[ad_1]

REITs underperformed broader markets, however ended greater than final week as macro components gave optimism.

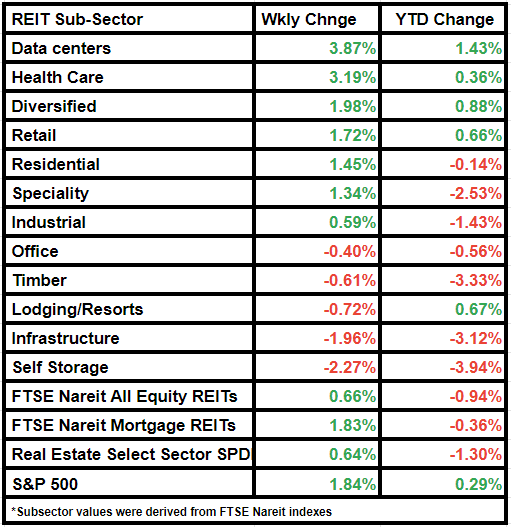

The FTSE Nareit All Fairness REITs index gained by 0.66%, whereas the Dow Jones Fairness All REIT Whole Return Index was up by 0.70%. Comparatively, S&P 500 noticed a rise of 1.84% on a weekly foundation.

The broader markets benefited from a fall in producer value inflation, which decreased by 0.1% in December in comparison with a rise of 0.1% anticipated.

Additionally, the This fall earnings season kicked off on word because the 5 main banks that reported their earnings on Friday pulled in nearly $66B of internet curiosity earnings (+0.98% Q/Q and +4.9% Y/Y) regardless of a backdrop of highest rates of interest in nearly 23 years.

Alternatively, the Actual Property Choose Sector SPDR ETF elevated by 0.64% and the mortgage REITs index by 1.83%.

Workplace REITs as a subsector declined by 0.40% from final week, however the largest movers of the week have been remarkably from this class. Web Lease Workplace Properties (NYSE:NLOP), which gained by ~28% W/W, was the largest gainer amongst REITs, whereas Workplace Properties Revenue Belief (NASDAQ:OPI) that fell by ~45% was the largest laggard.

The danger profile of Workplace REITs has not materially improved or declined, however the market’s view on the subsector has. There’s nonetheless enchantment in investing on this class, however the perfect upside has handed and valuations have turn out to be much less engaging, based on Looking for Alpha contributor Wolfe Report.

UMH Properties (NYSE:UMH) and Technology Revenue Properties (NASDAQ:GIPR) have been the opposite high gainers of the week. In the meantime, Wheeler Actual Property Funding Belief (NASDAQ:WHLR) that declined by ~22% was among the many largest losers.

Amongst subsectors, Self Storage noticed the steepest decline of two.27%, adopted by Infrastructure that decreased by 1.96% in worth.

Information facilities and Well being Care have been the highest gainers amongst subsectors, having risen by greater than 3% this week. Diversified REITs additionally noticed a notable achieve, a mean of 1.98%.

Here’s a take a look at the subsector efficiency for final week:

Extra on Actual Property Sector

[ad_2]

Source link