[ad_1]

Weiquan Lin/Second through Getty Photos

The Fab 7 Are Nonetheless Standard

Suffice it to say, that the rotation into worth for the primary buying and selling month of the yr has been postponed. It could possibly be that Fed communicate has now pushed out the handicapping of charge cuts til mid to finish summer season. That March reduce appears to be fading. With the fade, additionally comes a little bit of a lagging response in each the dividend inventory realm and longer-duration bond funds.

The Fabulous 7 are standard and for good cause. Sure, they’re mega-cap, not low-cost, or at the very least not as low-cost as they have been, and value progress charges have usually gotten forward of earnings and income progress charges. Nevertheless, many of those are additionally the most effective money printers available in the market, with ample free money stream which is arguably crucial metric of any. Gobs of money on the steadiness sheet make them invulnerable to the excessive charge setting. Star CEOs which assist to raise costs and stimulate the market by means of their efficient conveyance of their firm’s skill to innovate.

These are firms on the forefront of synthetic intelligence and many synergy prospects abound. With each in-house moonshots and capital to purchase non-public fairness unicorns which may not have exit technique because of the IPO market, additional non-organic efficient progress appears all however a given.

As Charlie Munger as soon as stated, it is onerous to purchase firm at a good value as a result of everybody already is aware of who the most effective firms are. Subsequently they commerce at bloated multiples for lengthy intervals of time. I fortunately maintain many of those, let’s study which of them are nonetheless price shopping for.

Remembering the Steering of Nomad and Invoice Miller

In a earlier article on Amazon, I had this to say concerning R&D bills and adjusted working revenue:

They spend on R&D proper as much as the max level to the place they function on a razor-thin working margin and go away little left over for Uncle Sam to tax. This in flip compounds my income at a sooner clip going ahead. Ultimately, when a excessive R&D spending firm determines income has been scaled to the max, R&D could also be rescinded to indicate a a lot increased GAAP revenue.

The mindset of needing value-based on GAAP versus Non-GAAP metrics when there may be apparent income progress is like desirous to have a better AGI in your tax returns through W2 revenue versus increased money stream and write-offs on a pleasant portfolio of passive revenue rental properties. I do know which one I choose.

This isn’t to say that Analysis and Growth works the identical manner for each business. Semiconductors, as an illustration, is a really aggressive business the place the expense is actually wanted to even exist and meet the demand of the shopper.

Nick Sleep & Qais Zakaria of Nomad Partnership and Invoice Miller have been all early Amazon.com, Inc. (AMZN) patrons earlier than profitability. Usually adjusting working earnings factoring again in how a lot potential revenue was being sheltered by Analysis and Growth bills. Pre-dating them was one in every of Warren Buffett’s influencers, Phil Fisher. He additionally had sure markers for a corporation he favored to see the place Analysis and Growth spending was at the very least a sure proportion of income.

That is what makes nearly all of this “Fab 7” distinctive. They spend extra on analysis and growth on common as a proportion of income than every other firm of their peer group.

The Jeff Bezos College of Lengthy-Time period Planning

From the Nomad Letters:

Take for instance the present controversy at Amazon.com. Final yr the corporate reported free money stream of simply over U$500m, certainly it has been round this quantity for the previous couple of years. What’s necessary is that the U$500m is in spite of everything funding spending on progress initiatives similar to capital spending, but in addition analysis and growth, transport subsidy, advertising and promoting and value givebacks. The agency has been investing in these things in the present day to develop the enterprise sooner or later in order that free money stream in years to return might be meaningfully higher than it could be in any other case. By our estimates, these discretionary investments, over and above that required to take care of the enterprise, are within the area of an extra U$500m, excluding the worth givebacks.

That is our subjective evaluation of the discretionary funding spend and implies that administration might, in that case inclined, cancel the discretionary progress spending and as a substitute return round U$800m every year to traders after taxes. An operation that was in a position to produce money stream on such a foundation is likely to be price U$10bn or so, and together with Amazon’s different belongings would suggest a share value of round U$26. In valuing the enterprise at these costs, as occurred final summer season, traders are saying to Amazon administration “your progress spending has no worth, you could as properly flip your self right into a money cow”! That is an odd assertion to make for a enterprise rising revenues in extra of twenty % every year.

