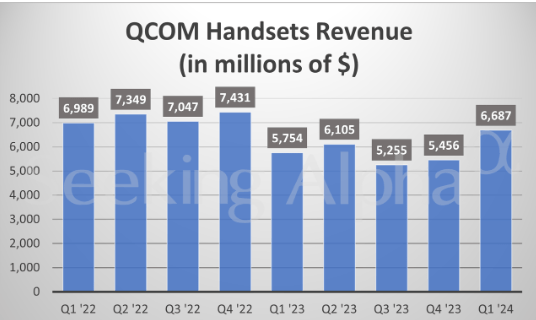

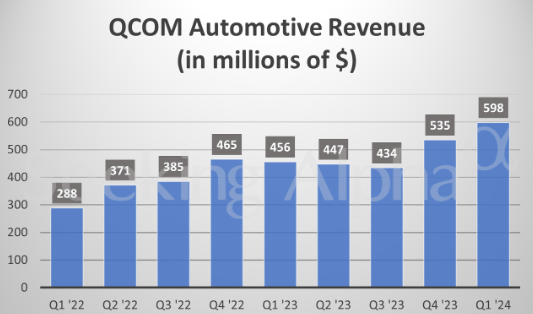

First, let’s focus on QCT, which Qualcomm additional divides into three reportable income streams: Handsets, Automotive, and IoT. One essential factor to recollect concerning the firm’s outcomes during the last yr is that the cell phone and IoT business has languished in a downturn. The excellent news is that Handset and Auto income are rebounding greater within the first quarter, as proven within the charts under.

From In search of Alpha In search of Alpha

It is good to see Handset’s income development speed up, as it’s Qualcomm’s largest income supply. Chief Monetary Officer Akash Palkhiwala mentioned concerning the section (emphasis added):

Handset revenues of $6.7 billion had been greater than our prior expectations primarily because of the elevated demand pushed by the acceleration of Android flagship launches with our Snapdragon 8 Gen 3 cell platform. Notably, our Android handset revenues from Chinese language OEMs exceeded our expectations of better than 35% sequential development.

Supply: Qualcomm First Quarter FY 2024 Earnings Name Transcript.

One motive that traders have taken curiosity within the firm currently is that specialists like market intelligence service Worldwide Knowledge Company (“IDC”) forecast the worldwide smartphone market to get better in 2024, rising 2.8% over 2023, which is in stark distinction to a downbeat market that smartphone producers have encountered just lately. In accordance to IDC, “Over the previous seven years, the worldwide smartphone market has contracted six occasions on an annual foundation.” If smartphone development does reaccelerate, it may act as a income development tailwind for 2024 and past.

Nevertheless, Qualcomm administration predicts little to no improve within the variety of handsets offered globally in 2024 in comparison with 2023. So, traders ought to proceed monitoring this section to see if income continues upward. If Handset development continues, investor sentiment towards the inventory ought to develop much more positively.

As for Automotive, Qualcomm remains to be within the early levels of scaling the enterprise. Chief Govt Officer (CEO) Cristiano Amon mentioned about Snapdragon Journey, its auto product, on the primary quarter earnings name:

Automotive continues to be an essential pillar of our development and diversification technique. Notably, 75 new fashions launched commercially in 2023 had been for applied sciences, highlighting Qualcomm’s [growing] scale in automotive and execution of our design wins. Earlier this month at CES (Client Electronics Present), we introduced our collaboration with Bosch to have our Snapdragon Journey Flex SoC energy their new central car laptop. As a reminder, Snapdragon Journey Flex permits the fusion of infotainment in ADAS functionalities on a single SoC enabling automakers to appreciate a unified central-compute and software-defined car structure that scales throughout tiers. Moreover, we demonstrated digital cockpits linked providers and superior driver techniques enabled by gen AI fashions operating regionally on the Snapdragon platform.

Supply: Qualcomm First Quarter FY 2024 Earnings Name Transcript.

