[ad_1]

hirun/iStock by way of Getty Pictures

Actual property shares dipped this week because the financial knowledge hampered fee lower hopes amongst inventory merchants and an absence of optimistic information made means for slight pessimism.

The S&P 500 Index declined 0.13% this week, logging its second straight weekly loss, as markets reacted to the inflation in addition to gross sales knowledge by dialing again their rate of interest lower expectations. The Federal Reserve is anticipated to carry charges regular on the second financial coverage resolution of the yr subsequent Wednesday.

“Mortgage charges ticked again up in February—a disappointing improvement for potential homebuyers, who just some months in the past received a glimmer of hope as charges lastly began to fall,” on-line actual property brokerage Redfin’s chief economist, Daryl Fairweather, mentioned.

“With charges nonetheless elevated, many are opting to proceed renting, which is buoying rental demand, and because of this, lease costs,” Fairweather added.

Asking rents within the U.S. noticed their largest annual improve in additional than a yr in February, Redfin (RDFN) mentioned in a report.

Actual property brokerages/platforms significantly fell on Friday on the Nationwide Affiliation of Realtors’ settlement information. NAR agreed to pay $418M to resolve a sequence of claims of collusion inside the true property business geared toward sustaining artificially excessive agent commissions. Additionally, the affiliation is about to revise a number of rules in a transfer that’s anticipated to lead to a considerable drop in the price of promoting a house.

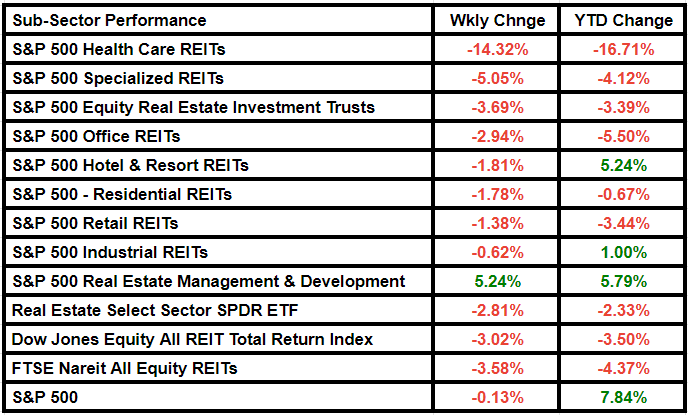

The Actual Property Choose Sector SPDR Fund ETF (NYSEARCA:XLRE), which tracks the S&P 500 actual property shares, retreated 2.81% through the course of the week to shut at $39.04. The FTSE Nareit All Fairness REITs index fell 3.58%, whereas the Dow Jones Fairness All REIT Whole Return Index decreased 3.02%.

Further House Storage (EXR), Equinix (EQIX) and Crown Fortress (CCI) had been the largest losers among the many S&P 500 actual property shares. CoStar Group (CSGP) was an outlier, being the one gainer of the week. Trinity Place Holdings (TPHS), Lead Actual Property (LRE) and Protected and Inexperienced Growth (SGD) had been the opposite notable actual property losers.

In search of Alpha’s Quant Score system maintained the Maintain score on XLRE, however lowered its suggestion regarding momentum. SA analysts additionally grade the inventory a Maintain.

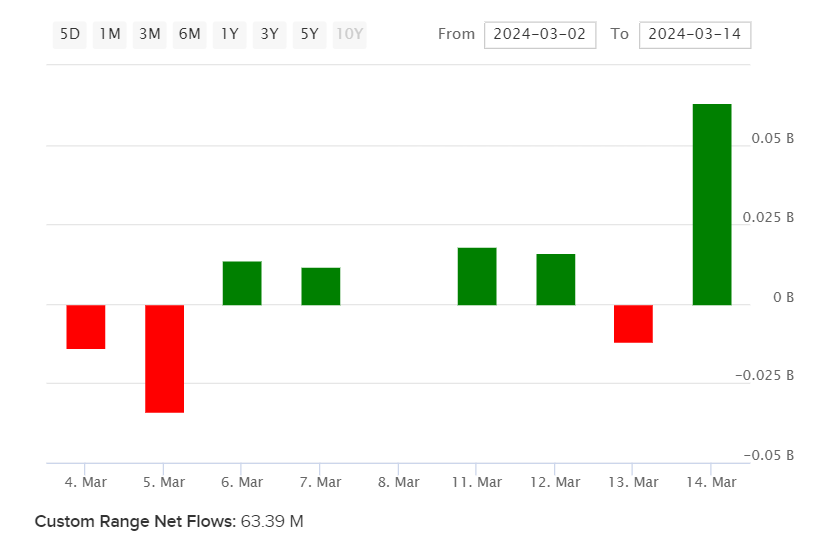

The ETF noticed web inflows of $85.48M this week, in comparison with outflows of $22.9M final week. Inflows particularly gained tempo after actual property shares dropped within the wake of the NRA settlement information. Here’s a take a look at the fund flows motion into and out of XLRE within the final 2 weeks, in keeping with the information options supplier VettaFi.

Earnings season ended for the sector this week. Of the 88 fairness REITs that present full-year FFO steerage, 59 REITs (67%) beat the midpoint of their forecast. Information Heart, Retail, Resort, and Single-Household Residential REITs had been among the many finest performing property sectors this quarter, SA contributor Hoya Capital mentioned in a latest report.

A relative weak spot was seen within the interest-rate-sensitive property sectors – web lease and workplace – together with goods-oriented sectors. Surging curiosity expense – not property-level fundamentals – was the perpetrator behind, in keeping with Hoya Capital.

For the week, healthcare REITs had been the largest losers, whereas Specialised REITs adopted from a distance. Here’s a take a look at the subsector performances:

[ad_2]

Source link