That is precisely the thought course of that I’ve absorbed from my previous studying of the Nomad Letters cowl to cowl. Spending on making an ideal product and giving as a lot to your buyer as attainable will finally scale back competitors and widen a moat. Throttle revenue till you have squeezed the market. All that Analysis and Growth expense could possibly be scaled again and returned as a dividend or within the type of share buybacks, however would not you fairly create a long-term impenetrable moat?

It’s true that with these tech firms, the Analysis and Growth CAPEX is partially grown and partially maintained. The argument with Analysis and Growth within the case of massive tech is that a lot of the funds are spent on innovation and progress not having a commodity-type enterprise. The identical cannot be stated for semiconductors or prescribed drugs who’ve many substitutes for his or her merchandise.

Worth Motion

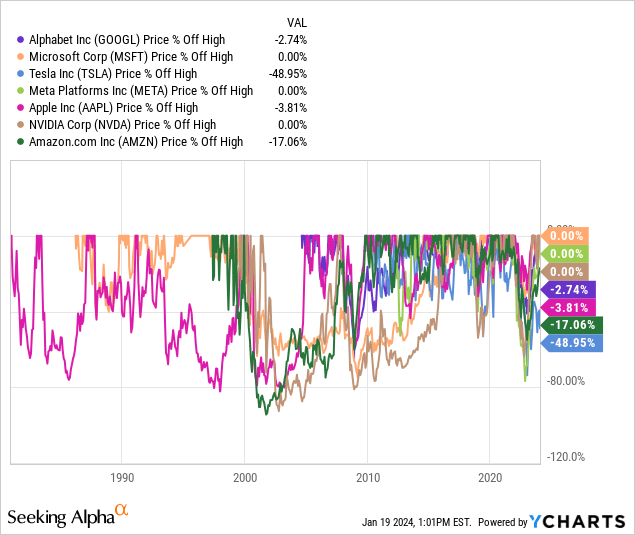

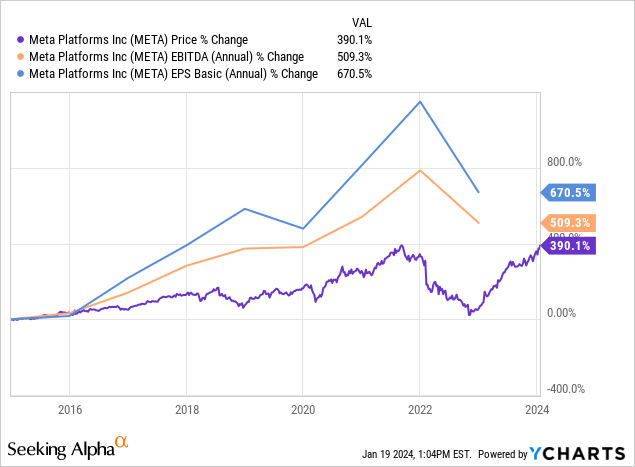

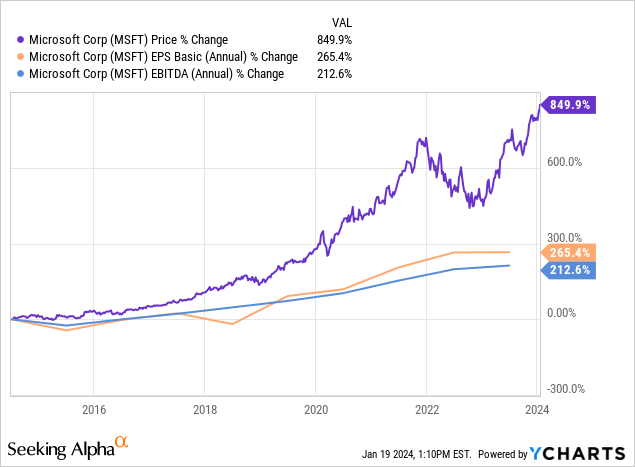

Right here we will see Nvidia, Microsoft and Meta are all buying and selling at all-time highs. It wasn’t too way back that commenters have been arguing on one in every of my Meta purchase articles whether or not Mark Zuckerberg was sinking the corporate or not. These are money printers of us. Many can afford to take moon-shots and nonetheless generate ample free money stream.