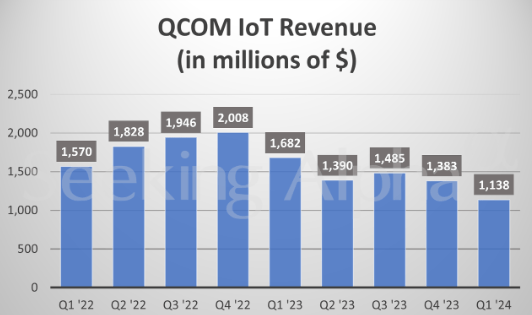

The IoT section stays caught in a listing correction attributable to weaker demand in an unsure market throughout 2023. If IoT income rebounds quickly, it ought to assist investor sentiment in the direction of Qualcomm as it’s a part of the corporate’s new development markets and important for its diversification efforts. As soon as the financial system turns into much less unsure and demand returns, this section’s income ought to return to development. The next chart reveals that IoT income stays on a downward pattern.

In search of Alpha

As for the QTL section, the excellent news is that Apple prolonged its license settlement to March 2027. Apple is trying to transfer away from Qualcomm know-how in the long run, and a number of other years in the past, some thought Apple may need minimize ties with Qualcomm by now. A two-year renewal offers administration a number of extra years to diversify its enterprise in order that if and when Apple does depart, the blow will not land as arduous. CEO Cristiano Amon mentioned on the earnings name:

First, Apple exercised its unilateral possibility to increase its world patent license settlement for an extra two years, taking the prevailing settlement by way of to March 2027; second, now we have renewed long-term agreements with two important Chinese language smartphone OEMs. As well as, we proceed to barter new agreements or renewals with different key licensees and OEMs, together with some whose present agreements are set to run out in early fiscal 2025.

Supply: Qualcomm First Quarter FY 2024 Earnings Name Transcript.

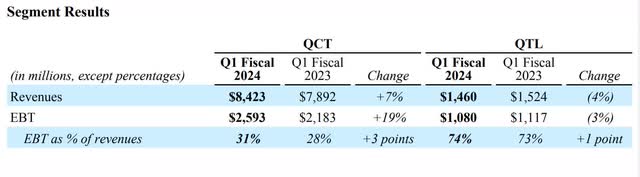

The desk under from Qualcomm’s first quarter FY 2024 earnings launch reveals QCT and QTL income and EBT metrics for 2023 and 2024. The acronym EBT stands for earnings earlier than taxes. Qualcomm stories EBT to take away the affect of taxes on earnings, which can be very totally different relying on the area. The corporate consists of EBT to offer traders a greater view of every section’s core profitability.

Qualcomm First Quarter FY 2024 Earnings Launch

Qualcomm’s first quarter 2024 QCT EBT margin was 31%, in comparison with 28% within the first quarter of 2023. Within the first quarter of 2024, QCL’s EBT margin was 74%, in comparison with 73% within the first quarter of 2023. So, core profitability is up for each reporting segments in comparison with final yr. Let us take a look at the consolidated outcomes:

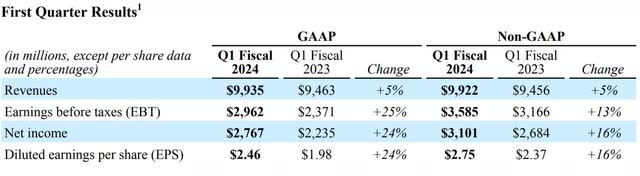

Qualcomm First Quarter FY 2024 Earnings Launch

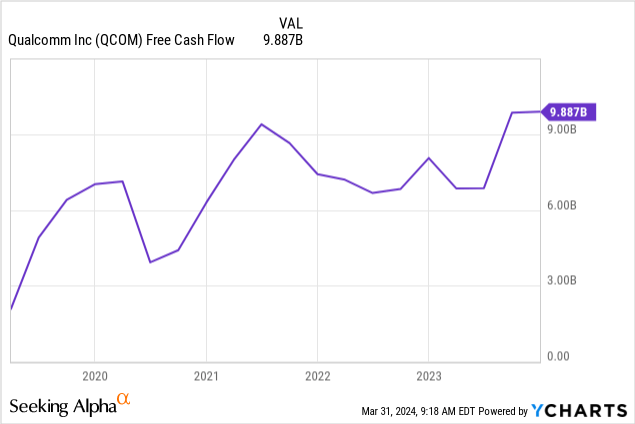

Qualcomm’s whole first-quarter GAAP income elevated by 5% to $9.94 billion, above analysts’ expectations of $9.52 billion. Its first-quarter GAAP diluted EPS was up 24% over the earlier quarter to $2.46, above analysts’ expectations of $1.97. The corporate produced a free money move (“FCF”) trailing twelve-month (“TTM”) of $9.887 billion within the first quarter.

