[ad_1]

Might Lim/iStock through Getty Photos

REITs ended decrease than final week within the absence of a constructive catalyst, underperforming broader markets for the 2nd consecutive week.

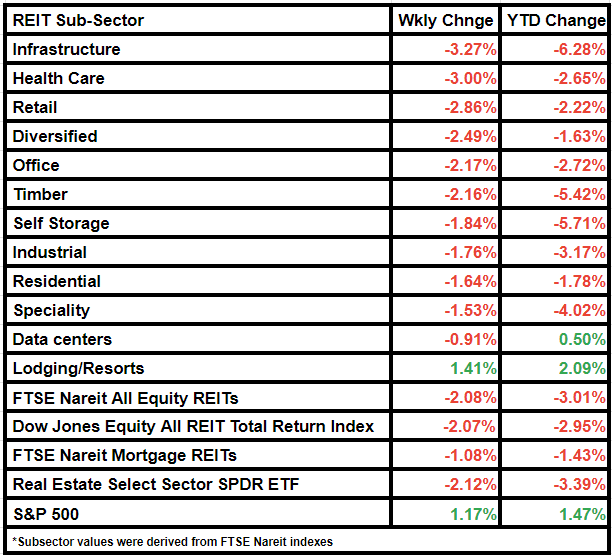

The FTSE Nareit All Fairness REITs index declined by 2.08%, whereas the Dow Jones Fairness All REIT Whole Return Index fell by 2.07%. FTSE NAREIT Mortgage REITs fell by 1.08%.

The broader Actual Property Choose Sector SPDR ETF was additionally down by 2.12%.

In the meantime, S&P 500 gained by 1.17%.

Quick curiosity on fairness REITs continued to say no, with the sector posting a median brief curiosity of three.3% of the entire float in December, a report by S&P International Market Intelligence confirmed. The determine stood at 3.6% in November.

Industrial REIT Prologis (PLD) kicked off the earnings season for REITs with a not-so-impressive monetary end result. The corporate’s This fall earnings did not beat the typical analyst estimate, whereas the 2024 steerage vary indicated that it may fall in need of the Wall Avenue consensus.

Mortgage REIT AGNC Funding (AGNC) can also be anticipated to put up a decline in This fall earnings subsequent week.

The Blackstone-Tricon Residential deal announcement helped the rental housing phase acquire on Friday, however the residential subsector fell by 1.64% over the course of the week.

Amongst subsectors, Infrastructure noticed the steepest decline, adopted by Well being Care. The previous declined by 3.27% and the latter by 3.00%.

A notable outlier for the week was Lodging/Resorts, which gained by 1.41%. A serious lodge REIT, Pebblebrook Resort Belief (PEB), introduced sturdy December outcomes immediately, and mentioned This fall adjusted FFO per share is anticipated to beat its prior outlook.

Energy REIT (PW) was a big laggard amongst firms, declining by ~13% this week in worth. Internet Lease Workplace Properties (NLOP) was the largest gainer, rising by ~22% from final week.

Here’s a take a look at the subsector efficiency for the week:

[ad_2]

Source link