[ad_1]

Shares completed flat, with the falling simply six bps. A lot of the weaknesses yesterday got here within the equal-weighted S&P 500, with the ETF falling by virtually 85 bps.

In the meantime, we noticed the rise by round 30 foundation factors, whereas the fell by seven bps to 4.2%, with the CDX Excessive Yield index shifting greater as nicely. This felt like a risk-off day.

The chart for the DXY seems attention-grabbing, because the has bounced off the 61.8% retracement degree, and it seems to be forming an inverse head and shoulders. And if it ought to transfer above the 104.50 degree, it might set off a escape again to 106.

What was odd about yesterday’s rally within the greenback was that it got here regardless of charges throughout the curve falling. However that’s as a result of charges globally fell sharply yesterday, which allowed the unfold between the and charges to rise.

So, if charges globally proceed to fall, the greenback can proceed to learn so long as the rate of interest differential grows wider in favor of the greenback.

What’s attention-grabbing in regards to the unfold on the 2-year is that it’s attending to the higher finish of its latest vary, and pushing above 2.05% on the unfold might result in additional greenback energy.

The CDX Excessive Yield Index additionally crept greater yesterday and, for now, has survived the 400 area, which it continues to carry.

The transfer down in charges, the rise within the greenback, and the excessive yield spreads counsel extra of a risk-off tone to the market. That is the primary time I can consider this dynamic taking place for a while, and it will likely be important to look at to see how this performs out.

It may very well be an indication of some nervousness coming into the market. For the previous two years, we’ve grown accustomed to charges, the greenback, and spreads shifting greater and shares shifting down.

However we’re seeing an important many modifications beginning to happen out there, with the latest rotation from progress to worth, and now charges shifting down, with the greenback and spreads shifting greater, together with .

These are old-school, basic risk-off trades and flights to security.

The odd factor is that there’s nothing within the clear and current within the US to see this kind of commerce manifest, which suggests the market could also be beginning to consider the potential for a tough touchdown.

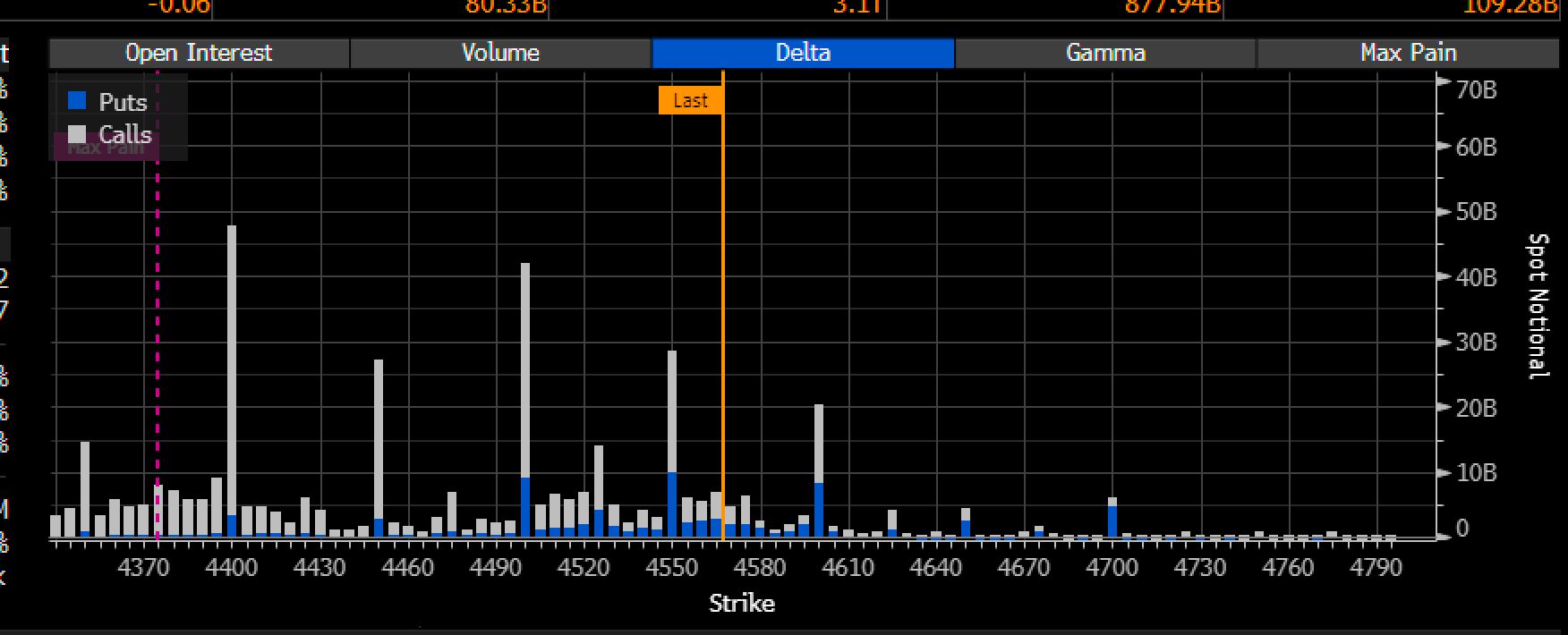

Lastly, the S&P 500 continues to consolidate across the 4,600 degree, which is the decision wall and stopping the index from shifting up.

If the decision wall doesn’t roll greater, the index will battle to maneuver greater from present ranges.

In the meantime, I believe there’s a good probability that the latest excessive will mark wave “C,” and the following leg of the decline is on the way in which, with the index shifting again to 4,100.

As famous beforehand, the dynamics of CTA flows are over, and the index is fairly heavy in optimistic gamma. However the flip degree is someplace round 4,530.

Any pullback that takes the index beneath 4,530 will flip the index from optimistic to detrimental gamma, and that can imply as an alternative of market makers propping the market up, market makers shall be going with the development of the market.

Contemplating the quantity of optimistic name delta and gamma on the boards, there may very well be a number of hedges market makers might want to unwind.

The dynamics that took the market greater are the identical ones that would in a short time take it decrease, and I proceed to suppose we’ll head again to 4,100 earlier than most individuals suppose.

Authentic Submit

[ad_2]

Source link