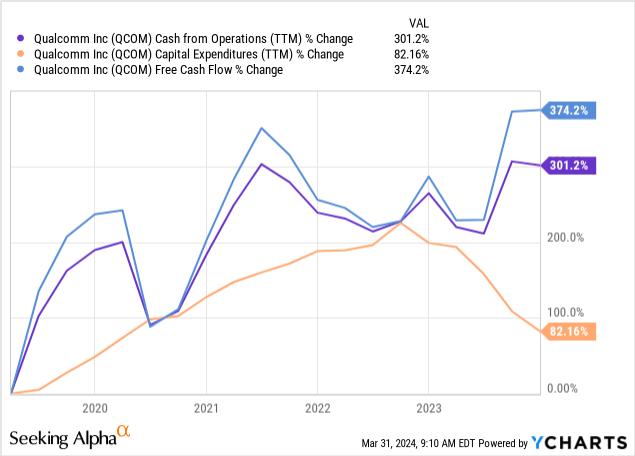

FCF might have jumped in 2023 partly as a result of administration pulled again on capital expenditures (“CapEX”). Qualcomm’s 2023 10-Ok said,

“We lowered our capital expenditures in fiscal 2023 in response to the weak spot within the macroeconomic surroundings (which negatively impacted client demand for smartphones and different gadgets that incorporate our merchandise and applied sciences).”

Because the financial system picks up, administration might begin spending closely on CapEx once more, so FCF might go up slower than it did in 2023. The chart under reveals share adjustments in money from operations up and CapEx down, leading to a leap in FCF in 2023.

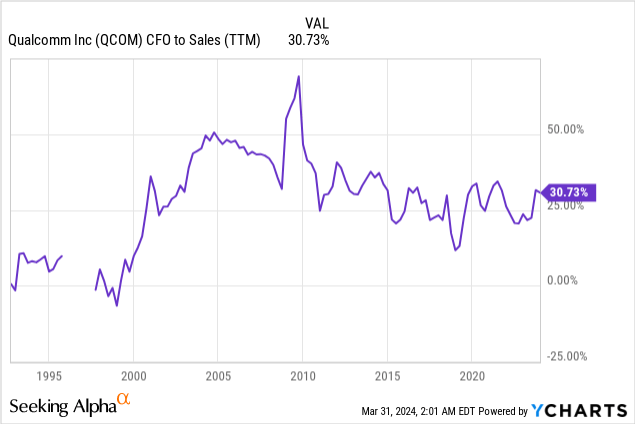

One other metric to observe is money move from operations (“CFO”) to gross sales, additionally referred to as the working money move margin. This metric reveals how effectively the corporate converts gross sales to money move. The chart under signifies Qualcomm had first quarter FY 2024 CFO to gross sales of 30.73%, a superb quantity that bodes effectively for the corporate rising its FCF, so long as administration retains its capital expenditures low.

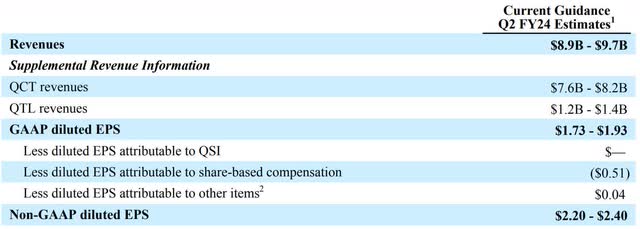

Qualcomm’s second-quarter FY 2024 steerage of $9.3 billion on the midpoint was consistent with analysts’ expectations. Administration’s non-GAAP steerage EPS on the midpoint was above analysts’ forecast of $2.25.