Methodology

The next are PEG ratio calculations including again analysis and growth to working revenue, first producing a 5-year CAGR charge after which utilizing that because the multiplier occasions the TTM adjusted working revenue per share.

There are solely a choose few firms I might use this mannequin on. Just like what the Nomad Partnership instituted together with Invoice Miller, non-cyclical, non-commodity primarily based companies which are efficiently rising the highest line and displaying moat-like qualities for his or her returns on invested capital are restricted.

Alphabet Inc. (GOOG), (GOOGL)

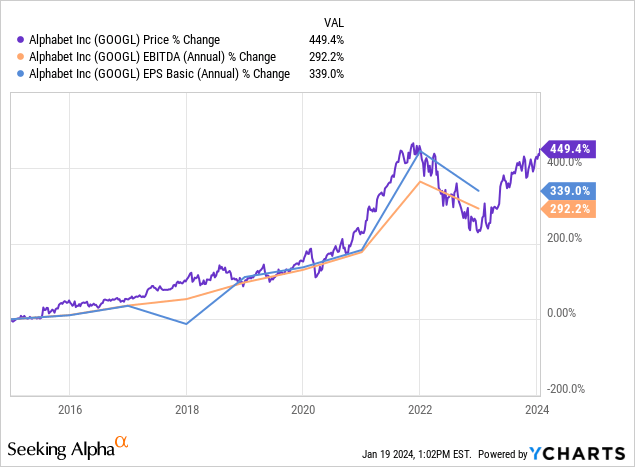

5-year adjusted working revenue progress charge [CAGR] 14.68%-multiplier. TTM adjusted working revenue per share= $9.09. Honest value at modified PEG 1 ratio = $9.09 X 14.68 = $145.38. Present value: $146.18.

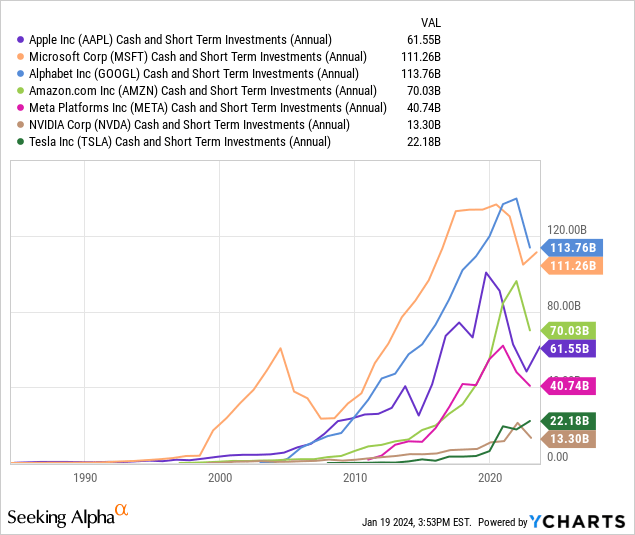

Commentary: Pretty priced. Google is present process the fitting sizing and is a outstanding participant in synthetic intelligence. The advert income king has been shopping for again shares and has the excellence together with Microsoft as being one of many solely two firms on the listing with over $100 billion in money and short-term investments.

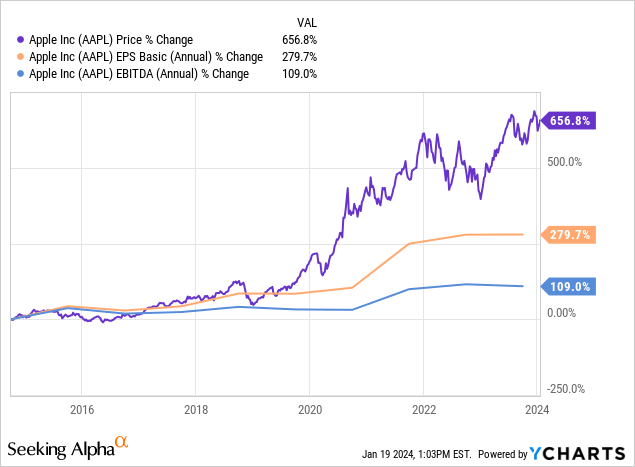

Apple Inc. (AAPL)

