[ad_1]

On the finish of 2023, the Los Angeles metro nonetheless struggled with new workplace provide, whereas funding exercise picked up from the top of the third quarter, in line with the newest knowledge from CommercialEdge. The Metropolis of Angels kicked off 2024 with an excellent workplace transaction, the place the asset traded at a value that exceeded greater than 5 occasions the metro’s common value per sq. foot in 2023. Moreover, some noteworthy leases additionally closed, together with Snapchat‘s mum or dad firm inking an almost 500,000-square-foot long-term dedication.

Final yr, 83 properties totaling 11.1 million sq. ft of workplace area modified palms for a mixed $1.7 billion in Los Angeles. Manhattan led the record of gateway cities with highest funding quantity in 2023 with $2.4 billion in offers, adopted by Washington, D.C. ($1.9 billion), Boston ($1.8 billion), whereas the Metropolis of Angels ranked fifth. When it comes to whole workplace sq. footage bought, the metro was outpaced solely by Chicago, with 16.5 million sq. ft.

In 2023, workplace belongings modified palms at a mean of $266.3 per sq. foot within the metro. Amongst gateway markets, Manhattan had the very best costs, averaging $833.9 per sq. foot, adopted by Boston ($346.8 per sq. foot), whereas Los Angeles outpaced Seattle ($259.6 per sq. foot) and Washington, D.C. ($209.1 per sq. foot).

Excessive-quality belongings command excessive costs

The most important workplace deal of 2023 stays Waterbridge Capital’s $104 million acquisition of Union Financial institution Plaza in downtown Los Angeles. The 675,945-square-foot Class A workplace constructing was bought by KBS because the final asset in its fund, KBS Actual Property Funding Belief II.

One other vital deal was JP Morgan Asset Administration’s buy of Pen Manufacturing facility’s West Constructing, within the Santa Monica submarket. The 132,200-square-foot, single-story constructing modified palms for $98.5 million.

In December 2023, First Residents Financial institution paid $86.7 million for Pier Level Pacific, a 66,812-square-foot Class A workplace property in the identical Los Angeles submarket. The three-story constructing was bought by Realty Bancorp Equities at $1,131 per sq. foot, marking one of many priciest offers within the county within the final three years, in line with TheRealDeal.

In January 2024, CommercialEdge recorded just one vital workplace sale within the Los Angeles metro, however at a remarkably excessive value. The deal closed at $70.5 million, or $1,405.8 per sq. foot. Skanska bought 9000 Wilshire Blvd., a 50,148-square-foot workplace constructing in Beverly Hills, to Dublin-based Flutter Leisure.

Largest downtown LA lease signed in late 2023

In December 2023, CIM Group inked final yr’s largest downtown Los Angeles workplace lease. The owner signed a 119,217-square-foot, long-term take care of Sheppard Mullin, a regulation agency that may relocate its headquarters to Metropolis Nationwide 2CAL, a 1.4 million-square-foot workplace tower.

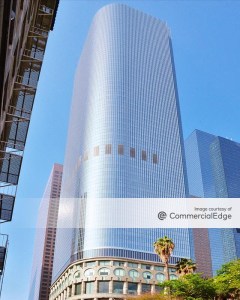

Throughout the identical interval, Avison Younger grew to become the unique leasing agent answerable for Brookfield Properties’ Figueroa at Wilshire, a 1.1 million-square-foot workplace tower in Los Angeles’ Monetary District. The corporate has been the proprietor of the Class A+ high-rise for practically 20 years.

In late January 2024, Snap Inc. signed a 467,000-square-foot long-term extension throughout eight workplace buildings at Santa Monica Enterprise Park. The mum or dad firm of Snapchat signed the 10-year dedication with landlord BXP.

Los Angeles workplace improvement gradual

As of January, the metro’s under-construction pipeline totaled 2.7 million sq. ft of workplace area unfold throughout 15 properties. The pipeline accounted for 0.8 p.c of the prevailing inventory, under the nationwide common of 1.6 p.c. Amongst gateway markets, Los Angeles’ relative to whole inventory pipeline was smaller than in Boston—that led with 5.2 p.c—San Francisco (3.7 p.c) and Manhattan (1.4 p.c), however was bigger than Chicago’s (0.5 p.c).

Vital workplace initiatives at the moment underway embrace Century Metropolis Heart, a 731,250-square-foot Class A workplace improvement of 37 tales. JMB Realty’s tower is rising at 1950 S. Avenue of The Stars and is anticipated to be delivered in early 2026.

One other noteworthy undertaking beneath development is the 370,000-square-foot Harbor-UCLA Medical Heart in Torrance, Calif. The Class A property broke floor final August and will probably be used as an outpatient facility, whereas additionally together with hospital, analysis and assist amenities. The 72-acre improvement at 1000 W. Carson St. is scheduled to come back on-line in September 2026.

Deliveries in 2023

All through 2023, 17 properties totaling 1.9 million sq. ft got here on-line within the Los Angeles metro, representing 0.6 p.c of whole inventory. Development begins amounted to 1.7 million sq. ft unfold throughout eight properties.

One in every of final yr’s vital deliveries was the completion of the 800,000-square-foot Second Century improvement, that got here on-line in Might. The 2-building workplace property was developed by a three way partnership fashioned between Worthe Actual Property Group and Stockbridge Actual Property Fund, that backed the undertaking with a $594.1 million development mortgage. The workplace advanced serves as Warner Bros.’ new headquarters.

In January 2024, two workplace initiatives totaling 137,397 sq. ft got here on-line in Los Angeles. One in every of them is Sandstone Properties’ Palisades Village Heart, a 89,755-square-foot medical workplace constructing at 881 Alma Actual Drive in Pacific Palisades, Calif. The second is at 850 Brea Canyon Highway in Walnut, Calif., and consists of a 47,642-square-foot, three-story constructing.

L.A.’s flex workplace market

As of January, the Los Angeles workplace market included 4.3 million sq. ft of shared area, rating second after Manhattan (9.2 million sq. ft) by way of largest flex workplace footprint within the nation. Different gateway cities with a large coworking market included Washington, D.C., with 3.3 million sq. ft, and Chicago, with 3 million sq. ft.

12 months-to-date by way of January, Cubework was the flex workplace supplier with the biggest footprint in L.A., with its places totaling 1,630,562 sq. ft. The corporate was adopted by WeWork, with 885,058 sq. ft, Regus, with 731,029 sq. ft, Areas, with 594,193 sq. ft and ReadySpaces, with 524,715 sq. ft.

In April final yr, Premier Workspaces opened a brand new coworking workplace totaling 14,500 sq. ft in Los Angeles’ Century Metropolis district. The corporate signed a 10-year lease with The Irvine Co. at 2121 Avenue of The Stars, a 970,000-square-foot workplace tower.

[ad_2]

Source link