Qualcomm First Quarter FY 2024 Earnings Launch

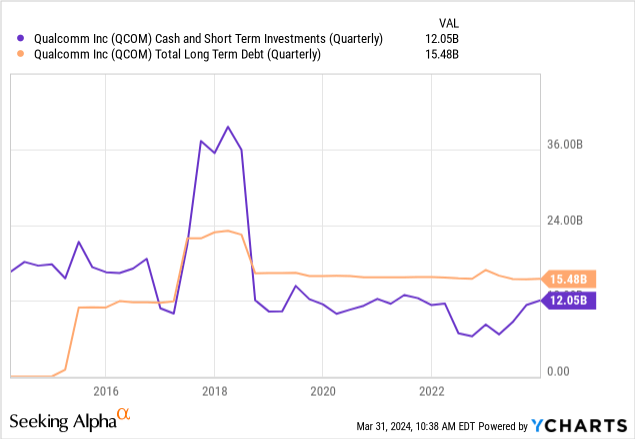

The chart under reveals that Qualcomm’s long-term debt exceeds its money and short-term investments. So, let us take a look at a couple of further metrics. Calculating the web debt-to-EBITDA (Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization) ratio utilizing numbers from In search of Alpha, the ratio was 1.02 on the finish of the primary quarter, a quantity indicating that it may pay its long-term debt. It has an curiosity protection of 16.29, which means that the corporate can cowl the curiosity on its debt with working earnings. It has a fast ratio of 1.88, which means it may pay its short-term obligations. Because of this, I imagine Qualcomm is in strong monetary situation.

General, Qualcomm’s first quarter FY 2024 outcomes had been good. Its future appears to be like brilliant, with attainable tailwinds from development within the cell handset market in 2024 and past and potential upside from diversifying into areas like IoT.

Dangers

One of many largest dangers with this firm is its excessive buyer focus threat in its core wi-fi enterprise, exacerbated by a few of these clients coming from China. Any friction between the U.S. and Chinese language governments that ends in extra commerce restrictions may negatively affect Qualcomm. Moreover, it faces important competitors from corporations like Broadcom (AVGO), MediaTek (OTCPK:MDTTF), and others within the wi-fi house. If considered one of its rivals takes away considered one of Qualcomm’s important clients, it may negatively affect its income.

The competitors in its wi-fi enterprise is actual, and traders are delicate to any discount in Qualcomm’s wi-fi market share. One motive the inventory dropped 5% the day after reporting first-quarter earnings on December 31, 2024, is the market share loss at Samsung ((SSNLF)) — a motive that its diversification efforts are so essential. The corporate’s Auto, IoT, and AR/MR/VR enterprise widens its buyer and income base and, hopefully, sooner or later, blunts the affect of any losses in its wi-fi enterprise.

One other consideration is competitors with Apple. The 2023 10-Ok states (emphasis added):

Apple purchases our MDM (or skinny modem) merchandise, which don’t embody our built-in utility processor know-how, and which have decrease income and margin contributions than our mixed modem and utility processor merchandise. Consequently, to the extent Apple takes gadget share from our clients who buy our built-in modem and utility processor merchandise, our revenues and margins could also be negatively impacted.

Supply: Qualcomm 2023 10-Ok.

Apple can be creating proprietary wi-fi modem know-how, efforts which have but to bear fruit. Lately, Apple prolonged its settlement with Qualcomm to make use of its modems till 2026, which is sweet information. The dangerous information is that Qualcomm can probably lose all of Apple’s wi-fi enterprise over the long run if Apple develops and strikes to its proprietary modem know-how.

Qualcomm is a controversial firm. A number of authorities entities have investigated it previously for alleged antitrust practices. Qualcomm wins most of its courtroom circumstances, however sometimes it loses. Moreover, a couple of corporations have hooked horns with Qualcomm in courtroom over its licensing practices, together with Apple, which is one motive Apple needs to maneuver away from Qualcomm’s wi-fi know-how. Extra just lately, Arm Holdings (ARM) sued Qualcomm for infringing its patents. An investor in Qualcomm dangers the corporate shedding a significant dispute over patents or enterprise practices in courtroom, probably considerably impacting income.