5-year adjusted working revenue progress charge [CAGR] 12.47%-multiplier. TTM adjusted working revenue per share $9.27. Honest value at modified PEG 1 ratio = $9.27 X 12.47 = $115.63. Present value = $191.

Commentary: Overpriced. Apple does buyback shares at a sooner clip than the remainder of the 7. Though progress is stagnating, the corporate has ample money and a big bond portfolio. Want to see one other hit from the corporate in addition to the newest model of the iPhone. The buybacks can improve intrinsic worth if continued, though I would argue towards shopping for again at such a excessive value above what would appear to be a good value within the $110-$120 vary.

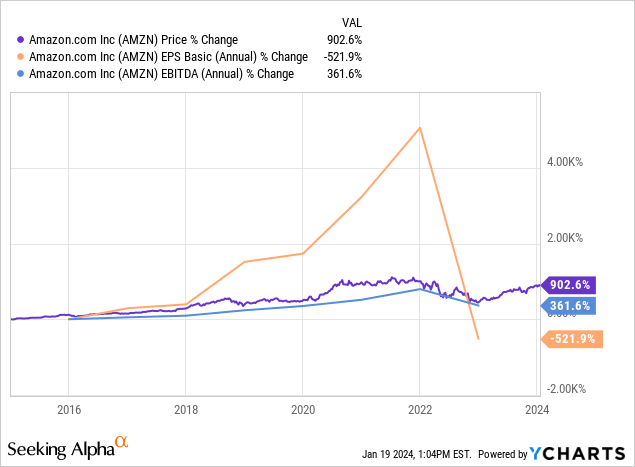

Amazon.com, Inc. (AMZN)

5-year adjusted working revenue progress charge [CAGR]= 16.74%-multiplier. TTM adjusted working revenue per share = $10.58. Honest value at modified PEG 1 ratio = $10.58 X 16.74 = $177.19. Present value = $155.58.

Commentary: Undervalued. Amazon isn’t as undervalued because it was in 2022, however the firm is the analysis and growth king of the 7. This has all the time been the place the worth within the conglomerate lies, they could possibly be worthwhile in the event that they wished to. Nevertheless, why ought to they notice extra taxable revenue in the event that they nonetheless have nice concepts to increase? Amazon is shortly turning into the “Taco Bell” reference from Demolition Man. For these unfamiliar with the 1993 movie, sooner or later, Taco Bell will take over all commerce.

Meta Platforms, Inc. (META)

5-year adjusted working revenue progress charge [CAGR] = 13.02%-multiplier. TTM adjusted working revenue per share = $30.51. Honest value at modified PEG 1 ratio = $30.51 X 13.02 = $397.24. Present value = $383.24.

Commentary: Undervalued. The corporate simply retains printing cash by means of numerous social media promoting strategies. Now a participant and investor in AI, the social media king can also be shopping for again shares and has over $40 billion in money and short-term investments.

Microsoft Company (MSFT)

5-year adjusted working revenue progress charge [CAGR]= 14.31%- multiplier TTM adjusted working revenue per share = $15.7 Honest value at modified PEG 1 ratio = $15.7 X 14.31 = $224.67 $397.71 Commentary: Overvalued. That is an especially high-quality software program king, nevertheless, the market appears to have gotten a bit forward of the expansion trajectory after the discharge of Chat GPT. The overvaluation is dampened a bit on account of an awesome share buyback trajectory and dividend bumps.

