[ad_1]

)

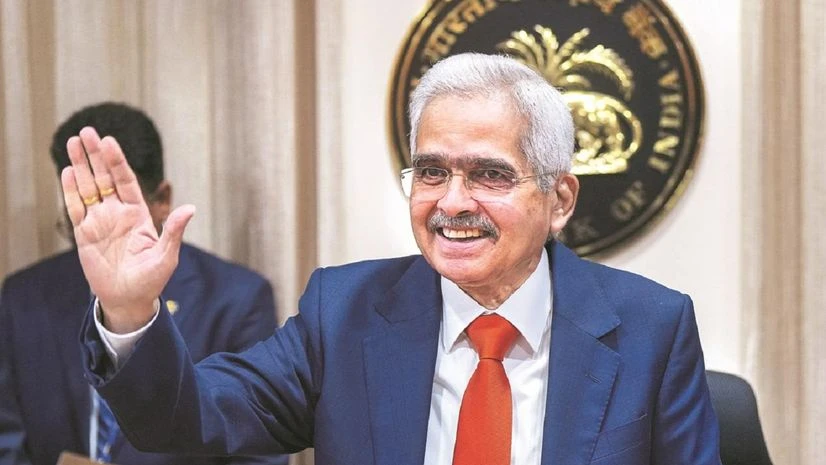

RBI Governor Shaktikanta Das (Picture: PTI)

The Reserve Financial institution of India (RBI) stays alert and dedicated to behave early and decisively to forestall any buildup of dangers, mentioned Governor Shaktikanta Das in his foreword to the “Monetary Stability Report” (FSR), launched on Thursday.

He mentioned the latest implementation of macro prudential measures, particularly geared toward tempering lenders’ enthusiasm in particular segments of retail loans, reaffirmed the central financial institution’s dedication to monetary stability whereas making certain the continued availability of funds for the productive wants of the financial system.

After issuing warnings to banks and non-banking monetary firms (NBFCs) concerning the escalating ranges of unsecured loans, together with private loans and bank card debt, on November 16, the regulator raised the chance weighting for such loans from 100 per cent to 125 per cent.

Moreover, a 25 percentage-point enhance was carried out for the chance weighting of financial institution loans prolonged to higher-rated NBFCs.

Das mentioned regardless of going through world headwinds and rising challenges akin to technological disruptions, cyber dangers, and local weather change, the dedication of the central financial institution was unwavering. The main target stays on fortifying the monetary system, encouraging accountable innovation, and fostering inclusive development.

He highlighted the great well being of the Indian monetary system, marked by multi-year-high earnings, a low degree of careworn property, and strong capital and liquidity buffers inside monetary establishments. Substantial progress has been made because the onset of the pandemic in steering each the financial system and the monetary system. Now, it’s essential to consolidate these achievements, propelling the financial system towards the next development trajectory whereas sustaining macroeconomic and monetary stability.

First Printed: Dec 28 2023 | 5:22 PM IST

[ad_2]

Source link