Valuation

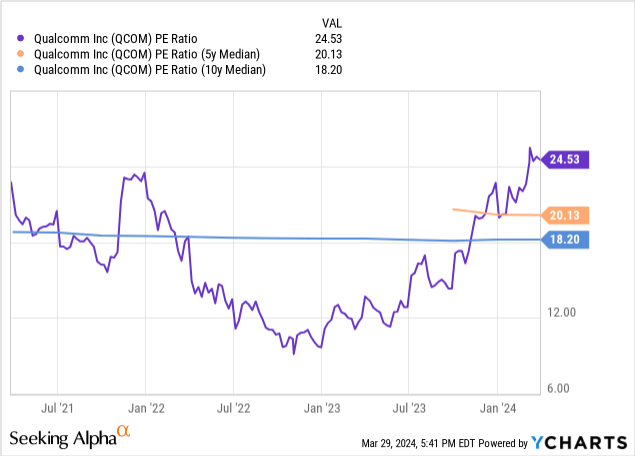

Though I’ve seen folks name Qualcomm a “Worth” inventory, it’s removed from cut price basement costs. The final time it offered at real cut price basement costs was when the price-to-earnings (P/E) ratio on a TTM foundation was within the single digits in late September or early October 2022, effectively under its ten-year median. The chart under reveals that the inventory now trades effectively above its five- and ten-year median TTM P/E.

In search of Alpha Quant grades Qualcomm’s valuation as a D. Nevertheless, wanting on the constructive facet, its TTM P/E of 24.53 is under its sector median P/E of 28.95, suggesting that the market might undervalue the inventory in comparison with the wi-fi sector. The next desk compares a number of corporations within the chip or wi-fi business from the best EPS development charges to the bottom.

Firm Identify Ahead P/E Calendar 12 months 2025 Analyst Consensus Estimated EPS development Superior Micro Gadgets (AMD) 32.93 50.37% Qorvo (QRVO) 14.89 27.59% Arm Holdings 82.18 26.63% Broadcom 23 21.94% NVIDIA (NVDA) 30.02 21.29% Skyworks Options (SWKS) 13.04 19.77% NXP Semiconductors (NXPI) 15.69 14.28% Qualcomm 15.74 10.57% Click on to enlarge

Usually, when a inventory’s ahead P/E a number of exceeds its EPS development charge, the market might overvalue it. In distinction, when a inventory’s ahead P/E a number of is under its EPS development charge, the market might undervalue it. Should you use that commonplace, Qualcomm could also be overvalued presently. Buyers searching for undervalued shares can be higher off AMD, Skyworks Options, and Qorvo.

The next reverse discounted money move, or DCF, reveals the implied free money move (“FCF”) development charges over the subsequent ten years for Qualcomm’s closing worth of $169.30 on March 28, 2024.

Reverse DCF

The primary quarter of FY 2025 reported Free Money Circulate TTM

(Trailing 12 months in thousands and thousands)

$9877 Terminal development charge 3% Low cost Price 10% Years 1 – 10 development charge 6.5% Inventory Value (March 26, 2024, closing worth) $169.30 Terminal FCF worth $19.097 billion Discounted Terminal Worth $105.180 billion FCF margin 27.24% Click on to enlarge

Analysts estimate EPS will develop at a CAGR of round 16% over the subsequent 5 years. I imagine the corporate can translate sufficient of its EPS development to attain FCF development of a minimum of 6.5% over the subsequent ten years, justifying in the present day’s inventory worth — nevertheless, one phrase of warning. EPS development does not at all times translate to FCF development, and traders ought to monitor whether or not Qualcomm has important non-cash bills, which might trigger greater EPS development than FCF development.

As an illustration, an organization with very excessive stock-based compensation (“SBC”), a non-cash expense, could cause EPS to develop sooner than FCF. Qualcomm produced a SBC as a share of income of 6.06% within the first quarter of FY 2024 and 6.93 in FY 2023, which is comparatively low. So, the corporate does not have a difficulty on the SBC entrance.

Why Qualcomm is a purchase

Not like a couple of different know-how corporations that individuals anticipate to supply blazing-hot income development from generative AI, Qualcomm is a comparatively mature firm. Wall Avenue analysts forecast solely mid-single-digit income development over the subsequent three years. Nevertheless, if its growth of on-device AI processing capabilities pays off, the corporate may probably exceed analysts’ estimates.

Though Qualcomm might not be a screaming cut price like in late 2022 or early 2023, in the present day’s inventory worth presents a very good worth. I contemplate this inventory a development at an affordable worth (GARP) funding. Qualcomm traders must be in it for its potential income development upside and its capacity to effectively convert gross sales into money move.

Suppose you might be an investor searching for a strong development firm that can probably profit from the generative AI alternative. In that case, Qualcomm nonetheless sells at a worth the place the potential upside nonetheless exceeds the dangers of investing. I charge Qualcomm a Purchase.

[ad_2]

Source link