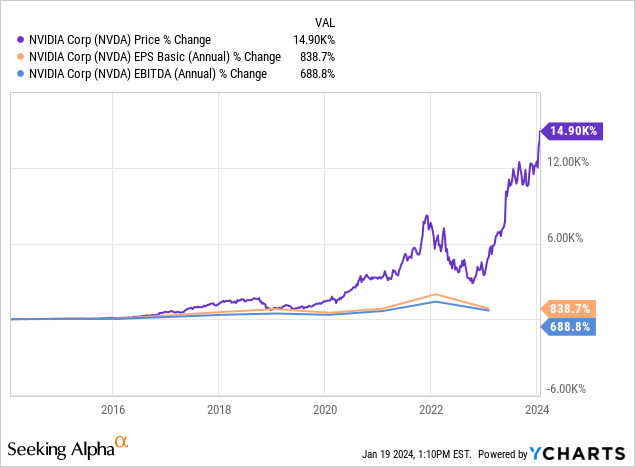

NVIDIA Company (NVDA)

5-year adjusted working revenue progress charge [CAGR] = 16.15%-multiplier TTM adjusted working revenue per share = $5.23 Honest value at modified PEG 1 ratio = $5.23 X 16.15 = $84.58 Present value = $592.69

Commentary: Very overvalued. The disconnect between share value appreciation and progress may be very obvious in NVIDIA. You probably have not been trying on the previous 10-year charts evaluating earnings and EBITDA progress charges to share value appreciation, please take a look at this one. 14k+% appreciation in value in comparison with underneath a thousand % earnings progress. Moreover, Superior Micro Gadgets, Inc. (AMD) is releasing rival chips that appear to be aggressive. It is a extremely cyclical, commodity-based and now regulated business with the U.S. curbing chip gross sales to China.

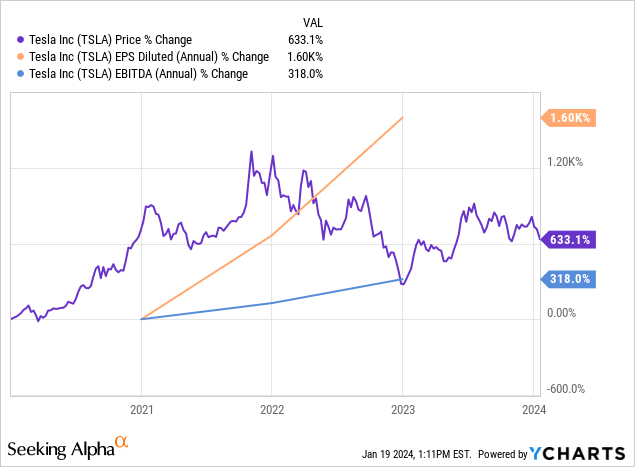

Tesla, Inc. (TSLA)

5-year adjusted working revenue progress charge [CAGR] 58.89%- capped at 25% [Advice of Peter Lynch]* TTM adjusted working revenue per share = $4.53 Honest value at modified PEG 1 ratio = $4.53 X 25 = $113.34 Present value= $211.6

*be aware, Peter Lynch suggested to not chase long-term progress assumptions increased than 25%. Subsequently I capped PEG progress charge a number of at 25 X.

Commentary: Overvalued. I like Tesla and have been out and in of the inventory just a few occasions. It is priced like a software program firm however is beginning to develop like a automotive firm. I capped the expansion charge assumptions at 25%, however in case you are a Tesla fan and imagine they nonetheless have a number of ahead years of fifty% progress left within the tank, in all probability because of the success of one in every of their different non-vehicle merchandise, then you could possibly actually justify a value within the $220 vary.

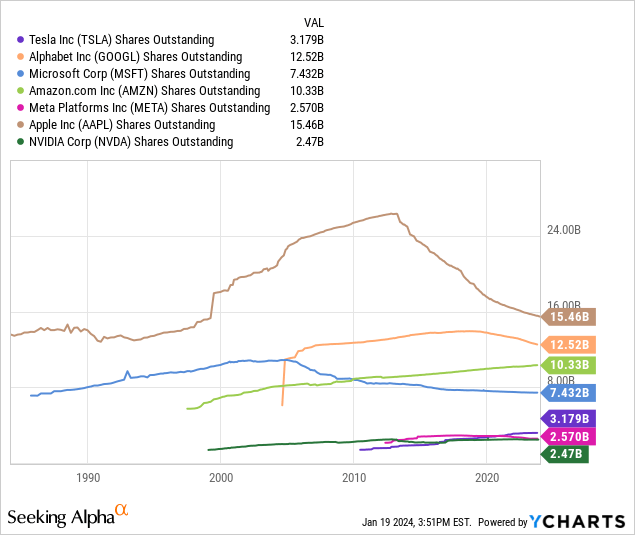

Share Progress Versus Discount Comparisons

Share reducers:

Apple Google Microsoft Meta NVIDIA

Share diluters:

Money and Quick-Time period Investments

Right here we will see the money on the steadiness sheet of the Fab 7. Google and Microsoft are in a category of their very own. Apple must also be counseled because of the over $100 Billion in long-term investments that additionally proceed to spin off money. If we incorporate the lengthy bonds into Apple’s steadiness sheet, they’re actually on par with Google and Microsoft however not as liquid.

Amazon and Meta are a peg down on steadiness sheet energy however nonetheless have ample powder for brand new initiatives and acquisitions.

Tesla and NVIDIA are within the lowest rung which can also be a testomony to how money flow-positive these two members are.

Dangers

As a result of these firms have been so profitable at rising income by means of R&D mixed with minimizing taxes, anti-trust points do finally rear their heads. Google, Apple, Meta, and Amazon are very notable for the current antitrust battles they’re dealing with with the FTC. Nevertheless, I might fairly run the danger of being sued as a monopoly than being sued for environmental damages or different objects associated to accounting. Being sued for being profitable is the most effective of the three however might additionally see a few of these firms divided sooner or later.

No matter is spun off from the lot I might gladly maintain on to, however it’s a danger to the share costs nonetheless.

Abstract of the Fab 7 Least expensive to Most Costly [cheapest first, most expensive last]

Amazon. Meta. Google. Apple. Microsoft. Tesla. Nvidia. STOCK INTRINSIC VALUE MARKET VALUE PERCENT OF FAIR VALUE GOOGL 145.38 146.18 100.50% AAPL 115.63 191 165% TSLA 113.34 211.6 186% AMZN 177.19 155.58 87.80% MSFT 224 397.71 177% NVDA 84.98 592.69 697% META 397.24 383.24 96.40% Click on to enlarge

This yr, Amazon, Meta, and Google stay on the purchase listing. The following 3 needs to be watched for strategic entry factors. Whereas NVIDIA is an efficient commerce with a number of momentum, I am unsure how the corporate can develop right into a valuation in such a regulated business.

Earlier Ideas

I’ve written items on Meta, Amazon, Google, and Microsoft prior to now. They’ve all labored out properly and have confirmed to be undervalued utilizing these fashions. I had written a purchase article on Tesla as properly close to the $100 stage however would submit that it goes too excessive above my intrinsic worth fashions utilizing these calculations. Microsoft touched intrinsic worth in 2022 however has been a maintain for fairly a while because the pleasure about AI ensued.

Apple has been a maintain for me since I started writing on Searching for Alpha, though I do personal some shares that I bought as a part of by Dow 30 indexing technique. NVIDIA has been probably the most overvalued of the shares on this listing and I nonetheless maintain that to be true. Though it continues to rise, do not be disillusioned in the event that they fail to develop into the anticipated progress displayed of their traditional Peter Lynch chart which compares the expansion charge in earnings to the expansion charge in share value.

Market Outlook

Many worry the Magazine 7. I might say that their modern qualities and tax avoidance by means of excessive spending on Analysis and Growth justify a better a number of of GAAP earnings primarily based on what’s taking place underneath the hood. Will increase in working effectivity by means of AI and automation could possibly be the subsequent nice progress driver.

Whereas I do not like all of the names that make up this mega-cap high slice of the S&P500, the ahead P/E at 20 X needs to be diminished a bit contemplating these firms are so worthwhile on a non-GAAP foundation. This was not the case within the prior tech bubble the place in the present day’s tech names did not exist or have been principally not worthwhile on any foundation.

[ad_2]

Source link